Industry Award Winner

Industry Award WinnerMy Mission Statement

About Me

Salpi’s approach begins with a discovery process to understand each client’s values, priorities, and aspirations. She then develops a comprehensive financial plan that may include investment management, tax, retirement planning, insurance, and business succession planning strategies. Her practice is rooted in acting in the client’s best interest, guided by strong ethical principles.

Clients appreciate her ability to simplify complex topics and communicate with care and understanding, especially during times of transition. Whether navigating financial independence, building wealth, planning for retirement or managing equity compensation as an executive investor, Salpi provides direction, accountability, and a tailored strategy focused on the important decisions to help clients move forward.

Salpi holds her Series 7, Series 63 and Series 65 financial securities registrations, is licensed to serve in all 50 states, and earned her Bachelor’s degree in Economics from York University in Toronto, Canada. During her spare time, she enjoys cooking, long walks, spending time with family and sailing on Lake Ontario.

Reach out to Salpi for an objective review of your current financial situation and to explore a long-term partnership built on trust and expertise.

NMLS#: 431839

The Guidepost Wealth Management Group at Morgan Stanley

Christopher Waltman (Senior Vice President, Financial Advisor, Senior Portfolio Management Director, Alternatives Investments Director, Family Wealth Director, Financial Planning Specialist), Joe Sullivan (Senior Vice President, Financial Advisor, Branch Manager), Salpi Doering, CFP® (Financial Advisor), Vipul Shah (Managing Director, Financial Advisor, Family Wealth Director, International Client Advisor, Senior Portfolio Management Director, Workplace Advisor - Equity Compensation, Financial Planning Specialist, Insurance Planning Director, Lending Specialist), Gilaad Matar (First Vice President, Financial Advisor, Senior Portfolio Manager), Melinda Harmon (Wealth Management Analyst, Financial Planning Specialist), Luke Michalik (Consulting Group Analyst), Allison Mead (Business Development Associate), Luke Brougham (Registered Client Service Associate), Linh Ta (Group Director),Zachary Baj (Registered Client Service Associate)

What Is a CFP® Professional?

When it comes to choosing a financial advisor, trust and expertise matter. That's why the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation is considered the gold standard in financial planning. A CFP® professional has met rigorous education, examination, experience, and ethics requirements—and is committed to acting as a fiduciary, always putting your best interests first.

- Comprehensive Knowledge – Covers a wide range of financial planning topics including retirement, investments, taxes, insurance, and estate planning.

- Fiduciary Duty – CFP® professionals are held to the highest ethical standards and are required to act in your best interest at all times.

- Experience-Based Guidance – To earn the designation, advisors must complete thousands of hours of hands-on financial planning experience.

- Ongoing Commitment – Maintaining the CFP® certification requires continuous education to stay current with financial regulations and strategies. Working with a CFP® professional means you're partnering with someone who has the training, accountability, and integrity to guide you with clarity and confidence—no matter where you are on your financial journey. Click the link below to learn more.

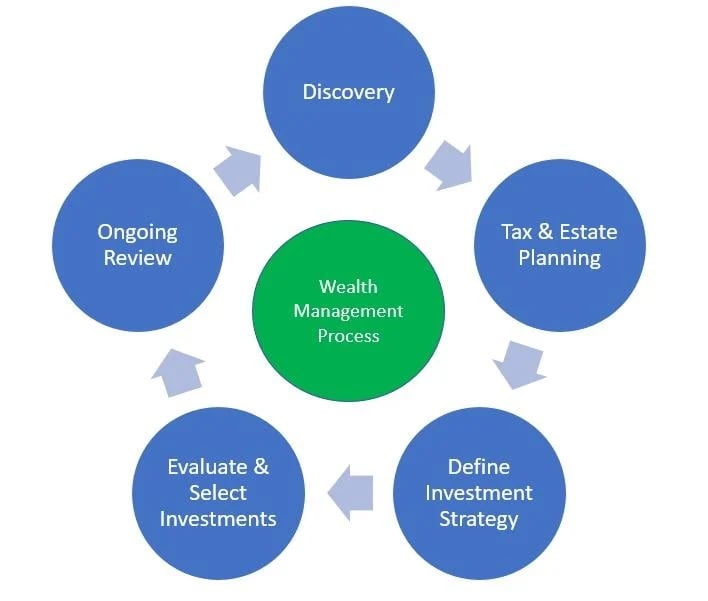

My Process

Our overall theme is our timely response, simple process, and utilizing executive summaries through onboarding process. We will work closely with clients to establish a realistic set of objectives based on their financial goals, time horizon, liquidity needs, and tolerance to volatility & risk. We break things down so that clients are educated and understand the next steps.

We begin by getting to know you—your goals, values, financial priorities, and any challenges you may be facing. This foundation allows us to build a plan tailored specifically to you.

We collaborate with your tax and legal professionals to help ensure your wealth is protected and passed on according to your wishes, in the most tax-efficient manner possible.

Based on your risk tolerance, time horizon, and objectives, we develop a personalized investment strategy designed to align with your long-term goals.

Using a disciplined, research-driven process, we carefully evaluate and select investments that fit your strategy and help drive progress toward your financial goals.

Financial plans are not set-it-and-forget-it. We regularly review your strategy and portfolio to adapt to life changes, market shifts, and evolving goals—keeping you on track.

Location

Awards and Recognition

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

7An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley