George Bettisworth, CFP®, CPM®

Senior Vice President,

Financial Advisor,

Certified Portfolio Manager,

Portfolio Management Director

Direct:

(408) 861-2020(408) 861-2020

My Mission Statement

I believe in developing long-term relationships by providing: premium service, intuitive guidance on complex global markets, comprehensive and customized investment planning for your financial future.

About George Bettisworth

George’s father introduced him to investing when he was in elementary school. George soon purchased his first stock mutual funds with savings from his low-yielding bank account. The excitement of reading the business section each day to check his investments’ performance became a lifelong obsession. That early hobby has blossomed into an investments and financial planning a career spanning numerous market cycles.

George began his career in wealth management after serving his country for four years in the U.S. Air Force. As a Master Crew Chief, managing the maintenance of multi-million-dollar aircraft, the safety of the crew and aircraft were his responsibility. That experience taught George the importance of focus, high attention to detail and discipline, all attributes he would carry over to his investment management career.

George started at Dean Witter, which was later acquired by Morgan Stanley. During his distinguished tenure with the Firm, George has received the numerous designations, including the Branch Retirement Planning Coordinator award; Certified Financial Planner®; Senior Portfolio Manager; Portfolio Management Director; and the peer voted, “Broker’s Broker” award, for his assistance to other Financial Advisors with technical retirement planning strategies.

A youth leader at his local church and a Boy Scout leader for more than 14 years, George is a native of Cupertino, California, where he lives today, with his wife, who was his high school sweetheart. His wife Marti is a registered nurse and they enjoy being active with their five children through travelling, fishing, boating, hiking and gardening. George holds a B.S. in Business Administration and an MBA.

George began his career in wealth management after serving his country for four years in the U.S. Air Force. As a Master Crew Chief, managing the maintenance of multi-million-dollar aircraft, the safety of the crew and aircraft were his responsibility. That experience taught George the importance of focus, high attention to detail and discipline, all attributes he would carry over to his investment management career.

George started at Dean Witter, which was later acquired by Morgan Stanley. During his distinguished tenure with the Firm, George has received the numerous designations, including the Branch Retirement Planning Coordinator award; Certified Financial Planner®; Senior Portfolio Manager; Portfolio Management Director; and the peer voted, “Broker’s Broker” award, for his assistance to other Financial Advisors with technical retirement planning strategies.

A youth leader at his local church and a Boy Scout leader for more than 14 years, George is a native of Cupertino, California, where he lives today, with his wife, who was his high school sweetheart. His wife Marti is a registered nurse and they enjoy being active with their five children through travelling, fishing, boating, hiking and gardening. George holds a B.S. in Business Administration and an MBA.

Services Include

- Wealth ManagementFootnote1

- 401(k) Rollovers

- 529 PlansFootnote2

- Corporate BondsFootnote3

- Estate Planning StrategiesFootnote4

- Exchange Traded FundsFootnote5

- Financial PlanningFootnote6

- Fixed IncomeFootnote7

- Lending Products

- Municipal BondsFootnote8

- Retirement PlanningFootnote9

- Sustainable InvestingFootnote10

- Trust AccountsFootnote11

Securities Agent: AL, MO, TN, SC, AK, MA, OR, ID, IA, AR, NY, MN, WA, CO, VA, NV, IL, CT, CA, OK, NM, NC, FL, OH, AZ, TX, IN, MT; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

CA Insurance License #: 0A37662

CA Insurance License #: 0A37662

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Adults of the Millennial generation select George Bettisworth for the same primary reason Baby Boomers do: Trust.

Whether my clients are in their 50s or 20s, they turn to me because I ardently listen. I do this to gain a comprehensive understanding of their lives: who they are as people, what they enjoy doing outside of work, their family, their background, their aspirations and their apprehensions, all of which help me to customize an investment plan and afford advisory services that completely addresses their financial aims.

During my discovery process, we search for anything that could negatively impact their financial life and legacy, even if it falls beyond our normal purview. Over the decades, I’ve seen that issues that are seemingly small and unrelated now, can sometimes balloon into major financial problems later.

As a result of this broad and deep discovery process, my clients are confident we will customize a plan reflecting the lifestyle they want to enjoy in the present, and in the future. I see our primary goals as not merely to enhance clients’ investment returns, but to protect them over the long-term.

This approach also imbues clients with the comfort of knowing they will never be treated as “a number.” In Silicon Valley, where so much comes down to hard data alone, clients find this more human approach refreshing and enlightening.

In formulating and maintaining client portfolios, I draw upon the knowledge of one of the largest and most highly respected equity research teams in the financial industry. However, we go beyond how and where to invest by providing counsel on the ever-changing global capital markets. Explaining different types of risk and how I seek to mitigate them is a central component of our advisory platform. I explain concepts in layman’s terms, so our clients – whether they are newly retired or new millionaires – truly understand today’s complex marketplace and sophisticated financial instruments. I leverage more than 20 years of experience – achieved during all market cycles – to share knowledge with my client base of families, young adults inheriting wealth, executives (pre- and post-liquidity events), IT professionals with concentrated stock positions and adults enjoying their golden years.

Most of our new clients are referrals and young relatives of long-standing clients ̶ a testament to the quality of advisory services and investment planning I provide. I believe in long-term relationships because most financial goals are strategic.

Whether my clients are in their 50s or 20s, they turn to me because I ardently listen. I do this to gain a comprehensive understanding of their lives: who they are as people, what they enjoy doing outside of work, their family, their background, their aspirations and their apprehensions, all of which help me to customize an investment plan and afford advisory services that completely addresses their financial aims.

During my discovery process, we search for anything that could negatively impact their financial life and legacy, even if it falls beyond our normal purview. Over the decades, I’ve seen that issues that are seemingly small and unrelated now, can sometimes balloon into major financial problems later.

As a result of this broad and deep discovery process, my clients are confident we will customize a plan reflecting the lifestyle they want to enjoy in the present, and in the future. I see our primary goals as not merely to enhance clients’ investment returns, but to protect them over the long-term.

This approach also imbues clients with the comfort of knowing they will never be treated as “a number.” In Silicon Valley, where so much comes down to hard data alone, clients find this more human approach refreshing and enlightening.

In formulating and maintaining client portfolios, I draw upon the knowledge of one of the largest and most highly respected equity research teams in the financial industry. However, we go beyond how and where to invest by providing counsel on the ever-changing global capital markets. Explaining different types of risk and how I seek to mitigate them is a central component of our advisory platform. I explain concepts in layman’s terms, so our clients – whether they are newly retired or new millionaires – truly understand today’s complex marketplace and sophisticated financial instruments. I leverage more than 20 years of experience – achieved during all market cycles – to share knowledge with my client base of families, young adults inheriting wealth, executives (pre- and post-liquidity events), IT professionals with concentrated stock positions and adults enjoying their golden years.

Most of our new clients are referrals and young relatives of long-standing clients ̶ a testament to the quality of advisory services and investment planning I provide. I believe in long-term relationships because most financial goals are strategic.

Working With You

My Wealth Management Process Starts with Understanding Your Financial Needs

I do not believe in high-risk, high-reward strategies. I conduct comprehensive planning and prudent investing, customizing an asset allocation and investment diversification plan to your specific needs. I seek to achieve a comfortable balance between risk and reward based on your objectives and risk appetite. A key component of this process is providing you with insight, knowledge and guidance based on my extensive experience, so that you clearly understand how market volatility and sophisticated products can impact your portfolio.

1. Learning About You

Our relationship begins with a thorough understanding of you: your needs, your lifestyle and family, and your aims for the future. We’ll discuss details about your balance sheet, credit and basic finances, and help you to take precautions to maintain credit and preserve assets. We’ll also discuss where you want to be in 5, 10 and 20 years. The initial consolation is complimentary.

2. Creating Your Strategic Asset Allocation

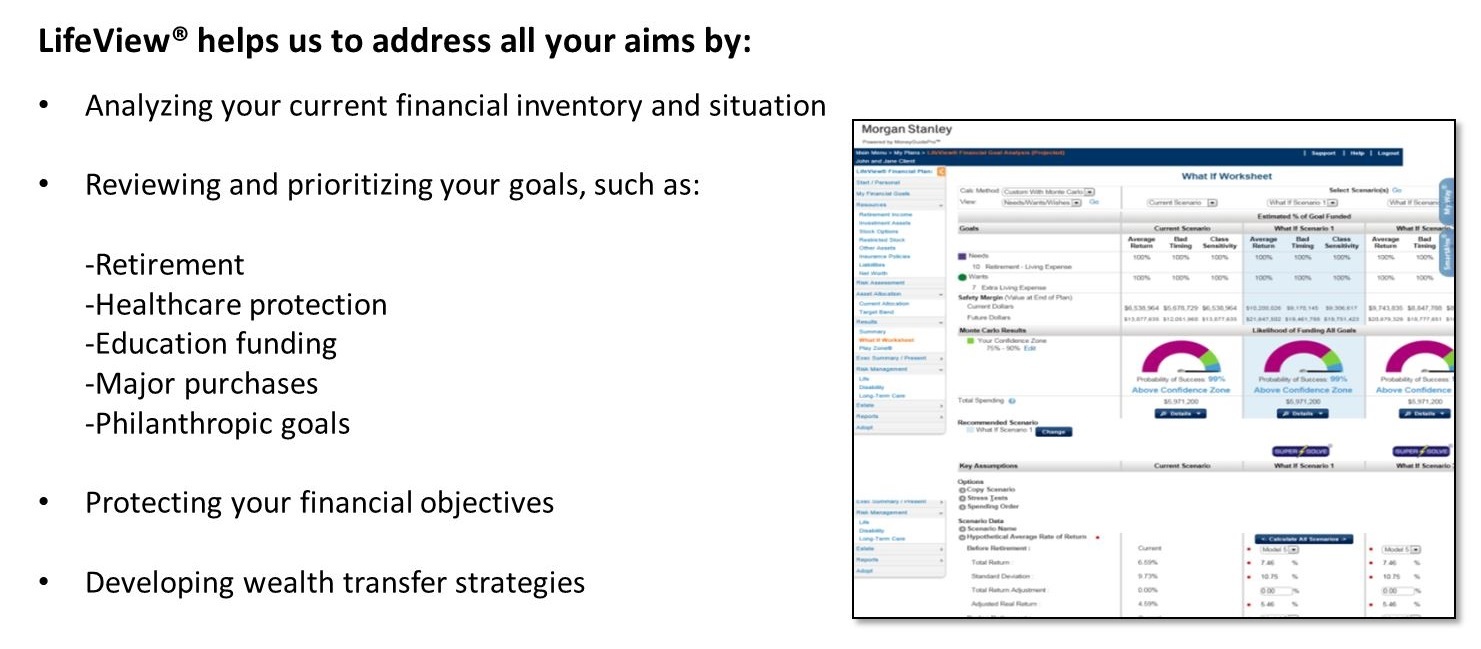

Using Morgan Stanley's proprietary Lifeview® platform we create a personal financial plan to help achieve and protect the outcomes you envision — a framework that connects your life goals, objectives and financial resources, while providing a baseline for future discussions. We’ll discuss the advantages and disadvantages of any product and service deemed appropriate for your life; and you’ll be able to see what results you can anticipate seeing over distinct periods of time.

Life View Financial Plan/LifeView Analysis

A LifeView Financial Goal Analysis or LifeView Financial Plan (“Financial Plan”) is based on the methodology, estimates, and assumptions, as described in your report, as well as personal data provided by you. It should be considered a working document that can assist you with your objectives. Morgan Stanley Smith Barney LLC (“Morgan Stanley”) makes no guarantees as to future results or that an individual’s investment objectives will be achieved. The responsibility for implementing, monitoring and adjusting your financial goal analysis or financial plan rests with you. After your Financial Advisor delivers your report to you, if you so desire, your Financial Advisor can help you implement any part that you choose; however, you are not obligated to work with your Financial Advisor or Morgan Stanley.

3. Implementing Your Asset Allocation Strategy

Next, we implement investment, retirement, cash management and insurance solutions tailored to your unique needs. I'll consider any special circumstances such as alimony, child support or tax consequences of selling larges assets like your home. This asset allocation will serve as your long-term investment strategy.

4. Tactically Adjusting Your Strategy

Achieving your goals requires vigilance and flexibility. On an ongoing basis, I'll meet with you to determine if adjustments need to be made to your asset allocation strategy to capitalize on opportunities or hurdle potential hazards. I’ll help you monitor your progress and adjust the asset allocation as your life evolves, priorities change, and markets and tax laws shift.

I do not believe in high-risk, high-reward strategies. I conduct comprehensive planning and prudent investing, customizing an asset allocation and investment diversification plan to your specific needs. I seek to achieve a comfortable balance between risk and reward based on your objectives and risk appetite. A key component of this process is providing you with insight, knowledge and guidance based on my extensive experience, so that you clearly understand how market volatility and sophisticated products can impact your portfolio.

1. Learning About You

Our relationship begins with a thorough understanding of you: your needs, your lifestyle and family, and your aims for the future. We’ll discuss details about your balance sheet, credit and basic finances, and help you to take precautions to maintain credit and preserve assets. We’ll also discuss where you want to be in 5, 10 and 20 years. The initial consolation is complimentary.

2. Creating Your Strategic Asset Allocation

Using Morgan Stanley's proprietary Lifeview® platform we create a personal financial plan to help achieve and protect the outcomes you envision — a framework that connects your life goals, objectives and financial resources, while providing a baseline for future discussions. We’ll discuss the advantages and disadvantages of any product and service deemed appropriate for your life; and you’ll be able to see what results you can anticipate seeing over distinct periods of time.

Life View Financial Plan/LifeView Analysis

A LifeView Financial Goal Analysis or LifeView Financial Plan (“Financial Plan”) is based on the methodology, estimates, and assumptions, as described in your report, as well as personal data provided by you. It should be considered a working document that can assist you with your objectives. Morgan Stanley Smith Barney LLC (“Morgan Stanley”) makes no guarantees as to future results or that an individual’s investment objectives will be achieved. The responsibility for implementing, monitoring and adjusting your financial goal analysis or financial plan rests with you. After your Financial Advisor delivers your report to you, if you so desire, your Financial Advisor can help you implement any part that you choose; however, you are not obligated to work with your Financial Advisor or Morgan Stanley.

3. Implementing Your Asset Allocation Strategy

Next, we implement investment, retirement, cash management and insurance solutions tailored to your unique needs. I'll consider any special circumstances such as alimony, child support or tax consequences of selling larges assets like your home. This asset allocation will serve as your long-term investment strategy.

4. Tactically Adjusting Your Strategy

Achieving your goals requires vigilance and flexibility. On an ongoing basis, I'll meet with you to determine if adjustments need to be made to your asset allocation strategy to capitalize on opportunities or hurdle potential hazards. I’ll help you monitor your progress and adjust the asset allocation as your life evolves, priorities change, and markets and tax laws shift.

Clients

Clients

My central focus is earning our clients’ trust. I work to accomplish this by delivering world-class service each day to tech professionals, business owners, executives in private and public companies (pre- and post-liquidity events), retirees, those nearing retirement, families and adult children of affluent families.

I help our clients to transfer, grow and manage their wealth by simplifying and consolidating their assets, sharing investment knowledge gained from decades of experience, and formulating a comprehensive and conservative investment plan that fits their evolving needs. As I monitor client portfolios, I educate clients about complex financial principles, and help them to maintain the plan as their lives and markets change.

During periodic meetings and through regular client communications, I share new ways to meet challenges, reach financial goals, nascent investment ideas, and information about changes in tax codes and retirement strategies. To capitalize on the benefits of compound earnings, I emphasize that clients, especially those in their twenties, create and implement a retirement strategy. Clients often turn to me for our time-tested experience in managing lump sum distributions from pension plans and 401K retirement savings.

My central focus is earning our clients’ trust. I work to accomplish this by delivering world-class service each day to tech professionals, business owners, executives in private and public companies (pre- and post-liquidity events), retirees, those nearing retirement, families and adult children of affluent families.

I help our clients to transfer, grow and manage their wealth by simplifying and consolidating their assets, sharing investment knowledge gained from decades of experience, and formulating a comprehensive and conservative investment plan that fits their evolving needs. As I monitor client portfolios, I educate clients about complex financial principles, and help them to maintain the plan as their lives and markets change.

During periodic meetings and through regular client communications, I share new ways to meet challenges, reach financial goals, nascent investment ideas, and information about changes in tax codes and retirement strategies. To capitalize on the benefits of compound earnings, I emphasize that clients, especially those in their twenties, create and implement a retirement strategy. Clients often turn to me for our time-tested experience in managing lump sum distributions from pension plans and 401K retirement savings.

Retirement solutions include:

- Traditional

- SEP & SAR-IRA

- Simple IRA

Location

20400 Stevens Creek Blvd

Ste 350

Cupertino, CA 95014

US

Direct:

(408) 861-2020(408) 861-2020

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact George Bettisworth today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)