Teri Twarkins Kelley, CFP®, CIMA®, CRPS®

Industry Award Winner

Industry Award WinnerSignificant wealth opens the door to unique opportunities, but also generates complex challenges. The Viewpoint Wealth Management Group is highly experienced in working with successful families, individuals, C-Suite executives, and retirees to maximum reward and minimize risk. We're here to help you build wealth, protect assets, mitigate tax burdens, and achieve as many of your life's goals as possible.

What sets us apart.

Our clients deserve a higher level of service and we're driven to exceed their expectations. We are positioned to support their short-term needs and long-term goals because of our people, our practice, and our process. That's why we continually seek to educate ourselves for the benefit of our clients. Above all, we believe in doing the right thing.

Comprehensive corporate service solutions.

We're also entrusted by corporations to provide first-class retirement programs and executive planning services. From stock plan reinvestment to corporate cash management—our goal is to create programs that attract and retain the right talent.

While the Viewpoint Wealth Management Group is a seasoned financial services team—we're really a group of nice people who understand the importance of family. We provide next gen education to heighten your adult children's financial savvy and offer sophisticated lending strategies that can make it easier for them to buy a home or start a business. Above all, we ensure that your wealth gets transferred on your terms and in the most tax-efficient way possible.

Trust & Estate Planning

We work collaboratively with your attorney to create the plan that fits your family. And for clients with highly complex estates, we can provide access to our Family Office Resources team.

Next Gen Education

We provide your adult children and grandchildren understand with valuable lessons about money management, investing, entrepreneurship, estate planning and what it means to be the beneficiary of a trust.

Lifestyle Advisory Group ($10M in AUM)

Planning for the future is important—and so is living for today. Select clients will get to experience an elite range of concierge services, including:

Family Office Resources ($25M in AUM)

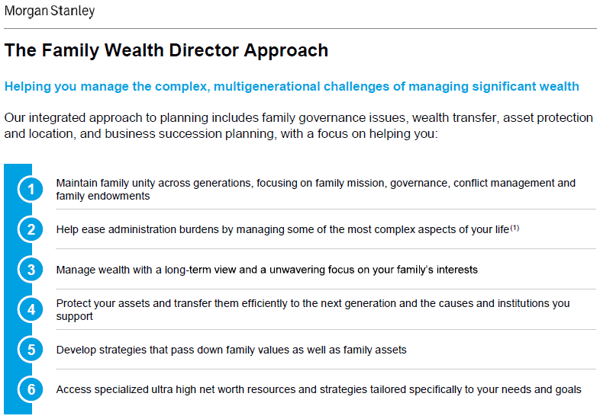

Significant wealth raises a whole new level of complex challenges and multigenerational issues. We can provide direct access to Morgan Stanley's Family Office Resources, which includes:

The Tax Cut and Jobs Act of 2017 made significant changes to federal individual taxes but set most provisions to expire on December 31, 2025. The One Big Beautiful Bill Act (the "OBBBA"), signed July 2025, makes some provisions permanent while modifying others. Since most changes start in 2026, you have a unique window in 2025 to make charitable gifts under pre-OBBBA rules.

Teri Twarkins Kelley, CFP®, CIMA®, CRPS® Managing Director& Matt Gimmelli CFA®, Senior Portfolio Management Director for Viewpoint Wealth Management Group will be answering top questions we receive from clients and explain recent market events.

Click the link below to watch the video!

Matthew A. Gimmelli is a Chartered Financial Analyst®, Executive Director, and Senior Portfolio Management Director with Viewpoint Wealth Management Group. With over 20 years of experience in the financial services industry, Matt concentrates on Portfolio Management, manager oversight and research for Viewpoint Wealth Management Group clients.

Click the link below to watch Matt's video!

Monika Kotowski manages client relationships for Viewpoint Wealth Management Group clients. She has extensive experience in discovery and learning what's most important to our clients. Monika is a client favorite, working with families to understand their needs and make smart decisions that allow them to accomplish their lifelong goals.

Click the link below to watch Monika's video!

Scott Ladrigan is a Investment Consultant with Viewpoint Wealth Management Group at Morgan Stanley. With over 20 years in the financial services industry, Scott focuses on custom investment solutions as well as investment research and portfolio management.

Click the link below to watch Scott's video!

Viewpoint Wealth Management Group understands today's competitive landscape that corporations face when it comes to recruiting and retaining the right talent. We will work with you to structure plans that enable C-Suite executives and senior management to recognize the power of your offerings, including: