About Vivian S Afriyie

Vivian Afriyie is a Vice President, Global Sports & Entertainment Director, Senior Portfolio Manager and Financial Advisor with Morgan Stanley in Los Angeles, California. She is part of the Wingfield Wealth Management Group within Morgan Stanley Private Wealth Management. With more than 25 years of experience across accounting and financial services, Vivian is recognized for her strong work ethic and steadfast focus on delivering disciplined, client-centered guidance.

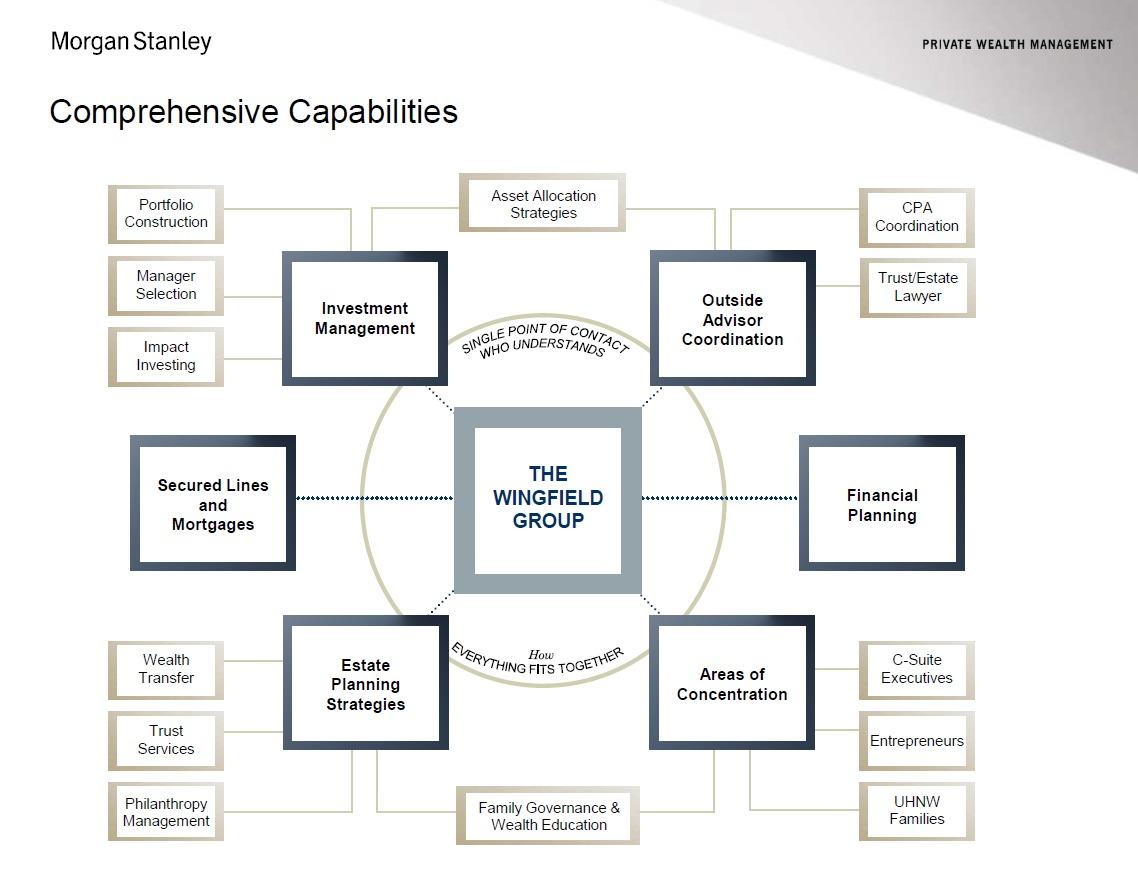

Vivian works primarily with high-net-worth individuals and families, including entrepreneurs, entertainers, athletes, corporate executives and multigenerational households. Her capabilities span a wide range of wealth planning and investment needs, including financial and retirement planning, investment management, philanthropic and charitable gifting strategies, pre- and post-liquidity event planning, concentrated stock risk management, trust and estate planning strategies, customized cash management and lending solutions, and Special Needs planning.

As a Global Sports & Entertainment Director—an advanced designation held by fewer than 2% of Morgan Stanley Financial Advisors—Vivian brings highly specialized experience serving clients in the sports and entertainment community. She and her team collaborate closely with each client’s attorneys, CPAs, managers and other advisors to deliver coordinated, 360-degree solutions that address the full scope of a client’s financial life. This includes values-aligned portfolio management, trust and estate advisory services, philanthropy planning, cash management and lending solutions, and support for family dynamics and legacy planning—helping clients work toward their vision for the future across generations.

Vivian is also a Chartered Special Needs Consultant® (ChSNC®), further strengthening her ability to help families develop comprehensive lifetime plans for dependents with special needs.

She began her career in 1997 as an associate in financial advisory services at PricewaterhouseCoopers, where she developed a strong foundation in detailed company analysis. Vivian also owned and operated a successful small business selling purse hooks for women, navigating supply chain and manufacturing complexities and ultimately sourcing a manufacturer in China. This entrepreneurial experience provides her with a practical understanding of the day-to-day realities facing executives and business owners, as well as an international perspective valued by many of her clients.

Outside of work, Vivian is an avid runner and has earned medals as part of a relay team in the Malibu Triathlon for three consecutive years. She also volunteers with Junior Achievement, where she teaches enterprise skills to high school seniors. Born and raised in Ghana, Vivian is fluent in Twi. She holds a B.S. degree from California State University, Los Angeles, with a concentration in Accounting and Finance.

Securities Agent: GA, CA, SD, NM, LA, ID, PA, NY, NC, KY, CT, WI, VT, MO, VA, TN, OH, MA, FL, DE, OR, NV, NJ, MI, CO, WY, NE, MD, UT, SC, WA, TX, NH, IA, AZ, MT, IL, HI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1253079

Industry Award Winner

Industry Award Winner