SoundView Wealth Management at Morgan Stanley

Frank Lourenso, CFP®, CIMA®Dan Griesmeyer, CIMA®Michael Simon, CRPS®Benjamin J Mihalik, CFP®, CPWA®, CIMA®Brad Schatz, CFP®, CIMA®Allison Giffuni, CFP®Nicolas Mangia, CFP®

(516) 336-0700(516) 336-0700

Industry Award Winner

Industry Award WinnerOur Mission Statement

Help each client find financial clarity and calm in an unpredictable world.

SoundView Wealth Management at Morgan Stanley

You have passions, goals, and ideas that inspire you — that’s what makes your life uniquely yours. So why use your time trying to make sense of a cumbersome financial landscape?

At SoundView Wealth Management, we strive to remove the confusion and stress of managing your own financial life.

Our team thrives on complexity and is here to help you think rationally and act thoughtfully. With 12 team members and decades of combined experience, we are passionate about helping you simplify and strengthen your wealth management. The world may be constantly changing, but being financially grounded and focused is possible. We believe that you deserve this solid foundation — and our responsibility is to help you build and maintain it.

No matter your goals, you can gain the sound views that foster better financial decisions — and support prosperity for every generation.

TEAM AWARDS

2023, 2024, 2025 & 2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2023-2026). Data compiled by SHOOK Research LLC based 12-month time period concluding in March of year prior to the issuance of the award.

2024 and 2025 Barron's Top 250 Private Wealth Management Teams

Source: Barron's - Awarded May (2024-2025). Data compiled by Barron's for the time period from Jan 2023 - Dec 2024. Awards Disclosures

At SoundView Wealth Management, we strive to remove the confusion and stress of managing your own financial life.

Our team thrives on complexity and is here to help you think rationally and act thoughtfully. With 12 team members and decades of combined experience, we are passionate about helping you simplify and strengthen your wealth management. The world may be constantly changing, but being financially grounded and focused is possible. We believe that you deserve this solid foundation — and our responsibility is to help you build and maintain it.

No matter your goals, you can gain the sound views that foster better financial decisions — and support prosperity for every generation.

TEAM AWARDS

2023, 2024, 2025 & 2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2023-2026). Data compiled by SHOOK Research LLC based 12-month time period concluding in March of year prior to the issuance of the award.

2024 and 2025 Barron's Top 250 Private Wealth Management Teams

Source: Barron's - Awarded May (2024-2025). Data compiled by Barron's for the time period from Jan 2023 - Dec 2024. Awards Disclosures

Services Include

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

Two Jericho Plaza

Jericho, NY 11753

US

Direct:

(516) 336-0700(516) 336-0700

Fax:

(631) 237-3357(631) 237-3357

Meet SoundView Wealth Management

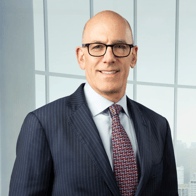

About Frank Lourenso

Frank Lourenso, CFP®, CIMA®

Managing Director

Financial Advisor

“I believe in serving people the way I would want to be served: Timely guidance and thoughtful recommendations tailored to an individual’s unique set of circumstances.”

Frank is our team’s founder, and his industry insight and client focus influence every aspect of our work. He combines 30 years of wealth management experience with a commitment to staying ahead of the financial world’s many changes.

As SoundView Wealth Management’s leader, Frank guides our team of seasoned professionals. He drives the collaboration and communication that help ensure our practice evolves with industry advances and client goals.

Frank enjoys working with many types of clients but focuses on ones who have more complex financial lives and sophisticated estate-planning and wealth-transfer needs. Ultimately, his greatest satisfaction comes from helping clients gain a sense of control and calmness around their wealth — both how it will support their current objectives and impact future generations.

Before joining Morgan Stanley in 2007 and forming SoundView Wealth Management, Frank was a financial advisor with Smith Barney for 17 years. He has been a Huntington Long Island resident for over 20 years and has a long history of community involvement. Frank has served as a trustee for Make-A-Wish Foundation of Suffolk, Long Island University, and the Heckscher Museum of Art.

Professional Highlights

• Forbes 2021, 2022, 2023, 2024, 2025 NY Best in State Wealth Advisor

• Certified Financial Planner™ designation from the University of Colorado

• Certified Investment Manager Analyst (CIMA®) designation from The Wharton School of Business

• Investments and Wealth Management Institute Member

• Morgan Stanley Executive Financial Services Director

• Bachelor of Business Administration from Hofstra University

2021 - 2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2021-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Managing Director

Financial Advisor

“I believe in serving people the way I would want to be served: Timely guidance and thoughtful recommendations tailored to an individual’s unique set of circumstances.”

Frank is our team’s founder, and his industry insight and client focus influence every aspect of our work. He combines 30 years of wealth management experience with a commitment to staying ahead of the financial world’s many changes.

As SoundView Wealth Management’s leader, Frank guides our team of seasoned professionals. He drives the collaboration and communication that help ensure our practice evolves with industry advances and client goals.

Frank enjoys working with many types of clients but focuses on ones who have more complex financial lives and sophisticated estate-planning and wealth-transfer needs. Ultimately, his greatest satisfaction comes from helping clients gain a sense of control and calmness around their wealth — both how it will support their current objectives and impact future generations.

Before joining Morgan Stanley in 2007 and forming SoundView Wealth Management, Frank was a financial advisor with Smith Barney for 17 years. He has been a Huntington Long Island resident for over 20 years and has a long history of community involvement. Frank has served as a trustee for Make-A-Wish Foundation of Suffolk, Long Island University, and the Heckscher Museum of Art.

Professional Highlights

• Forbes 2021, 2022, 2023, 2024, 2025 NY Best in State Wealth Advisor

• Certified Financial Planner™ designation from the University of Colorado

• Certified Investment Manager Analyst (CIMA®) designation from The Wharton School of Business

• Investments and Wealth Management Institute Member

• Morgan Stanley Executive Financial Services Director

• Bachelor of Business Administration from Hofstra University

2021 - 2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2021-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: NY, KY, FL, CT, MD, OR, WV, NJ, MA, IL, DE, AZ, VT, TN, NM, MI, CA, CO, WA, MO, GA, MN, VA, UT, SC, PA, DC, TX, OH, NV, NC, ME, HI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1288184

NMLS#: 1288184

About Dan Griesmeyer

“I love that I am our clients’ first call for all financial decisions. If something is important to them; it’s significant to me.”

Dan is a founding member of SoundView Wealth Management and often supports our team as a lead advisor for our clients with the most complex needs. He also serves as our chief investment officer and is a member of our Partnership Committee. In each role, he helps guide the strategy and research that underpin our client experience.

Intricate financial lives require interwoven strategies, and Dan helps each client find practical, proactive guidance for what’s ahead. No matter how challenging or confusing the financial landscape may seem for clients, Dan thrives on helping them create a clear path toward their goals.

Prior to Morgan Stanley, Dan was partner in a CPA firm. He is an engaged community member who has served on several boards of trustees, including for Family & Children’s Association. Outside of the office, he enjoys spending time with his wife and two daughters, as well as strength training, running, hiking, bike riding, reading, and cooking.

Professional Highlights

• Forbes 2025 NY Best-in-State Wealth Advisor

• Certified Investment Manager Analyst designation from The Wharton

School of Business

• Certified Public Accountant (non-practicing at Morgan Stanley)

• Executive Financial Services Director designation from Morgan Stanley

• Summa cum laude graduate with bachelor’s degree in accounting from LIU Post

2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Dan is a founding member of SoundView Wealth Management and often supports our team as a lead advisor for our clients with the most complex needs. He also serves as our chief investment officer and is a member of our Partnership Committee. In each role, he helps guide the strategy and research that underpin our client experience.

Intricate financial lives require interwoven strategies, and Dan helps each client find practical, proactive guidance for what’s ahead. No matter how challenging or confusing the financial landscape may seem for clients, Dan thrives on helping them create a clear path toward their goals.

Prior to Morgan Stanley, Dan was partner in a CPA firm. He is an engaged community member who has served on several boards of trustees, including for Family & Children’s Association. Outside of the office, he enjoys spending time with his wife and two daughters, as well as strength training, running, hiking, bike riding, reading, and cooking.

Professional Highlights

• Forbes 2025 NY Best-in-State Wealth Advisor

• Certified Investment Manager Analyst designation from The Wharton

School of Business

• Certified Public Accountant (non-practicing at Morgan Stanley)

• Executive Financial Services Director designation from Morgan Stanley

• Summa cum laude graduate with bachelor’s degree in accounting from LIU Post

2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: NV, MN, MD, HI, NY, NM, DE, DC, WV, VT, OH, MI, FL, MO, WA, SC, PA, GA, CT, AZ, ME, KY, UT, IL, NJ, CO, TX, NC, CA, VA, TN, MA, OR; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279212

NMLS#: 1279212

About Michael A. Simon, CRPS®

Michael Simon, CRPS®

Senior Vice President

Family Wealth Director

Corporate Retirement Director

Financial Advisor

With over two decades of experience in wealth management, Mike helps his clients solve complex financial problems by providing customized advice and investment solutions. As a Family Wealth Director, Mike concentrates on working with high-net-worth professionals, families and small business owners in several industries including finance, law, and entertainment. In addition, his Corporate Retirement Director designation reflects his expertise in Corporate Retirement Planning, enabling him to help structure, implement and monitor retirement plans for businesses and their employees.

Mike began his career in financial services in 2004 as a Financial Advisor at UBS Financial Services. He joined Morgan Stanley in 2007 and three years later, expanded his responsibilities to become a Producing Complex Business Development Manager at the firm. In this dual role, Mike provides comprehensive wealth management services to his clients, while mentoring and supporting other financial advisors in the Western Long Island Complex. Mike has been recognized as a 2025 Forbes Best-In-State Wealth Advisor in NY.

Prior to becoming a Financial Advisor, Mike was a sports psychology and education consultant, providing counseling services to college and professional athletes and entertainers. He also designed professional development programs for youth sport and school-based programs. These experiences prepared him well for a career in financial services, where goal setting, focus, preparation, discipline, and risk management are critical components in developing thorough and thoughtful wealth management strategies.

Mike is dedicated to continuing education, a cornerstone of the dynamic philosophy of his wealth management practice. Throughout his career, he has continued to expand his skills and experience by undertaking various advanced courses of study. He earned doctorate and master’s degrees at Columbia University Teachers College, a master’s degree at Ithaca College, and his undergraduate degree at Washington University in St. Louis. He also earned his Chartered Retirement Plans Specialist℠ designation from the College for Financial Planning.

A native of Woodbury, NY, Mike has lived in other places but was proud to return to his hometown in 2003. When not working at the firm, he enjoys playing golf and tennis and spending time with his wife Donna and their two children, Sarah, and Jack. Mike has recently taken up the acoustic guitar, which helps take his mind off his golf handicap.

2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Senior Vice President

Family Wealth Director

Corporate Retirement Director

Financial Advisor

With over two decades of experience in wealth management, Mike helps his clients solve complex financial problems by providing customized advice and investment solutions. As a Family Wealth Director, Mike concentrates on working with high-net-worth professionals, families and small business owners in several industries including finance, law, and entertainment. In addition, his Corporate Retirement Director designation reflects his expertise in Corporate Retirement Planning, enabling him to help structure, implement and monitor retirement plans for businesses and their employees.

Mike began his career in financial services in 2004 as a Financial Advisor at UBS Financial Services. He joined Morgan Stanley in 2007 and three years later, expanded his responsibilities to become a Producing Complex Business Development Manager at the firm. In this dual role, Mike provides comprehensive wealth management services to his clients, while mentoring and supporting other financial advisors in the Western Long Island Complex. Mike has been recognized as a 2025 Forbes Best-In-State Wealth Advisor in NY.

Prior to becoming a Financial Advisor, Mike was a sports psychology and education consultant, providing counseling services to college and professional athletes and entertainers. He also designed professional development programs for youth sport and school-based programs. These experiences prepared him well for a career in financial services, where goal setting, focus, preparation, discipline, and risk management are critical components in developing thorough and thoughtful wealth management strategies.

Mike is dedicated to continuing education, a cornerstone of the dynamic philosophy of his wealth management practice. Throughout his career, he has continued to expand his skills and experience by undertaking various advanced courses of study. He earned doctorate and master’s degrees at Columbia University Teachers College, a master’s degree at Ithaca College, and his undergraduate degree at Washington University in St. Louis. He also earned his Chartered Retirement Plans Specialist℠ designation from the College for Financial Planning.

A native of Woodbury, NY, Mike has lived in other places but was proud to return to his hometown in 2003. When not working at the firm, he enjoys playing golf and tennis and spending time with his wife Donna and their two children, Sarah, and Jack. Mike has recently taken up the acoustic guitar, which helps take his mind off his golf handicap.

2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: DE, SD, ME, HI, MA, VT, IL, WV, UT, NV, CA, PA, WA, SC, MO, VA, TX, MI, TN, OH, NY, NJ, MN, MD, GA, DC, CO, AZ, OR, NM, NC, KY, FL, CT; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279535

NMLS#: 1279535

About Benjamin J Mihalik

“Whether reorganizing a financial strategy or starting from scratch, I enjoy showing our clients that a better way is possible.”

Ben is analytical and driven as he helps our clients create financial momentum and focus. He joined SoundView Wealth Management with his father, Peter Mihalik, in 2020 after serving in their family-based practice at Morgan Stanley. Today, he often supports coordinating investments with complex estate planning and liability and debt management needs, and strategically guides business owners in fulfilling their vision.

The financial world carries many unknowns and moving pieces that can often feel difficult for clients to anticipate. So, Ben provides perspectives and resources that can help them make sense of this dynamic environment. At the center of his relationships are candid conversations where he takes the time to talk through questions and ideas. His goal is for each wealth management step to be rational, personal, and productive.

Ben and his wife live in New York City. He’s an active community member and serves as President of the Advisory Board for St. John the Baptist Diocesan High School and is the recipient of their 2019 Visionary Award.

Professional Highlights

• Forbes 2024 & 2025 NY Best in State Next Gen Wealth Advisor

• Certified Private Wealth Advisor® designation

• CERTIFIED FINANCIAL PLANNER™ professional designation

• Certified Investment Management Analyst® professional designation

• Life, Accident and Health Insurance license

• Bachelor’s degree in accounting from the University of Richmond

2024 & 2025 Forbes Best-In-State Next-Gen Wealth Advisors

Source:Forbes.com (Awarded 2024 & 2025). Data compiled by Shook Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Ben is analytical and driven as he helps our clients create financial momentum and focus. He joined SoundView Wealth Management with his father, Peter Mihalik, in 2020 after serving in their family-based practice at Morgan Stanley. Today, he often supports coordinating investments with complex estate planning and liability and debt management needs, and strategically guides business owners in fulfilling their vision.

The financial world carries many unknowns and moving pieces that can often feel difficult for clients to anticipate. So, Ben provides perspectives and resources that can help them make sense of this dynamic environment. At the center of his relationships are candid conversations where he takes the time to talk through questions and ideas. His goal is for each wealth management step to be rational, personal, and productive.

Ben and his wife live in New York City. He’s an active community member and serves as President of the Advisory Board for St. John the Baptist Diocesan High School and is the recipient of their 2019 Visionary Award.

Professional Highlights

• Forbes 2024 & 2025 NY Best in State Next Gen Wealth Advisor

• Certified Private Wealth Advisor® designation

• CERTIFIED FINANCIAL PLANNER™ professional designation

• Certified Investment Management Analyst® professional designation

• Life, Accident and Health Insurance license

• Bachelor’s degree in accounting from the University of Richmond

2024 & 2025 Forbes Best-In-State Next-Gen Wealth Advisors

Source:Forbes.com (Awarded 2024 & 2025). Data compiled by Shook Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Securities Agent: UT, NV, CT, NC, MI, FL, AZ, GA, WV, OH, NJ, DE, SC, MN, IL, MD, MA, CO, VA, TX, MO, KY, HI, NY, ME, DC, CA, VT, TN, WA, PA, OR, NM; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1407644

CA Insurance License #: 4114319

NMLS#: 1407644

CA Insurance License #: 4114319

About Brad Schatz

“I appreciate the opportunity to help our clients understand the intricacies of their financial lives and how each decision connects to their goals.”

Brad is passionate about helping clients of all generations find meaningful wealth management support. He joined SoundView Wealth Management in 2009 and has over a decade of industry experience at Morgan Stanley. Whether he’s helping clients make logical decisions or supporting their loved ones, Brad appreciates being a voice of reason and clarity.

A variety of factors can affect the steps clients take across their wealth management. Brad’s goal is to understand the financial and emotional elements that may create challenges, so he can help clients look forward and embrace their opportunities. He applies an analytical perspective in all endeavors, from investment strategies to deeper planning needs. Through every decision — both big and small — Brad is available to guide and inform clients.

Brad is active in his community as a member of UJA Federation of New York and the UJA Federation of Morgan Stanley. In his free time, he likes playing golf and traveling.

Professional Highlights

• Forbes 2024 & 2025 NY Best in State Next Gen Wealth Advisor

• CERTIFIED FINANCIAL PLANNERTM professional designation

• Certified Investment Management Analyst® designation

• Bachelor’s degree in business administration from University of Miami

2024 & 2025 Forbes Best-In-State Next-Gen Wealth Advisors

Source: Forbes.com (Awarded 2024 & 2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Brad is passionate about helping clients of all generations find meaningful wealth management support. He joined SoundView Wealth Management in 2009 and has over a decade of industry experience at Morgan Stanley. Whether he’s helping clients make logical decisions or supporting their loved ones, Brad appreciates being a voice of reason and clarity.

A variety of factors can affect the steps clients take across their wealth management. Brad’s goal is to understand the financial and emotional elements that may create challenges, so he can help clients look forward and embrace their opportunities. He applies an analytical perspective in all endeavors, from investment strategies to deeper planning needs. Through every decision — both big and small — Brad is available to guide and inform clients.

Brad is active in his community as a member of UJA Federation of New York and the UJA Federation of Morgan Stanley. In his free time, he likes playing golf and traveling.

Professional Highlights

• Forbes 2024 & 2025 NY Best in State Next Gen Wealth Advisor

• CERTIFIED FINANCIAL PLANNERTM professional designation

• Certified Investment Management Analyst® designation

• Bachelor’s degree in business administration from University of Miami

2024 & 2025 Forbes Best-In-State Next-Gen Wealth Advisors

Source: Forbes.com (Awarded 2024 & 2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Securities Agent: NC, MA, VT, SC, NV, MI, IL, CT, UT, KY, WA, VA, TX, OR, OH, HI, DC, CO, NJ, TN, NM, DE, CA, AZ, NY, MN, ME, GA, FL, WV, PA, MO, MD; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1275593

NMLS#: 1275593

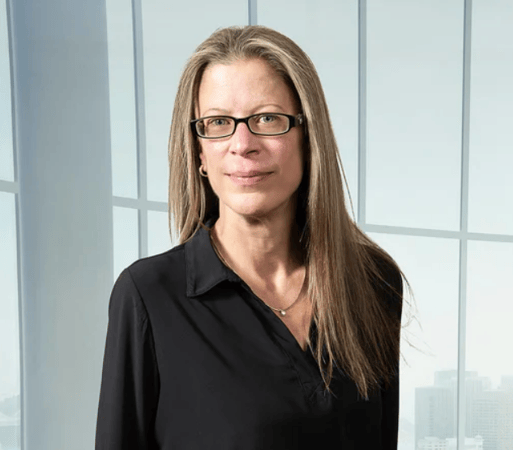

About Allison Giffuni

“Seeing our clients make confident financial decisions as I help them achieve their goals brings me great joy.”

Allison has two decades of industry experience supporting clients as they navigate an array of financial priorities. She joined SoundView Wealth Management in 2016 and has served at Morgan Stanley and Merrill Lynch. Today, she often supports clients in retirement who seek ways to maintain their wealth and enjoy a fulfilling lifestyle. Allison also helps women who are single, divorced, or widowed gain thoughtful guidance.

Whether clients want to buy a home, fund a grandchild’s education, or another goal, Allison brings forethought and attentiveness. As a financial planner, she supports clients through a planning lens and helps them create logical paths forward. She enjoys creating retirement-income plans that prepare clients for their future while providing financial check-ups to keep their strategies on track. Shrewd with details, Allison aims to ensure that each person makes proactive, sound financial decisions.

Allison is a member of Morgan Stanley Women’s Professional Group (HERWAY). She also enjoys being creative, and in her free time, helps friends achieve timeless, budget-friendly home decorating styles.

Professional Highlights

• CERTIFIED FINANCIAL PLANNERTM professional designation

• Series 7 and 66 securities registration

• Life and Health Insurance License

• Bachelor’s degree in finance from Hofstra University

Allison has two decades of industry experience supporting clients as they navigate an array of financial priorities. She joined SoundView Wealth Management in 2016 and has served at Morgan Stanley and Merrill Lynch. Today, she often supports clients in retirement who seek ways to maintain their wealth and enjoy a fulfilling lifestyle. Allison also helps women who are single, divorced, or widowed gain thoughtful guidance.

Whether clients want to buy a home, fund a grandchild’s education, or another goal, Allison brings forethought and attentiveness. As a financial planner, she supports clients through a planning lens and helps them create logical paths forward. She enjoys creating retirement-income plans that prepare clients for their future while providing financial check-ups to keep their strategies on track. Shrewd with details, Allison aims to ensure that each person makes proactive, sound financial decisions.

Allison is a member of Morgan Stanley Women’s Professional Group (HERWAY). She also enjoys being creative, and in her free time, helps friends achieve timeless, budget-friendly home decorating styles.

Professional Highlights

• CERTIFIED FINANCIAL PLANNERTM professional designation

• Series 7 and 66 securities registration

• Life and Health Insurance License

• Bachelor’s degree in finance from Hofstra University

Securities Agent: WV, KY, VT, MO, WA, UT, DE, PA, OR, OH, MN, HI, GA, FL, DC, CA, CO, NV, MD, IL, TX, NM, CT, VA, TN, ME, NY, MI, MA, AZ, SC, NJ, NC; General Securities Representative; Investment Advisor Representative

NMLS#: 1255292

NMLS#: 1255292

About Nick Mangia

“To give real service you must add something which cannot be bought or measured with money, and that is sincerity and integrity.” – Douglas Adams

Nick joined our team on Halloween 2022 after working at New York Life for two and a half years as a Financial Services Professional.

A Fairleigh Dickinson graduate with a Finance major and a Wealth Management minor, Nick brings an enthusiastic, curious, and solemn approach to the way he operates. There is no ask too big, as his goal is to make sure that all client needs are met with a diligent and timely response.

The best part of Nick’s days is continuing to grow relationships with the clients that he helps. Knowing that he made a difference in a client’s day is what makes Nick enjoy coming into the office each day.

Outside of the office Nick enjoys spending time with his friends, working out and playing golf.

Professional Highlights:

Series 6, 7, 63, and 66 securities registrations

Accidental Life and Health Insurance license

CLTC ®

Morgan Stanley Financial Planning Specialist

Nick joined our team on Halloween 2022 after working at New York Life for two and a half years as a Financial Services Professional.

A Fairleigh Dickinson graduate with a Finance major and a Wealth Management minor, Nick brings an enthusiastic, curious, and solemn approach to the way he operates. There is no ask too big, as his goal is to make sure that all client needs are met with a diligent and timely response.

The best part of Nick’s days is continuing to grow relationships with the clients that he helps. Knowing that he made a difference in a client’s day is what makes Nick enjoy coming into the office each day.

Outside of the office Nick enjoys spending time with his friends, working out and playing golf.

Professional Highlights:

Series 6, 7, 63, and 66 securities registrations

Accidental Life and Health Insurance license

CLTC ®

Morgan Stanley Financial Planning Specialist

About Amanda Finnie

“I enjoy understanding what’s important to our clients and supporting them as they thoughtfully prepare for their future.”

Amanda joined SoundView Wealth Management in 2021 and brings over a decade of experience. As a Financial Planning Analyst, Amanda collaborates with our team as we help clients build strategies that account for changing life events and a dynamic economy. Whether preparing for retirement or navigating investment goals, her goal is to craft a stable foundation for clients as they pursue their various financial priorities.

Analytical and proactive, Amanda thrives in assessing how multiple scenarios can affect clients’ financial plans — and helping them diligently move forward. She understands how each person’s unique needs require intricate attention and enjoys finding the specific solution that aligns with their financial vision.

Prior to joining our team, Amanda was a professional with Fidelity Investments. She served in various roles working with clients and financial planners where she assisted them with retirement plans. From these experiences, she enjoys ensuring that each person — from our team members to our clients — has the knowledge they need to turn ideas into action.

Outside of the office, Amanda enjoys spending time with her daughter, family, and friends.

Professional Highlights

• Certified Financial Planner™ professional

• Master’s of Business Administration with concentration in Personal Financial Planning, Molloy College

• Bachelor’s of Science in Finance, Siena College

Amanda joined SoundView Wealth Management in 2021 and brings over a decade of experience. As a Financial Planning Analyst, Amanda collaborates with our team as we help clients build strategies that account for changing life events and a dynamic economy. Whether preparing for retirement or navigating investment goals, her goal is to craft a stable foundation for clients as they pursue their various financial priorities.

Analytical and proactive, Amanda thrives in assessing how multiple scenarios can affect clients’ financial plans — and helping them diligently move forward. She understands how each person’s unique needs require intricate attention and enjoys finding the specific solution that aligns with their financial vision.

Prior to joining our team, Amanda was a professional with Fidelity Investments. She served in various roles working with clients and financial planners where she assisted them with retirement plans. From these experiences, she enjoys ensuring that each person — from our team members to our clients — has the knowledge they need to turn ideas into action.

Outside of the office, Amanda enjoys spending time with her daughter, family, and friends.

Professional Highlights

• Certified Financial Planner™ professional

• Master’s of Business Administration with concentration in Personal Financial Planning, Molloy College

• Bachelor’s of Science in Finance, Siena College

About Tyler Epakchi

“I enjoy being part of such a collaborative team and providing our clients with thoughtful, research-driven guidance.”

As a Registered Client Service Associate Tyler Epakchi combines fundamental and technical knowledge with a keen understanding of client goals to develop personalized investment strategies. Known for his analytical acumen and dedication, Tyler plays an instrumental role in research, portfolio construction, and risk assessment, helping to optimize client portfolios and strengthen client relationships. His work demonstrates a commitment to excellence, adaptability, and a forward-thinking approach in the dynamic world of finance.

Tyler joined our team in 2021 after completing an internship with the BGS Team at Morgan Stanley. He attained the Certified Investment Management Analyst (CIMA) designation in 2024. He is a SUNY Geneseo graduate with an economics major and business studies minor. Today, he brings curiosity, enthusiasm, and commitment to every task he takes on. His goal is to be a helpful resource as he supports colleagues and clients with diligent service.

As a Registered Client Service Associate Tyler Epakchi combines fundamental and technical knowledge with a keen understanding of client goals to develop personalized investment strategies. Known for his analytical acumen and dedication, Tyler plays an instrumental role in research, portfolio construction, and risk assessment, helping to optimize client portfolios and strengthen client relationships. His work demonstrates a commitment to excellence, adaptability, and a forward-thinking approach in the dynamic world of finance.

Tyler joined our team in 2021 after completing an internship with the BGS Team at Morgan Stanley. He attained the Certified Investment Management Analyst (CIMA) designation in 2024. He is a SUNY Geneseo graduate with an economics major and business studies minor. Today, he brings curiosity, enthusiasm, and commitment to every task he takes on. His goal is to be a helpful resource as he supports colleagues and clients with diligent service.

About Jaclyn DiMarzo

“I enjoy being a go-to resource for clients and helping them through new life events.”

Jaclyn is an upbeat professional who thrives in guiding clients and aligning their financial strategies with their life vision. She joined SoundView Wealth Management in 2020, bringing with her 10 years of industry experience. Since then, Jaclyn’s become a dependable resource for assisting with our clients’ various needs, including a focus in insurance and annuities strategies.

Each day, Jaclyn enjoys collaborating with our team and clients to think through the different opportunities ahead of them. Life is ever changing, and her goal is to thoughtfully help each person understand and pursue their unique priorities. Prior to joining Morgan Stanley, Jaclyn worked at Ameriprise Financial, TD Bank, and Citibank. She appreciates the relationships she forms with our clients and the opportunity to draw from her experiences to help each person flourish.

Outside of the office, Jaclyn enjoys being on the water and going boating. She’s an avid traveler with a love of shoes and a collection to match.

Professional Highlights

• Series 7, 63, and 66 securities registrations

• Accidental Life and Health Insurance license

• Bachelor’s degree in business administration and marketing from Northeastern State University

• Associates degrees in liberal arts, applied science in marketing, and applied science in business

Jaclyn is an upbeat professional who thrives in guiding clients and aligning their financial strategies with their life vision. She joined SoundView Wealth Management in 2020, bringing with her 10 years of industry experience. Since then, Jaclyn’s become a dependable resource for assisting with our clients’ various needs, including a focus in insurance and annuities strategies.

Each day, Jaclyn enjoys collaborating with our team and clients to think through the different opportunities ahead of them. Life is ever changing, and her goal is to thoughtfully help each person understand and pursue their unique priorities. Prior to joining Morgan Stanley, Jaclyn worked at Ameriprise Financial, TD Bank, and Citibank. She appreciates the relationships she forms with our clients and the opportunity to draw from her experiences to help each person flourish.

Outside of the office, Jaclyn enjoys being on the water and going boating. She’s an avid traveler with a love of shoes and a collection to match.

Professional Highlights

• Series 7, 63, and 66 securities registrations

• Accidental Life and Health Insurance license

• Bachelor’s degree in business administration and marketing from Northeastern State University

• Associates degrees in liberal arts, applied science in marketing, and applied science in business

About Gail Barbaro

“I enjoy resolving and researching questions that clients may have throughout the course of their daily financial lives.”

Gail is a dedicated professional who enjoys the critical thinking required to help make a difference in the support we provide each client. She joined SoundView Wealth Management in 2016, bringing years of experience with Morgan Stanley. From this background, she gained intricate knowledge of the opportunities and resources available to our clients throughout their financial journey.

Whether supporting their cash management needs, investment administration, or another goal, Gail offers caring, focused service. In her role, she appreciates the opportunities to talk with each person and build personal connections that provide meaningful support.

Married for nearly 40 years, Gail enjoys spending time with her family. She also likes reading, kayaking and being at the beach.

Professional Highlights

• Series 7 securities registration

• Series 63 securities registration

Gail is a dedicated professional who enjoys the critical thinking required to help make a difference in the support we provide each client. She joined SoundView Wealth Management in 2016, bringing years of experience with Morgan Stanley. From this background, she gained intricate knowledge of the opportunities and resources available to our clients throughout their financial journey.

Whether supporting their cash management needs, investment administration, or another goal, Gail offers caring, focused service. In her role, she appreciates the opportunities to talk with each person and build personal connections that provide meaningful support.

Married for nearly 40 years, Gail enjoys spending time with her family. She also likes reading, kayaking and being at the beach.

Professional Highlights

• Series 7 securities registration

• Series 63 securities registration

About Kerma Brunecker

Kerma joined Morgan Stanley in 2019 after 20 years in the industry at various firms. Some of her responsibilities include coordinating the team's daily operations, overseeing the new account opening process, enabling online access for our clients and serving as the main point of contact for client service matters. Kerma provides ongoing administrative and operational support primarily for our clients.

Kerma earned her MBA from Dowling College and her BA from Long Island University. She maintains her Series 7, Series 31 and Series 66 securities license. Kerma also has her life and health insurance licenses.

Kerma currently resides on Long Island with her husband, two children and two dogs.

Kerma earned her MBA from Dowling College and her BA from Long Island University. She maintains her Series 7, Series 31 and Series 66 securities license. Kerma also has her life and health insurance licenses.

