Daniel C. Umbel, CPWA®

Industry Award Winner

Industry Award WinnerOn the surface, it seems rather simple — manage investments and resources in pursuit of a goal. However, if you're like most of the clients we serve, you have an array of goals. Often these goals are multi-faceted and complex, requiring the experience of a number of professionals. When working with The Umbel Group, our clients may benefit not only from the day-to-day advice and guidance that we provide. They can also benefit from an extensive team of Morgan Stanley professionals who are available for additional support and expertise. All working together with one focus - You. Our approach to goals-based wealth management seeks to tie together your entire financial outlook — income, expenses, investments, debt, business interest, real property — in one strategy.

We start by:

CRC: 4279903

From the moment you become a client, The Umbel Group gives you access to the worldwide investment insights and resources of Morgan Stanley. We can offer you access to new investment opportunities, global research, economic forecasts, and the latest thinking on portfolio management.

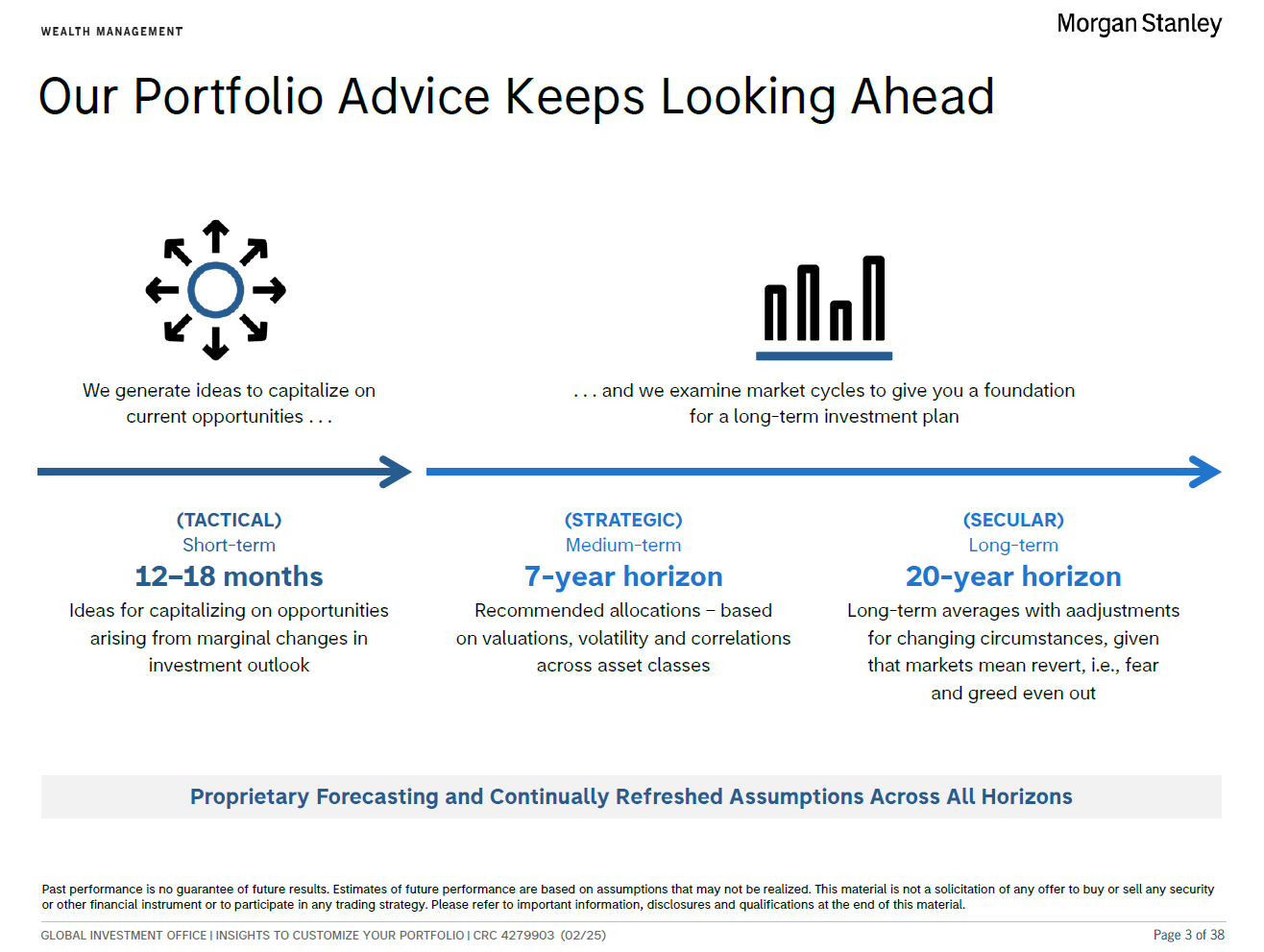

After we gain clarity about your goals and outlook, our advice and guidance center around tailoring portfolios targeted to each of your objectives. We then take into account your risk tolerance, liquidity needs, and time horizons to create strategies based on the three fundamentals of investing: Asset Allocation, Diversification, and Rebalancing. Broadly, your asset allocation is intended to pursue your short-term, intermediate, and long-term goals.

Disclaimer:

Asset Allocation, Diversification and Rebalancing do not protect against a loss in declining financial markets. There may be a potential tax implication with a rebalancing strategy. Investors should consult with their tax advisor before implementing such a strategy.

If appropriate, we can recommend shorter-term investments and accounts for your cash and other liquid assets, and help you allocate income from your business and distributions from your other investment, trust, or retirement accounts. We can help you manage these assets to maintain your lifestyle and day-to-day expenditures.

For your intermediate-term objectives, we may suggest a well-diversified portfolio of equities, fixed-income instruments, mutual funds and alternative investments for certain qualified investors. Here we focus on helping to preserve your wealth from inflation, taxes, and attrition.

When appropriate, we can offer investment advice and guidance on concentrated equity positions, stock options, business interests, and alternative investments. Clients generally seek long-term growth through these holdings, and our advice and guidance are targeted to that objective.