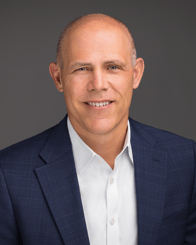

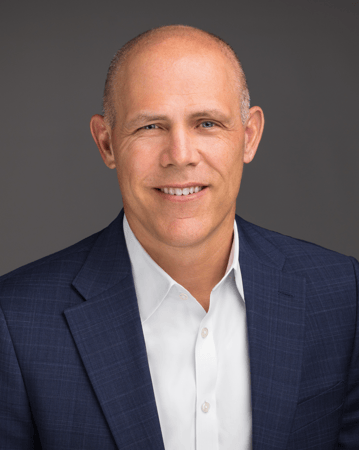

Paul W. Shoemaker, CFP®

Industry Award Winner

Industry Award WinnerAs a client of the Capital Street Group, you'll have access to the experience and skill of highly trained financial advisors, who are supported by a wealth management platform and thought leadership program we believe are second-to-none. We offer an objective and flexible framework that we can use to help you organize your financial life, whether your aim is growth, wealth preservation, succession planning or wealth transfer.

We offer a highly disciplined wealth management philosophy in managing $2.7 billion of client assets as of January 2026. We specifically target to address the needs of a high-net-worth clientele - individuals and families, corporate executives, professional athletes, business owners, foundations, venture capital firms and private and public businesses.

We begin each relationship by taking the time to fully understand each client's unique financial situation. We then use that information to shape a thoughtful, customized approach that can make use of numerous products and services from one of the world's largest full-service investment firms. Our global perspective helps you adjust to financial challenges and identify potential opportunities.

IN THE PRESS:

Capital Street Group at Morgan Stanley

2024-2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2024-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award. Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure/