The Tysons Corner Group at Morgan Stanley

Direct:

(703) 556-8116(703) 556-8116

Toll-Free:

(800) 336-0156(800) 336-0156

Our Mission Statement

Our mission is to help our clients make smart investment and financial decisions through professional relationships based on uncompromising integrity, trust, and personalized service. Our personalized client experience seeks to provide special value to you and your family by offering holistic, comprehensive advisory services to help clients prioritize and attain their life goals.

Welcome

Our passion for our clients’ financial well-being is the cornerstone of our business philosophy. We believe you will not find a team of professionals more dedicated and committed to helping you reach your financial objectives. As seasoned wealth management professionals, we develop and manage highly customized wealth plans and investment portfolios for high net worth individuals, business owners and multi-generational families. Our mission is to enable you – through steadfast guidance, tailored strategies and unwavering discipline – to help you make informed decisions that can help you achieve financial success. Our primary goal for each client is a personalized approach to wealth enhancement, wealth preservation and wealth transfer. Money, in and of itself, does not always create the skills to manage it. Our ultimate purpose is to empower you to be confident in your financial decisions through education and help you manage your investment portfolio and your overall wealth management plan. At the Tysons Corner Group, we feel a deep responsibility to our clients. We are committed to helping you protect and grow your assets, and in many cases, prepare families and heirs for the transfer of wealth to future generations. We know how hard you are working to achieve your goals, and we will work with you to help your wealth support your continued prosperity over time. We work with all sorts of clients from all different areas, specifically from the Northern Virginia and Washington D.C. area.

Services Include

- Retirement PlanningFootnote1

- Alternative InvestmentsFootnote2

- 401(k) Rollovers

- Trust ServicesFootnote3

- Corporate Pension Plans

- Business PlanningFootnote4

- Wealth PlanningFootnote5

- Trust AccountsFootnote6

- Structured ProductsFootnote7

- Stock Plan ServicesFootnote8

- Stock Option PlansFootnote9

- Sustainable InvestingFootnote10

- Qualified Retirement PlansFootnote11

- Professional Portfolio ManagementFootnote12

- Planning for Education FundingFootnote13

- Philanthropic ManagementFootnote14

- Long Term Care InsuranceFootnote15

- Life InsuranceFootnote16

- LGBT+ Planning ServicesFootnote17

- Cash Management and Lending ProductsFootnote18

- Institutional ServicesFootnote19

- Fixed IncomeFootnote20

- Financial PlanningFootnote21

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Portfolio Management

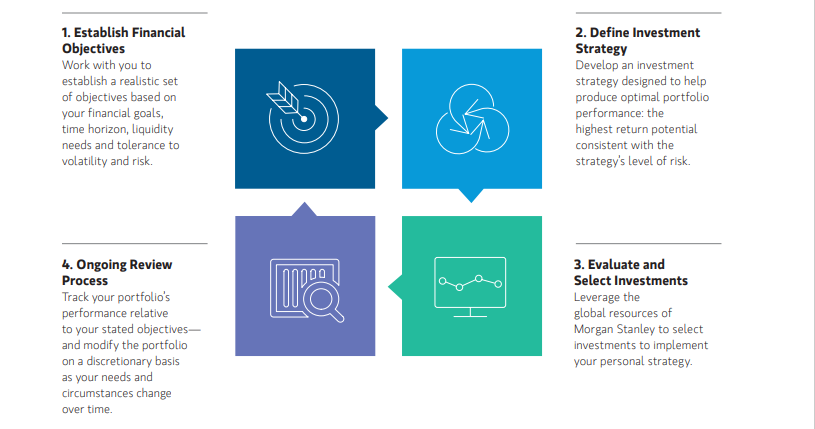

We work closely with you to understand your needs while maintaining the focus and discipline necessary to guide your portfolio in the most challenging market cycles. Our disciplined investment process considers your values, risk tolerance, and liquidity needs to develop perspective about building and managing your wealth.

We will:

We will:

Asset Management

Helping clients define an investment strategy tailored to their goals, then guiding informed investment choices from among our expansive investment platform, including proprietary and third-party offerings across every market and asset class.

Traditional Investments

Providing access to a diverse array of high-quality traditional investment options – including equities, fixed income, mutual funds, UITs, ETFs, separately managed accounts, annuities, closed-end funds and multi-asset programs.

Alternative Investments

Offering clients a diverse range of investment strategies that fall outside of the traditional, long-only purchase and sale of stocks and bonds such as funds of funds, private equity and managed futures.

Tax Efficient Management Process

Minimizing the impact of taxes on client portfolios to potentially boost their overall returns and help them build wealth over the long term with strategies like tax-loss harvesting and tax-aware asset location.

Location

1650 Tysons Blvd

Suite 1000

McLean, VA 22102

US

Direct:

(703) 556-8116(703) 556-8116

Toll-Free:

(800) 336-0156(800) 336-0156

Meet The Tysons Corner Group

About Robert Silva

Robert J. Silva, Jr. is an Managing Director, Financial Advisor and Senior Portfolio Management Director at the Tysons Corner Group at Morgan Stanley. For more than 19 years, Rob has been providing highly customized advice, comprehensive investment solutions and other financial services to individuals and families in the Washington D.C. metro area and across the country. His area of focus includes building globally diversified discretionary portfolios with a goal of producing competitive risk-adjusted performance, based on each client’s personal investment objectives.

Prior to joining Morgan Stanley in 2003, Rob spent over a decade in leadership roles in the technology and engineering sectors. Upon graduating from Massachusetts Institute of Technology with a Bachelor of Science degree in Mechanical Engineering, Rob started a software company with classmates from MIT that was eventually sold to BEA Systems. He then created a new division for Reflexite Corporation, a manufacturing company that engineers and manufactures reflective materials. While working at Reflexite Corporation in Rochester, NY, he earned his M.B.A. from Rensselaer Polytechnic Institute. Rob previously served on the Board of Directors of the MIT Club in Washington D.C.

This unique set of experiences has enabled Rob to develop a practice that is well suited for the fast-paced global economy in which we live. He is keenly aware of the financial management challenges faced by entrepreneurs today and is dedicated to helping them maintain the discipline necessary to navigate today’s challenging markets.

Originally from Golden, Colorado, Rob currently resides in Chevy Chase with his wife, Julie and their three children, Savannah, Tripp and Sydney. He and his wife are very active with their children’s school program at St. Patrick’s Episcopal Day School. In his free time, Rob enjoys spending quality time with his family, as well as ice hockey, skiing and traveling.

Prior to joining Morgan Stanley in 2003, Rob spent over a decade in leadership roles in the technology and engineering sectors. Upon graduating from Massachusetts Institute of Technology with a Bachelor of Science degree in Mechanical Engineering, Rob started a software company with classmates from MIT that was eventually sold to BEA Systems. He then created a new division for Reflexite Corporation, a manufacturing company that engineers and manufactures reflective materials. While working at Reflexite Corporation in Rochester, NY, he earned his M.B.A. from Rensselaer Polytechnic Institute. Rob previously served on the Board of Directors of the MIT Club in Washington D.C.

This unique set of experiences has enabled Rob to develop a practice that is well suited for the fast-paced global economy in which we live. He is keenly aware of the financial management challenges faced by entrepreneurs today and is dedicated to helping them maintain the discipline necessary to navigate today’s challenging markets.

Originally from Golden, Colorado, Rob currently resides in Chevy Chase with his wife, Julie and their three children, Savannah, Tripp and Sydney. He and his wife are very active with their children’s school program at St. Patrick’s Episcopal Day School. In his free time, Rob enjoys spending quality time with his family, as well as ice hockey, skiing and traveling.

Securities Agent: DC, CO, TX, MD, IN, AK, WV, OH, NV, ND, IL, IA, CT, VA, PA, NJ, AL, PR, NC, WI, WA, VT, NY, NE, MN, MI, MA, AR, DE, RI, ME, HI, AZ, UT, OR, MS, KY, CA, TN, SD, SC, GA, FL; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1832948

NMLS#: 1832948

About Me

Forbes Best-in-State Wealth Advisors, 2019, 2020, 2021, 2022, 2023.

Fardin joined Morgan Stanley in July 2023. He started his career as a Financial Advisor in 2003 with Smith Barney followed by UBS in 2008. Prior to joining financial services industry, he held various sales and management positions at AT&T and MCI WorldCom. His 15 years of experience in the telecommunications industry were focused on developing and managing complex network strategies for Tier 1 Internet Service Providers and the Department of Defense. Fardin holds an MBA in International Finance from the American University and a B.S. in Architecture from the University of Maryland. Fardin and his wife Morgan, support the continued growth and accomplishments of their daughter, LaDan, and their son, Camron. In 2017, LaDan had the privilege of representing TEAM USA synchronized Ice Skating Team in Austria and Croatia with the New York Skyliners. In 2018, Camron represented United States in Europe as part of the MVP International Ice Hockey program. LaDan graduated from University of Virginia and is currently employed by Bank of America as a Treasury Sales Analyst. Camron is pursuing a degree in International Finance at James Madison University. Both finished their high school careers at the Bishop O'Connell High School in Arlington, VA.

2019-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019-2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Fardin joined Morgan Stanley in July 2023. He started his career as a Financial Advisor in 2003 with Smith Barney followed by UBS in 2008. Prior to joining financial services industry, he held various sales and management positions at AT&T and MCI WorldCom. His 15 years of experience in the telecommunications industry were focused on developing and managing complex network strategies for Tier 1 Internet Service Providers and the Department of Defense. Fardin holds an MBA in International Finance from the American University and a B.S. in Architecture from the University of Maryland. Fardin and his wife Morgan, support the continued growth and accomplishments of their daughter, LaDan, and their son, Camron. In 2017, LaDan had the privilege of representing TEAM USA synchronized Ice Skating Team in Austria and Croatia with the New York Skyliners. In 2018, Camron represented United States in Europe as part of the MVP International Ice Hockey program. LaDan graduated from University of Virginia and is currently employed by Bank of America as a Treasury Sales Analyst. Camron is pursuing a degree in International Finance at James Madison University. Both finished their high school careers at the Bishop O'Connell High School in Arlington, VA.

2019-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019-2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: NV, MA, IL, WA, SD, NC, HI, FL, AZ, UT, TX, NY, MI, LA, DE, CO, CA, MN, AK, VT, AR, MS, GA, TN, IN, IA, DC, VA, OH, KY, WI, SC, PA, AL, RI, NE, ME, CT, NJ, MD; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 2526748

CA Insurance License #: 0K10973

NMLS#: 2526748

CA Insurance License #: 0K10973

About Me

Kleo entered the financial services industry in 2003, after graduating from Adrian College with a degree in political science. She has held various roles and responsibilities during her 20-year career at Smith Barney and UBS, each one attuned to delivering superior client service and complex wealth planning strategies to high-net-worth clients.

Kleo holds the coveted CERTIFIED FINANCIAL PLANNER™ and Chartered Retirement Planning Counselor® certifications, to further strengthen the high level of service and expertise she provides to multicultural, multigenerational, individuals, and families. She believes that every person deserves to find an experienced, trusted and proactive Financial Advisor who can help them efficiently align their resources with their short- and long-term goals.

Strong advisory relationships are both long-term and multi-generational in scope. For over two decades she has been entrusted with helping families achieve their goals and dreams. Along with the families she supports, she works with many clients who are single, either by design or because of a major life event. The financial situations they navigate can feel overwhelming. Fostering mutual trust has been the key to her success in helping these individuals achieve higher levels of financial health and success.

As a recognized financial services professional, you will frequently find her offering common sense financial advice and perspective around complex economic issues on local and national television shows and podcasts. She is also a contributor to national financial publications including Fortune and Morningstar.

Kleo and her husband, Len, reside in Loudoun County. She is deeply involved in civic causes that support addiction recovery and housing. Kleo currently serves on the investment committee for the Community Foundation for Loudoun and Northern Fauquier Counties. She is also a former Board member of the Loudoun Abused Women's Shelter and the Loudoun County Transit Advisory Board. In her spare time, you will find her curled up with a good book.

Kleo holds the coveted CERTIFIED FINANCIAL PLANNER™ and Chartered Retirement Planning Counselor® certifications, to further strengthen the high level of service and expertise she provides to multicultural, multigenerational, individuals, and families. She believes that every person deserves to find an experienced, trusted and proactive Financial Advisor who can help them efficiently align their resources with their short- and long-term goals.

Strong advisory relationships are both long-term and multi-generational in scope. For over two decades she has been entrusted with helping families achieve their goals and dreams. Along with the families she supports, she works with many clients who are single, either by design or because of a major life event. The financial situations they navigate can feel overwhelming. Fostering mutual trust has been the key to her success in helping these individuals achieve higher levels of financial health and success.

As a recognized financial services professional, you will frequently find her offering common sense financial advice and perspective around complex economic issues on local and national television shows and podcasts. She is also a contributor to national financial publications including Fortune and Morningstar.

Kleo and her husband, Len, reside in Loudoun County. She is deeply involved in civic causes that support addiction recovery and housing. Kleo currently serves on the investment committee for the Community Foundation for Loudoun and Northern Fauquier Counties. She is also a former Board member of the Loudoun Abused Women's Shelter and the Loudoun County Transit Advisory Board. In her spare time, you will find her curled up with a good book.

Securities Agent: WA, CA, NJ, AL, AK, NC, MA, FL, OH, NY, MD, LA, VT, TX, SC, NE, ND, MN, IA, CT, UT, SD, ME, GA, RI, PA, DE, CO, AZ, WI, VA, TN, NV, MI, KY, IN, AR, IL, HI, DC, MS; General Securities Representative; Investment Advisor Representative

NMLS#: 2528598

CA Insurance License #: 0M33717

NMLS#: 2528598

CA Insurance License #: 0M33717

About Erin Fox

Erin K. Fox is a financial advisor at the Tysons Corner Group at Morgan Stanley. Erin brings dedication, attention to detail and planning skills to her role, giving her an ability to provide order and structure to complex client situations. Her objective is to provide clients with informed decisions about retirement planning and estate preservation. She works with clients to form lasting relationships built on trust, integrity, and a high level of service. Passionate about working with people with their pre and post-divorce needs, Erin has the distinguished designation of Certified Divorce Financial Analyst.

Prior to joining Morgan Stanley in 2015, Erin began her career in the financial industry in 2001 at Wachovia Securities. Working in the Legal Department, Erin handled legal inquiries for the home office and the branches. She then transitioned to Compliance and represented the Firm in an array of SEC, FINRA and state-agency examinations and investigations. Throughout her career, Erin continues to invest in her education. While at Wachovia, she obtained her Series 7 license, along with her Supervisory Principal license. Additionally, she completed a Securities Regulation and Compliance Certification from the University of Richmond.

Erin graduated from Old Dominion University in Norfolk, Virginia with a Bachelor of Science Degree and a Minor in Sociology. A native to northern Virginia, Erin enjoys spending time in the nation's capital. As an outdoor enthusiast, Erin enjoys being on the water, boating or jet-skiing. Committed to health and fitness, Erin appreciates a good run or a long bike ride. She enjoys traveling and as a certified scuba diver, Erin likes to find new places to explore. Erin has two grown children, Mackenzie and Kody. Mackenzie recently graduated from Virginia Commonwealth University and is pursuing a law degree. Kody joined the Army and is serving our country. He is currently stationed in Germany.

Prior to joining Morgan Stanley in 2015, Erin began her career in the financial industry in 2001 at Wachovia Securities. Working in the Legal Department, Erin handled legal inquiries for the home office and the branches. She then transitioned to Compliance and represented the Firm in an array of SEC, FINRA and state-agency examinations and investigations. Throughout her career, Erin continues to invest in her education. While at Wachovia, she obtained her Series 7 license, along with her Supervisory Principal license. Additionally, she completed a Securities Regulation and Compliance Certification from the University of Richmond.

Erin graduated from Old Dominion University in Norfolk, Virginia with a Bachelor of Science Degree and a Minor in Sociology. A native to northern Virginia, Erin enjoys spending time in the nation's capital. As an outdoor enthusiast, Erin enjoys being on the water, boating or jet-skiing. Committed to health and fitness, Erin appreciates a good run or a long bike ride. She enjoys traveling and as a certified scuba diver, Erin likes to find new places to explore. Erin has two grown children, Mackenzie and Kody. Mackenzie recently graduated from Virginia Commonwealth University and is pursuing a law degree. Kody joined the Army and is serving our country. He is currently stationed in Germany.

Securities Agent: CA, VA, TX, NC, MI, AR, AK, SC, ND, ME, IA, CT, SD, PA, NV, WA, UT, NJ, GA, WV, HI, DE, MS, KY, CO, RI, NY, MN, IL, DC, AZ, NE, AL, WI, VT, TN, OR, OH, OK, MO, MD, MA, IN, FL; General Securities Representative; Investment Advisor Representative

NMLS#: 1490588

NMLS#: 1490588

About Kevin Cortina

Kevin Cortina joined Morgan Stanley as an Associate in 2014. An essential member of the team, Kevin is responsible for client service research, administrative support, and alternative investment accounting to meet the select needs of clients. Kevin is able to assist with all aspects of our service, including accessing funds, questions regarding statements, online access and specific stock or industry research.

Kevin currently resides in Falls Church, Virginia. A Washington, D.C. native, he is an enthusiast of the thriving food scene that has developed locally, and becomes a food tourist when on travel. When not perusing a tasting menu, Kevin enjoys spending time with his tight-knit family, as well as his close friends.

Kevin currently resides in Falls Church, Virginia. A Washington, D.C. native, he is an enthusiast of the thriving food scene that has developed locally, and becomes a food tourist when on travel. When not perusing a tasting menu, Kevin enjoys spending time with his tight-knit family, as well as his close friends.

About Kristen W. Herard

Drawing on 20 years of experience in the financial services industry, Kristen Herard provides a wide range of operational and administrative support services for clients of The Tysons Corner Group. Her many responsibilities include retirement account activity, 529 plans, required minimum distributions and tax forms. She is always available to answer client's questions and assist them in a wide range of client services.

Highly adept at handling a broad range of responsibilities quickly and professionally, Kristen enjoys providing what Rob and Erin refer to as white glove service to every client. Working with investors since 2001, she not only knows how to meet their specific needs, she knows how to anticipate them as well. Prior to joining Morgan Stanley in 2005, she worked at Ferris Baker Watts and First Virginia Bank. Kristen earned her B.B.A. in Finance from James Madison University. She holds the Series 7, 63 and 65 securities licenses.

Kristen currently resides in Gainesville, VA with her husband, Tim, their daughter, Allison, and their dog, Rain. In her free time, she enjoys staying active with boxing and spending quality time with her family.

Highly adept at handling a broad range of responsibilities quickly and professionally, Kristen enjoys providing what Rob and Erin refer to as white glove service to every client. Working with investors since 2001, she not only knows how to meet their specific needs, she knows how to anticipate them as well. Prior to joining Morgan Stanley in 2005, she worked at Ferris Baker Watts and First Virginia Bank. Kristen earned her B.B.A. in Finance from James Madison University. She holds the Series 7, 63 and 65 securities licenses.

Kristen currently resides in Gainesville, VA with her husband, Tim, their daughter, Allison, and their dog, Rain. In her free time, she enjoys staying active with boxing and spending quality time with her family.

About Jacob Langer

As the team’s Client Service Associate, Jacob manages the operational needs for clients. Previously, Jacob has held positions as a Client Associate at UBS, as well as an Associate Client Advisor at Bessemer Trust, assisting ultra-high net worth clients. He developed his love for business and drive for helping others by watching his mother pursue various entrepreneurial endeavors. Jacob earned his B.S. in Management from the University of Maryland, where he was a part of the Scholars program and President of his Fraternity Lambda Chi Alpha. He grew up in Towson, MD and currently resides in Arlington, VA.

Contact Robert Silva

Contact Fardin Nematollahi

Contact Kleo N. Curry

Contact Erin Fox

Wealth Management

From Our Team

You're Ready for Retirement. Is Your Portfolio?

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Tysons Corner Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

13When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

14Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

15Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

16Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

17Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

18Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

19Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

20Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

21Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

13When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

14Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

15Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

16Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

17Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

18Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

19Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

20Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

21Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)