Andrew Champagne, QPFC

My Mission Statement

MY STORY

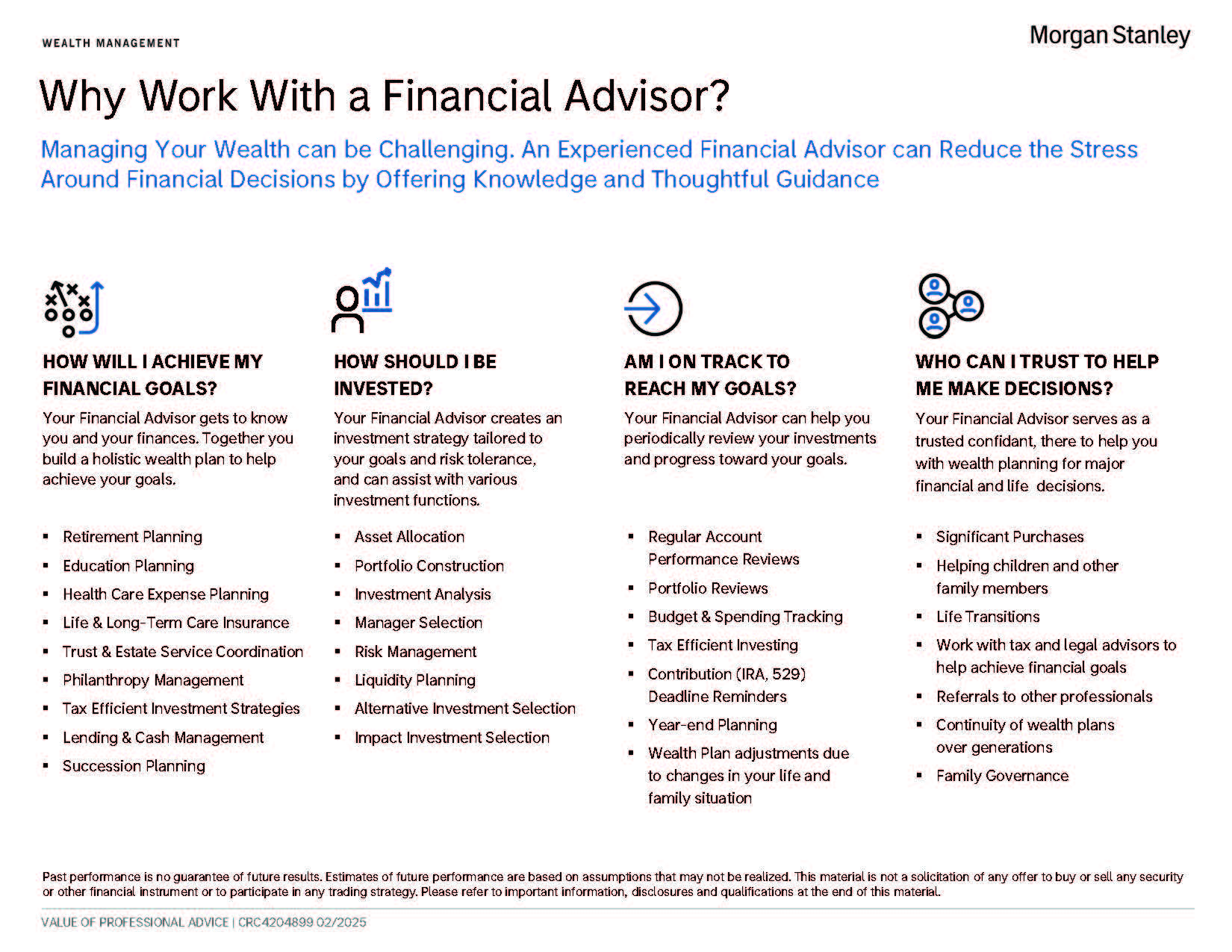

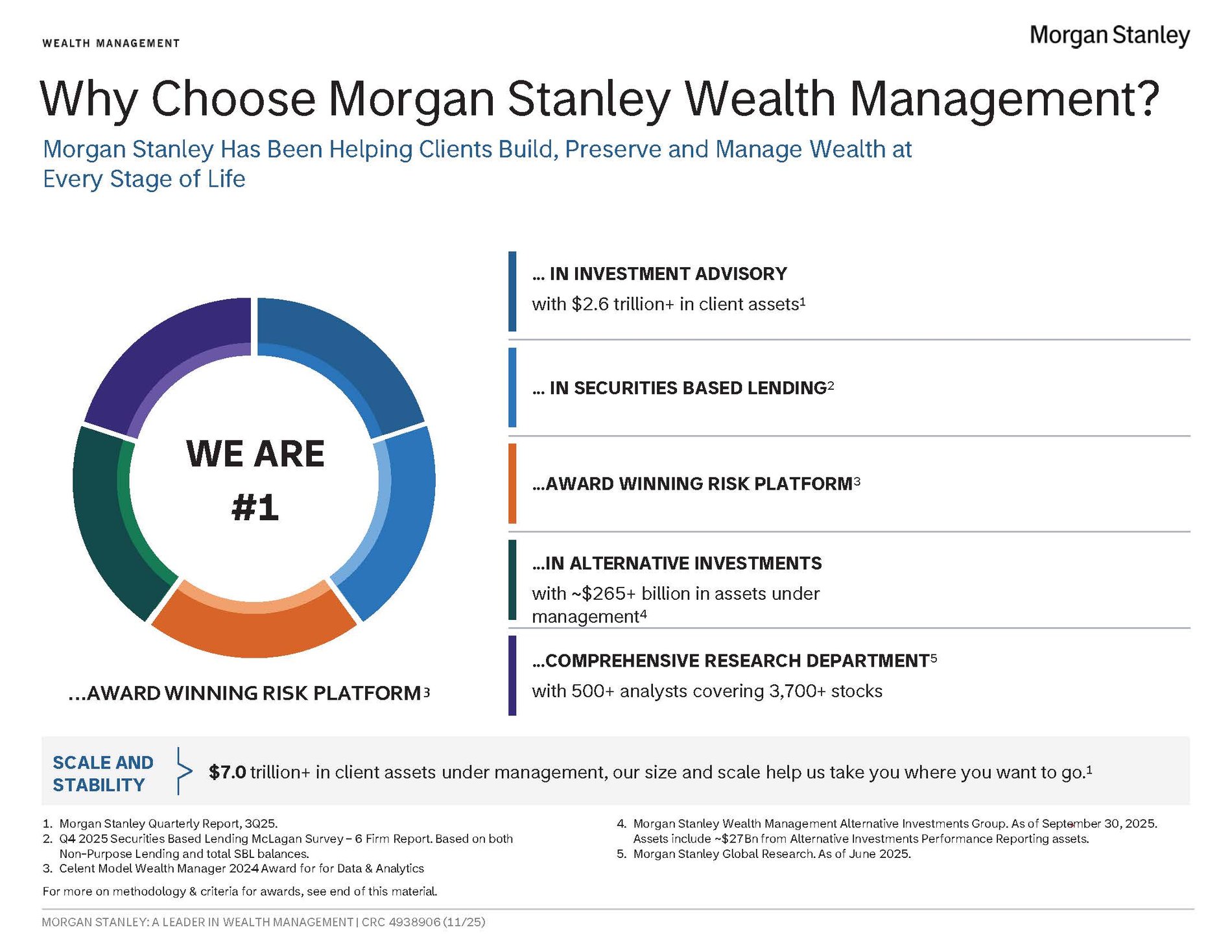

Andrew is a dedicated financial advisor whose wealth management practice is centered on addressing the unique goals and needs of individuals, business owners, executives, and their families. With a robust background in institutional investment and financial planning, Andrew is committed to helping his clients navigate their ever-changing financial landscapes. He leverages the extensive resources of a global financial services firm, managing over $6 trillion in client assets, while maintaining independence, objectivity, and a commitment to delivering an outstanding client experience.

Andrew's approach is deeply client-centric, focusing on understanding the full financial picture and aspirations of each client. He recognizes that there is no "one-size-fits-all" solution and tailors his financial plans and investment strategies to optimize resources and provide a clear roadmap for achieving life goals.

A graduate of Pennsylvania State University, Andrew earned his bachelor's degree in Business with concentrations in Accounting and Financial Services, along with a minor in Entrepreneurship in 2014. He began his financial career in 2013 with Morgan Stanley and its predecessor firm, gaining valuable experience as an analyst for seven years with the Graystone Consulting Team in Wyomissing, PA. Graystone Consulting is Morgan Stanley's Institutional Consulting business, offering advice and services to large institutions, corporations, foundations, and endowments. Andrew further honed his experience as a Wealth Advisor Associate, assisting Senior Financial Advisors and their clients with complex financial plans.

Outside of his professional commitments, Andrew enjoys spending quality time with his wife, family, and friends. His hobbies include golfing, fishing, kayaking, and gardening.

Community Involvement

- Integrate For Good (Finance Committee Member)

- International Spring Festival (Volunteer Committee Member)

- Rotary International (Pottstown Club Member)

- Pottstown Rotary (Board of Directors)

- Pottstown Rotary Community Endowment Fund (Board of Directors)

- Chamber of Commerce for Greater Montgomery County (Member)

- Co-Chair - Business With A Purpose Committee (Chamber of Commerce for Greater Montgomery County)

- Inclusion Council Committee Member (Chamber of Commerce for Greater Montgomery County)

Financial Planning Specialist - Morgan Stanley's Designation for Financial Advisors who have demonstrated knowledge across 13 areas of key financial planning considerations.

Qualified Plan Financial Consultant (QPFC) | National Association of Plan Advisors

- Comprehensive Wealth Planning

- Wealth ManagementFootnote1

- Retirement PlanningFootnote2

- Estate Planning StrategiesFootnote3

- Alternative InvestmentsFootnote4

- Private Investments

- Philanthropy Management

- Trust ServicesFootnote5

- Executive Financial ServicesFootnote6

- Stock Plan ServicesFootnote7

- Business Succession PlanningFootnote8

- Pre-liquidity Planning

- Corporate Retirement PlansFootnote9

- Qualified Retirement PlansFootnote10

- Institutional ServicesFootnote11

- Endowments and FoundationsFootnote12

- Single Family Office Services

NMLS#: 2150355

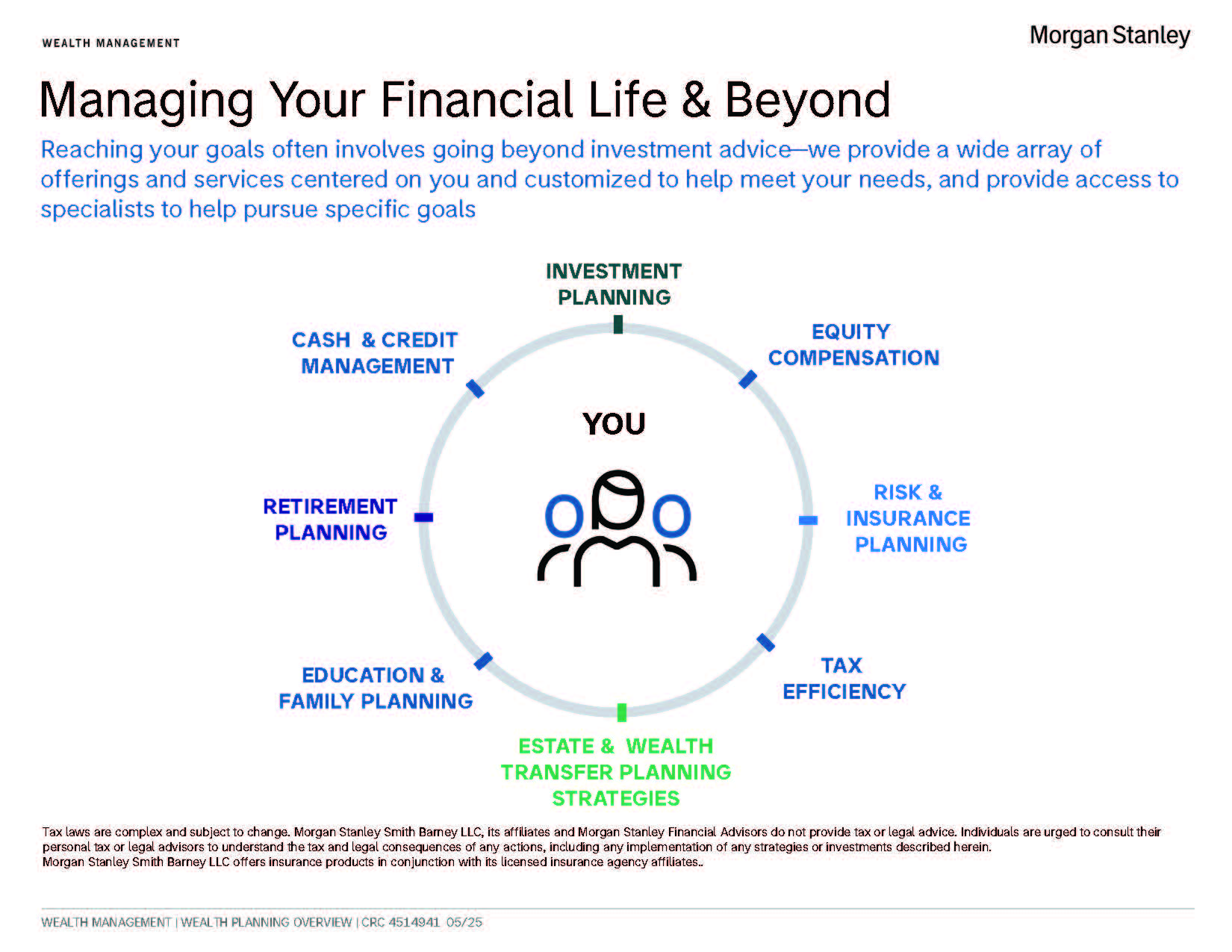

Your Life, Your Legacy: Wealth Planning That Reflects What Matters Most

Focused in crafting personalized investment strategies that can help align with your unique financial goals and risk tolerance. Whether you're:

- Planning for retirement

- Saving for your child's education

- Building long-term wealth

I provide tailored guidance, diversified portfolio strategies, and ongoing support to help you navigate market fluctuations with confidence.

Dedicated to guiding professionals through the intricacies of equity compensation, including:

- RSUs

- ISOs

- ESPPs

- Stock Options

I provide personalized strategies to help you manage tax implications, understand vesting schedules, and make informed decisions about diversification and timing. Aiming to simplify the process and help empower you to leverage your equity as a key component of your wealth-building strategy.

Understand that safeguarding your financial future is paramount. Our comprehensive Insurance & Risk Planning services are designed to help protect your assets and provide a level of confidence. I work closely with you to assess your unique needs and develop tailored strategies that can help manage risks and seek to ensure long-term security. Offering professional guidance to help you make informed decisions that align with your financial goals.

Unlock the full potential of your wealth with tailored tax-efficient strategies designed to help preserve and grow your assets. As your deciated financial advisor, I focus in:

- Seeking to reduce your tax olbigations through proactive planning and smart investment structuring

- Leveraging tax-advantaged accounts and strategies to help maximize long-term returns

- Staying ahead of evolving tax laws to help ensure your financial plan remains optimized

Secure your legacy with bespoke estate and wealth planning strategies tailored for high-net-worth individuals and their families. My partners in Family Office Resources at Morgan Stanley focus in:

- Minimizing estate, gift, and generation-skipping transfer taxes through advanced trust structures such as irrevocable trusts, dynasty trusts, GRATs, and ILITs. These tools help preserve wealth across generations while reducing tax exposure.

- Ensuring efficient and private wealth transfer by leveraging revocable living trusts, powers of attorney, and strategic beneficiary designations to avoid probate and maintain confidentiality.

- Protecting your assets from creditors and legal risks through structures like irrevocable trusts, family limited partnerships, and LLCs.

- Incorporating philanthropic strategies such as charitable remainder trusts and donor-advised funds to support your values while optimizing tax benefits.

- Establishing family governance, staged distributions, and financial education to ensure your wealth is managed responsibly and aligned with your legacy goals.

Empower your family's future with strategic education and family planning solutions tailored to your unique goals. I focus on:

- Guiding families through the benefits of 529 education savings plans, including tax-free growth and withdrawals for qualified educational expenses such as college tuition, K–12 tuition (up to $10,000 annually), apprenticeships, and student loan repayment.

- Leveraging estate planning advantages—529 contributions are considered completed gifts, reducing your taxable estate while you retain control over the account.

- Maximizing flexibility with features like super funding (front-loading up to five years of contributions), rolling over unused funds into a Roth IRA (up to $35,000 lifetime limit), and transferring funds to other family members.

- Minimizing the impact on financial aid eligibility—parent-owned 529 accounts typically reduce aid by only about 5.64%, and grandparent-owned accounts may not affect FAFSA calculations at all.

Secure your future with personalized retirement planning strategies designed to help you retire with confidence and peace of mind. I offer:

- Tailored retirement income planning that balances guaranteed sources like Social Security or annuities with growth investments to ensure your savings last as long as you do.

- Tax-efficient withdrawal strategies, including Roth conversions, tax-loss harvesting, and smart sequencing of account distributions to minimize your tax burden in retirement.

- Ongoing support and plan adjustments to keep your retirement strategy aligned with changing life circumstances, market conditions, and policy updates.

Optimize your liquidity and unlock financial flexibility with tailored cash management and lending solutions designed to support your goals.

- Strategic cash management that ensures your funds are working harder—earning competitive yields, maintaining liquidity, and providing visibility across all accounts.

- Access to lending options that allow you to leverage your investments for short-term needs—without liquidating assets—helping you seize opportunities or manage cash flow efficiently.

- A seamless, tech-enabled experience using digital platforms that automate cash sweeps, provide real-time insights on spending and budgeting, and enhance control over your financial picture.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Empower Your Workforce with Morgan Stanley at Work

Unlock the full potential of your organization with Morgan Stanley at Work—a dynamic partner for both public and private companies, from nimble startups to established enterprises. Whether you're a venture capital firm, law practice, or growing business, our scalable and customizable workplace financial solutions—spanning equity management, financial wellness, and retirement planning—are designed to evolve with you. Discover how teaming up with Morgan Stanley at Work and me can elevate your business, helping you attract and retain top talent. Reach out today to explore bespoke solutions tailored to your organization's unique needs.

Ignite motivation through equity ownership. Simplify equity management with our cutting-edge technology, offering audit-ready global reporting and insightful analytics. Deliver personalized, engaging experiences that educate employees on maximizing their benefits. Whether you're a private or public company at any growth stage, our global solutions are designed to support your journey.

- Equity Plan Adminsitration

- Financial Reporting

- Liquidity Events

- 409A Valuation

- Cap Table Management

Transform retirement from a distant goal into a celebrated milestone. For your employees, retirement represents years of dedication, thoughtful planning, and the right support. With our consultative approach, we help you confidently manage fiduciary responsibilities, reduce risk, streamline plan administration, and elevate your employees' retirement readiness.

- Defined Contribution Consulting

- Small Business Retirement Plans

- Fiduciary Investment Oversight

Discover the power of our tailored Nonqualified Deferred Compensation (NQDC) services, whether you're looking for a full-service solution or just the components that fit your goals. From expert recordkeeping and strategic plan design to sophisticated portfolio construction and executive education, our consultative, needs-based approach ensures you build the ideal plan structure and funding strategy for your organization.

- Record Keeping and Plan Design

- Porfolio Construction

- Wealth management Services

Experience the difference of concierge-level support for your executives' equity compensation plans. From crafting strategic 10b5‑1 trading plans and managing Rule 144 filings to delivering bespoke wealth management and tax-optimization strategies, our dedicated team empowers your leaders to navigate complex financial decisions with confidence and clarity.

- Equity Compensation Services

- Equity Award Analysis

- Comprehensive Solutions

Amplify the impact of Saving and Giving to make a meaningful difference in your employees' lives. Whether they're saving for education or paying off student loans, these benefits address what matters most. Show your commitment to their financial well-being with innovative solutions that empower them to shape their future.

- College Savings

- Student Loan Repayment and Refinancing

- Charitable Giving (Corporate and Individual Giving)

Elevate your employee experience with our comprehensive Financial Wellness offering. By blending experienced education, intuitive digital tools, and personalized guidance, we tailor support to help meet each individual's financial needs—no matter where they are on their journey. Empower your team with the confidence and clarity to take control of their financial future.

- Financial Education

- Financial Guidance

- Digital Tools

- Exclusive Perks and Offers

Location

Portfolio Insights

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Insights and Outcomes

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Signature Access

- Business Services

Private Wealth Management Podcast

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

12Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley