Industry Award Winner

Industry Award WinnerOur Mission Statement

About Us

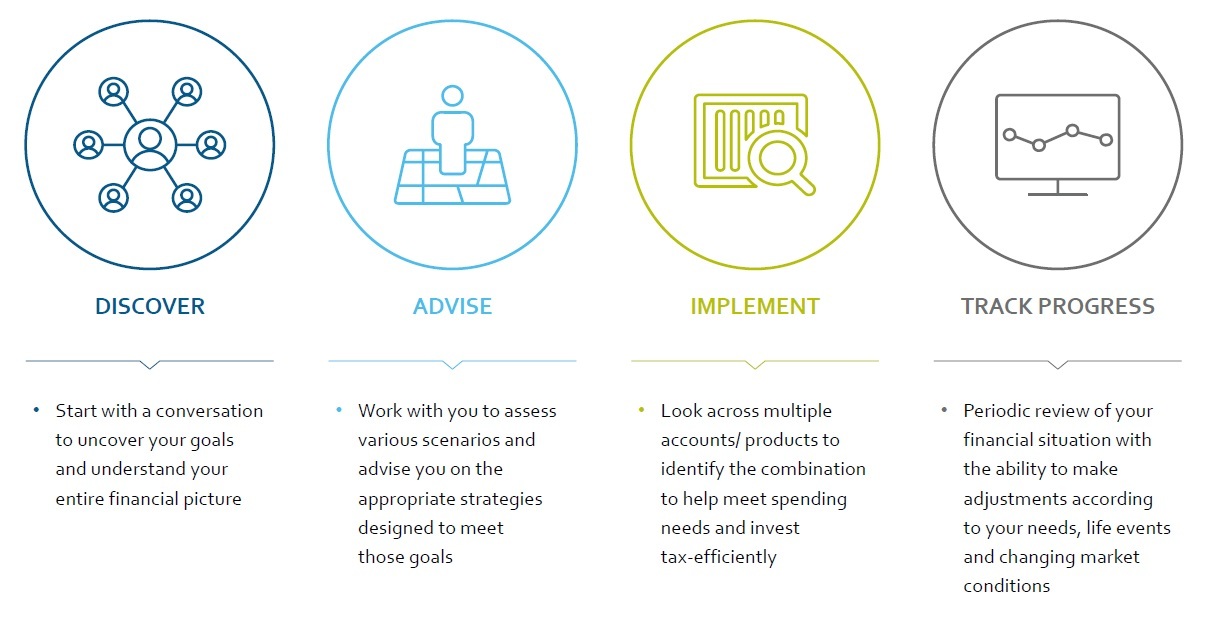

At The Ward Chefas Group, we strive to design wealth preserving financial strategies for our clients' unique objectives. With a passionate focus on your life goals, we create strategies to help navigate the realities of markets, taxation, legacy planning, and risk management strategies. With our combined experience and market perspective, we are able to offer quality guidance and exceptional service.

We believe that working collectively as a team allows us to provide our clients with sophisticated strategies, while ensuring that they benefit from the highest level of service. We bring complementary skills and perspectives to our clients and are committed to meeting their needs promptly and professionally.

We strive to offer our clients the finest thinking, products and strategies to help them achieve their specific financial goals. We continuously deliver value through Morgan Stanley research, our Portfolio Management platform, and tax-efficient investment strategies. When we work together, our clients benefit from personalized advice, objective guidance and dedication to their success as an investor. With Morgan Stanley's renowned technological and investment resources, we can develop and maintain an optimal financial plan to help address the entirety of our clients' financial concerns.

Awards & Recognition

The Ward Chefas Group was recognized as one of the Forbes Best-In-State Wealth Management teams in 2024 and 2025.

2024 and 2025 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2024 and 2025) Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award. (https://mgstn.ly/3HeMkw0)

- Wealth ManagementFootnote1

- Financial PlanningFootnote2

- Professional Portfolio ManagementFootnote3

- Executive Financial ServicesFootnote4

- Executive Benefit ServicesFootnote5

- Defined Contribution PlansFootnote6

- Qualified Retirement PlansFootnote7

- Alternative InvestmentsFootnote8

- 401(k) Rollovers

- Stock Option PlansFootnote9

- Estate Planning StrategiesFootnote10

- Long Term Care InsuranceFootnote11

- Life InsuranceFootnote12

- Cash ManagementFootnote13

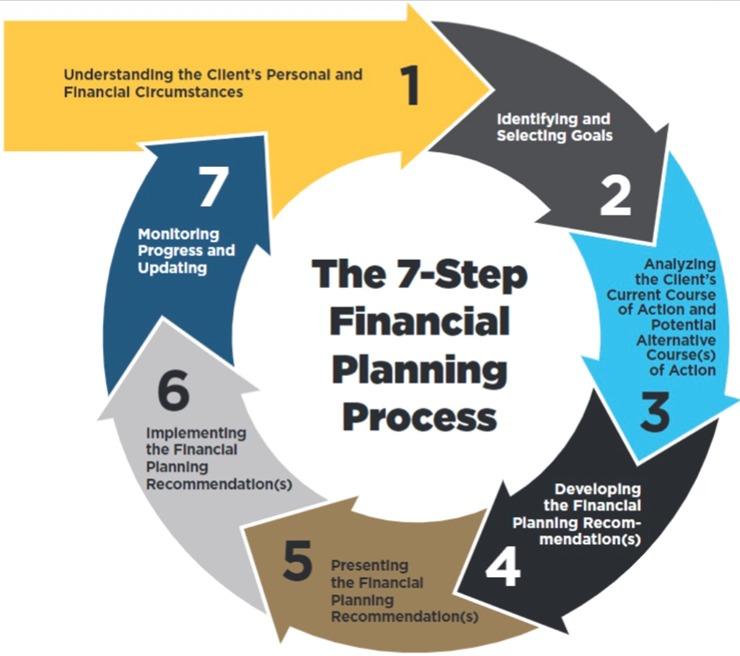

The 7-Step Financial Planning Process

Financial Counseling Program

The Financial Counseling Program is an executive benefit designed to provide personal financial advice to employees in order to help maximize their preparation towards retirement. The program provides a personal Certified Financial Planner® from the Ward Chefas Team to help you understand the full scope of compensation, investments, and benefits to help manage personal financial wealth.

Areas of focus include: CIP, ESIP, CRP, LTIP, RRP, DCP, ESIP-RP, Retiree Medical Plan, Medicare, Social Security, Net Unrealized Appreciation (NUA), etc.

• Designed to help maximize Compensation, Retirement, and Benefit Plans

• Takes advantage of Investment, Tax, Insurance, and Estate planning strategies

• Further assist with the management of financial affairs

• A recognition of time commitment and dedication

The FCP program was established in January 2012. Gary Ward was selected as one of the first advisors to offer this service to eligible participants. Offered to only PSG 26 and above (or Law Guide Curve LCG equivalent), the annual financial planning process offers one-on-one personalized interactions that will help you make well in-formed decisions for your financial future.

EQUITY COMPENSATION 101

Morgan Stanley Reserved Living & Giving

As a Reserved member, clients will have access to exclusive partner offers and discounts, as well as thought leadership content on a variety of lifestyle and personal finance topics.

Clients with $1 million+ in assets and liabilities at Morgan Stanley are eligible to enroll in the Reserved Living & Giving program.

Location

Meet The Strata Evergreen Group

About Steven Chefas

Steven holds the Series 7, 66, and 31 licenses, as well as Health, Life & LTC insurance licenses in Texas and California. He earned the CERTIFIED FINANCIAL PLANNER™ certification in 2015 and the Certified Portfolio Manager (CPM®) designation in 2019. He served on the board of the Portfolio Management Institute from 2021 to 2023. His client-first approach has earned his team recognition on the Forbes Best-in-State Wealth Advisors list in both 2024 and 2025.

His practice emphasizes investment management, tax-efficient strategies, insurance planning, and estate considerations—all tailored to support multigenerational wealth preservation and legacy planning.

Steven earned a B.S. in Business Administration from the University of Central Florida and became a Certified Arborist in 2010. Outside of the office, he also became a certified referee with the Northwest Aquatics League in 2016 and is an avid aviation enthusiast, having earned his Private Pilot License in 2022 and Instrument Rating in 2023. He married his high school sweetheart in 2006 and has three adorable daughters who enjoy marching band, color guard, tennis, and traveling with family.

Forbes America’s Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2025) Data compiled by SHOOK Research LLC based on time period from 3/31/23 – 3/31/24.

NMLS#: 1393611

CA Insurance License #: 0M27059

About Cortney Corpus

Cortney also earned the Certified Financial Planner, CFP®, designation enabling her to create financial strategies that are tailored to each individual client's risk and investment parameters. She works high net worth clients to identify and articulate their goals and objectives, and provides real planning solutions, both short and long term, so clients can achieve economic freedom.

Cortney is a native Houstonian and remains active in the athletic community. She is an avid Pickleball player and spends a lot of her time on the court practicing for tournaments and leagues. Cortney has a competitive edge and likes to beat people at things!

NMLS#: 1578891

CA Insurance License #: OM81864

About Alessandra Kath

Before joining Morgan Stanley in 2024, Allie spent eight years in financial services, developing a strong track record in consultative sales and marketing. Her transition into wealth management was fueled by a deepening passion for investing and a desire to help successful individuals navigate the intersection of their wealth, responsibilities, and aspirations.

With a background in philosophy and international affairs, Allie brings both strategic insight and emotional intelligence to her work. Her approach is rooted in listening closely, understanding priorities, and delivering tailored solutions that align with each client’s lifestyle, business interests, and multigenerational legacy goals. Allie has been tasked to provide corporations and their executives the needed clarity on insider rules, insight into industry practices and services to access value in their equity.

Allie holds a B.A. in philosophy from Wellesley College and a master’s degree in international affairs from Columbia University. She lives in The Woodlands with her family and is an active member of Christ Church United Methodist. Outside the office, she enjoys traveling with her husband and children—especially to Wisconsin and Idaho—and can often be found cheering on her son at football games or her daughters on the volleyball court.

NMLS#: 2058638

About Jacquelyn Davis

About Sterling Jones

Born and raised in Houston, he assists the team in many different facets such as client relations, account maintenance, and other administrative responsibilities. After work you can catch Parker at the gym or on the pickleball court.

Contact Steven Chefas

Contact Cortney Corpus

Contact Alessandra Kath

Awards and Recognition

The Power of Partnerships

About Lisa D'Alessandro

She earned her undergraduate degree from The University of New Hampshire] and received the Financial Planning Specialist® designation from the College for Financial Planning. Lisa is originally from New Jersey and currently resides there.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

13Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley