Wulf Group at Morgan Stanley

Our Mission Statement

Welcome to Wulf Group

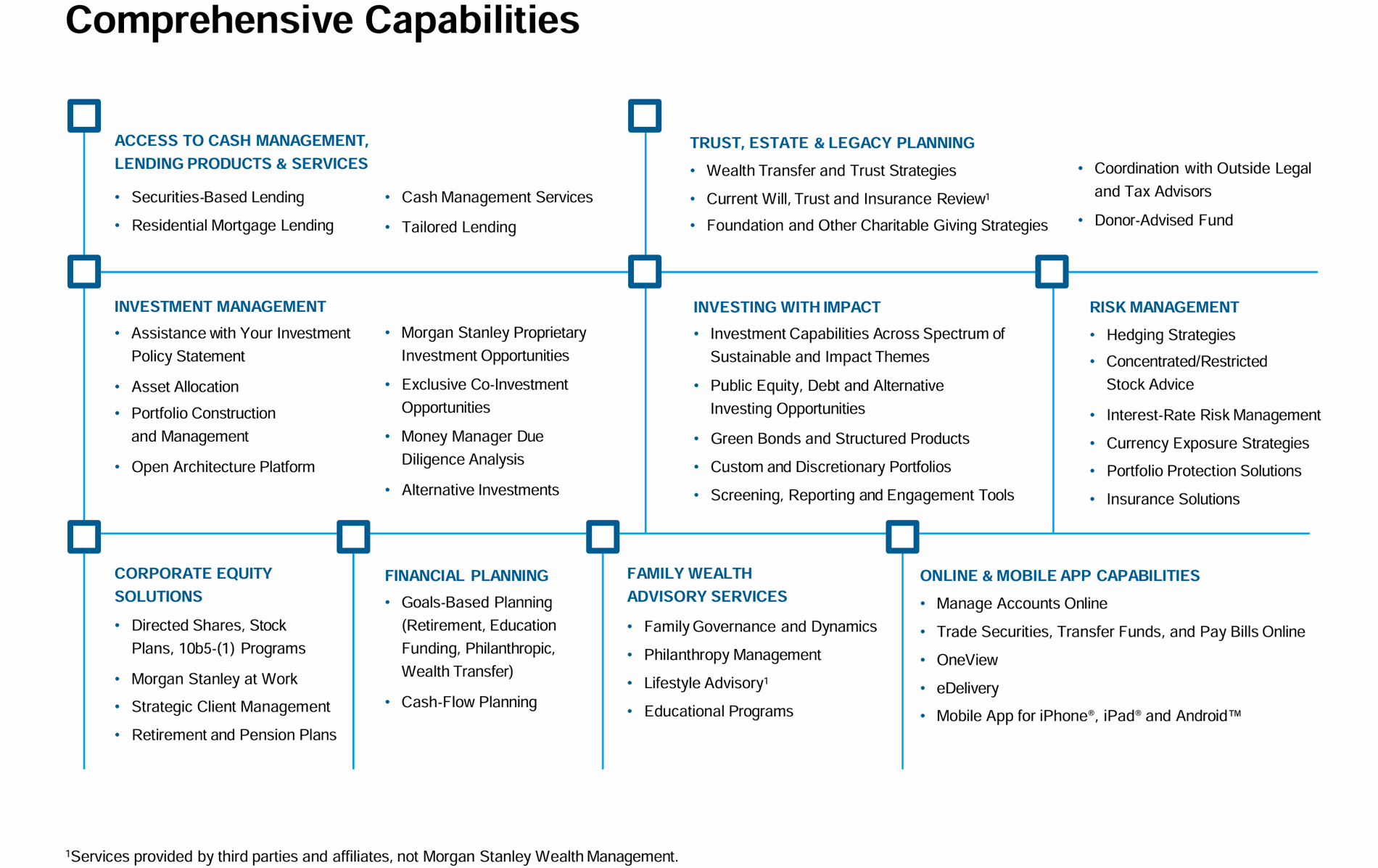

At Wulf Group at Morgan Stanley, we focus on financial planning and goals-based investing designed to guide you toward your objectives for your family, career, retirement, and legacy.

• Our team believes we have much more to accomplish in our lives— and many of our clients share our vibrant perspective on the future. Through proactive planning, we want to help you explore, identify, and pursue the opportunities that await you on life's journey.

• We offer the knowledge, experience, and resources to address your near-term considerations like investment allocations, cash-flow requirements, and tax-planning strategies, as well as long-term factors like estate planning, multigenerational wealth management, and philanthropic aspirations.

• At every step, we are backed by the extensive investment capabilities, intellectual capital, and global reach of Morgan Stanley, a world leader in financial services.

- Cash Management and Lending ProductsFootnote1

- Estate Planning StrategiesFootnote2

- Trust ServicesFootnote3

- Retirement PlanningFootnote4

- Business Succession PlanningFootnote5

- Endowments and FoundationsFootnote6

- Financial PlanningFootnote7

- Divorce Financial AnalysisFootnote8

- Corporate Investment SolutionsFootnote9

- Professional Portfolio ManagementFootnote10

The Whole Picture

Learn more about the dedicated professionals who make up Wulf Group. Our brochure provides an in-depth look at our team, our philosophy, and the resources we leverage to help clients address the complexities of wealth management.

Our team is well positioned to provide the knowledge and resources you need to help you realize the potential of your wealth—so you can direct it toward the people, organizations, and communities that mean the most to you. We look forward to helping you and your family work toward the future you envision.

Location

Meet Wulf Group

About Gary Wulf

Gary believes that every client deserves the best financial, legal, and emotional support during divorce for the best possible outcome.

As a Certified Divorce Financial Analyst (CDFA®), he provides analysis that illustrates the financial impact of settlement proposals to help his clients choose the best option. Post-divorce, he helps them become financially independent through financial education, comprehensive financial planning, investment strategies, budgeting and cash management.

Along with his CDFA®, Gary also earned the Certified Investment Management Analyst (CIMA®) designation after successful completion of coursework at the Wharton School of Business at The University of Pennsylvania.

A graduate of the University of Texas, Arlington, with a Bachelor of Arts in Communications, Gary was Ernst & Young's Southwest Regional Director for Investment Advisory Services, serving high-net-worth individuals, family businesses and institutions. He was also a member of their National Investment Committee.

Gary began his career as a financial advisor at Fidelity Investments, where he was a Retirement Specialist and Senior Financial Advisor. he joining Morgan Stanley in 2008 from Merrill Lynch.

Active in many professional and community organizations, Gary is a member of the Investment Management Consultants Association and Collaborate Divorce, Houston. He volunteers with Interfaith of The Woodlands and the Montgomery Country Food Bank. He is also a lifetime member of The Greater Houston Partnership.

A naturalized Texan, Gary has resided here for over 30 years. Before wising up, he participated in many marathons and Ironman-sponsored events. He now enjoys a more balanced approach to fitness through biking, strength and yoga training, He actively promotes the idea of additional grandchildren to his two sons and is likely planning his next domestic or international trip, preferably to a region where the food is excellent!

The use of the CDFA® designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney.

NMLS#: 1288110

About Lona McManus, MBA

After September 11, Lona had a change of heart about her career trajectory and what she wanted out of life. She transitioned to become a full-time professional fundraiser, initially in the arts, and joined her family in Houston, Texas. She has raised philanthropic capital for Houston Grand Opera, and the Museum of Fine Arts, Houston, and most recently, she spent eleven years in the Texas Medical Center with Baylor College of Medicine and UTHealth Science Center working with generous donors to commit over $50 Million for capital projects, scientific research, and public interest projects.

Realizing how important that financial planning is to the giving equation, Lona decided to pursue an MBA and a career in finance in 2020. Now she works with individuals, families, closely held businesses, non-profits, and charitable foundations to help them secure the future and realize their philanthropic goals. She is a proud member of Wulf Group at Morgan Stanley.

Lona volunteers in leadership positions at local non-profit organizations, including Houston Community College Foundation, ROCO, Westcott Cemetery Association and 4th Wall Theater Company.

NMLS#: 2370618

About Jesse Ramos

Jesse began his career at New York Life in 2021, where he was an insurance agent and moved on to Broughton Investment Group as an Investment Adviser Representative.

Born and raised in Houston, he is a huge fan of Houston sports. Jesse is passionate about music, playing guitar and bass. When it’s not scorching hot outside, he enjoys fishing and hanging with his two children Cat and Jacob.

Contact Gary Wulf

Contact Lona McManus, MBA

The Power of Partnerships

About Ben Cucuzza

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Ben began his career in financial services in 2005 and joined Morgan Stanley in 2022. Prior to joining the firm, he was an Affluent Segment Leader at Wells Fargo Bank, N.A.

Ben is a graduate of the University of Georgia, where he received a Bachelor of Business Administration in Marketing. He lives in Houston, Texas with his family. Outside of the office, Ben is involved with the Junior Achievement as well as the Big Brothers Big Sisters program. He also enjoys fishing, sports, and watching the Georgia Bulldogs.

About Joe Saadi

Prior to joining the firm, Joe’s 30 years of legal and comprehensive wealth planning experience include positions as Managing Director at TIAA Trust Company, Market Trust Director at JP Morgan Trust Company, Trust & Estate Specialist at Merrill Lynch Trust Company, and District Attorney General at the Ohio Attorney General’s Office.

Joe obtained his Bachelor of Science in Business Administration degree from John Carroll University and his Juris Doctor from Cleveland-Marshall College of Law. Joe is a member of the State Bar of Ohio and holds his Series 7 and 66 licenses.

About Clint Eddy

Prior to joining Morgan Stanley in 2022, Clint was a Wealth Strategist at Merrill Lynch for over 15 years. Clint also practiced tax and business law at the law firm of Fox Rothschild for over six years. He was a member of the firm’s Estate Planning and Tax and Corporate Transactions groups. Clint is a member of Washington State Bar Association (WSBA) and is actively involved in the WSBA’s Real Property, Probate and Trust section. He is the co-author of the Washington Partnership and Limited Liability Company Deskbook and was named a “Rising Star” by Washington Law and Politics magazine.

Clint received his Master of Laws in Taxation from the University of Washington School of Law, his Juris Doctor from the University of Oregon School of Law, and his Bachelor of Arts from the University of Washington. He is Series 7 and 66 licensed.

Outside of work Clint is an avid, but admittedly, pretty awful skier. He and his fiancé live in Seattle with their 10 year old Boston Terrier named Annie.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley does not accept appointments, nor will it act as a trustee, but it will provide access to trust services through an appropriate third-party corporate trustee.

Trusts are not necessarily appropriate for all clients. There are risks and considerations which may outweigh any potential benefits. Establishing a trust will incur fees and expenses which may be substantial. Trusts often incur ongoing administrative fees and expenses such as the services of a corporate trustee, attorney, or tax professional.

Trust services are provided by third parties who are not affiliated with Morgan Stanley. Neither Morgan Stanley nor its affiliates are the provider of such trust services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with these trust services. Neither Morgan Stanley nor its affiliates shall be responsible for any advice or services provided by the unaffiliated third parties. Morgan Stanley or its affiliates may participate in transactions on a basis separate from the referral of clients to these third parties and may receive compensation in connection with referrals made to them.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley