The Zislin Group at Morgan Stanley

Direct:

(561) 394-8571(561) 394-8571

Our Mission Statement

We are committed to building lifelong relationships, understanding Clients’ goals, and strategizing to expand their wealth through life’s transitions by utilizing our family wealth management process.

About Us

Welcome to the Zislin Group at Morgan Stanley!

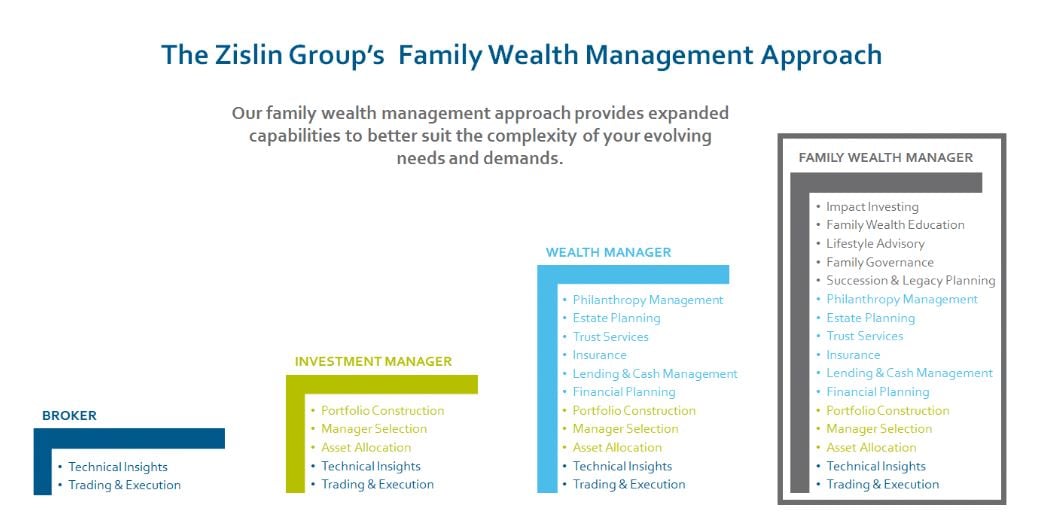

The Zislin Group at Morgan Stanley is a comprehensive family wealth management practice located in Boca Raton, Florida. Through strong leadership, trust, and experience, our team is dedicated to providing an exceptional level of service and professional skills. We are committed to helping clients with every aspect of their financial needs. We provide access to the full range of services necessary to find solutions to the many complexities of wealth management planning. It is our purpose to make a true difference in the lives of our clients and their families.

The Zislin Group uses a goals-based wealth management and a customized family wealth management process as the blueprint to helping our Clients reach their goals and optimize their financial plan. Understanding your needs, challenges, and aspirations are the fundamentals and building blocks of our philosophy.

As a Client of the Zislin Group, not only do you benefit from the personalized care of a family office, you also benefit from the research, resources, security, and intellectual capital from one of the world’s premier wealth management firms. We interact with our Clients and distinguish ourselves from other financial firms and advisors. We strive to maintain a level of satisfaction that you can expect not just the first time you meet us, but time and time again.

We look forward to working with you and your family!

The Zislin Group at Morgan Stanley is a comprehensive family wealth management practice located in Boca Raton, Florida. Through strong leadership, trust, and experience, our team is dedicated to providing an exceptional level of service and professional skills. We are committed to helping clients with every aspect of their financial needs. We provide access to the full range of services necessary to find solutions to the many complexities of wealth management planning. It is our purpose to make a true difference in the lives of our clients and their families.

The Zislin Group uses a goals-based wealth management and a customized family wealth management process as the blueprint to helping our Clients reach their goals and optimize their financial plan. Understanding your needs, challenges, and aspirations are the fundamentals and building blocks of our philosophy.

As a Client of the Zislin Group, not only do you benefit from the personalized care of a family office, you also benefit from the research, resources, security, and intellectual capital from one of the world’s premier wealth management firms. We interact with our Clients and distinguish ourselves from other financial firms and advisors. We strive to maintain a level of satisfaction that you can expect not just the first time you meet us, but time and time again.

We look forward to working with you and your family!

Services Include

- Structured ProductsFootnote1

- Wealth ManagementFootnote2

- Financial PlanningFootnote3

- Retirement PlanningFootnote4

- Professional Portfolio ManagementFootnote5

- Cash ManagementFootnote6

- Estate Planning StrategiesFootnote7

- Lending Products

- Alternative InvestmentsFootnote8

- Life InsuranceFootnote9

- Long Term Care InsuranceFootnote10

- Trust Services*

- Donor Advised Funds

- 401(k) Rollovers

- UGMA/UTMAFootnote11

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

595 So Federal Hwy

Ste 400

Boca Raton, FL 33432

US

Direct:

(561) 394-8571(561) 394-8571

Meet The Zislin Group

About Merle Zislin

Merle has been developing and implementing wealth management strategies in the investment industry to uniquely successful individuals, families, and business for 40 years with Morgan Stanley.

Her multi-generational financial planning includes developing and implementing broad investment strategies that are customized to reflect each client’s unique needs. Through the financial planning process, she can help you access your financial complexities and needs and develop strategies that are designed to help you achieve your goals and strengthen your financial security. Within Morgan Stanley, she holds the internal designations of Insurance Planning Director, Alternative Investments Director, and Family Wealth Advisor. Her goal is to cultivate deep long-lasting relationships by providing her clients exceptional experiences. She is someone who makes a difference in people’s lives. Her focus also includes a special emphasis on empowering women.

Merle is a member of the MAKERS Class of 2023, receiving the Lifetime Achievement Award, a national organization that recognizes leaders within various industries who are committed to helping and mentoring to make a difference and serve as advocates, innovators, and groundbreakers, for women advancement in the workplace.

Merle has been acknowledged for exceptional performance and dedication to clients as a Morgan Stanley club member since 1992. Merle is a member of the Master’s Club. In additional to demonstrating leadership through best practices of wealth management, Morgan Stanley club members must satisfy all other aspects of job performance, conduct, and compliance standards. She is a former member of Morgan Stanley's National FA Advisory Council, a select group of top financial advisors and senior management who represent all financial advisors in the firm on industry matters.

She was recognized by Forbes list of "America's Best-in-State Wealth Advisors" (2018-2023), Forbes named in the top 100 "America's Top Women Wealth Advisors Best-in-State" (2017- 2023), Forbes America’s Top Women Wealth Advisors 2020- 2023. Merle was also named in the top 100 list of Working Mother’s Magazine, “Top Wealth Advisor Moms" in 2017- 2021. The Zislin Group at Morgan Stanley was named to Forbes list of "Forbes Best-In-State Wealth Management Teams" (2023). Receiving these prestigious awards by Forbes is a testament to Merle and her Team’s experience, professionalism, and dedication to their clients.

Merle believes in giving back to the community by being active in those that share her passions. Merle is a strong supporter of our Nation’s servicemen and servicewomen. She volunteers for Honor Flight and Freedom Fighter Outdoors, an organization that supports injured veterans providing once in a lifetime fishing adventures and outdoor activities. Her family team is passionate in providing financial advice and planning to Military Veterans and First Responders.

She has been a mentor and leader within Morgan Stanley and her community and has had a positive influence on so many over the years.

Balancing a family life with her husband Scott, two sons, Michael and Christopher and her daughter Jennifer takes a creative approach. Merle is an avid reader, and she enjoys fishing, boating, and hiking. She is a 2nd degree Black Belt in Mixed Martial Arts.

2017-2023 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded02017-2023). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2018-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2017-2022 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October 2017-2022). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

Source: Forbes.com (Jan 2023) 2023 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf

©2023 Morgan Stanley Smith Barney LLC. Member SIPC. CRC5514962 3/23

Securities Agent: FL, IL, IN, MA, MD, MI, MN, MO, NC, NH, NJ, NV, NY, OH, PA, PR, RI, SC, TN, TX, VA, WA, GA, AZ, CA, CO, CT, DC, DE; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1282984

CRC5514941 3/23

Her multi-generational financial planning includes developing and implementing broad investment strategies that are customized to reflect each client’s unique needs. Through the financial planning process, she can help you access your financial complexities and needs and develop strategies that are designed to help you achieve your goals and strengthen your financial security. Within Morgan Stanley, she holds the internal designations of Insurance Planning Director, Alternative Investments Director, and Family Wealth Advisor. Her goal is to cultivate deep long-lasting relationships by providing her clients exceptional experiences. She is someone who makes a difference in people’s lives. Her focus also includes a special emphasis on empowering women.

Merle is a member of the MAKERS Class of 2023, receiving the Lifetime Achievement Award, a national organization that recognizes leaders within various industries who are committed to helping and mentoring to make a difference and serve as advocates, innovators, and groundbreakers, for women advancement in the workplace.

Merle has been acknowledged for exceptional performance and dedication to clients as a Morgan Stanley club member since 1992. Merle is a member of the Master’s Club. In additional to demonstrating leadership through best practices of wealth management, Morgan Stanley club members must satisfy all other aspects of job performance, conduct, and compliance standards. She is a former member of Morgan Stanley's National FA Advisory Council, a select group of top financial advisors and senior management who represent all financial advisors in the firm on industry matters.

She was recognized by Forbes list of "America's Best-in-State Wealth Advisors" (2018-2023), Forbes named in the top 100 "America's Top Women Wealth Advisors Best-in-State" (2017- 2023), Forbes America’s Top Women Wealth Advisors 2020- 2023. Merle was also named in the top 100 list of Working Mother’s Magazine, “Top Wealth Advisor Moms" in 2017- 2021. The Zislin Group at Morgan Stanley was named to Forbes list of "Forbes Best-In-State Wealth Management Teams" (2023). Receiving these prestigious awards by Forbes is a testament to Merle and her Team’s experience, professionalism, and dedication to their clients.

Merle believes in giving back to the community by being active in those that share her passions. Merle is a strong supporter of our Nation’s servicemen and servicewomen. She volunteers for Honor Flight and Freedom Fighter Outdoors, an organization that supports injured veterans providing once in a lifetime fishing adventures and outdoor activities. Her family team is passionate in providing financial advice and planning to Military Veterans and First Responders.

She has been a mentor and leader within Morgan Stanley and her community and has had a positive influence on so many over the years.

Balancing a family life with her husband Scott, two sons, Michael and Christopher and her daughter Jennifer takes a creative approach. Merle is an avid reader, and she enjoys fishing, boating, and hiking. She is a 2nd degree Black Belt in Mixed Martial Arts.

2017-2023 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded02017-2023). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2018-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2017-2022 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October 2017-2022). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

Source: Forbes.com (Jan 2023) 2023 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf

©2023 Morgan Stanley Smith Barney LLC. Member SIPC. CRC5514962 3/23

Securities Agent: FL, IL, IN, MA, MD, MI, MN, MO, NC, NH, NJ, NV, NY, OH, PA, PR, RI, SC, TN, TX, VA, WA, GA, AZ, CA, CO, CT, DC, DE; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1282984

CRC5514941 3/23

Securities Agent: OH, AZ, VT, OK, NM, NJ, NH, ME, ID, DE, CA, WY, NC, AL, WA, VA, LA, RI, NV, MN, IL, TN, NY, DC, CO, WI, SC, PA, GA, MT, MA, FL, IN, TX, MI, UT, PR, MO, MD, CT; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1282984

NMLS#: 1282984

About Michael Zislin

A South Florida native, Michael attended Cardinal Gibbons High School. He earned a Bachelor’s of Science degree in Finance and a Master’s of Business Administration (MBA) with a concentration in finance, both from Nova Southeastern University. Michael currently lives in Lighthouse Point, FL.

Before joining Morgan Stanley, Michael owned and operated a marine consulting company for over 10 years. He managed many private yachts, maintained boats, and ran private fishing charters. Michael also fished commercially and sold fish to the local seafood distributors and wholesalers. Michael has also been coaching high school swimming for numerous years.

Away from work, Michael actively contributes to many non-profit organizations such as Freedom Fighter Outdoors, The Boys and Girls Club, The Cliff Floyd Foundation, and Habitat for Humanity. His hobbies include fishing, diving, boating, hunting, and spending time with his family. Michael’s previous work endeavors and community involvement have helped him build a strong foundation for his career as a financial advisor with Morgan Stanley.

Before joining Morgan Stanley, Michael owned and operated a marine consulting company for over 10 years. He managed many private yachts, maintained boats, and ran private fishing charters. Michael also fished commercially and sold fish to the local seafood distributors and wholesalers. Michael has also been coaching high school swimming for numerous years.

Away from work, Michael actively contributes to many non-profit organizations such as Freedom Fighter Outdoors, The Boys and Girls Club, The Cliff Floyd Foundation, and Habitat for Humanity. His hobbies include fishing, diving, boating, hunting, and spending time with his family. Michael’s previous work endeavors and community involvement have helped him build a strong foundation for his career as a financial advisor with Morgan Stanley.

Securities Agent: MO, ME, FL, RI, MA, ID, WI, TN, OH, NV, AZ, TX, NC, DC, NY, MD, CT, AL, VA, UT, OK, MT, LA, IN, WY, NM, MI, CO, CA, NH, MN, IL, DE, WA, GA, VT, SC, PR, PA, NJ; General Securities Representative; Investment Advisor Representative

NMLS#: 1785348

NMLS#: 1785348

About Jennifer Zislin

Jennifer provides clients with personalized wealth management guidance by creating extensive financial plans to help them and their families prepare for the future. She uses these financial plans to help create a roadmap for the clients and optimizes the data to help achieve the best probability of success. Jennifer views exceptional service as her top priority. She brings a wealth of knowledge of day-to-day operations needed to run a well-organized business.

Jennifer graduated with honors from the University of North Florida with a B.A. in Business Finance and holds the Series 7, SIE, Series 63, and Series 65 Licenses. Jennifer also holds the Financial Planning Specialist Designation. She is a volunteer and proud supporter of FFO Freedom Fighter Outdoors supporting veterans and she enjoys volunteering for animal rescue organizations. In her spare time, Jennifer enjoys swimming, boating, and spending time with family and friends. Jennifer’s favorite sport teams include The Florida Panthers and the 2018 and 2025 Super Bowl Champion Philadelphia Eagles.

Jennifer graduated with honors from the University of North Florida with a B.A. in Business Finance and holds the Series 7, SIE, Series 63, and Series 65 Licenses. Jennifer also holds the Financial Planning Specialist Designation. She is a volunteer and proud supporter of FFO Freedom Fighter Outdoors supporting veterans and she enjoys volunteering for animal rescue organizations. In her spare time, Jennifer enjoys swimming, boating, and spending time with family and friends. Jennifer’s favorite sport teams include The Florida Panthers and the 2018 and 2025 Super Bowl Champion Philadelphia Eagles.

Securities Agent: TX, ID, NV, NJ, NC, MT, SC, OH, MA, LA, GA, CT, AL, VT, TN, PA, NY, NH, MO, CO, AZ, WY, UT, MD, FL, NM, DE, MN, WA, PR, MI, IN, WI, DC, VA, RI, ME, IL, CA, OK; General Securities Representative; Investment Advisor Representative

NMLS#: 2411746

NMLS#: 2411746

About Les Campbell

Les joined Morgan Stanley as a Senior Vice President in April 2023, after serving as a fixed income advisor the previous 25 years with a family-owned investment firm. A native Floridian, Les graduated with honors from Florida State University, and started his career as a C.P.A. with Price Waterhouse. He then worked as the C.F.O. for two large real estate developers in south Florida before becoming a financial advisor in 1997.

Les is active in his community, serving as past Chairman and long-time board member for Junior Achievement of South Florida (“JA”), which teaches financial literacy and entrepreneurship to students in our community. He remains active as a mentor for a JA student company program at Stoneman Douglas High School and is proud that his student team took 3rd place in JA’s National Company of the Year competition this summer.

He is an active member and serves on the board for the Rotary Club of Downtown Ft. Lauderdale. He also serves as a board member and Treasurer for LifeNet4Families, an organization which provides food and other services to homeless and food insecure members of our community.

Les and his wife Robin live in Coral Springs with their two dogs, Dexter and Lizzie, and are blessed that their children and four grandkids live in the area.

Les is active in his community, serving as past Chairman and long-time board member for Junior Achievement of South Florida (“JA”), which teaches financial literacy and entrepreneurship to students in our community. He remains active as a mentor for a JA student company program at Stoneman Douglas High School and is proud that his student team took 3rd place in JA’s National Company of the Year competition this summer.

He is an active member and serves on the board for the Rotary Club of Downtown Ft. Lauderdale. He also serves as a board member and Treasurer for LifeNet4Families, an organization which provides food and other services to homeless and food insecure members of our community.

Les and his wife Robin live in Coral Springs with their two dogs, Dexter and Lizzie, and are blessed that their children and four grandkids live in the area.

Securities Agent: NH, GA, VT, SC, MN, PR, DE, DC, UT, TN, OK, MO, CT, AL, WA, PA, MT, MA, LA, CA, TX, KS, IL, WI, RI, MS, AZ, VA, MI, MD, WY, NC, FL, CO, OH, NV, NM, NJ, IN, AR, NY, ME, ID; General Securities Representative; Investment Advisor Representative

NMLS#: 2500424

NMLS#: 2500424

About Jeannette Deorchis

Securities Agent: VT, AL, UT, MA, WA, NH, LA, ID, FL, WI, DC, CT, CO, PA, WY, TN, SC, OK, NC, MN, MI, IN, ME, GA, NY, TX, NJ, DE, CA, AZ, NV, NM, MD, VA, MT, IL, RI, OH; General Securities Representative; Investment Advisor Representative

NMLS#: 1312427

NMLS#: 1312427

About Alex Recio

Before joining Morgan Stanley, Alex joined the insurance and financial planning industry right out of Flagler College where he received his B.A in Business Administration with an emphasis in Finance. He prides himself in learning the ins and outs of Medicare, the numerous life insurance vehicles that apply to various stages and legacy leaving goals, the value of Long term care, and the different investment vehicles that can go hand in hand with accomplishing one’s retirement goals.

He has his series 215, SIE, 7,6 and 66 exams and is very passionate about the continuous learning opportunities this industry provides.

He provides operational and administrative support to the clients of The Zislin Group. He nurtures both new and existing client relationships by utilizing hard work and creativity to tackle special situations. In addition, he serves as a liaison between his Financial Advisor, clients and our back office team.

Alex enjoys spending his free time playing baseball, basketball, football and golf with his friends. He loves to watch the New York Yankees and Knicks play in their respected sports as he has been a lifelong fan of these two teams. Although he was born in Long Island, NY he will claim to be born in New York but raised here in South Florida. He is very avid about his own and everybody around his personal growth and loves to give his time and energy back into the community by attending charity events as most of his immediate family are proud civil servants.

He has his series 215, SIE, 7,6 and 66 exams and is very passionate about the continuous learning opportunities this industry provides.

He provides operational and administrative support to the clients of The Zislin Group. He nurtures both new and existing client relationships by utilizing hard work and creativity to tackle special situations. In addition, he serves as a liaison between his Financial Advisor, clients and our back office team.

Alex enjoys spending his free time playing baseball, basketball, football and golf with his friends. He loves to watch the New York Yankees and Knicks play in their respected sports as he has been a lifelong fan of these two teams. Although he was born in Long Island, NY he will claim to be born in New York but raised here in South Florida. He is very avid about his own and everybody around his personal growth and loves to give his time and energy back into the community by attending charity events as most of his immediate family are proud civil servants.

About Chris Zislin

Joined Morgan Stanley Wealth Management in November 2023

Finance degree from the University of Florida

Series 7, Series 63 and Series 65 Licensed

Assists with Daily Account Maintenance, Transactions, Trades, and All Operational Procedures

Finance degree from the University of Florida

Series 7, Series 63 and Series 65 Licensed

Assists with Daily Account Maintenance, Transactions, Trades, and All Operational Procedures

Contact Merle Zislin

Contact Michael Zislin

Contact Jennifer Zislin

Contact Les Campbell

Contact Jeannette Deorchis

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Frank Hammad

Frank Hammad is a Private Banker serving Morgan Stanley Wealth Management offices in Florida.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending

solutions.

Frank began his career in financial services in 2000 and joined Morgan Stanley in 2010 as a Commercial Real Estate Banker. Prior to joining the firm, he was a Commercial Real Estate Banker at BB&T.

Frank is a graduate of the University of Miami, where he received a Bachelor of Business Administration in International Marketing and Business Management, and Nova Southeastern University, where he received his Master’s in International Business Administration. He lives in Plantation, Florida with his family. Outside of the office, he enjoys football and hockey.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending

solutions.

Frank began his career in financial services in 2000 and joined Morgan Stanley in 2010 as a Commercial Real Estate Banker. Prior to joining the firm, he was a Commercial Real Estate Banker at BB&T.

Frank is a graduate of the University of Miami, where he received a Bachelor of Business Administration in International Marketing and Business Management, and Nova Southeastern University, where he received his Master’s in International Business Administration. He lives in Plantation, Florida with his family. Outside of the office, he enjoys football and hockey.

NMLS#: 798426

About Rob Ward

Rob Ward is a Private Banker serving Morgan Stanley Wealth Management offices in Florida.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Rob began his career in financial services in 2001, and rejoined Morgan Stanley in 2019. Rob has over 8 years of experience as a Private Banker at the firm. Prior to joining the firm, he was a Client Advisor with Seaside National Bank & Trust. He also served as a Wealth Management Banker at Merrill Lynch and an Institutional Fixed Income Sales Representative at Vining Sparks IBG, LLP.

Rob is a graduate of Florida State University, where he received a Bachelor of Science in Business Management. He lives in Fort Lauderdale, Florida with his family. Outside of the office, Rob enjoys spending time with family, watching Florida State football, and being outdoors.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Rob began his career in financial services in 2001, and rejoined Morgan Stanley in 2019. Rob has over 8 years of experience as a Private Banker at the firm. Prior to joining the firm, he was a Client Advisor with Seaside National Bank & Trust. He also served as a Wealth Management Banker at Merrill Lynch and an Institutional Fixed Income Sales Representative at Vining Sparks IBG, LLP.

Rob is a graduate of Florida State University, where he received a Bachelor of Science in Business Management. He lives in Fort Lauderdale, Florida with his family. Outside of the office, Rob enjoys spending time with family, watching Florida State football, and being outdoors.

NMLS#: 799983

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Zislin Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)