Kerma currently resides on Long Island with her husband, two children and two dogs.

About Elizabeth Gidge

“I appreciate the conversations I get to have with our clients and the caring service I’m able to provide them.”

Beth is considerate and proactive as she supports our clients throughout their financial journeys. She joined SoundView Wealth Management in 2020, bringing with her over two decades of industry experience. She has served in various roles during her career, including branch administrator and consulting group analyst. Today, Beth helps maintain seamless client experiences and is a point of contact for new clients when they join our financial family.

Always ready to help, Beth makes herself available with timely, diligent service. She’s experienced in assisting with investment performance analysis, portfolio needs, and beyond, and is adept at navigating our clients’ various priorities. As she works with each person, Beth appreciates the opportunities to learn about what makes them happy and fulfilled — and to be an ongoing source of support.

Beth lives in Huntington, NY, with her husband and daughters. She enjoys traveling, playing tennis, taking long walks, and spending time at the beach paddle boarding.

Professional Highlights

• Series 7 and 66 securities registrations

• Bachelor’s degree in psychology from St. Joseph’s University

Beth is considerate and proactive as she supports our clients throughout their financial journeys. She joined SoundView Wealth Management in 2020, bringing with her over two decades of industry experience. She has served in various roles during her career, including branch administrator and consulting group analyst. Today, Beth helps maintain seamless client experiences and is a point of contact for new clients when they join our financial family.

Always ready to help, Beth makes herself available with timely, diligent service. She’s experienced in assisting with investment performance analysis, portfolio needs, and beyond, and is adept at navigating our clients’ various priorities. As she works with each person, Beth appreciates the opportunities to learn about what makes them happy and fulfilled — and to be an ongoing source of support.

Beth lives in Huntington, NY, with her husband and daughters. She enjoys traveling, playing tennis, taking long walks, and spending time at the beach paddle boarding.

Professional Highlights

• Series 7 and 66 securities registrations

• Bachelor’s degree in psychology from St. Joseph’s University

About Louis Mangia

"Being a part of this team and being trusted to assist clients with their financial plan is an honor."

Louis joined our team on July 7th, 2025, after spending three and a half years at New York Life Insurance Company where he honed his skills in financial services.

Louis graduated from SUNY Albany with a major in Economics and a minor in Sociology.

Outside of work, he enjoys spending time with family and friends, watching sports, and exploring new dining experiences.

Helping clients with their finances and providing solutions to complex situations is something Louis takes great pride in. Louis finds it rewarding to know that he can positively impact a client's day. He is always eager to tackle new tasks and situations, as they enhance his knowledge and better prepare him to serve our clients effectively.

Professional Highlights:

Series 6, 7, 63 and 66 securities registrations

Accident Life and Health Insurance License

Bachelor's degree in Economics from SUNY Albany.

Louis joined our team on July 7th, 2025, after spending three and a half years at New York Life Insurance Company where he honed his skills in financial services.

Louis graduated from SUNY Albany with a major in Economics and a minor in Sociology.

Outside of work, he enjoys spending time with family and friends, watching sports, and exploring new dining experiences.

Helping clients with their finances and providing solutions to complex situations is something Louis takes great pride in. Louis finds it rewarding to know that he can positively impact a client's day. He is always eager to tackle new tasks and situations, as they enhance his knowledge and better prepare him to serve our clients effectively.

Professional Highlights:

Series 6, 7, 63 and 66 securities registrations

Accident Life and Health Insurance License

Bachelor's degree in Economics from SUNY Albany.

Contact Frank Lourenso

Contact Dan Griesmeyer

Contact Michael Simon

Contact Benjamin J Mihalik

Contact Brad Schatz

Contact Allison Giffuni

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2023-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2023-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Barron's Top 250 Private Wealth Management Teams

2024-2025 Barron's Top 100 Private Wealth Management Teams (formerly referred to as Barron's Top 100 Private Wealth Management Teams, Barron's Top 50 Private Wealth Management Teams, Barron's Top 50 Private Wealth Advisory Teams) Source: Barrons.com (Awarded April 2024-2025). Data compiled by Barron's based on 12-month period concluding in Dec of the year prior to the issuance of the award.

2

Wealth Management

From Our Team

SoundView Wealth Management - Q4 2025 Market Recap and 2026 Market Outlook

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Retirement for Plan Sponsors

End-to-End Services, Made Simple:

We can provide the tools and guidance to help you manage a retirement plan.

We can provide the tools and guidance to help you manage a retirement plan.

- Plan Evaluation

- Investment Management

- Plan Management Support

- Plan Participant Education

Small Business Retirement Plans

Article Image

Ready to start a conversation? Contact SoundView Wealth Management today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)