Industry Award Winner

Industry Award WinnerOur Mission Statement

Our role as Fiduciaries is to help you grow and protect your wealth. Our Mission is to help families plan and prepare for the responsibilities that come with maintaining and managing that wealth.

Our Story

The Trilogy Group believes that in order to define what your legacy is F.O.R. (Family, Occupation, Recreation), it must begin with a comprehensive wealth strategy tailored to your family’s goals and needs. We focus our efforts on working with three primary groups of clients, select corporate executives, business owners and PwC Partners as part of the BSP - Select Advisor Program.

The Trilogy Group employs a Financial Planning process that is akin to building a home. The foundation is rooted in an emergency fund with appropriate insurance coverages. The structure is focused on the identification of family goals and the implementation of saving, investments, debt, and spending strategies. Just as any home requires maintenance or updates, so does your financial plan. Some of the updates may be small adjustments akin to changing wall color while others will be more involved, closer to a remodel or addition to the home. Plans are proactively monitored and designed to grow with your family and its evolving legacy.

While the majority of our relationships begin with a single generation of a family, they often become multi-generational quickly. Typically the generation we initially engage with is the first to have accumulated wealth and our efforts have been focused on the maintenance and transfer of said wealth. Recently we have begun to engage the third (youngest) generation, as they prepare to become adults and establish themselves.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

The Trilogy Group employs a Financial Planning process that is akin to building a home. The foundation is rooted in an emergency fund with appropriate insurance coverages. The structure is focused on the identification of family goals and the implementation of saving, investments, debt, and spending strategies. Just as any home requires maintenance or updates, so does your financial plan. Some of the updates may be small adjustments akin to changing wall color while others will be more involved, closer to a remodel or addition to the home. Plans are proactively monitored and designed to grow with your family and its evolving legacy.

While the majority of our relationships begin with a single generation of a family, they often become multi-generational quickly. Typically the generation we initially engage with is the first to have accumulated wealth and our efforts have been focused on the maintenance and transfer of said wealth. Recently we have begun to engage the third (youngest) generation, as they prepare to become adults and establish themselves.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

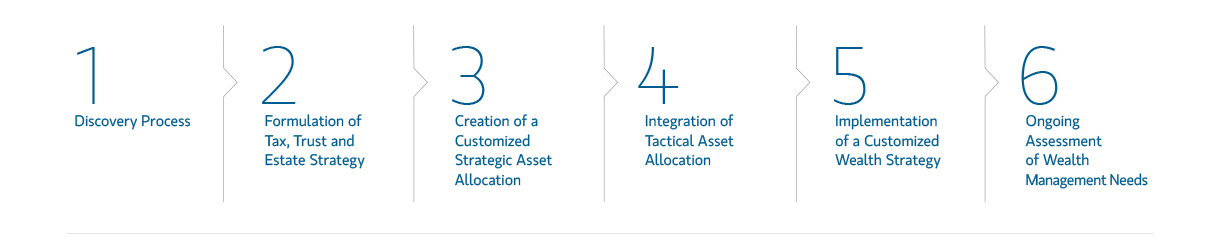

Our Approach

Discovery Process

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

340 Mount Kemble Avenue

Morristown, NJ 07960

US

Direct:

(855) 317-7211(855) 317-7211

Meet The Trilogy Group

About Christopher Lutz

Chris is the founder and senior member of The Trilogy Group, leading a team of dedicated professionals whose goal is to help successful families streamline and manage the complexities of their wealth. With over three decades of industry experience and appearances on Forbes Best-In-State Wealth Advisors since 2019, Chris leads the team's new business development efforts as well as oversight of the team’s overall investment strategy, monitoring and selection of investment managers.

Born and raised in New Jersey, Chris graduated with BA from Muhlenberg College, PA where he was a lineman on the varsity football team. He and his wife, Alison, live in Madison, NJ with their three children Paige, Matthew, and Alexandra. A firm believer in giving back, Chris is a Board Member of the Wells Mountain Initiative, a non-profit organization providing bright young people in developing economies with educational scholarships, as well as a Board Member of the Madison Junior Lacrosse Club and representative of the Madison Recreation Advisory Committee. An avid fisherman and golfer, Chris enjoys spending his down time with his family and their Labrador retriever, Ollie.

Forbes Best-In-State Wealth Advisors 2019-2025

Source: Forbes.com (Awarded April 2025) Data compiled by SHOOK Research LLC based on time period from 6/30/23 - 6/30/24.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Born and raised in New Jersey, Chris graduated with BA from Muhlenberg College, PA where he was a lineman on the varsity football team. He and his wife, Alison, live in Madison, NJ with their three children Paige, Matthew, and Alexandra. A firm believer in giving back, Chris is a Board Member of the Wells Mountain Initiative, a non-profit organization providing bright young people in developing economies with educational scholarships, as well as a Board Member of the Madison Junior Lacrosse Club and representative of the Madison Recreation Advisory Committee. An avid fisherman and golfer, Chris enjoys spending his down time with his family and their Labrador retriever, Ollie.

Forbes Best-In-State Wealth Advisors 2019-2025

Source: Forbes.com (Awarded April 2025) Data compiled by SHOOK Research LLC based on time period from 6/30/23 - 6/30/24.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: MA, PA, OK, ME, CA, MT, FL, DE, TN, AR, VA, RI, MS, KY, VT, TX, NJ, WV, WA, UT, NY, NM, NC, MN, CO, OR, NH, IL, GA, DC, CT, AZ, MI, MD, NV, LA, SC, OH; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1297774

NMLS#: 1297774

About Joseph Rumore

Joe has spent his career helping families successfully plan for their future. He is a CERTIFIED FINANCIAL PLANNER, CFP® in charge of The Trilogy Group's financial planning operations, and is responsible for developing comprehensive financial plans for the group’s high net worth clients. Additionally, Joe is in charge of the team's PwC practice, assisting Senior Staff, Principals and Partners to design and implement their family’s financial plans; doing so in accordance with PwC’s Independence Protocols through the Brokerage Simplification Program (BSP).

Joe joined Morgan Stanley in 2008 after spending five years at Citigroup’s Smith Barney division. In 2019, he was named to Forbes list of the Top Next-Gen Wealth Advisors. A graduate of the University of Pennsylvania with a BA in Economics, Joe is acutely conscious of the opportunities his passions have provided him, specifically through sport. To this end, he dedicates each spring to coaching youth lacrosse and conducts alumni interviews of prospective Penn students. Joe is an avid golfer and member of White Beeches Country Club in Haworth, NJ. Joe and his wife, Sarah, reside in Ridgewood, NJ.

Forbes Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded June 2019) Data compiled by SHOOK Research LLC based on time period from 3/31/18 - 3/31/19.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Joe joined Morgan Stanley in 2008 after spending five years at Citigroup’s Smith Barney division. In 2019, he was named to Forbes list of the Top Next-Gen Wealth Advisors. A graduate of the University of Pennsylvania with a BA in Economics, Joe is acutely conscious of the opportunities his passions have provided him, specifically through sport. To this end, he dedicates each spring to coaching youth lacrosse and conducts alumni interviews of prospective Penn students. Joe is an avid golfer and member of White Beeches Country Club in Haworth, NJ. Joe and his wife, Sarah, reside in Ridgewood, NJ.

Forbes Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded June 2019) Data compiled by SHOOK Research LLC based on time period from 3/31/18 - 3/31/19.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: SC, DC, TX, MN, MI, IL, CO, NJ, CA, WV, WA, DE, PA, NY, AZ, VA, OK, NC, ME, MD, VT, UT, NV, NM, MA, LA, KY, FL, AR, RI, GA, CT, OH, TN, MT, MS, OR, NH; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1278832

NMLS#: 1278832

About Matthew Langan

Matt accepted a full-time position with The Trilogy Group in August of 2011 after serving as an associate during the summers of 2009 and 2010. He is recognized as a Forbes Top Next-Gen Wealth Advisor and a member of Morgan Stanley Wealth Management Pacesetter's Club, a global recognition program for Financial Advisors who, within their first five years, demonstrate the highest professional standards and first-class client service.

