Adriano Schirmer De Campos

Industry Award Winner

Industry Award WinnerAwards & Recognitions

2025 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Jan 2025) 2025 Forbes Best-In-State Wealth Management Teams ranking awarded in 2025. This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period from 3/31/23–3/31/24.

The Seven BRZ Group at Morgan Stanley is passionate about helping you manage the intricate balance of your family and finances.

As successful Global Asset Managers, our group focuses on building, growing, managing and protecting our client's assets. We advise individuals, families, and corporations in U.S, Latin America, and Europe. Given our advisors background, we have substantial experience in the Brazilian market and regulations.

Maintaining a great team is our key to success. Everyone who works with us is committed to helping you succeed. With over 40+ years of combined investment and international market experience(1), we are comprised of 4 financial professionals, including 3 International Client Advisor, 1 Portfolio Manager, and 3 Client Services Associate.

Along with our financial experience, we pride ourselves on being strong communicators. That means we take time to listen carefully to you. We also work hard to make sure you understand—and are comfortable with—any financial options we suggest. We are a bilingual team with fluency in English, Spanish, and Portuguese.

We speak your language, understand your culture and are ready to serve as the close family advisor you can rely upon to help make important financial decisions.

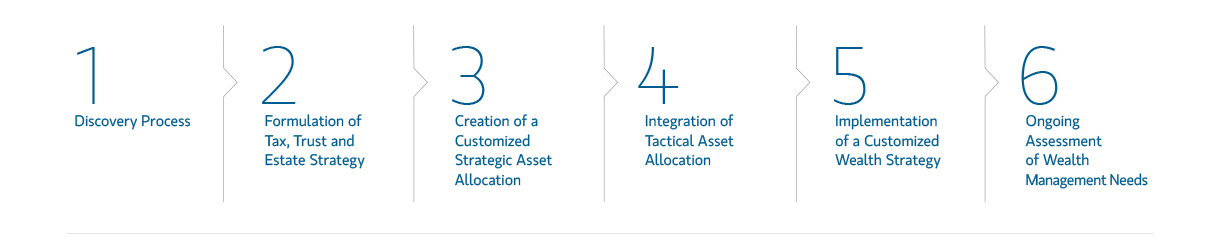

WEALTH MANAGEMENT SERVICES

OUR CLIENT'S PROFILE

CLIENT SERVICING

NATIONAL & INTERNATIONAL COVERAGE

Individual years of experience listed in our biographies