Glendale Group at Morgan Stanley

Direct:

(626) 304-2443(626) 304-2443

Toll-Free:

(800) 488-1240(800) 488-1240

Our Mission Statement

The Glendale Group is committed to your success. Tailored advice employing Morgan Stanley's suite of services is based on our deep understanding of and commitment to you and your family's life goals.

The Glendale Group Story

The Glendale Group came together organically, through many years of client service. Nathan and Jonathan have been collaborating together for more than 10 years, building and tracking achievable financial plans directly related to current and future financial goals. Rebecca began working with families like yours more than 40 years ago, answering calls and requests often for multiple generations of the same family. We focus on combining goals based wealth management strategies with customized portfolio management to give our clients a comprehensive financial plan. We offer more than just investment advice; our comprehensive financial plans use a full suite of financial planning services and solutions. We take pride in giving our clients the best possible client service. We are ready to serve families like yours for many years to come.

Services Include

- Wealth ManagementFootnote1

- Professional Portfolio ManagementFootnote2

- Financial PlanningFootnote3

- Endowments and FoundationsFootnote4

- Certificates of DepositFootnote5

- 401(k) Rollovers

- Qualified Retirement PlansFootnote6

- 529 PlansFootnote7

- AnnuitiesFootnote8

- Fixed IncomeFootnote9

- Life InsuranceFootnote10

- Long Term Care InsuranceFootnote11

- Sustainable InvestingFootnote12

- Trust AccountsFootnote13

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

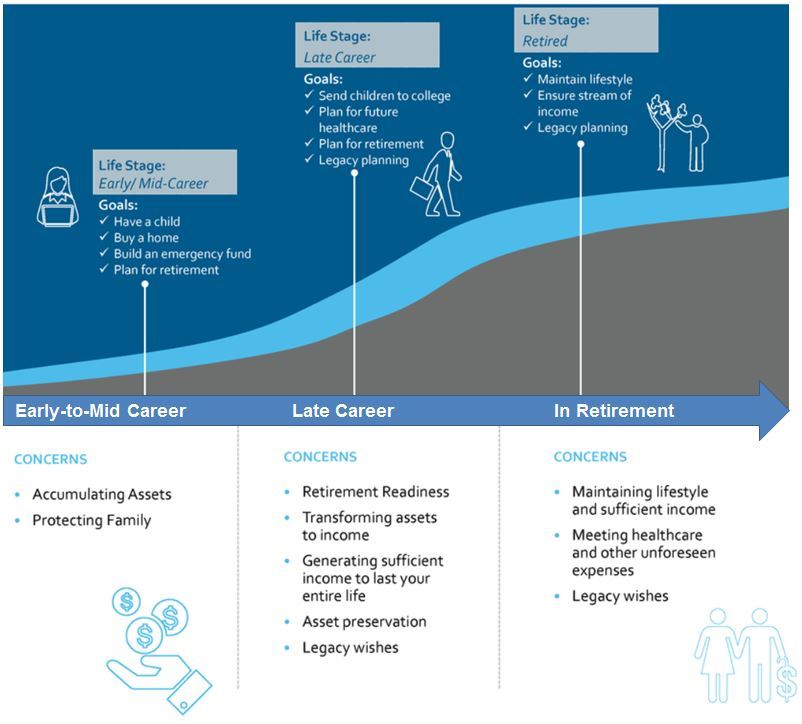

Goals and Concerns 2

Where are you in life?

Financial Planning

Financial Planning with the Glendale Group

Your wealth strategy doesn’t just consider your investment objectives. Rather, it is tailored to address the personal life goals you’ve identified and prioritized.

Using our suite of tools — our LifeView® platform — we can create your personal roadmap to help achieve and protect your goals — a framework that makes the connection between your life goals and your financial resources, and provides a baseline for future discussions.

LifeView® helps us:

Analyze your current investments, and financial situation

Review and prioritize your goals with you, such as Retirement

Education funding

Major purchases and philanthropic goals

Protect your goals

Develop wealth transfer strategies

Click the link below to access the sample LifeView® Goal Analysis and Client Profile.

Your wealth strategy doesn’t just consider your investment objectives. Rather, it is tailored to address the personal life goals you’ve identified and prioritized.

Using our suite of tools — our LifeView® platform — we can create your personal roadmap to help achieve and protect your goals — a framework that makes the connection between your life goals and your financial resources, and provides a baseline for future discussions.

LifeView® helps us:

Analyze your current investments, and financial situation

Review and prioritize your goals with you, such as Retirement

Education funding

Major purchases and philanthropic goals

Protect your goals

Develop wealth transfer strategies

Click the link below to access the sample LifeView® Goal Analysis and Client Profile.

4 Step Process

ESTABLISH FINANCIAL OBJECTIVES

Work with you to establish a realistic set of objectives based on:

• Your financial goals

• Time horizon

• Liquidity needs

• Tolerance to volatility and risk

• Your financial goals

• Time horizon

• Liquidity needs

• Tolerance to volatility and risk

DEFINE INVESTMENT STRATEGY

• Develop an investment strategy designed to help produce optimal portfolio performance

• Seek to generate the highest return potential consistent with the strategy’s level of risk

• Seek to generate the highest return potential consistent with the strategy’s level of risk

EVALUATE AND SELECT INVESTMENTS

• Leverage the global resources of Morgan Stanley to select investments to implement your personal strategy

ONGOING REVIEW PROCESS

• Monitor your portfolio to track its performance relative to your stated objectives

• Modify the portfolio on a discretionary basis as your needs and circumstances change over time

The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Financial Advisor invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

In this program the client pays a wrap fee to MSWM (the “MSWM Fee”), which covers MSWM investment advisory services, custody of securities (if we are the custodian), trade execution with or through MSWM, as well as compensation to any Financial Advisor. The Portfolio Management program fees are described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

• Modify the portfolio on a discretionary basis as your needs and circumstances change over time

The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Financial Advisor invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

In this program the client pays a wrap fee to MSWM (the “MSWM Fee”), which covers MSWM investment advisory services, custody of securities (if we are the custodian), trade execution with or through MSWM, as well as compensation to any Financial Advisor. The Portfolio Management program fees are described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

Location

55 South Lake Avenue

Suite 700

Pasadena, CA 91101

US

Direct:

(626) 304-2443(626) 304-2443

Toll-Free:

(800) 488-1240(800) 488-1240

Fax:

(818) 230-9394(818) 230-9394

Meet Glendale Group

About Jonathan McLean

As a CERTIFIED FINANCIAL PLANNER™, Vice President, and Financial Advisor for the Glendale Group, Jonathan’s primary role on the team is the big picture financial planning for all clients. Jonathan works diligently to establish and maintain investments in the context of comprehensive financial plans.

Jonathan has been a financial advisor for more than 20 years. He is a CERTIFIED FINANCIAL PLANNER™, and has earned the Chartered Retirement Plan Specialist, and Accredited Domestic Partner’s Advisor designations. Jonathan brings his experience and knowledge to the fore, where the Glendale Group works best: putting together comprehensive solutions as we work together to achieve life goals. Jonathan’s skill in financial planning for individuals and families blends well with a focus on servicing local business retirement plans. Jonathan strives to educate and empower all clients, including plan participants, to confidently accumulate wealth while working towards a goal of a more secure retirement.

Originally from the east coast, Jonathan attended the University of Vermont (UVM) where he earned a Master’s in Business Administration. Following UVM, Jonathan earned a Masters in Teaching at Saint Michael’s College.

Jonathan strongly believes in a balance between family, education and work. He and his wife Min live near Pasadena. Their three grown children live as nearby as Orange County, and as far away as Indonesia, with two grandchildren in the Oakland area, and one in Indonesia. Jonathan and Min enjoy participating in various community projects within the local Indonesian community. Min loves to garden.

Jonathan has been a financial advisor for more than 20 years. He is a CERTIFIED FINANCIAL PLANNER™, and has earned the Chartered Retirement Plan Specialist, and Accredited Domestic Partner’s Advisor designations. Jonathan brings his experience and knowledge to the fore, where the Glendale Group works best: putting together comprehensive solutions as we work together to achieve life goals. Jonathan’s skill in financial planning for individuals and families blends well with a focus on servicing local business retirement plans. Jonathan strives to educate and empower all clients, including plan participants, to confidently accumulate wealth while working towards a goal of a more secure retirement.

Originally from the east coast, Jonathan attended the University of Vermont (UVM) where he earned a Master’s in Business Administration. Following UVM, Jonathan earned a Masters in Teaching at Saint Michael’s College.