He manages the team's tailored investment strategies helping clients achieve their financial aspirations whether they are through capital appreciation, preservation and/or income. He is responsible for researching investment and strategy ideas, asset allocation decisions and working alongside his partners on new business development.

Matt is a graduate of Loyola University, MD where he earned his BA and was a member of the varsity lacrosse team. During his time as a member of the lacrosse team, he was elected Captain, MVP and chosen as a USILA Scholar All American. In 2025, Matt was inducted into the New Jersey Lacrosse Hall of Fame. He is actively involved in his hometown community of Madison, NJ where he volunteers for the youth recreational sports programs and travel programs, while serving as an acting Board Member for the Madison Junior Lacrosse Club, a nonprofit organization formed to promote the sport of lacrosse in the Borough of Madison, NJ and the Township of Harding, NJ. He also volunteers for the Covenant House New Jersey, a nonprofit charity serving homeless youth with a network of shelters across the Americas. Matt lives in Morristown, NJ with his fiancé, Anna.

Forbes Top Next-Gen Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Aug 2025) Data provided by SHOOK Research LLC as of 3/31/25.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

He manages the team's tailored investment strategies helping clients achieve their financial aspirations whether they are through capital appreciation, preservation and/or income. He is responsible for researching investment and strategy ideas, asset allocation decisions and working alongside his partners on new business development.

Matt is a graduate of Loyola University, MD where he earned his BA and was a member of the varsity lacrosse team. During his time as a member of the lacrosse team, he was elected Captain, MVP and chosen as a USILA Scholar All American. In 2025, Matt was inducted into the New Jersey Lacrosse Hall of Fame. He is actively involved in his hometown community of Madison, NJ where he volunteers for the youth recreational sports programs and travel programs, while serving as an acting Board Member for the Madison Junior Lacrosse Club, a nonprofit organization formed to promote the sport of lacrosse in the Borough of Madison, NJ and the Township of Harding, NJ. He also volunteers for the Covenant House New Jersey, a nonprofit charity serving homeless youth with a network of shelters across the Americas. Matt lives in Morristown, NJ with his fiancé, Anna.

Forbes Top Next-Gen Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Aug 2025) Data provided by SHOOK Research LLC as of 3/31/25.

Awards Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: OK, NC, CO, CA, PA, NV, NJ, VA, SC, RI, OH, VT, MS, WA, NY, MI, MD, IL, GA, DE, ME, LA, DC, MA, KY, CT, TX, MT, AZ, TN, OR, WV, UT, NH, FL, AR; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1262369

NMLS#: 1262369

About James Farrell

Jim Farrell joined The Trilogy Group in 2019 as a Financial Advisor after spending 25 years working in institutional equity sales and trading. He is recognized as a member of Morgan Stanley Wealth Management Pacesetter's Club, a global recognition program for Financial Advisors who, within their first five years, demonstrate the highest professional standards and first-class client service.

He began his career in finance on the Chicago Board of Options. Over the next 20 years, he worked at several global financial firms, including Merrill Lynch, JP Morgan and Santander. From his extensive institutional investment experience, Jim has developed a deep and thorough understanding of the complexities of the world’s financial markets.

Jim is a seasoned professional that helps accomplished individuals and families build and preserve wealth. He utilizes Morgan Stanley’s technology platform and vast resources to create individualized, comprehensive financial plans for his clients.

Jim grew up in Gladstone, NJ in a large family; he was the youngest among six children. He met his wife, Karin, at Bernardsville High School and they both attended the University of Lynchburg. After living in Madison, NJ for 20 years, they recently moved to New Vernon, NJ with their three children, Madeleine, Charlie and Elizabeth. In his free time, Jim volunteers for the Covenant House New Jersey, a nonprofit charity serving homeless youth a network of shelters across the Americas.

He began his career in finance on the Chicago Board of Options. Over the next 20 years, he worked at several global financial firms, including Merrill Lynch, JP Morgan and Santander. From his extensive institutional investment experience, Jim has developed a deep and thorough understanding of the complexities of the world’s financial markets.

Jim is a seasoned professional that helps accomplished individuals and families build and preserve wealth. He utilizes Morgan Stanley’s technology platform and vast resources to create individualized, comprehensive financial plans for his clients.

Jim grew up in Gladstone, NJ in a large family; he was the youngest among six children. He met his wife, Karin, at Bernardsville High School and they both attended the University of Lynchburg. After living in Madison, NJ for 20 years, they recently moved to New Vernon, NJ with their three children, Madeleine, Charlie and Elizabeth. In his free time, Jim volunteers for the Covenant House New Jersey, a nonprofit charity serving homeless youth a network of shelters across the Americas.

Securities Agent: AR, NJ, ME, CA, VT, FL, DE, VA, TX, PA, LA, DC, MD, KY, AZ, OK, NV, SC, NH, NC, WV, UT, OR, NY, IL, WA, TN, MI, MA, GA, CT, OH, MT, MS, CO, RI; General Securities Representative; Investment Advisor Representative

NMLS#: 1920564

NMLS#: 1920564

About Steven Bredahl

Steve joined The Trilogy Group in 2022 after spending over 25 years as a broker in the financial markets. He is recognized as a member of Morgan Stanley Wealth Management Pacesetter's Club, a global recognition program for Financial Advisors who, within their first five years, demonstrate the highest professional standards and first-class client service.

He uses his extensive knowledge of the financial markets while leveraging the vast resources of Morgan Stanley to help business owners, corporate executives and other high net worth individuals and families reach their financial goals.

Steve earned his BA from the University of Delaware. He is currently pursuing the Certified Financial Planning designation. He is a member of the Estate Planning Council of Northern New Jersey, Morris County Chamber of Commerce and other business organizations. Steve volunteers his free time with the Covenant House New Jersey, American Red Cross and Harlem Lacrosse after spending many years as a volunteer coach of youth football and lacrosse in Chatham, NJ. Steve lives in Morris Twp., NJ with his wife, Andrea, and is the proud father of three recent college graduates, Elizabeth, Christopher and Mac.

He uses his extensive knowledge of the financial markets while leveraging the vast resources of Morgan Stanley to help business owners, corporate executives and other high net worth individuals and families reach their financial goals.

Steve earned his BA from the University of Delaware. He is currently pursuing the Certified Financial Planning designation. He is a member of the Estate Planning Council of Northern New Jersey, Morris County Chamber of Commerce and other business organizations. Steve volunteers his free time with the Covenant House New Jersey, American Red Cross and Harlem Lacrosse after spending many years as a volunteer coach of youth football and lacrosse in Chatham, NJ. Steve lives in Morris Twp., NJ with his wife, Andrea, and is the proud father of three recent college graduates, Elizabeth, Christopher and Mac.

Securities Agent: NV, TN, OR, WV, WI, WA, VT, VA, UT, TX, SC, RI, PA, OK, OH, NY, NM, NJ, NH, NC, MT, MO, MN, ME, MD, MA, KY, IN, IL, GA, FL, DE, DC, CT, CO, CA, AZ, AR, MI, LA, MS; General Securities Representative; Investment Advisor Representative

NMLS#: 1817040

NMLS#: 1817040

About Timothy Finnegan

Tim has built a distinguished 25-year career in financial services. He spent 17 years as a Managing Director in the Latin American Private Bank at JP Morgan. He was responsible for the daily supervision of registered personnel across their banking, trading and investment management platforms. More recently Tim worked at KPMG for nine years as a Director in the risk management/independence group. He was responsible for the development and implementation of independence workflows and partner rotation applications.

Tim earned a Bachelor of Arts in Economics from Muhlenberg College. He resides in Ramsey, NJ with his wife Tricia, two very energetic dogs and has three sons. Outside of work, he enjoys golf and paddle tennis and is a member of Team Rubicon, a veteran-led humanitarian organization that serves global communities before, during and after disasters and crises. Their mission is to support humanity and build resiliency for vulnerable communities across the world.

Tim is very excited to begin the next chapter in his career at Morgan Stanley with the Trilogy Group and is looking forward to getting up to speed and adding value to the group!

Tim earned a Bachelor of Arts in Economics from Muhlenberg College. He resides in Ramsey, NJ with his wife Tricia, two very energetic dogs and has three sons. Outside of work, he enjoys golf and paddle tennis and is a member of Team Rubicon, a veteran-led humanitarian organization that serves global communities before, during and after disasters and crises. Their mission is to support humanity and build resiliency for vulnerable communities across the world.

Tim is very excited to begin the next chapter in his career at Morgan Stanley with the Trilogy Group and is looking forward to getting up to speed and adding value to the group!

About Brooke Benna

Brooke joined the Trilogy Group in January of 2022, and enhances the client experience by providing exceptional client service, supporting branch functions, assisting in safeguarding client assets, and serving as administrative and operational support to Financial Advisors.

Brooke is a graduate of SUNY Plattsburgh where she earned her BA, and was a member of the Varsity Women’s Basketball Team. During her time as a member, she was elected co-captain, named Vice President of the Student Athletic Advisory Committee, achieved the Student-Athlete Academic Honor Roll, and received The Maple Leaf Award for outstanding community service contributions. Brooke continues to stay active while playing in different leagues with her friends, and rooting for her favorite sports teams.

Brooke is a graduate of SUNY Plattsburgh where she earned her BA, and was a member of the Varsity Women’s Basketball Team. During her time as a member, she was elected co-captain, named Vice President of the Student Athletic Advisory Committee, achieved the Student-Athlete Academic Honor Roll, and received The Maple Leaf Award for outstanding community service contributions. Brooke continues to stay active while playing in different leagues with her friends, and rooting for her favorite sports teams.

Contact Christopher Lutz

Contact Joseph Rumore

Contact Matthew Langan

Contact James Farrell

Contact Steven Bredahl

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2023-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2023-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Julian Cho

Julian Cho is a Private Banker serving Morgan Stanley Wealth Management offices in New Jersey.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Julian began his career in financial services in 2009 and joined Morgan Stanley in 2017 as an Associate Private Banker. Prior to joining the firm, he was a Private Client Banker at JP Morgan Chase.

Julian is a graduate of Nyack College, where he received a Bachelor of Science in Management and Finance. He lives in North Haledon, New Jersey with his family. Outside of the office, Julian enjoys billiards, surfing and kite boarding, fishing, skiing, and playing lacrosse.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Julian began his career in financial services in 2009 and joined Morgan Stanley in 2017 as an Associate Private Banker. Prior to joining the firm, he was a Private Client Banker at JP Morgan Chase.

Julian is a graduate of Nyack College, where he received a Bachelor of Science in Management and Finance. He lives in North Haledon, New Jersey with his family. Outside of the office, Julian enjoys billiards, surfing and kite boarding, fishing, skiing, and playing lacrosse.

NMLS#: 833560

About Lasha Mchedlidze

Lasha Mchedlidze is a Client Relationship Associate at Morgan Stanley providing dedicated support to Financial Advisors and their teams. Operating as an extension of the FA/Team, Lasha collaborates with clients to discover how best to engage and enroll in the services available at Morgan Stanley during their onboarding journey, specifically cash management. Lasha provides expertise across a wide suite of cash management offerings and is able to help open cash management accounts, assist with credit cards and provide education on the breadth of what Morgan Stanley has to offer in the cash management space.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking-related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking-related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Trilogy Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)