About Dan R De St. Aubin

My primary goal as your Financial Advisor is to help you achieve financial independence. From my 20 years of experience in wealth management, I have found that developing a thorough understanding of client’s financial situation and creating an individualized plan is one of the most effective way for helping clients reach their goals.

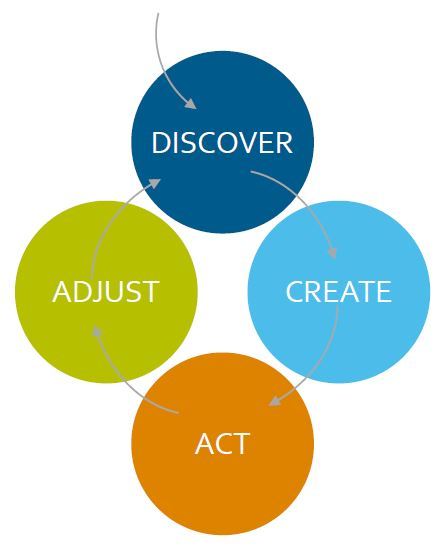

I take a holistic, collaborative approach when I meet with you. Not only do I conduct a detailed review of your finances, but I take the time to find out about your family, values, dreams, and thoughts on risk. I use this information in combination with the firm’s modern wealth management analytics and cutting edge research to formulate customized strategies. To help ensure you are comfortable with my approach, I take the necessary time to educate and explain your program’s details.

Your wealth plan will not just include investments, but it can help you manage taxes, plan your estate, and manage your borrowing needs. We will draw upon Morgan Stanley’s extensive network of specialists in insurance, structured solutions, estate planning, and lending services to complement and deepen our advice.

Once your plan is in place, we will communicate with you regularly and set-up meetings to discuss your progress. As your life and the markets change, we will make adjustments to your program as needed.

By putting clients first and sincerely caring about their future, we have developed a successful practice. We take pride in having worked with clients for decades, including families whom we have served for multiple generations. Our dedications to our clients remains our highest priority

Dan brings over 20 years of experience as Financial Advisor. Dan lives in Stillwater with his wife Danielle and 4 children, Izzy, Eli, Charlotte and Elsa. Dan serves on the St. Croix Soccer Club board of directors.

Securities Agent: OH, AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV, WY; BM/Supervisor; General Securities Representative; Investment Advisor Representative

NMLS#: 1380633

Industry Award Winner

Industry Award Winner