Spring Life Group at Morgan Stanley

Our Mission Statement

Our Story & Services

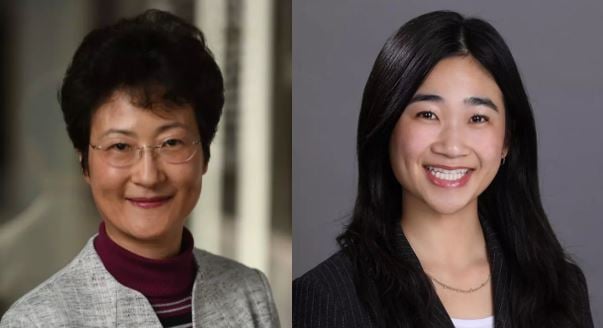

Welcome to our team, where expertise meets personal touch. We are a dynamic, mother-daughter duo passionate about empowering individuals and their families, professionals, business owners, and others to achieve their financial goals and secure their financial future.

Hongmin has been in the investment industry for over three decades and joined Morgan Stanley over a decade ago. Karen brings fresh insights and understandings to the ever-evolving financial landscape and complements Hongmin's seasoned expertise. Together, we are poised to bring greater value to our clients.

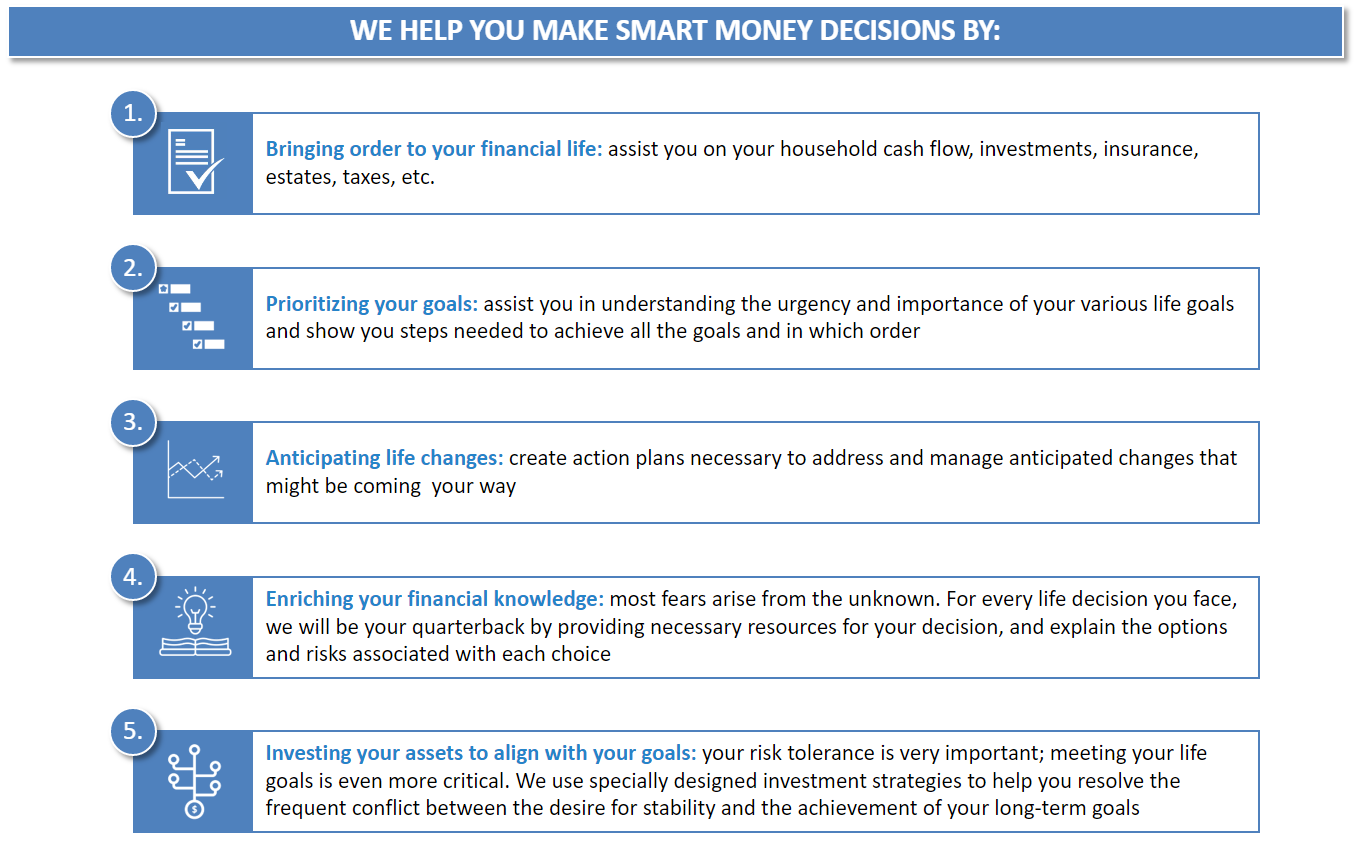

As we build a relationship, we help our clients focus on and understand:

- Your short, medium, and long-term goals

- Investment for your life goals

- The true meaning of risk and what your personal risk means through different stages in life

- Implication of risk tolerance and conservatism

- Retirement planning, education planning, estate planning, tax-advantaged investment management, and more

Beyond our professional expertise, we pride ourselves on building lasting relationships based on trust, integrity, and empathy. We understand that each client's journey is unique, and we are committed to providing personalized guidance every step of the way.

Awards:

2023 - 2025 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2023 to 2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

- Wealth PlanningFootnote1

- Wealth ManagementFootnote2

- Planning for Education FundingFootnote3

- Retirement PlanningFootnote4

- Estate Planning StrategiesFootnote5

- Corporate Retirement PlansFootnote6

- Professional Portfolio ManagementFootnote7

- Cash Management and Lending ProductsFootnote8

- Long-term Care InsuranceFootnote9

- Life InsuranceFootnote10

- AnnuitiesFootnote11

- Philanthropic ManagementFootnote12

- Endowments and FoundationsFootnote13

- Stock Plan ServicesFootnote14

- Stock Option PlansFootnote15

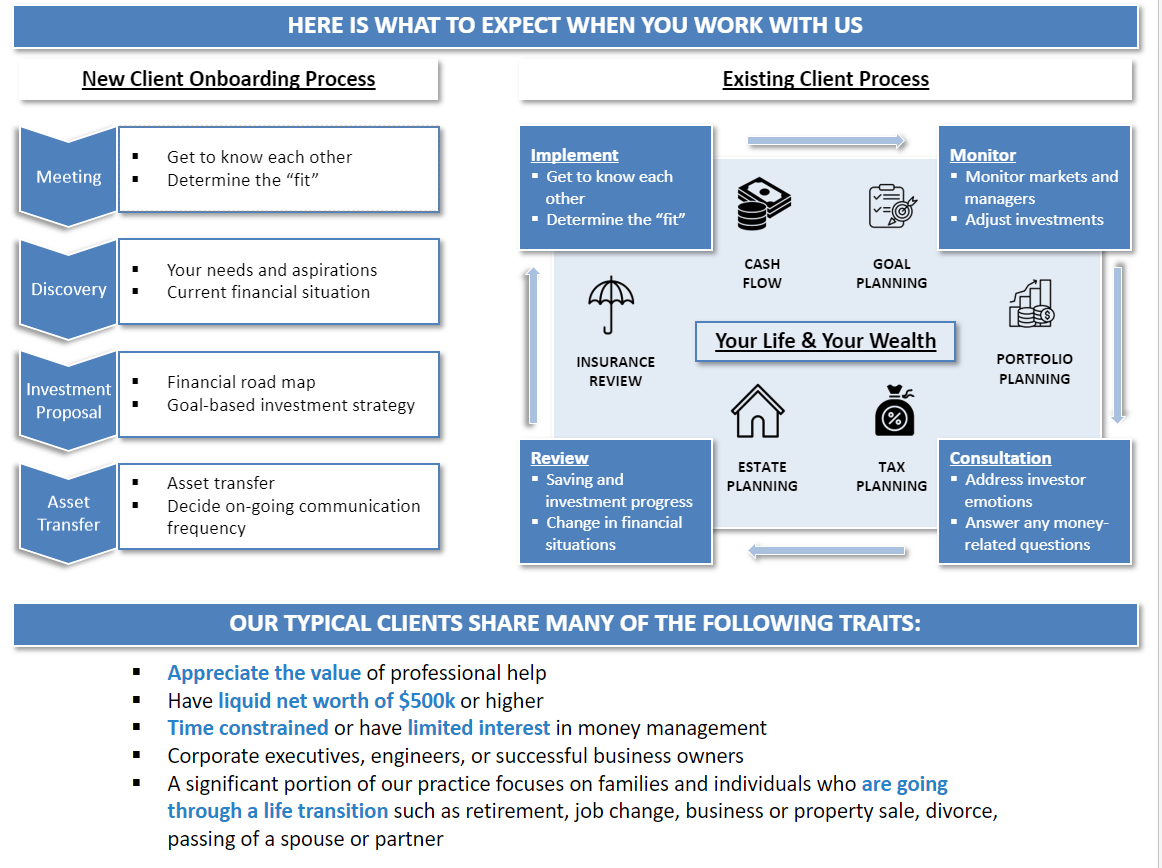

We understand you are very busy and do not have any availability to manage your wealth yourself. We work with you by understanding your life and goals, answer any questions you may have, create a customize solution for you, and continuously review for any adjustment needs.

By overviewing your investments, cashflow, insurance policies and estate needs, we can create financial goals to align with every milestone of your life. By understanding your risk tolerance through customized investment strategies, we can make necessary anticipated changes.

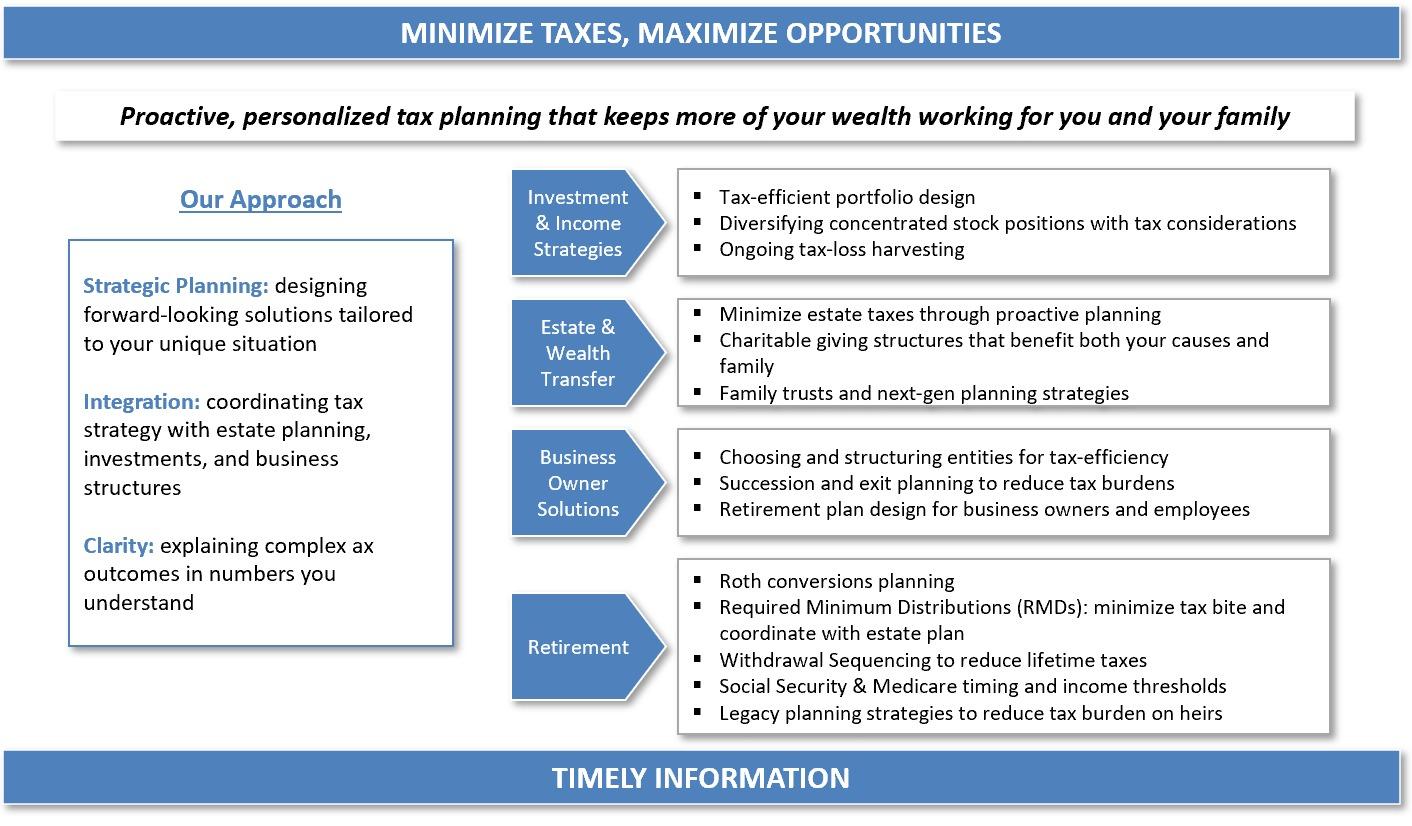

Each year, the tax bill highlights how significantly taxes can impact your journey toward your financial goals — and highlights the value of integrating tax-efficient strategies into your investment process. They might also be the easiest to reduce, with the right strategies in place. We offer a full spectrum of tax-efficient solutions to help mitigate the tax drag on your portfolio—so you can keep more of what you earn and improve after-tax returns.

For information that may be useful in filing this year's taxes, or preparing for next year's, see the 2025 tax tables.

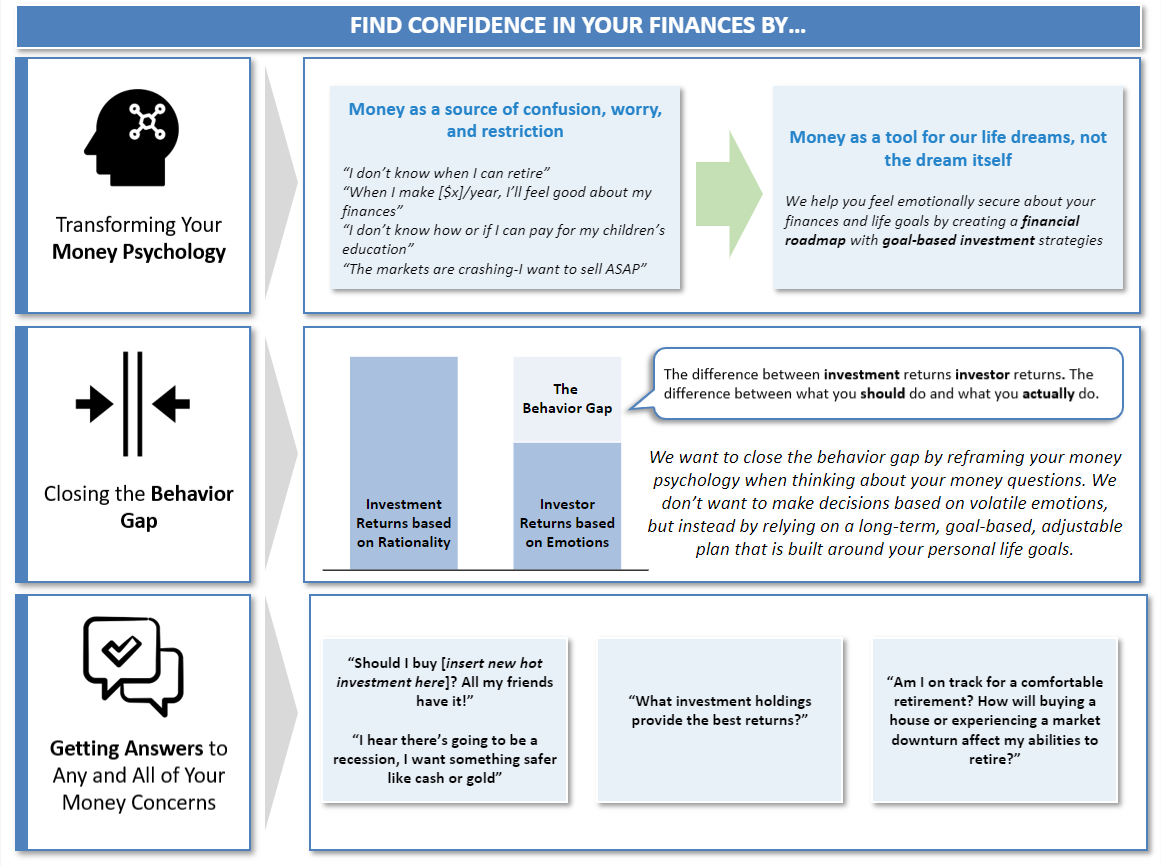

People often are very worried when it comes to their finances. Improper management can cause confusion and worry. By creating a goal-based investment strategies and financial roadmap, we can make you feel happy about the utilization of your wealth to achieve your dreams & goals. With investment based on rationality and logic, rather than emotion, you can generate greater investment returns.

Location

Meet Spring Life Group

About Hongmin Lu

With the expansion of my knowledge and experience in investment, my work responsibility evolved. I transitioned from an analyst to a portfolio manager, and later into personal finance and wealth management.

At Morgan Stanley, I help a selected group of affluent families and individuals. They are mostly engineers, corporate executives, and business owners. My work focuses on clients’ value, passion, and desire, and I see myself as a supporter for my client’s pursue in life. I firmly believe that money is a tool for life, not a goal of life. Life always has ways to throw us curve balls unexpectedly; in order not to be knocked down, we need to plan well. This plan is the financial roadmap, and the clients’ investments are designed to service this plan.

This goal-focused, plan-driven wealth management approach helps clients stay away from the hysteria generated by performance-focused, market event-driven investment crowd. Contrary to popular believe, a large portion of superior long-term return does not come from portfolio construction neither asset selection, it comes from good investor behavior. Investor behavior consultation is the key to my practice and it generates the most value to my client’s long-term wealth.

In the twelfth year of joining Morgan Stanley, I’m so proud to be recognized by Forbes on their 2023 and 2024 ranking of Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State. It’s truly an honor to be recognized for my efforts in this industry. And a special thank you to my clients/colleagues, who helped make this possible!

2023 & 2024 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State

Source: Forbes.com (Awarded 2023 & 2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

NMLS#: 1255540

CA Insurance License #: 0H19286

About Karen Zhu

The exact role where I could continue utilizing and developing my analytical financial background while making the personal connections and impacts on families and individuals that I was looking for.

My desire at Morgan Stanley is to help understand your life goals and needs and translate those into a goal-based financial plan. I truly believe that the money we make in our life is merely a tool to make our life dreams come true, and not the dream itself. The best way to utilize this tool is to create a written, date-specific, dollar-specific, long-term investment plan and asset allocation model. As I develop a relationship with you and as life throws different curveballs, together we will adjust and update your plan accordingly. My ultimate goal is to help you maximize your long term returns.

Together with Hongmin Lu, we provide our clients with planning, behavioral coaching during periods of financial stress, convenience, peace of mind, and force to maintain discipline all with the backing and massive resources of Morgan Stanley. As a multi-generational team, we leverage a unique blend of experience and expertise to foster collaboration. I understand the importance of embracing diverse perspective and harnessing the collective wisdom of different generations to drive success.

NMLS#: 2566066

Contact Hongmin Lu

Contact Karen Zhu

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

8Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

14Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

15Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley