Gregory A. Watts, CMFC®

Industry Award Winner

Industry Award WinnerWe believe success in achieving important financial goals starts with a comprehensive wealth strategy. We will help you define what is most important to you and then formulate the strategies that are appropriate for your needs, whether you are accumulating wealth or investing for income, solidifying your retirement plan or devising a distribution approach that helps meet your lifestyle and legacy goals.

WORKING WITH YOU

As your life evolves, not only does your financial strategy become more complex, but your options for managing it effectively increase as well. Often, evaluating these options and wisely choosing among them may require the guidance of an experienced team of advisors — a team who not only understands your diverse needs, but has access to customized programs that can be properly utilized to provide you with appropriate financial strategies for your particular situation.

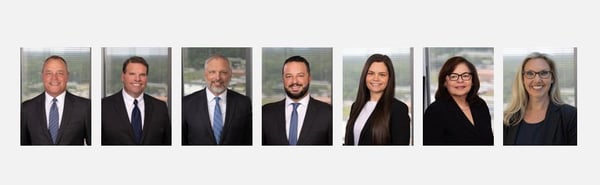

At The Veritas Group at Morgan Stanley, we focus on what is most important to you and provide the specialized skills, integrated strategies and world-class resources needed to make informed, confident decisions about your life, your family and your finances.

We use a goals-based wealth management approach that measures success by how you're progressing toward meeting the goals most important to you. It enables you to stay flexible and proactive in managing your portfolio and identifies innovative ways to help improve your results by either altering saving and spending behaviors or changing investment strategies for potentially better long-term results.

Ultimately, goals-based planning empowers you to be more confident in your investment decisions. It brings clarity and focus to what matters most to you and your family through an integrated approach that aligns your goals with your finances.