Aron D. Huddleston, CFA

Industry Award Winner

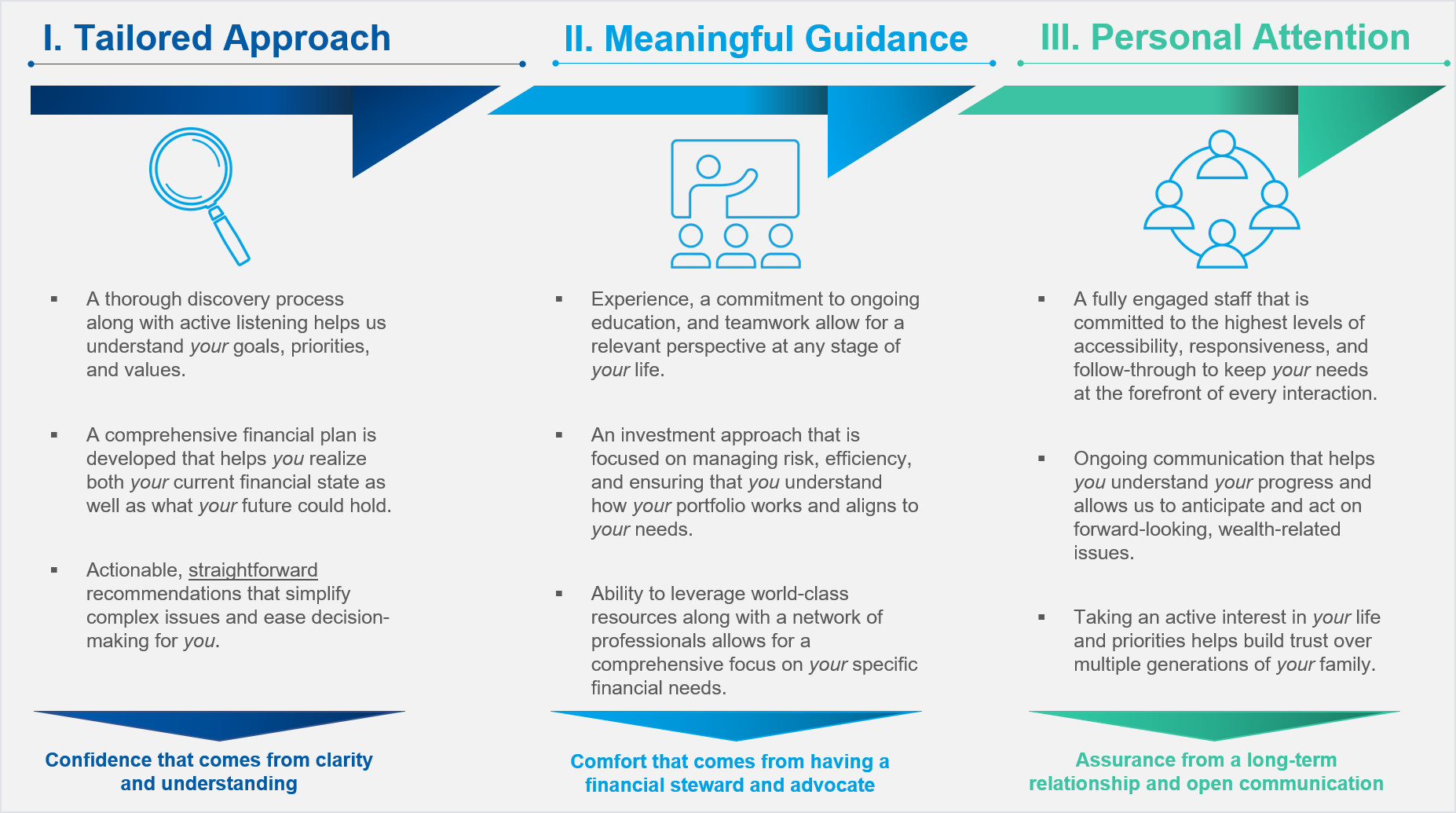

Industry Award WinnerRealize Wealth Management Group, is a credentialed, multi-generational team that delivers meaningful guidance and an elevated standard of care to a select group of individuals, families, businesses and institutions – nationwide.

Our mission is defined by the components of our name:

REALIZE – By definition, "realize" has multiple meanings relevant to your financial life:

To make more clear. We use a straightforward approach to help you gain a clear understanding of your entire financial situation.

To bring into concrete existence. In practice, this is about bringing creativity, focus, and engagement into every interaction with one goal in mind: To help you reach yours.

WEALTH – We take a client-centered approach to delivering comprehensive personal wealth strategies. Drawing on decades of real-world financial experience, our team assists you in planning for the certainty of uncertainty in virtually all aspects of your financial life.

MANAGEMENT – As discretionary Portfolio Managers, we manage your assets using a clear and understandable investment philosophy that provides the foundation for helping you reach your goals. Our process is defined by a disciplined, prudent approach that continuously adjusts and adapts to ever-changing economic and market conditions.

GROUP – We believe that the power of a dedicated team of people, versus just one individual, allows for a greater degree of client focus and innovation at every stage of your life.

Our commitment to excellence has earned notable recognition, including Aron Huddleston's eight consecutive years (2018-2025) on Forbes Magazine's list of America's Best-in-State Wealth Advisors and our team's inclusion in the Forbes Best-in-State Wealth Management Teams Ranking for 2024 and 2025.

Disclosures:

2018 - 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018 - 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2024 - 2025 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2024-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award. Awards Disclaimers: https://www.morganstanley.com/disclosures/awards-disclosure/

The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Morgan Stanley Smith Barney LLC. Member SIPC. CRC 4226918 02/25