Jonathan strongly believes in a balance between family, education and work. He and his wife Min live near Pasadena. Their three grown children live as nearby as Orange County, and as far away as Indonesia, with two grandchildren in the Oakland area, and one in Indonesia. Jonathan and Min enjoy participating in various community projects within the local Indonesian community. Min loves to garden.

Securities Agent: VT, CO, TN, IL, AZ, SD, OR, NC, MT, MN, KS, GA, CT, CA, WA, MI, VA, NJ, SC, NV, MS, LA, AL, AK, ID, WI, TX, OK, NM, MD, MA, FL, DC, UT, MO, ME, KY, HI, OH, NY; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1275649

CA Insurance License #: 0C53696

NMLS#: 1275649

CA Insurance License #: 0C53696

About Nathan Logan

As a financial advisor for the Glendale Group, Nathan’s primary focus is the portfolio management and individual investment decisions. He makes sure client portfolios reflect their big picture financial plan. Nathan works closely with his clients to develop long term relationships built on trust, understanding and meeting the needs of his clientele.

Nathan joined Morgan Stanley in February 2008 as a Client Service Associate. His primary role as a Client Service Associate was to assist more than 500 clients with their day to day needs. As a lifelong learner, Nathan felt it was important to further his understanding of portfolio construction and risk management. In 2011 he successfully completed the Consulting Group Analyst training program where he learned the science of portfolio construction and asset allocation. In August 2012, Nathan decided it was time to take his career to the next level as a Financial Advisor. Nathan’s previous experience has helped develop a Process Based Wealth Management philosophy and Service Model.

Nathan graduated from the University of La Verne in 2008 with a BS degree in Business with a Finance concentration. While at ULV, he was a 4 year Letterman on the Leopards Golf team. He was a part of 3 NCAA Championship team appearances culminating with a 2nd place finish in his senior season. On an individual basis he earned 2 All-American awards as well as 2 Academic All-American awards.

Nathan is still an avid golfer, but spends most of his time with his family, friends and giving back to the community. He serves as a Volunteer to the German Shepard Rescue of Orange County and as a Volunteer to Covina Rotary’s annual Field of Valor; honoring the Men and Women who serve in the United States Military.

Nathan joined Morgan Stanley in February 2008 as a Client Service Associate. His primary role as a Client Service Associate was to assist more than 500 clients with their day to day needs. As a lifelong learner, Nathan felt it was important to further his understanding of portfolio construction and risk management. In 2011 he successfully completed the Consulting Group Analyst training program where he learned the science of portfolio construction and asset allocation. In August 2012, Nathan decided it was time to take his career to the next level as a Financial Advisor. Nathan’s previous experience has helped develop a Process Based Wealth Management philosophy and Service Model.

Nathan graduated from the University of La Verne in 2008 with a BS degree in Business with a Finance concentration. While at ULV, he was a 4 year Letterman on the Leopards Golf team. He was a part of 3 NCAA Championship team appearances culminating with a 2nd place finish in his senior season. On an individual basis he earned 2 All-American awards as well as 2 Academic All-American awards.

Nathan is still an avid golfer, but spends most of his time with his family, friends and giving back to the community. He serves as a Volunteer to the German Shepard Rescue of Orange County and as a Volunteer to Covina Rotary’s annual Field of Valor; honoring the Men and Women who serve in the United States Military.

Securities Agent: MT, KY, AL, PA, NJ, MI, MD, LA, NY, CT, TN, MS, ME, HI, DC, CA, AZ, SD, SC, NV, NC, WI, VT, ID, VA, OK, MA, KS, IL, FL, OH, MN, GA, CO, AK, WA, UT, TX, OR, NM, MO; General Securities Representative; Investment Advisor Representative

NMLS#: 1261928

CA Insurance License #: 0I23613

NMLS#: 1261928

CA Insurance License #: 0I23613

About Rebecca Dickson

Rebecca brings more than 40 years of financial services experience to our team. As a Portfolio Associate in our Pasadena office, she is essential to helping enhance the client experience and brings a wealth of knowledge to her position. Lovingly referred to as the team’s “Momma Bear,” Rebecca has an extensive knowledge of the firm’s operations that allows her to quickly align the correct resources, providing clients with confidence as she works to find the appropriate solution to their particular challenge.

Rebecca began her career working for her father, who was a financial advisor and branch manager. She has since worked in all areas of the wealth management business, both operationally and administratively, and received the Morgan Stanley Service Excellence Award for exceeding client expectations. Rebecca holds Series 7 and 66 licenses and has been with Morgan Stanley since 1994.

In her free time, Rebecca pursues her passion for design and gardening. Her memorial garden, built in honor of her late husband, was featured in a local magazine. She also established a scholarship at her local high school to pay tribute to his memory. She believes in the power of paying it forward, helping others achieve their goals and putting good into the world. Rebecca loves to travel and spend time with her son, Bryan, and his wife, Sharon, as well as her daughter, Jennifer, and her husband, Chris. Bryan serves in the U.S. Navy and Chris serves in the U.S. Air Force.

Rebecca began her career working for her father, who was a financial advisor and branch manager. She has since worked in all areas of the wealth management business, both operationally and administratively, and received the Morgan Stanley Service Excellence Award for exceeding client expectations. Rebecca holds Series 7 and 66 licenses and has been with Morgan Stanley since 1994.

In her free time, Rebecca pursues her passion for design and gardening. Her memorial garden, built in honor of her late husband, was featured in a local magazine. She also established a scholarship at her local high school to pay tribute to his memory. She believes in the power of paying it forward, helping others achieve their goals and putting good into the world. Rebecca loves to travel and spend time with her son, Bryan, and his wife, Sharon, as well as her daughter, Jennifer, and her husband, Chris. Bryan serves in the U.S. Navy and Chris serves in the U.S. Air Force.

About Rich Wang

Rich is a Registered Client Service Associate with the designation of Financial Planning Specialist. He earned his Bachelor of Science degree in Business Administration, with a concentration in Finance, from the University of California, Riverside. During his education, he was also exposed to the finance industry, starting his career at JPMorgan Chase. Upon graduating with valuable experience, he joined the Morgan Stanley team in 2022. At Morgan Stanley, he obtained his securities licenses by successfully passing the Series 7 and Series 66 examination. Determined to demonstrate his commitment to professional development, Rich pursued advanced studies at Boston University, completing their CFP Program. In 2024, he achieved the prestigious CERTIFIED FINANCIAL PLANNER® Professional designation from the CFP Board.

On Rich’s personal side, he is a lifelong resident of Orange County. As someone who appreciates their Taiwanese American heritage, his connection to his roots was enriched by his study abroad in Asia during his educational pursuits. Rich enjoys maintaining an active lifestyle, derived from his experience as a former Division II Varsity Swim Captain. He now channels his passion for fitness into Weightlifting, marathon training, and Spartan races. Dedicated to community engagement, Rich seeks out opportunities to participate in local events and create lasting memories through meaningful connections.

Disclaimer: this role does not solicit or provide investment advice

On Rich’s personal side, he is a lifelong resident of Orange County. As someone who appreciates their Taiwanese American heritage, his connection to his roots was enriched by his study abroad in Asia during his educational pursuits. Rich enjoys maintaining an active lifestyle, derived from his experience as a former Division II Varsity Swim Captain. He now channels his passion for fitness into Weightlifting, marathon training, and Spartan races. Dedicated to community engagement, Rich seeks out opportunities to participate in local events and create lasting memories through meaningful connections.

Disclaimer: this role does not solicit or provide investment advice

CA Insurance License #: Insurance Lic #4284000

Contact Jonathan McLean

Contact Nathan Logan

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Peter Barash

Peter Barash is a Private Banker serving Morgan Stanley Wealth Management offices in California.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs,

leveraging our comprehensive suite of cash management and lending solutions.

Peter began his career in financial services in 1984, and joined Morgan Stanley in 2010 as a Private Banker. Prior to joining the firm, he was a Private Banking Specialist at U.S. Bank.

Peter is a graduate of Columbia University, where he received a Bachelor of Arts in Economics and Comparative Literature. He holds an MBA from the University of Southern California. He lives in Glendale, California with his family. Outside of the office, Peter enjoys, hiking, playing bass guitar and reading.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs,

leveraging our comprehensive suite of cash management and lending solutions.

Peter began his career in financial services in 1984, and joined Morgan Stanley in 2010 as a Private Banker. Prior to joining the firm, he was a Private Banking Specialist at U.S. Bank.

Peter is a graduate of Columbia University, where he received a Bachelor of Arts in Economics and Comparative Literature. He holds an MBA from the University of Southern California. He lives in Glendale, California with his family. Outside of the office, Peter enjoys, hiking, playing bass guitar and reading.

NMLS#: 799189

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact Glendale Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

8Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

8Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)