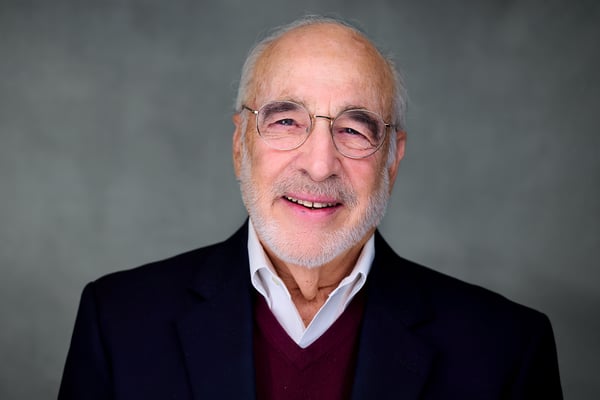

About Dustin Seidman

Dustin is a Financial Advisor, Portfolio Management Director, and CERTIFIED FINANCIAL PLANNER®. Starting at Morgan Stanley in 2009, he serves high and ultra high-net-worth clients.

Dustin was named to the 2022 Forbes Top Next-Gen Wealth Advisors Best-In-State ranking for Pennsylvania. Dustin’s wealth advisory practice focuses on consulting to successful families and their businesses. Prior to his time at Morgan Stanley, he was a Staffing Manager at Robert Half International and a Senior Mortgage Banker at National Fidelity Mortgage. He is on the Board of Directors for JEVS Human Services in Philadelphia and serves on their Investment Committee. Dustin holds a B.A. degree in Public Relations with concentration in Strategic Communications, and a marketing certificate. While at Towson, Dustin was president of his Sigma Pi Fraternity International chapter. He also was a past member of the Tribe 12 Fellowship for social entrepreneurs.

Dustin is active in his community of Lafayette Hill and volunteers at Congregation Or Ami. During his free time, Dustin enjoys spending time with his wife Sara, daughter Eva, and son Benjamin. Additionally, he likes cooking for friends and family, landscaping and gardening, reading about entrepreneurship and investments, being active in the great outdoors, skiing, hiking, and exercising.

Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded Aug 2022) Data compiled by SHOOK Research LLC based on time period from 3/31/21 - 3/31/22

Securities Agent: TX, SC, MI, IA, AZ, NY, NV, NC, PA, IN, OH, MO, MN, MA, LA, NJ, MD, CT, CO, WA, KS, DC, WV, VA, FL, OR, IL, CA, WI, ME, GA, DE, VT, RI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1290423

Industry Award Winner

Industry Award Winner