Eszter Tamas

Drawing on two decades of wealth management experience, Max Bull advises a select clientele of successful individuals and families on all aspects of their complex financial lives. He strives to help each client develop customized investment management and wealth planning solutions based on their unique needs, challenges and aspirations. Max has extensive experience providing strategic investment advice to private business owners, corporate executives and professional athletes. His areas of focus include pre- and post-liquidity event preparation, retirement income planning, tax efficiency, and tailored portfolio management. Max has been named an Alternative Investment Director and Lending Specialist at Morgan Stanley.

Max interned with Morgan Stanley during college and became an Advisor in 2005. He became a Managing Director and earned membership in the firm's prestigious Chairman's Club in 2020. Max was named to On Wall Street magazine's annual listing of Top 40 Advisors Under 40 and Forbes magazine's America's Top Next Generation Wealth Advisors nationally from 2017-2020. He has been recognized by Barron's and Forbes as a Top Financial Advisor in his state and nationally since 2018. Max was named to the Barron's Top 100 Financial Advisors ranking in 2024 and 2025.

Max graduated from the University of Denver with a B.S. in finance. He was a national CoSIDA academic award winner and Co-Captain of the 2003-04 NCAA national championship hockey team. Max is an avid supporter of Shattuck-St. Mary's School, The University of Denver, DAWG Nation Hockey Foundation, Children's Diabetes Foundation and Navy SEAL Foundation. He enjoys spending time with his wife Kea and son Gunnar, travelling, reading, hockey and golf.

Regardless of what stage your life is in - moving ahead in your career, enjoying retirement, or somewhere in between - as your Financial Advisor, I can help you achieve your financial goals.

Using a suite of tools that includes goal-specific analysis, I can work with you to create a realistic, holistic strategy that integrates the various aspects of your financial life, including your investments and cash management needs.

I can create your personal roadmap to help achieve and protect your goals — a framework that makes the connection between your life goals and your financial resources, and provides a baseline for future discussions.

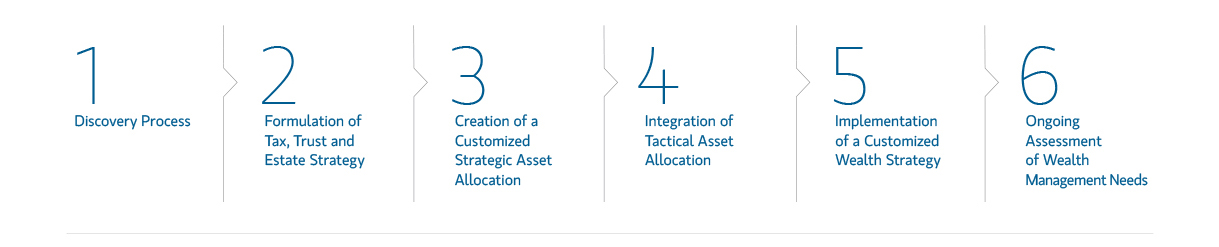

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Alternatives are the investments that go beyond traditional stocks and bonds. They can open doors to unique opportunities to help grow and protect your wealth, and have long sought to offer enhanced returns, portfolio diversification, lower volatility, as well as potential tax efficiency.

With 45+ years of experience and $230+ billion in client assets invested in alternatives, Morgan Stanley is an industry leader in the asset class. Individuals and institutions can gain access to exclusive offerings, preeminent fund managers and innovative investment opportunities spanning private equity, private credit, real assets, hedge funds and more.

See the link below for more information..

Disclosures

Alternative investments are often speculative and include a high degree of risk. Investors can lose all or a substantial amount of their investment. They may be highly illiquid, can engage in leverage, short-selling and other speculative practices that may increase volatility and the risk of loss, and may be subject to large investment minimums and initial lock-ups. They may involve complex tax structures, tax inefficient investing and delays in distributing important tax information. They may have higher fees and expenses that traditional investments, and such fees and expenses can lower the returns achieved by investors.