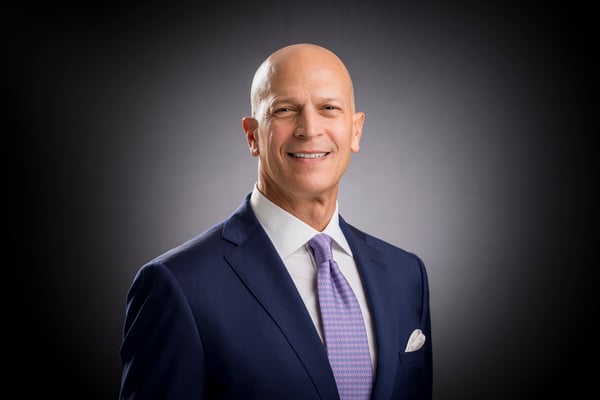

About Anthony DiValerio

Anthony is the founder of Front Street Group and a Managing Director, Family Wealth Director, Alternative Investments Director, Portfolio Management Director, Global Sports and Entertainment Director, and Private Wealth Advisor with Morgan Stanley Private Wealth Management. Drawing on more than 30 years of financial industry experience, Anthony works with clients to create integrated wealth plans focusing on fixed-income management, private equity and risk management strategies for concentrated positions. Anthony has been recognized by Barron’s as one of the Top 1,000 U.S. Financial Advisors from 2011 to 2013 and Top 1,200 U.S. Financial Advisors from 2014 to 2023. He was named among the Financial Times 400 Top Advisers from 2015 to 2017 and Forbes Best-in-State Wealth Advisors from 2018 to 2024.

Prior to joining Morgan Stanley in 2008, Anthony worked as a private wealth advisor at UBS, also serving as a member of the Advisory Council to Management, the Global Circle of Excellence, the UBS Chairman’s Council and the Dow Jones Wealth Management Advisory Council. He joined UBS from Donaldson, Lufkin & Jenrette/Credit Suisse’s Corporate Services Group, where he was a regional director and served on the Corporate Advisory Council. Earlier in his career, Anthony worked with select family groups at Tucker Anthony and Bear Stearns. He earned a B.S. in business management and economics from Bloomsburg University. Anthony served as a member of the Morgan Stanley PWM Advisory Council to Management from 2018 to 2025, including the Co-Chair position from 2022 to 2025.

Outside the office, Anthony was a trustee of the Paoli Hospital Foundation (2016-2022) and the Willistown Conservation Trust (2019-2022). He previously served as a trustee at the Malvern Preparatory School and was formerly a member of the executive committee at Bringing Hope Home, a nonprofit organization that provides financial assistance to families battling cancer in the Greater Philadelphia area. He currently lives in Austin, Texas, with his wife, Linda. They have three grown children.

2011-2023 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2011-2023). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2018-2024 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2015-2017 Financial Times 400 Top Financial Advisors

Source: ft.com. Data compiled by the Financial Times based the following time periods:

Awarded 2017; data 9/30/14 - 9/30/16

Awarded 2016; data 9/30/13 - 9/30/15

Awarded 2015; data 9/30/13 - 9/30/14

Securities Agent: IN, WA, AZ, NV, NM, ID, CT, AL, UT, NY, KS, AR, SC, PR, MN, ME, KY, IA, DE, DC, CO, CA, PA, NJ, NH, MD, WY, TX, RI, OH, VT, VA, MT, MA, LA, GA, WV, TN, NC, IL, FL, SD, OR, OK, MI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1295599