The 350 Wealth Management Group at Morgan Stanley

Gregory SteinmetzBrian P. Mahoney, CFP®, CPWA®, CDFA®Michael P. GeeJames Funk, CFP®, CPWA®Richard De Luca, NFLPAAngaddeep Ahluwalia, CEPA®, NFLPAShawn E. Eager, CFP®, CIMA®, CPWA®, RMA®John Snyder, CFP®

Direct:

(954) 762-3000(954) 762-3000

Toll-Free:

(800) 327-8323(800) 327-8323

Industry Award Winner

Industry Award WinnerOur Mission Statement

We help successful individuals and families navigate the complexities that come with significant wealth and gain control over their finances by building and implementing a financial plan personalized to their needs, values, and aspirations.

Our Story and Services

At The 350 Wealth Management Group, we help coaches, athletes, and successful individuals and their families identify strategies that help them resolve the complexities of their financial lives.

Through a holistic approach, we design, implement and coordinate a fully integrated financial plan customized to address your specific objectives for the accumulation, preservation, and transfer of your wealth.

Our team provides advanced technical focus across a broad range of wealth management areas, while delivering a personalized experience for your day-to-day needs.

In addition, we hold two of the most sought-after Morgan Stanley credentials: Family Wealth Director, which demonstrates our experience and advanced knowledge serving the specific challenges of multigenerational families, and Global Sports and Entertainment Director, a distinguished credential that confirms our value to individuals in the sports industry.

We are privileged to serve an exceptional group of clients, each of whom has a unique story about how they created their wealth and how they want to use it to enhance their lives. We look forward to hearing your story and helping you achieve your own definition of success.

Our team includes the following certification holders:

- CERTIFIED FINANCIAL PLANNER™ - CFP®

- Certified Private Wealth Advisor® - CPWA®

- Certified Exit Planning Advisor® - CEPA®

- Certified Divorce Financial Analyst® - CDFA®

- Certified Investment Management Analyst® - CIMA®

- Retirement Management Advisor® - RMA®

- Retirement Income Certified Professional® - RICP®

- Chartered Life Underwriter® - CLU®

- Chartered Financial Consultant® - ChFC®

- Qualified Plan Financial Consultant® - QPFC®

Through a holistic approach, we design, implement and coordinate a fully integrated financial plan customized to address your specific objectives for the accumulation, preservation, and transfer of your wealth.

Our team provides advanced technical focus across a broad range of wealth management areas, while delivering a personalized experience for your day-to-day needs.

In addition, we hold two of the most sought-after Morgan Stanley credentials: Family Wealth Director, which demonstrates our experience and advanced knowledge serving the specific challenges of multigenerational families, and Global Sports and Entertainment Director, a distinguished credential that confirms our value to individuals in the sports industry.

We are privileged to serve an exceptional group of clients, each of whom has a unique story about how they created their wealth and how they want to use it to enhance their lives. We look forward to hearing your story and helping you achieve your own definition of success.

Our team includes the following certification holders:

- CERTIFIED FINANCIAL PLANNER™ - CFP®

- Certified Private Wealth Advisor® - CPWA®

- Certified Exit Planning Advisor® - CEPA®

- Certified Divorce Financial Analyst® - CDFA®

- Certified Investment Management Analyst® - CIMA®

- Retirement Management Advisor® - RMA®

- Retirement Income Certified Professional® - RICP®

- Chartered Life Underwriter® - CLU®

- Chartered Financial Consultant® - ChFC®

- Qualified Plan Financial Consultant® - QPFC®

Services Include

- Asset Management

- Alternative InvestmentsFootnote1

- Business Succession PlanningFootnote2

- Cash Management and Lending ProductsFootnote3

- Divorce Financial AnalysisFootnote4

- Estate Planning StrategiesFootnote5

- Financial PlanningFootnote6

- Fixed IncomeFootnote7

- Life InsuranceFootnote8

- Long-term Care InsuranceFootnote9

- Municipal BondsFootnote10

- Philanthropic ManagementFootnote11

- Planning for Education FundingFootnote12

- Professional Portfolio ManagementFootnote13

- Retirement PlanningFootnote14

- Structured ProductsFootnote15

- Trust ServicesFootnote16

- 401(k) Rollovers

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

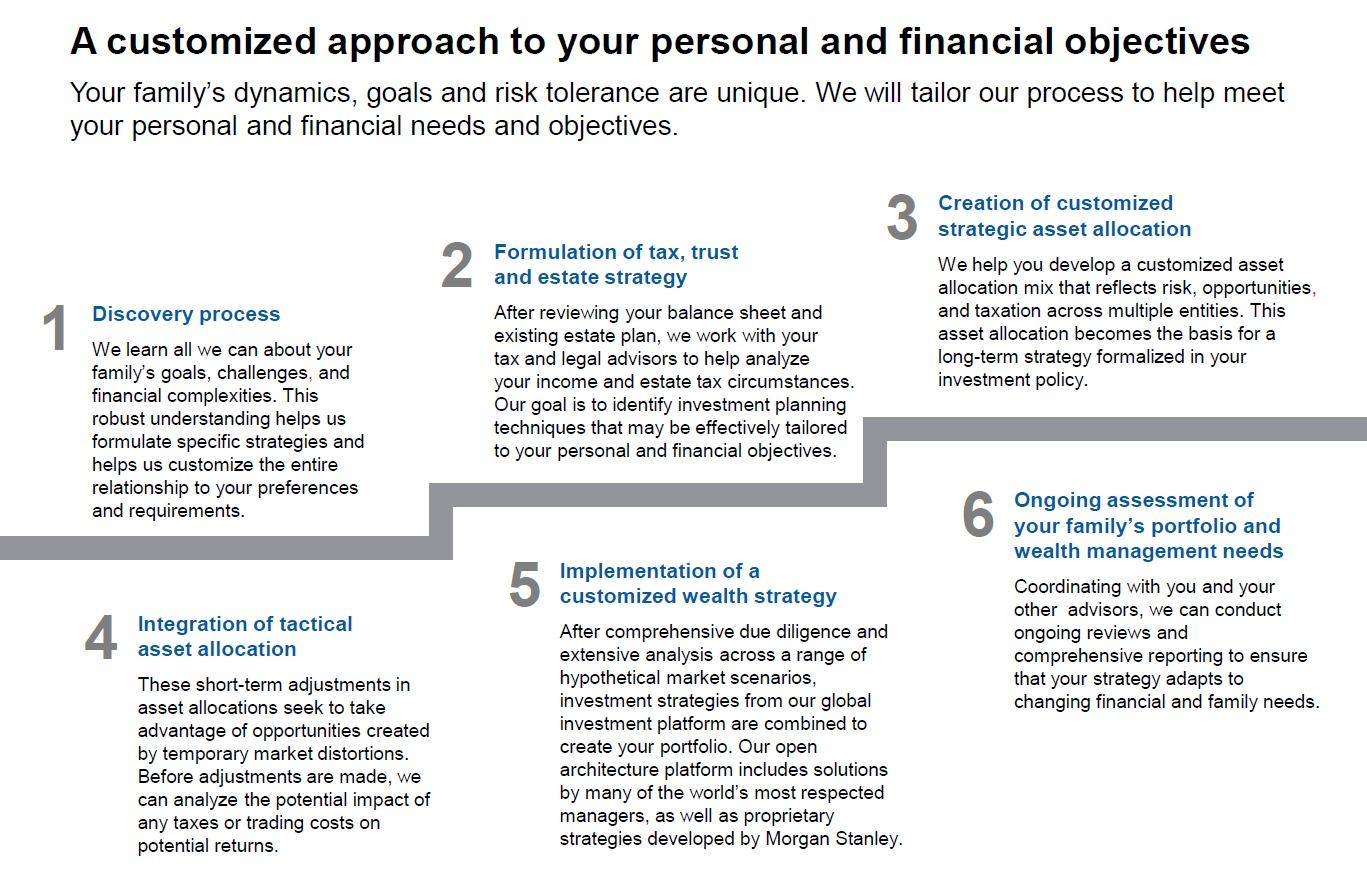

The 350 Wealth Management Group Process

Personalized Client Experience

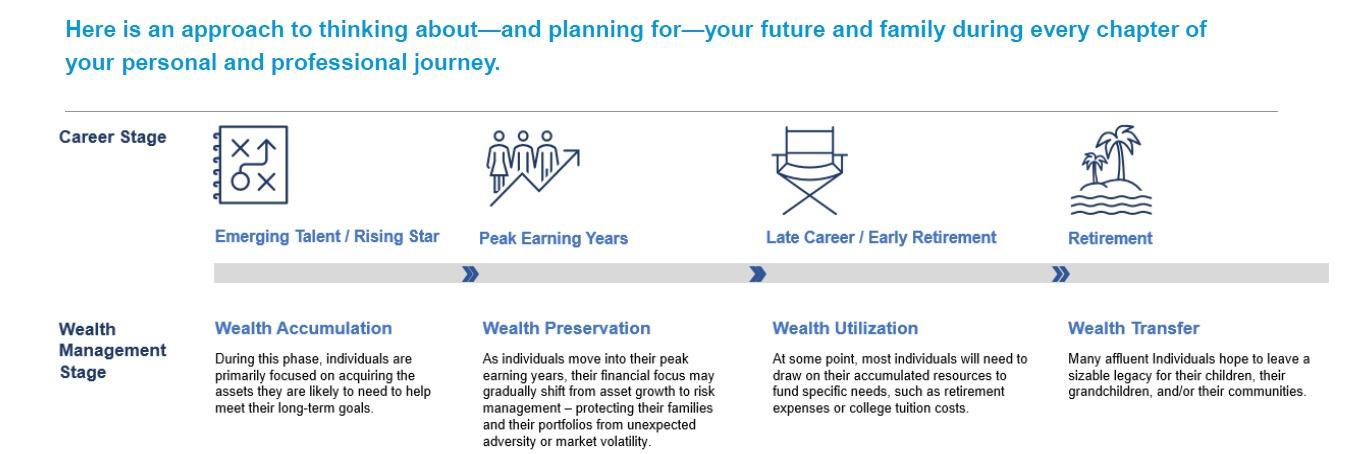

Life is about change. As you progress through different stages of your personal and professional life, you will face a succession of financial opportunities and challenges. Your financial goals and priorities may shift or evolve, and your wealth management strategies will need to adapt to keep pace.

Throughout your life, you will move through four stages of wealth: Accumulation, Preservation, Utilization, and Transfer. These stages overlap, and the transition between stages may be gradual. As an accomplished individual in the sports or entertainment industry, you have unique career dynamics and variable income streams. Your path through the wealth management cycle is rarely linear and transitions can be abrupt. Given these intricacies, you need comprehensive, customized wealth management strategies that match your lifestyle and your career trajectory.

Throughout your life, you will move through four stages of wealth: Accumulation, Preservation, Utilization, and Transfer. These stages overlap, and the transition between stages may be gradual. As an accomplished individual in the sports or entertainment industry, you have unique career dynamics and variable income streams. Your path through the wealth management cycle is rarely linear and transitions can be abrupt. Given these intricacies, you need comprehensive, customized wealth management strategies that match your lifestyle and your career trajectory.

AWARDS AND RECOGNITIONS

The following are just some of the awards, recognitions and press releases that The 350 Wealth Management Group has received as a result of their constant dedication to assisting clients reach their financial goals.

Links to Awards

2025 Forbes Best-In-State Wealth Management Teams__________________

Disclosures

Forbes Best In State Wealth Management Teams 2025

Source: Forbes.com (Awarded Jan 2025) Data compiled by SHOOK Research LLC based for the period 3/31/23-3/31/24.

Forbes Best In State Wealth Management Teams 2024

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based for the period 3/31/22-3/31/23.

Forbes Best-In-State Next-Gen Wealth Advisors: Angaddeep Ahluwalia, CEPA®

Source: Forbes.com (Awarded Aug 2024) Data compiled by SHOOK Research LLC for the period 3/31/23 - 3/31/24.

2021 - 2023 Forbes Best-In- State Wealth Advisors: Gregory Steinmetz

Source: Forbes.com (Awarded 2021 - 2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Source: Forbes.com (Awarded Jan 2025) Data compiled by SHOOK Research LLC based for the period 3/31/23-3/31/24.

Forbes Best In State Wealth Management Teams 2024

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based for the period 3/31/22-3/31/23.

Forbes Best-In-State Next-Gen Wealth Advisors: Angaddeep Ahluwalia, CEPA®

Source: Forbes.com (Awarded Aug 2024) Data compiled by SHOOK Research LLC for the period 3/31/23 - 3/31/24.

2021 - 2023 Forbes Best-In- State Wealth Advisors: Gregory Steinmetz

Source: Forbes.com (Awarded 2021 - 2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Location

350 East Las Olas Blvd

Ste 1500

Ft Lauderdale, FL 33301

US

Direct:

(954) 762-3000(954) 762-3000

Toll-Free:

(800) 327-8323(800) 327-8323

Fax:

(954) 446-1933(954) 446-1933

Meet The 350 Wealth Management Group

About Gregory Steinmetz

Greg focuses primarily on meeting the specialized needs of clients in the sports and entertainment industries, and he brings a high level of knowledge and a unique perspective to his clients. With his extensive experience and tailored approach, he helps high-net-worth individuals and their families develop retirement planning strategies that are integrated into a comprehensive financial plan. Greg’s holistic process for wealth management includes customizing client portfolios around their goals for themselves, their families and other loved ones.

Greg has more than 30 years of experience in the financial services industry, including more than 18 years working with professional coaches and athletes. He has also attained the Family Wealth Director designation at Morgan Stanley. Currently held by only 4% of advisors at the firm, this allows Greg to provide true “best-in-class” solutions and personalized strategies to his clients. He is a member of the Morgan Stanley President’s Club and has been named a Forbes “Best-in-State Wealth Advisor” annually since 2019.

An avid sports fan, Greg enjoys playing hockey in his weekly league games, as well as watching his favorite professional football, baseball, basketball, and hockey teams. He resides in Davie, Florida, with his wife and three children.

2019-2022 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Greg has more than 30 years of experience in the financial services industry, including more than 18 years working with professional coaches and athletes. He has also attained the Family Wealth Director designation at Morgan Stanley. Currently held by only 4% of advisors at the firm, this allows Greg to provide true “best-in-class” solutions and personalized strategies to his clients. He is a member of the Morgan Stanley President’s Club and has been named a Forbes “Best-in-State Wealth Advisor” annually since 2019.

An avid sports fan, Greg enjoys playing hockey in his weekly league games, as well as watching his favorite professional football, baseball, basketball, and hockey teams. He resides in Davie, Florida, with his wife and three children.

2019-2022 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: AL, AZ, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, KY, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, TN, TX, UT, VA, VT, WA, WI, WV, AR, LA, MA, MD, ME, MI, MN, MO, MS, MT, KS, NC, ND, NH, NJ, NE, IA, WY, SD, AK; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1282711

NMLS#: 1282711

About Brian P. Mahoney

Brian works with a variety of clients—including entrepreneurs, retirees, medical professionals, and ultra-high-net-worth investors—to provide disciplined and diversified investment management that supports each client’s unique financial objectives. He has particular knowledge about developing customized wealth strategies for retirement planning, estate planning, and divorce situations.

As CERTIFIED FINANCIAL PLANNER™, Certified Private Wealth Advisor®, and Certified Divorce Financial Analyst® professional, Brian is a credentialed and passionate practitioner of financial planning. Having worked with individuals and families since 1993, Brian has experienced nearly every kind of market cycle and navigated diverse opportunities, and challenges for client portfolios.

Brian is a member of the American Bar Association as an affiliated professional, with a focus on the Family Law Section, reinforcing his commitment to collaborating with divorce attorneys to help support clients with the financial analysis and long-term planning considerations that often accompany the divorce process.

Brian resides in Fort Lauderdale with his wife with their daughter. Outside the office, he enjoys spending his time with his family, as well as boating, Brazilian Jiu Jitsu, and life in South Florida.

As CERTIFIED FINANCIAL PLANNER™, Certified Private Wealth Advisor®, and Certified Divorce Financial Analyst® professional, Brian is a credentialed and passionate practitioner of financial planning. Having worked with individuals and families since 1993, Brian has experienced nearly every kind of market cycle and navigated diverse opportunities, and challenges for client portfolios.

Brian is a member of the American Bar Association as an affiliated professional, with a focus on the Family Law Section, reinforcing his commitment to collaborating with divorce attorneys to help support clients with the financial analysis and long-term planning considerations that often accompany the divorce process.

Brian resides in Fort Lauderdale with his wife with their daughter. Outside the office, he enjoys spending his time with his family, as well as boating, Brazilian Jiu Jitsu, and life in South Florida.

Securities Agent: NC, MD, UT, OK, NJ, IA, HI, GA, RI, KY, IN, ID, FL, AZ, WV, VA, SC, IL, AR, NV, DC, OR, MT, MN, CO, WI, WA, MI, NY, LA, CA, AK, TN, NH, ND, ME, KS, CT, MA, AL, WY, TX, PA, OH, NM, MS, MO; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 2069363

NMLS#: 2069363

About Michael P. Gee

Michael is a Senior Vice President, Financial Advisor, and Portfolio Management Director with The 350 Wealth Management Group at Morgan Stanley in Fort Lauderdale. With over 30 years of experience in the financial services industry, Michael is dedicated to understanding and meeting the unique needs of each client and their families. His passion lies in truly comprehending his clients’ financial aspirations and goals. Through comprehensive and thoughtful planning, Michael – and his team – design and customize investment portfolios that are strategically allocated to fit each client’s personal financial situation, while also being adaptable to timely and tactical opportunities in the market.

Michael’s journey in financial services began after earning his bachelor's degree in business administration from the University of Florida. Over the years, he has built extensive knowledge and experience, guiding clients through various market cycles with informed investment strategies. His skilled focus allows him to navigate the complexities of ever-changing market conditions, providing insightful advice to help clients achieve their financial goals.

A South Florida native, Michael currently resides in Boca Raton, with his wife, Patty. They have two grown children, Michael and Sara. Outside the office, Michael treasures quality time with his family and enjoys the vibrant South Florida lifestyle, including golfing, boating, and fishing.

Michael’s journey in financial services began after earning his bachelor's degree in business administration from the University of Florida. Over the years, he has built extensive knowledge and experience, guiding clients through various market cycles with informed investment strategies. His skilled focus allows him to navigate the complexities of ever-changing market conditions, providing insightful advice to help clients achieve their financial goals.

A South Florida native, Michael currently resides in Boca Raton, with his wife, Patty. They have two grown children, Michael and Sara. Outside the office, Michael treasures quality time with his family and enjoys the vibrant South Florida lifestyle, including golfing, boating, and fishing.

Securities Agent: WY, ME, ND, MI, UT, TN, OH, NJ, NH, NC, MD, MO, MA, DC, AR, AL, MT, AK, OR, MS, CT, WV, VA, NV, NM, KS, ID, HI, CA, WI, WA, PA, OK, NY, LA, KY, IN, GA, RI, IL, IA, SC, FL, CO, AZ, TX, MN; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1431006

NMLS#: 1431006

About James Funk

As a CERTIFIED FINANCIAL PLANNER™ professional, James offers particular knowledge in portfolio review and construction, as well as financial and estate planning strategies. He has built his practice with an emphasis on listening carefully to understand clients’ goals and objectives in order to align their investment solutions accordingly, and he focuses on superior communication and service across every stage of the wealth management experience.

James joined Morgan Stanley in 2000. He holds the Series 31, 7, 66, and Life, Health Insurance and Variable Annuity licenses, and he earned a bachelor’s degree in finance from the University of Central Florida.

A resident of Broward County for more than 40 years, James and his wife, Monica, have two daughters, Dana and Briana, and two friendly dogs, Lexi and Jake. He has been a member of the Kiwanis Club of Plantation since 2000 and has served in many positions over the years, including president. Outside the office, James enjoys spending time with his family, working on his classic car, improving his golf swing and traveling to find the perfect surfing experience.

James joined Morgan Stanley in 2000. He holds the Series 31, 7, 66, and Life, Health Insurance and Variable Annuity licenses, and he earned a bachelor’s degree in finance from the University of Central Florida.

A resident of Broward County for more than 40 years, James and his wife, Monica, have two daughters, Dana and Briana, and two friendly dogs, Lexi and Jake. He has been a member of the Kiwanis Club of Plantation since 2000 and has served in many positions over the years, including president. Outside the office, James enjoys spending time with his family, working on his classic car, improving his golf swing and traveling to find the perfect surfing experience.

Securities Agent: DC, OR, NM, PA, NV, ND, MS, MO, LA, IL, WA, VA, SC, OK, NY, MN, MI, IA, CO, AK, WV, IN, AR, TN, NH, MD, KY, HI, GA, CA, AZ, WI, TX, RI, OH, NC, KS, CT, WY, NJ, MT, FL, AL, NE, ME, MA, ID, VT, SD; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1290472

NMLS#: 1290472

About Richard De Luca

Rich focuses on working with clients in the sports and entertainment industry, particularly professional athletes. He takes a holistic approach to wealth management, advising clients on their total financial picture, tailoring their investment plans to their goals and helping manage the day-to-day details of their complex lives.

Rich brings 15 years of experience in the financial industry to the team. Previously, he spent 22 years in the sports industry as a National Football League Players Association (NFLPA) registered contract advisor, which gives him extensive knowledge of professional athletes’ contracts. In addition, Rich’s background has allowed him to gain a deep understanding of the various cycles of an athlete’s personal and professional life that underpins his financial advice. Rich is an NFLPA Registered Institutional Player Financial Advisor, and he earned Morgan Stanley Pacesetters Club recognition in 2022. He graduated from Tulane University with a Bachelor of Science degree.

Rich lives in Weston, Florida, with his wife, Vicki, and their three daughters. He is a big sports fan and animal advocate, and he enjoys playing tennis and basketball in his free time.

Rich brings 15 years of experience in the financial industry to the team. Previously, he spent 22 years in the sports industry as a National Football League Players Association (NFLPA) registered contract advisor, which gives him extensive knowledge of professional athletes’ contracts. In addition, Rich’s background has allowed him to gain a deep understanding of the various cycles of an athlete’s personal and professional life that underpins his financial advice. Rich is an NFLPA Registered Institutional Player Financial Advisor, and he earned Morgan Stanley Pacesetters Club recognition in 2022. He graduated from Tulane University with a Bachelor of Science degree.

Rich lives in Weston, Florida, with his wife, Vicki, and their three daughters. He is a big sports fan and animal advocate, and he enjoys playing tennis and basketball in his free time.

Securities Agent: IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY, ID, AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI; General Securities Representative; Investment Advisor Representative

NMLS#: 520998

NMLS#: 520998

About Angaddeep Ahluwalia

Angaddeep works with entrepreneurs, ultra-high-net-worth investors and professional coaches, athletes and entertainers to provide disciplined investment management and comprehensive financial planning strategies. He oversees the team’s management and maintenance of investment accounts, including trading, research and portfolio construction. Specifically, he is responsible for building equity and fixed income portfolios and developing customized alternative and structured note portfolios—all of which require him to conduct fundamental and technical analysis on individual equity and fixed income positions.

Angaddeep joined the 350 Wealth Management Group at Morgan Stanley in 2014 and was named a Forbes “Top Next-Gen Wealth Advisor Best-in-State” in 2024. He also holds the “NFLPA Registered Institutional Player Financial Advisor” designation and is a Global Sports and Entertainment Associate Director. He holds the FINRA Series 7 and 66 licenses and has earned the Certified Exit Planning Advisor designation. Angaddeep graduated from Nova Southeastern University with a degree in finance.

Angaddeep lives in Parkland with his family. In his spare time, he enjoys volunteering in his community, and playing basketball and racquetball. He is also an avid cricket, football, and soccer fan.

Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded Aug 2024) Data compiled by SHOOK Research LLC for the period 3/31/23 - 3/31/24.

Technical analysis is the study of past price and volume trends of a security in an attempt to predict the security's future price and volume trends. Its limitations include but are not limited to: the lack of fundamental analysis of a security's financial condition, lack of analysis of macro-economic trend forecasts, the bias of the technician's view and the possibility that past participants were not entirely rational in their past purchases or sales of the security being analyzed. Investors using technical analysis should consider these limitations prior to making an investment decision.

Angaddeep joined the 350 Wealth Management Group at Morgan Stanley in 2014 and was named a Forbes “Top Next-Gen Wealth Advisor Best-in-State” in 2024. He also holds the “NFLPA Registered Institutional Player Financial Advisor” designation and is a Global Sports and Entertainment Associate Director. He holds the FINRA Series 7 and 66 licenses and has earned the Certified Exit Planning Advisor designation. Angaddeep graduated from Nova Southeastern University with a degree in finance.

Angaddeep lives in Parkland with his family. In his spare time, he enjoys volunteering in his community, and playing basketball and racquetball. He is also an avid cricket, football, and soccer fan.

Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded Aug 2024) Data compiled by SHOOK Research LLC for the period 3/31/23 - 3/31/24.

Technical analysis is the study of past price and volume trends of a security in an attempt to predict the security's future price and volume trends. Its limitations include but are not limited to: the lack of fundamental analysis of a security's financial condition, lack of analysis of macro-economic trend forecasts, the bias of the technician's view and the possibility that past participants were not entirely rational in their past purchases or sales of the security being analyzed. Investors using technical analysis should consider these limitations prior to making an investment decision.

Securities Agent: GA, DC, UT, OR, NJ, IA, WI, OK, MS, IL, CA, MO, MI, MA, CO, WA, NM, MT, AZ, AL, VA, OH, MN, SC, RI, PA, KY, FL, AK, TX, NV, NC, KS, HI, AR, ID, NH, MD, CT, VT, NY, ME, LA, IN, WV, TN, ND; General Securities Representative; Investment Advisor Representative

NMLS#: 1569116

NMLS#: 1569116

About Shawn E. Eager

Shawn is committed to skillfully navigating complex financial landscapes to help you achieve your goals during significant life events and beyond. Serving clients in South Florida and nationwide, he combines his extensive professional focus with Morgan Stanley’s global resources, specialized research, and world-class solutions.

Shawn provides personalized and qualified guidance, providing financial advice and strategies to help you navigate pivotal moments with confidence, clarity, and an increased comfort level. His focus areas include:

- Ultra/High-Net-Worth Individuals & Families: Delivering comprehensive guidance for managing the unique challenges and opportunities of significant wealth, including legacy planning, family dynamics, sophisticated tax strategies, and wealth transfer solutions.

- Closely-Held Business Owners: Offering strategic planning to maximize business value, facilitate succession, and explore exit options.

- Individuals Facing Divorce: Providing guidance to navigate the financial complexities and implications of divorce.

- Corporate Executives: Seamlessly integrating equity compensation into comprehensive financial plans.

- Retirees: Developing sustainable retirement income plans and effective risk management strategies.

Shawn’s advanced certifications underscore his comprehensive professional focus :

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Certified Private Wealth Advisor® (CPWA®)

- Certified Investment Management Analyst® (CIMA®)

- Certified Exit Planning Advisor® (CEPA®)

- Certified Divorce Financial Analyst® (CDFA®)

- Chartered Financial Consultant® (ChFC®)

- Chartered Life Underwriter® (CLU®)

- Retirement Management Advisor® (RMA®)

- Retirement Income Certified Professional® (RICP®)

- Qualified Plan Financial Consultant® (QPFC®)

In addition, Shawn is a member of the American Bar Association as an affiliated professional, with a focus on the Family Law Section, reinforcing his commitment to collaborating with divorce attorneys to help support clients with the financial analysis and long-term planning considerations that often accompany the divorce process.

Since joining Morgan Stanley in 2018, Shawn has been named to the firm’s prestigious Pacesetter’s Club (2022-2026), a global recognition program for Financial Advisors who have demonstrated the highest professional standards and first-class client service early in their career.

Originally from Biddeford, Maine, Shawn holds a bachelor’s degree from the University of Southern Maine and a master’s degree from Florida Atlantic University. Now residing in Fort Lauderdale, he enjoys life with his son, Thomas.

Beyond his professional and family commitments, Shawn serves on the Board of Directors for Gilda’s Club South Florida, supporting individuals and families affected by cancer. An avid reader and scuba diving enthusiast, Shawn also holds a second-degree black belt in Brazilian Jiu-Jitsu and engages in EMS fitness training.

___________________________________________

Morgan Stanley Wealth Management Pacesetter's Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance.

Shawn provides personalized and qualified guidance, providing financial advice and strategies to help you navigate pivotal moments with confidence, clarity, and an increased comfort level. His focus areas include:

- Ultra/High-Net-Worth Individuals & Families: Delivering comprehensive guidance for managing the unique challenges and opportunities of significant wealth, including legacy planning, family dynamics, sophisticated tax strategies, and wealth transfer solutions.

- Closely-Held Business Owners: Offering strategic planning to maximize business value, facilitate succession, and explore exit options.

- Individuals Facing Divorce: Providing guidance to navigate the financial complexities and implications of divorce.

- Corporate Executives: Seamlessly integrating equity compensation into comprehensive financial plans.

- Retirees: Developing sustainable retirement income plans and effective risk management strategies.

Shawn’s advanced certifications underscore his comprehensive professional focus :

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Certified Private Wealth Advisor® (CPWA®)

- Certified Investment Management Analyst® (CIMA®)

- Certified Exit Planning Advisor® (CEPA®)

- Certified Divorce Financial Analyst® (CDFA®)

- Chartered Financial Consultant® (ChFC®)

- Chartered Life Underwriter® (CLU®)

- Retirement Management Advisor® (RMA®)

- Retirement Income Certified Professional® (RICP®)

- Qualified Plan Financial Consultant® (QPFC®)

In addition, Shawn is a member of the American Bar Association as an affiliated professional, with a focus on the Family Law Section, reinforcing his commitment to collaborating with divorce attorneys to help support clients with the financial analysis and long-term planning considerations that often accompany the divorce process.

Since joining Morgan Stanley in 2018, Shawn has been named to the firm’s prestigious Pacesetter’s Club (2022-2026), a global recognition program for Financial Advisors who have demonstrated the highest professional standards and first-class client service early in their career.

Originally from Biddeford, Maine, Shawn holds a bachelor’s degree from the University of Southern Maine and a master’s degree from Florida Atlantic University. Now residing in Fort Lauderdale, he enjoys life with his son, Thomas.

Beyond his professional and family commitments, Shawn serves on the Board of Directors for Gilda’s Club South Florida, supporting individuals and families affected by cancer. An avid reader and scuba diving enthusiast, Shawn also holds a second-degree black belt in Brazilian Jiu-Jitsu and engages in EMS fitness training.

___________________________________________

Morgan Stanley Wealth Management Pacesetter's Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance.

Securities Agent: WV, IL, DC, OK, MS, ME, TN, MT, MA, ID, CT, CO, VT, UT, TX, NY, NV, MN, MD, KY, GA, AR, AL, AK, SC, RI, OR, CA, VA, OH, NH, NC, LA, HI, WY, WI, PA, NM, ND, MO, IA, FL, AZ, WA, MI, KS, NJ, IN; General Securities Representative; Investment Advisor Representative

NMLS#: 1889161

CA Insurance License #: 4091347

NMLS#: 1889161

CA Insurance License #: 4091347

About John Snyder

John Snyder is a Senior Vice President, Wealth Advisor, and Portfolio Management Director with The 350 Wealth Management Group at Morgan Stanley in Fort Lauderdale. For decades, John has helped professionals, retirees, and families secure their financial futures, and simplify their financial lives.

A graduate of the University of Maryland, John began his career in wealth management as an Associate Vice President with Dean Whitter in 1981. He would go on to serve as a Financial Advisor for Oppenheimer, Paine Webber, and Prudential Securities, working to earn the rigorous CERTIFIED FINANCIAL PLANNER™ designation in 1997. In 2003, he joined Morgan Stanley, as it would allow his clients access to the elite resources of one of the most well-respected financial institutions in the world.

With The 350 Wealth Management Group, John helps clients address their comprehensive wealth management needs. From retirement planning, portfolio management, and financial planning; to cash management, lending, insurance needs, and more. Having worked in the industry for decades, John has been fortunate to work with clients throughout many important moments in their life, and even across multiple generations. With experience, integrity, and commitment, he works tirelessly to help his clients achieve their long-term objectives, and establish long-lasting legacies.

Outside the office, John lives in Fort Lauderdale with his wife Diane. A former professional U.S.A.C & S.C.C.A. race driver, he now enjoys getting out on the water for a day of sailing. Previously, he has served as a trustee and head of the Investment Committee for First Presbyterian Church of Fort Lauderdale.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

A graduate of the University of Maryland, John began his career in wealth management as an Associate Vice President with Dean Whitter in 1981. He would go on to serve as a Financial Advisor for Oppenheimer, Paine Webber, and Prudential Securities, working to earn the rigorous CERTIFIED FINANCIAL PLANNER™ designation in 1997. In 2003, he joined Morgan Stanley, as it would allow his clients access to the elite resources of one of the most well-respected financial institutions in the world.

With The 350 Wealth Management Group, John helps clients address their comprehensive wealth management needs. From retirement planning, portfolio management, and financial planning; to cash management, lending, insurance needs, and more. Having worked in the industry for decades, John has been fortunate to work with clients throughout many important moments in their life, and even across multiple generations. With experience, integrity, and commitment, he works tirelessly to help his clients achieve their long-term objectives, and establish long-lasting legacies.

Outside the office, John lives in Fort Lauderdale with his wife Diane. A former professional U.S.A.C & S.C.C.A. race driver, he now enjoys getting out on the water for a day of sailing. Previously, he has served as a trustee and head of the Investment Committee for First Presbyterian Church of Fort Lauderdale.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Securities Agent: MO, SC, NC, LA, DC, CO, WV, AZ, AL, WA, OK, OH, ME, IL, ID, VT, HI, GA, PA, OR, NV, NH, KY, FL, WI, NJ, IN, DE, CA, TX, MN, MA, KS, IA, AK, VA, RI, MI, AR, MD, TN, NY, ND, MT, MS, CT, NM; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1406574

NMLS#: 1406574

About Jackie M. Bookman

Jackie has over 20 years of experience in the financial industry. She joined Morgan Stanley in 2010 after having previously worked at a financial services firm for almost 15 years. Jackie's role includes being responsible for day-to-day operations, monitoring client accounts, and most importantly helping to service clients on a daily basis. Jackie has been married to her husband Michael for almost 40 years, and has two sons and one granddaughter.

About Mary L. Gorman

Mary handles client-related requests and inquiries with efficiency, from financial transactions to account maintenance. She is committed to delivering superior service and building relationships that help her anticipate and address clients’ needs. Mary brings 40 years of financial services industry experience to the team, which she uses to help solve service-related issues every day. She earned a business degree from the Taylor Business Institute in New Jersey.

Originally from Point Pleasant Beach, New Jersey, Mary moved to Florida in 1977 and currently lives in Hollywood. She and her husband have two children, three grandchildren and a rescue dog, Ginger (who goes by the name of Bahamian Pot Cake). Outside the office, she enjoys boating, camping (or glamping) and traveling.

Originally from Point Pleasant Beach, New Jersey, Mary moved to Florida in 1977 and currently lives in Hollywood. She and her husband have two children, three grandchildren and a rescue dog, Ginger (who goes by the name of Bahamian Pot Cake). Outside the office, she enjoys boating, camping (or glamping) and traveling.

About Jess Delareza

Jessica joins the 350 Wealth Management Group at Morgan Stanley as a Wealth Management Associate. With over 25 years of experience in the industry, Jessica started her career in investment banking at UBS. She made the move to Fort Lauderdale in 2005, where she joined a mid-size broker dealer. Focusing on the wealth management in the later part of her career, Jessica recognizes that importance of providing a comprehensive plan that will ensure clients stay on track with their financial goals.

Jessica enjoys building long term relationships and takes great care in creating an exclusive personalized client experience. Jessica works closely with the client & the wealth management team to deliver unparalleled client service.

Originally from Connecticut, Jessica lives in Plantation with her husband, Howat and their three dogs. In her free time, she is an avid sport enthusiast & yogi. She loves traveling and exploring new destinations.

Jessica enjoys building long term relationships and takes great care in creating an exclusive personalized client experience. Jessica works closely with the client & the wealth management team to deliver unparalleled client service.

Originally from Connecticut, Jessica lives in Plantation with her husband, Howat and their three dogs. In her free time, she is an avid sport enthusiast & yogi. She loves traveling and exploring new destinations.

About Isabella Cozad

With over eight years of experience at Morgan Stanley, Isabella is a dedicated Portfolio Associate specializing in cultivating and enhancing new and existing client relationships. In her role, she collaborates closely with clients to ensure they receive exceptional service and support to ensure their account needs are met.

Isabella holds a Bachelor’s degree in Communications with a minor in Entrepreneurship from Florida International University, which has contributed to her strong communication and problem-solving skills. Her background allows her to connect with clients and colleagues alike, providing thoughtful insights and a high level of service.

Outside of work, Isabella resides in Davie, FL with her husband and two children. She is passionate about spending time outdoors and enjoys traveling with her family, constantly seeking new experiences and adventures.

Isabella holds a Bachelor’s degree in Communications with a minor in Entrepreneurship from Florida International University, which has contributed to her strong communication and problem-solving skills. Her background allows her to connect with clients and colleagues alike, providing thoughtful insights and a high level of service.

Outside of work, Isabella resides in Davie, FL with her husband and two children. She is passionate about spending time outdoors and enjoys traveling with her family, constantly seeking new experiences and adventures.

About Tilson Rodriguez

Tilson began his career with Morgan Stanley in Jan 2016, and bringing with him 19 years of experience in financial services. He works closely with the team to enhance new and existing client relationships through active communication, providing assistance with new account opening/maintenance, money movement transactions, and enrolling/training clients in operating Morgan Stanley's proprietary Modern Wealth tools.

His demonstrated knowledge, problem-solving capabilities, strong communication skills, and friendly demeanor allow Tilson to be a key resource for clients. Tilson earned his Bachelor’s Degree in Communications from Florida International University and has his Series 7 and Series 66 licenses.

Outside of work, he's a fan of film, television and music as well as an avid concert goer in the South Florida area.

His demonstrated knowledge, problem-solving capabilities, strong communication skills, and friendly demeanor allow Tilson to be a key resource for clients. Tilson earned his Bachelor’s Degree in Communications from Florida International University and has his Series 7 and Series 66 licenses.

Outside of work, he's a fan of film, television and music as well as an avid concert goer in the South Florida area.

About Ann Pharris

Ann has been with Morgan Stanley for over 5 years; she assists the team by helping service clients and developing customized financial plans. Her previous experience is in small business, in both ownership and administrative roles. In her spare time Ann enjoys volunteering and indulging her artistic nature by painting. Originally from Wisconsin, Ann currently resides in Davie, FL with her two children.

Contact Gregory Steinmetz

Contact Brian P. Mahoney

Contact Michael P. Gee

Contact James Funk

Contact Richard De Luca

Contact Angaddeep Ahluwalia

Contact Shawn E. Eager

Contact John Snyder

Hear From Our Clients

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2024-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2024-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Forbes America's Top Next-Gen Wealth Advisors

2024-2025 Forbes America's Top Next-Gen Wealth Advisors (formerly referred to as Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors) Source: Forbes.com (Awarded 2024-2025). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

Forbes Best-In-State Wealth Advisors

2019-2022 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2019-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

3

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Wealth Management for Athletes and Entertainers

Understanding the unique financial challenges of athletes and entertainers and how they differ from one profession to the next, we deliver the experience and resources you need to help create and implement a comprehensive, multigenerational wealth management plan based on your needs, values and aspirations.

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The 350 Wealth Management Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

11Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

13Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

14When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

15Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

16Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

11Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

13Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

14When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

15Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

16Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Testimonial(s) solicited by Morgan Stanley and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)

Verified Client

Verified Client