Frank Rivera

Our clients understand that decisions they make around company stock and options are some of the most consequential they'll face in their financial life.

• How well do I understand my equity compensation and the strategies that exist to maximize its value?

• Can I afford to leave my company, and how should I plan for that?

• Should I be making different choices based on my specific situation?

• How do I turn my company equity into something I can enjoy?

• What is the Alternative Minimum Tax?

The first step is understanding how your stock or option plan works is only the first step. We can work with you to articulate specific goals such as diversification, tax management, charitable gifting, or simply having enough cash to live on while you wait for an exit. Projecting a variety of multi-year scenarios, we can help you make the best decisions you can to maximize this valuable asset.

We are a small, experienced team of Morgan Stanley advisors that are trained to handle these complex issues and possess tools and resources to address your needs.

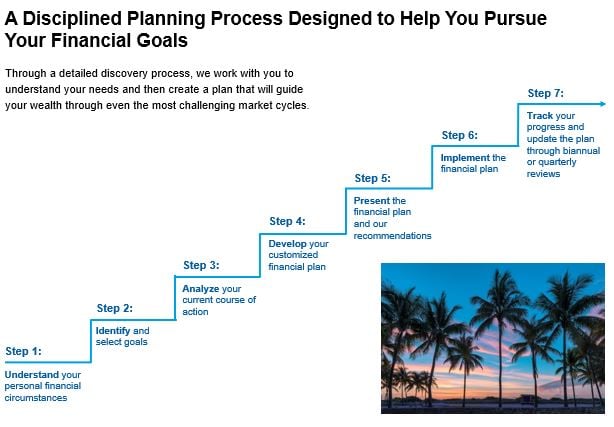

Step 1: Understanding the Client's Personal Financial Circumstances

I take the time to learn about you, your family, and all the assets/liabilities you have. This part of the process is the most important. This enables my team and I to understand your needs and risk tolerances.

Step 2: Identifying and Selecting Goals

Like any endeavor in life, establishing a clear and defined goal is paramount to achieving an objective. I work with you and your family to create clearly defined goals that help guide us to manage your hard-earned assets.

Step 3: Analyzing the Client's Current Course of Action and Potential Alternative Course(s) of Action

Through an in-depth analysis of your current investing strategies, we are able to identify where I can provide value and optimize your investments to meet your goals. Often when reviewing a client's portfolio at a competitor, we see cookie cutter models that do not directly reflect the needs to the client.

Step 4: Develop the Financial Planning Recommendation(s)

My team and I prepare a financial plan that includes every aspect of your wealth. We know that many of your largest wealth generating opportunities lay outside of your liquid investments.

Step 5: Presenting the Financial Planning Recommendation(s)

With a robust Financial Plan, we prepare a clear and understandable plan to guide you through your life. The plan will also help guide my team and I in managing your assets and making recommendations on your portfolio.

Step 6: Implementing the Financial Planning Recommendation(s)

Putting clients first is the foundation of our implementation process. You are a part of every step. We ensure that you are in full agreement with our recommendations and the timeframe in which we implement.

Step 7: Track Your Progress

We review the accounts and plans on a quarterly basis. This is not a once-a-year call. You are always kept abreast of your financial well-being through an in-depth review of your accounts and the progress on your plan. We will update and make changes when necessary.

This is a lifelong journey. The Miami Legacy Group is here to guide you along the way.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool: When your Financial Advisor prepares a Financial Plan, they will be acting in an investment advisory capacity with respect to the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our "Understanding Your Brokerage and Investment Advisory Relationships" brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

CRC 6627922 5/24