The Tankersley Tomlin Lowery Group at Morgan Stanley

Mike Tankersley, CRPC®Dwight Tomlin, CRPC®Angie Lowery, CRPC®Colton Lowery, CRPC®Amy EubanksWendy F. Johnson

Direct:

(731) 891-9078(731) 891-9078

Toll-Free:

(800) 965-0293(800) 965-0293

Our Mission Statement

Experience, intellectual capital and dedicated personal service to help you meet your life goals.

The Tankersley Tomlin Lowery Group

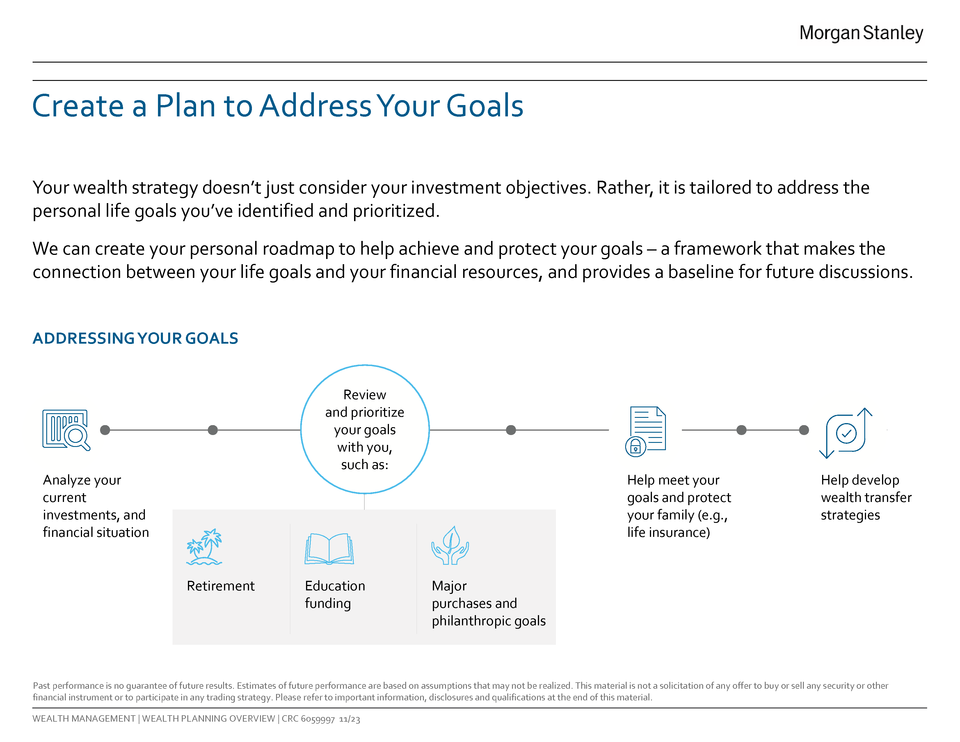

As the financial world becomes more complex and investment choices multiply, careful planning becomes ever more important to helping you achieve your financial goals. As Financial Advisors, our role is to work with you to help you develop a strategy that lays out a clear path to your goals---a strategy that we develop in collaboration with you, and one designed to help you follow with confidence in the face of the market's ups and downs. Together, we will explore a broad range of topics that are likely to influence your financial future---from your family situation to your career aspirations, from likely education expenses to the retirement you ultimately envision. What we learn will become the foundation for a financial and investment strategy based on who you are and where you want to go. Only then will we talk to you about the details of investing: how much risk makes sense, your asset allocation, and which investments may be appropriate for your portfolio. But that's just the beginning. Over time and as necessary, together we will revise your strategy to reflect new aspirations and priorities, helping your strategy keep pace as the markets change and your life unfolds. We look forward to hearing your dreams and goals and most importantly, helping your work towards them.

Disclosures:

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

Disclosures:

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

Services Include

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

A PLAN MADE FOR YOUR UNIQUE SITUATION AND CIRCUMSTANCE

At The Tankersley Tomlin Lowery Group, we understand the importance of strategic financial planning, especially when it comes to retirement. We specialize in providing comprehensive solutions that are tailored to your unique needs and goals.

By combining our extensive knowledge and experience with the vast resources of a global Wealth Management Firm, we offer you world-class strategies designed to maximize your financial potential. Our approach to financial and retirement planning is rooted in personalized service and objective advice.

We take the time to understand your aspirations, risk tolerance, and timeline, allowing us to develop a custom-tailored plan that aligns with your vision for retirement. Whether you're a financially successful individual or family, a small business owner, or a professional in the financial industry, we have the expertise to address your specific needs.

Explore more about our approach below and some of the tools Morgan Stanley offers to our esteemed clients:

By combining our extensive knowledge and experience with the vast resources of a global Wealth Management Firm, we offer you world-class strategies designed to maximize your financial potential. Our approach to financial and retirement planning is rooted in personalized service and objective advice.

We take the time to understand your aspirations, risk tolerance, and timeline, allowing us to develop a custom-tailored plan that aligns with your vision for retirement. Whether you're a financially successful individual or family, a small business owner, or a professional in the financial industry, we have the expertise to address your specific needs.

Explore more about our approach below and some of the tools Morgan Stanley offers to our esteemed clients:

Discover

We begin by engaging in a conversation to gain a deep understanding of your specific requirements, lifestyle, family dynamics, and future aspirations.

Advise

Our team collaborates with you to develop tailored portfolio strategies that not only align with your goals but also safeguard your desired outcomes.

Implement

We analyze a wide range of accounts and products to identify and implement solutions that best suit your unique investment strategy.

Track Progress

We provide assistance in tracking your progress, monitoring your spending habits, and managing your savings to ensure that you stay on course towards achieving your objectives.

Aladdin - Portfolio Risk Platform

When you partner with us, you gain exclusive access to Morgan Stanley's cutting-edge Portfolio Risk Platform. This platform offers a comprehensive range of risk assessment and reporting tools covering various asset classes and security types. It provides both a macro-level overview and in-depth analysis, enabling you to streamline your risk monitoring and management processes effectively.

Watch To Learn MoreGoals Planning System (GPS)

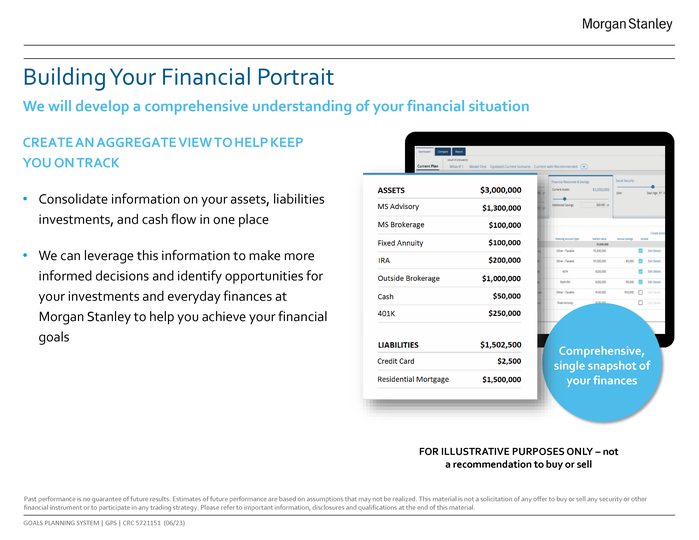

At Morgan Stanley, we prioritize the importance of financial planning, which is why our Firm has meticulously developed our proprietary integrated planning tool known as the Goals Planning System (GPS). By harnessing our Firm's extensive intellectual capital and capabilities, GPS offers a user-friendly and highly efficient platform specifically designed to evaluate the progress of clients in attaining their financial objectives. With GPS, you can navigate the path towards your clients' desired financial outcomes with confidence and precision.

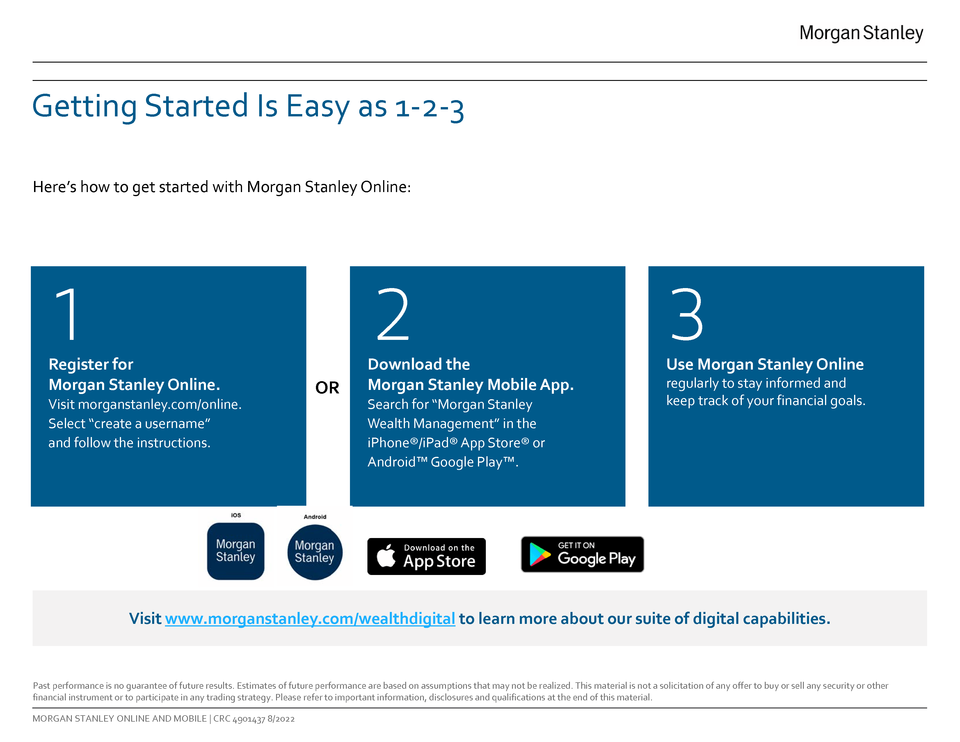

Watch To Learn MoreMORGAN STANLEY'S SUITE OF CUTTING-EDGE DIGITAL TOOLS

At Morgan Stanley we proudly offer our clients a suite of digital resources meticulously designed to empower and enhance every aspect of their financial portfolio. We understand the importance of staying ahead in today's fast-paced world, and that's why we have curated a range of Modern Wealth Management tools to cater to our valued clients.

Take the time to explore and learn more about the many digital resources at your disposal. Whether you're seeking real-time market insights, personalized financial planning guidance, or seamless access to your accounts, Morgan Stanley has you covered. Join us on this journey towards financial success, powered by the tools that set us apart in the world of wealth management.

Take the time to explore and learn more about the many digital resources at your disposal. Whether you're seeking real-time market insights, personalized financial planning guidance, or seamless access to your accounts, Morgan Stanley has you covered. Join us on this journey towards financial success, powered by the tools that set us apart in the world of wealth management.

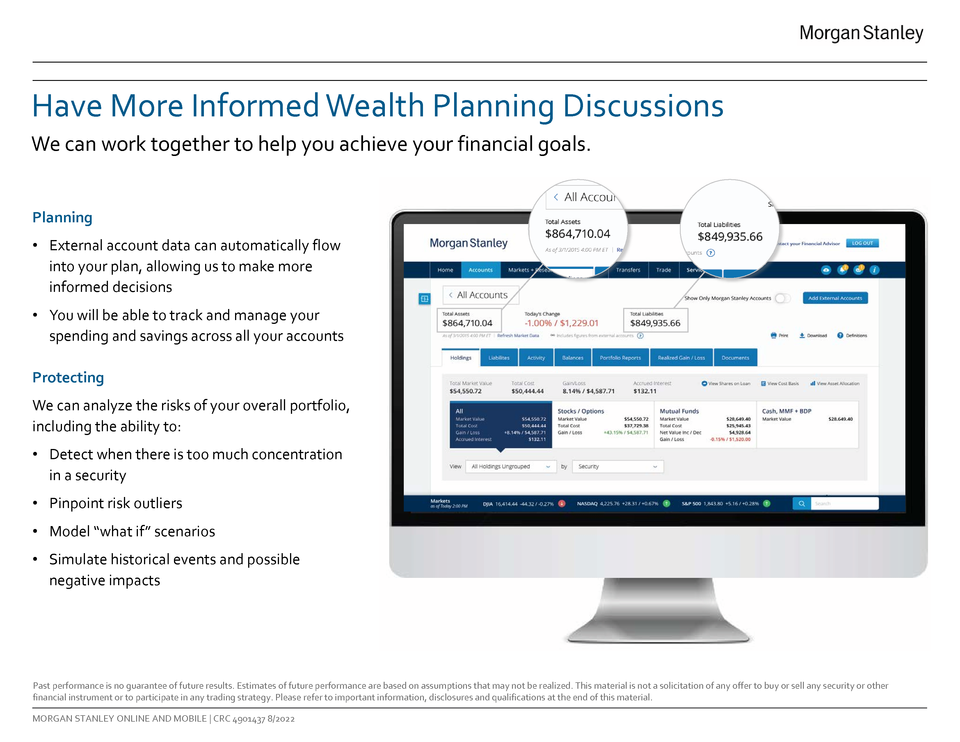

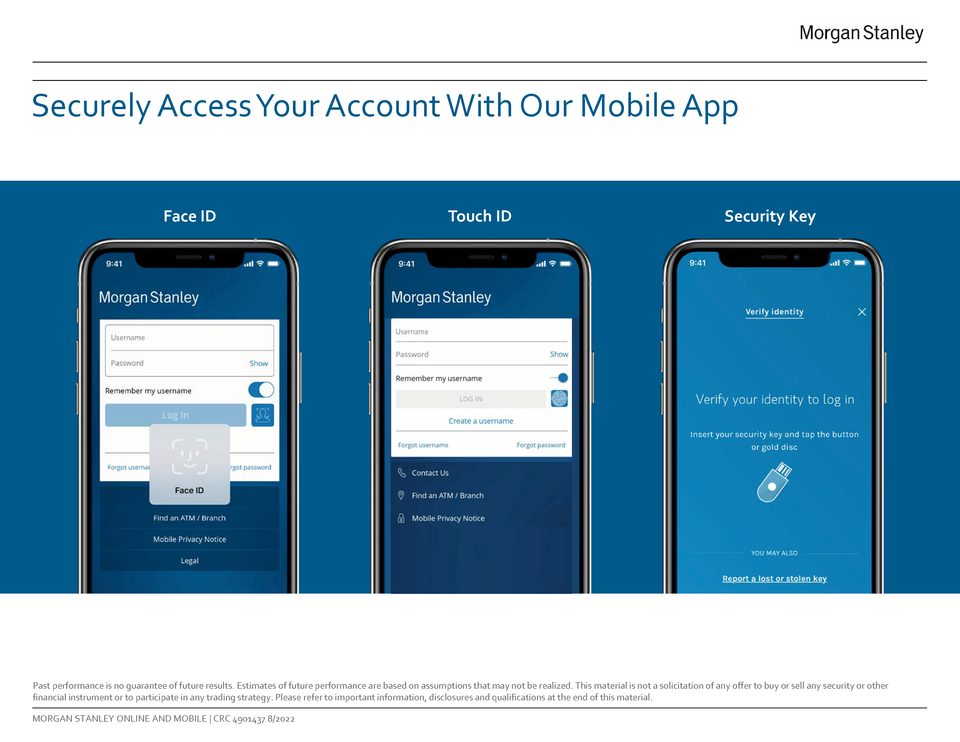

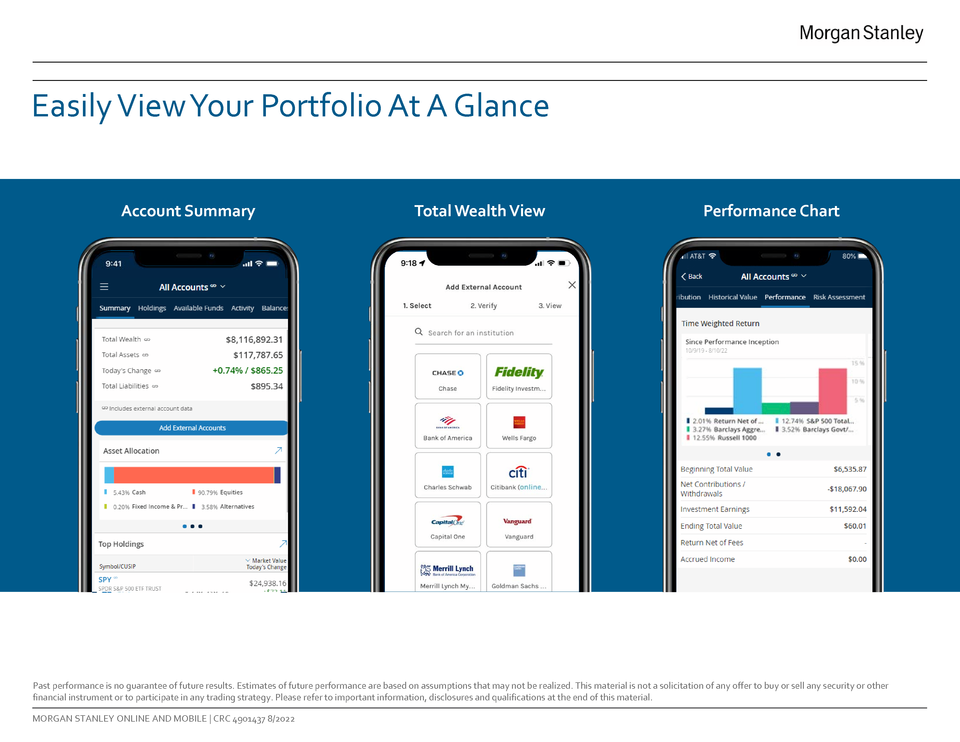

Morgan Stanley Online and MS Mobile

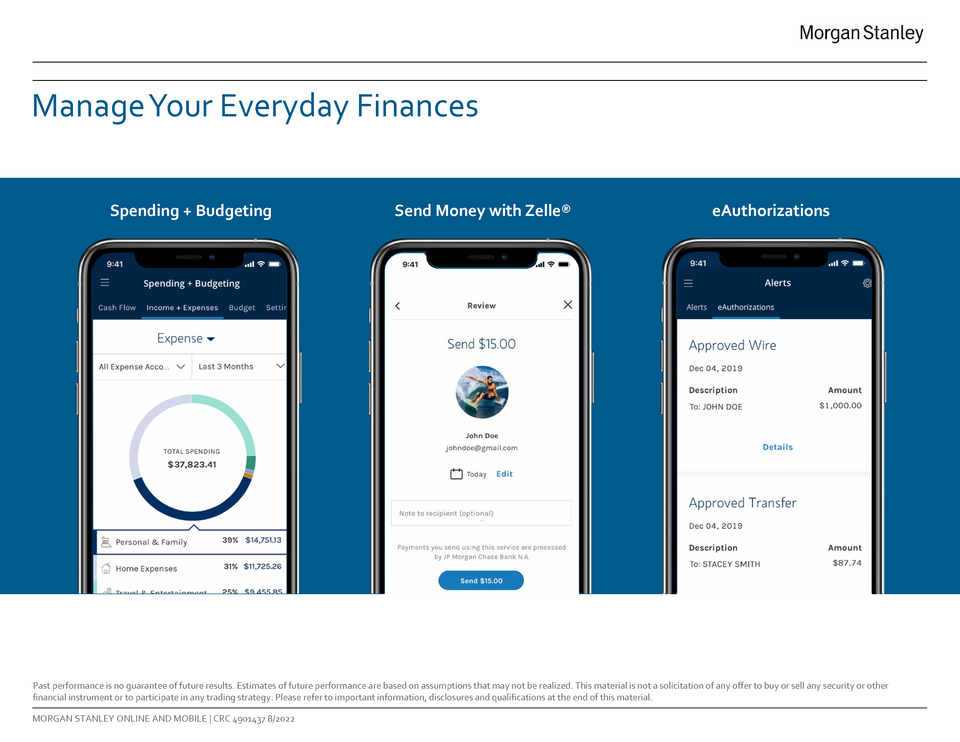

Morgan Stanley Online (MSO) provides a comprehensive suite of features designed to enhance your daily financial management. With MSO, you not only gain access to your account balance and activity but also enjoy a range of functionalities that streamline tasks such as bill payments, fund transfers, and expedited transactions. Our meticulously crafted eAuthorizations feature ensures secure and efficient transaction approvals, optimizing your financial management processes and saving you valuable time and effort.

Morgan Stanley OnlineTotal Wealth View

Total Wealth View offers a secure and holistic solution for consolidating accounts from multiple sources. By bringing all your financial information into one place, it enables an overarching view of your portfolio. This in-depth understanding allows our team to provide personalized and tailored advice, perfectly aligned with your unique financial situation.

Total Wealth VieweAuthorizations

Our eAuthorizations feature provides a streamlined and secure method for granting transaction approvals electronically. With just a single click, you can easily manage and authorize transactions through Morgan Stanley's Online and Mobile App, ensuring seamless and hassle-free financial control.

eAuthorizations Client GuideDigital Vault

The Digital Vault, available on Morgan Stanley Online and the Mobile App, offers a highly secure and convenient way to access, upload, and share crucial documents. From wills and deeds to financial statements and tax filings, the Digital Vault serves as a centralized repository for managing your important records, ensuring they are easily accessible whenever you need them.

Digital Vault Client GuideeSign

Our efficient document management process enables you to swiftly receive, review, and execute necessary documents, without the delays associated with traditional mail. With our seamless and user-friendly eSign feature, which only requires a valid email address and phone number to initiate, you can effortlessly navigate the document signing process, ensuring a smooth and expedited experience.

eDelivery

Take advantage of our eDelivery feature, which offers you the convenience and flexibility of accessing your statements and important documents in an electronic format. By eliminating the need for paper copies, eDelivery not only reduces clutter but also enhances accessibility. Morgan Stanley Online clients can easily enroll in eDelivery, and the platform currently supports a wide range of documents including trade confirmations, prospectuses, general correspondence, selected IRS-approved tax documents, and more.

eDelivery Client GuideLocation

1382 Union University Dr

Jackson, TN 38305

US

Direct:

(731) 891-9078(731) 891-9078

Toll-Free:

(800) 965-0293(800) 965-0293

Meet The Tankersley Tomlin Lowery Group

About Angie Lowery

With a career spanning almost three decades in the financial services industry, Angie’s passion for finance and economics blossomed during her academic years at The University of Tennessee at Martin, leading her directly into the field post-graduation in 1996. Angie’s unique, client-centered approach is conversational and detail-oriented, fostering a relaxed environment where life’s financial decisions are carefully mapped out and regularly reviewed.

Angie’s office doors have always been open Monday through Friday, a testament to her focused work ethic and commitment to her clients' well-being. She believes in understanding the intricate details of her clients' lives, allowing her to create tailored strategies and conduct ongoing reviews to help ensure their financial plans remain aligned with any life changes.

Her clients describe her as caring, attentive, friendly, dedicated, and knowledgeable—a reflection of her genuine concern for their well-being. This client-centric approach is complemented by the teams Portfolio Associate, Amy Eubanks, who is instrumental in addressing clients' immediate needs with precision and care.

Beyond finance, Angie is deeply committed to her community, having served on boards for organizations like WRAP, the Carl Perkins Center, Jackson Exchange Club, and the West Tennessee Pickleball Association, advocating for causes from preventing intimate partner violence to child abuse, and promoting healthy community activities. She also volunteers at the Dream Center of Jackson and RIFA, where she helps break the chronic cycle of homelessness for women and serves lunch regularly with the love of Christ, respectively.

A mother of two, a grandmother to four, and a devoted church member, Angie cherishes family and faith. She leads a HomeGroup, has recently completed a three year seminary-level program at her church called Fellowship University, and enjoys mountain biking, pickleball, running, hiking, traveling, and cooking. A fun fact about Angie: every year she and her family scale Colorado's 14ers (Mountain’s that rise to an altitude of greater than 14,000 feet), embracing the adventure and the bond it fosters.

Angie joined Morgan Stanley in 2015, bringing with her a profound understanding of finance and a Senior Portfolio Manager designation, ready to scale financial heights with her clients just as confidently as she does mountains.

Angie’s office doors have always been open Monday through Friday, a testament to her focused work ethic and commitment to her clients' well-being. She believes in understanding the intricate details of her clients' lives, allowing her to create tailored strategies and conduct ongoing reviews to help ensure their financial plans remain aligned with any life changes.

Her clients describe her as caring, attentive, friendly, dedicated, and knowledgeable—a reflection of her genuine concern for their well-being. This client-centric approach is complemented by the teams Portfolio Associate, Amy Eubanks, who is instrumental in addressing clients' immediate needs with precision and care.

Beyond finance, Angie is deeply committed to her community, having served on boards for organizations like WRAP, the Carl Perkins Center, Jackson Exchange Club, and the West Tennessee Pickleball Association, advocating for causes from preventing intimate partner violence to child abuse, and promoting healthy community activities. She also volunteers at the Dream Center of Jackson and RIFA, where she helps break the chronic cycle of homelessness for women and serves lunch regularly with the love of Christ, respectively.

A mother of two, a grandmother to four, and a devoted church member, Angie cherishes family and faith. She leads a HomeGroup, has recently completed a three year seminary-level program at her church called Fellowship University, and enjoys mountain biking, pickleball, running, hiking, traveling, and cooking. A fun fact about Angie: every year she and her family scale Colorado's 14ers (Mountain’s that rise to an altitude of greater than 14,000 feet), embracing the adventure and the bond it fosters.

Angie joined Morgan Stanley in 2015, bringing with her a profound understanding of finance and a Senior Portfolio Manager designation, ready to scale financial heights with her clients just as confidently as she does mountains.

Securities Agent: NE, IL, OH, PA, AL, MS, CA, AZ, AK, SC, NY, VA, NC, AR, MO, KY, KS, WI, TX, TN, NV, IN, FL, GA, CO, UT, OK; General Securities Representative; Investment Advisor Representative

NMLS#: 590370

NMLS#: 590370

About Dwight Tomlin

Dwight is a steady hand in the world of financial advising, bringing over four decades of experience and a no-nonsense approach rooted in doing what’s right for the client, always. He believes in straightforward, disciplined asset allocation tailored to each individual’s goals and risk tolerance, and he’s built his career on trust, integrity, and long-term relationships.

He began his journey in the financial industry back in 1982 and joined Morgan Stanley in 2015. With a Bachelor of Science in Business from Lambuth University and certifications including Series 7 and Insurance, Dwight now serves as a Senior Portfolio Manager. His knowledge runs deep, and so does his commitment to guiding clients with clarity and purpose.

Outside the office, Dwight has always believed in giving back. He’s held leadership roles in the Jackson community, including serving as president of Crime Stoppers and board member for organizations like the YMCA and the historic Hollywood Cemetery. He also volunteers his time at RIFA, helping serve meals to those in need.

At the heart of Dwight’s life is his family. He and his wife have been married for over 40 years, and together they’ve raised four children and are now proud grandparents to nine. He finds peace in the simple things—his faith, working in the yard, a good day of golf, hunting, fishing, and time spent at his river house. After all these years, it’s the people that matter most to him.

Disclosures:

Asset allocation and diversification do not guarantee a profit or protect against a loss in a declining financial market.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

He began his journey in the financial industry back in 1982 and joined Morgan Stanley in 2015. With a Bachelor of Science in Business from Lambuth University and certifications including Series 7 and Insurance, Dwight now serves as a Senior Portfolio Manager. His knowledge runs deep, and so does his commitment to guiding clients with clarity and purpose.

Outside the office, Dwight has always believed in giving back. He’s held leadership roles in the Jackson community, including serving as president of Crime Stoppers and board member for organizations like the YMCA and the historic Hollywood Cemetery. He also volunteers his time at RIFA, helping serve meals to those in need.

At the heart of Dwight’s life is his family. He and his wife have been married for over 40 years, and together they’ve raised four children and are now proud grandparents to nine. He finds peace in the simple things—his faith, working in the yard, a good day of golf, hunting, fishing, and time spent at his river house. After all these years, it’s the people that matter most to him.

Disclosures:

Asset allocation and diversification do not guarantee a profit or protect against a loss in a declining financial market.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Securities Agent: SC, KY, AL, PA, OK, NC, AR, MO, CO, CA, WI, NY, MS, IN, OH, TX, NE, KS, IL, AZ, TN, NV, FL, AK, VA, GA, UT; General Securities Representative; Investment Advisor Representative

NMLS#: 590431

NMLS#: 590431

About Mike Tankersley

With a career spanning over four decades, Mike Tankersley has been a dedicated Financial Advisor since starting at J.C.Bradford & Co. in 1984, joining Morgan Stanley in 2015. Mike earned a B.S. in Business Administration from the University of Tennessee with a major in marketing. His background in marketing and a genuine interest in people led him to a fulfilling career in financial advising. His approach is deeply personalized; he listens intently to understand each client’s unique financial aspirations, crafting tailored strategies that translate complex financial concepts into clear, actionable plans. Mike believes you never stop learning and over the years has completed industry related training at the University of Pennsylvania’s Wharton School of Business and Vanderbilt University’s Owen School of Management.

As a Senior Portfolio Management Director with a Chartered Retirement Planning Counselor (CRPC) designation, Mike's experience is in creating pathways to financial security, whether it's planning for retirement, education, or legacy goals. His years of experience, combined with a people-first attitude, ensures that each client receives thoughtful and effective financial solutions. Witnessing these solutions make a difference in people’s lives is what Mike finds most rewarding about his career.

Mike's commitment extends beyond finances; he is actively involved in the Jackson community, having served on the boards of the Jackson Rotary Club, the Jackson Chamber of Commerce, the Exchange Club of Jackson, Crimestoppers of Jackson and supporting many local charities with his time and money. A family man at heart, Mike cherishes his roots in Jackson, Tennessee, where he enjoys life with his wife Janet, three children, and a grandson. He is a lifelong member of West Jackson Baptist Church and has served there in many capacities. He is currently the church treasurer and, in the past, has taught college students and children of all ages. He enjoys traveling, delving into his passion for history and attending sporting events and live performances of any kind. Mike embodies the spirit of service and dedication in both his professional and personal life.

As a Senior Portfolio Management Director with a Chartered Retirement Planning Counselor (CRPC) designation, Mike's experience is in creating pathways to financial security, whether it's planning for retirement, education, or legacy goals. His years of experience, combined with a people-first attitude, ensures that each client receives thoughtful and effective financial solutions. Witnessing these solutions make a difference in people’s lives is what Mike finds most rewarding about his career.

Mike's commitment extends beyond finances; he is actively involved in the Jackson community, having served on the boards of the Jackson Rotary Club, the Jackson Chamber of Commerce, the Exchange Club of Jackson, Crimestoppers of Jackson and supporting many local charities with his time and money. A family man at heart, Mike cherishes his roots in Jackson, Tennessee, where he enjoys life with his wife Janet, three children, and a grandson. He is a lifelong member of West Jackson Baptist Church and has served there in many capacities. He is currently the church treasurer and, in the past, has taught college students and children of all ages. He enjoys traveling, delving into his passion for history and attending sporting events and live performances of any kind. Mike embodies the spirit of service and dedication in both his professional and personal life.

Securities Agent: AL, OH, SC, MS, CO, NV, NE, IL, GA, FL, WI, TN, NY, KY, VA, PA, AK, CA, AR, OK, AZ, IN, TX, UT, NC, MO, KS; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 590424

AR Insurance License #: AR Insurance Lic. #2480976

NMLS#: 590424

AR Insurance License #: AR Insurance Lic. #2480976

About Colton Lowery

Colton Lowery is a Financial Advisor and a Chartered Retirement Planning Counselor (CRPC) at Morgan Stanley. His journey into finance began at the University of Tennessee at Chattanooga, where he graduated with a bachelor’s degree from the Gary W. Rollins College of Business. After graduation, he quickly obtained his licenses in Life and Health Insurance, along with Series 7 and Series 66 certifications, equipping him with the tools necessary to guide his clients through complex financial situations.

Colton’s passion for finance was sparked in high school and was further fueled by his involvement in a campus organization that managed investment portfolios. This early exposure led him to appreciate the significance of financial literacy and inspired him to pursue a career as a Financial Advisor. His approach is deeply rooted in personalized strategies and collaboration, seeking to ensure that every client’s financial situation is handled with utmost care and precision. He finds great joy in building lasting relationships with his clients, helping them achieve their financial goals and celebrating their milestones.

Outside of his professional life, Colton is an active member of his community, committed to promoting financial awareness among young people. He enjoys an active lifestyle with his fiancée and their beloved dogs and cheering on their local sports teams. Known for delivering exceptional service, Colton provides investment strategies that seek to help ensure his clients’ portfolios are aligned with their long-term financial aspirations.

Colton’s passion for finance was sparked in high school and was further fueled by his involvement in a campus organization that managed investment portfolios. This early exposure led him to appreciate the significance of financial literacy and inspired him to pursue a career as a Financial Advisor. His approach is deeply rooted in personalized strategies and collaboration, seeking to ensure that every client’s financial situation is handled with utmost care and precision. He finds great joy in building lasting relationships with his clients, helping them achieve their financial goals and celebrating their milestones.

Outside of his professional life, Colton is an active member of his community, committed to promoting financial awareness among young people. He enjoys an active lifestyle with his fiancée and their beloved dogs and cheering on their local sports teams. Known for delivering exceptional service, Colton provides investment strategies that seek to help ensure his clients’ portfolios are aligned with their long-term financial aspirations.

Securities Agent: OH, VA, NY, NV, FL, AR, SC, NC, KY, GA, WI, AL, IN, CO, CA, NE, MO, AK, UT, TN, MS, PA, KS, TX, IL, AZ, OK; General Securities Representative; Investment Advisor Representative

NMLS#: 2469968

NMLS#: 2469968

About Wendy F. Johnson

Wendy brings a rich history of experience and personal commitment to her role as a Senior Registered Portfolio Associate. A proud 1984 graduate of Bolivar Central High School, Wendy's journey in professional services began with her degree in Paralegal Services from West Tennessee Business College in 1986. Her career took root in 1989 at JC Bradford & Company Investments, where she honed her skills in operations and client services. Starting in 1998, she dedicated her time to her family and raising her children. In 2006 Wendy transitioned her sharp eye for detail into the real estate sector, becoming a licensed Residential Real Estate Appraiser for her family-owned real estate appraisal business, where she worked until 2014.

Wendy's passion for finance reignited in 2015 when she joined Morgan Stanley as a Client Service Associate, further solidifying her experience by obtaining her Series 7 and Series 66 licenses in 2017. Working alongside Mike Tankersley, she has brought a personal touch to client interactions, valuing each unique relationship, and striving to deliver exceptional service.

Outside the office, Wendy's life is full of vitality. Married to her husband Randy, she is a mother and grandmother, relishing time in the mountains and with family. Her community spirit shines through her past role as treasurer for the Junior Auxiliary and her current dedication as a St. Jude Partner in Hope. Wendy also nurtures her creative side through piano, woodworking, and interior design, finding joy and relaxation in these pursuits.

Wendy's passion for finance reignited in 2015 when she joined Morgan Stanley as a Client Service Associate, further solidifying her experience by obtaining her Series 7 and Series 66 licenses in 2017. Working alongside Mike Tankersley, she has brought a personal touch to client interactions, valuing each unique relationship, and striving to deliver exceptional service.

Outside the office, Wendy's life is full of vitality. Married to her husband Randy, she is a mother and grandmother, relishing time in the mountains and with family. Her community spirit shines through her past role as treasurer for the Junior Auxiliary and her current dedication as a St. Jude Partner in Hope. Wendy also nurtures her creative side through piano, woodworking, and interior design, finding joy and relaxation in these pursuits.

About Amy Eubanks

With a passion for nurturing strong, lasting client relationships, Amy brings over two decades of dedication to the financial services industry. Since her career launch in 1999, fresh from Lambuth University with a B.S. in Business and Marketing, Amy's commitment has only deepened. Her approach is personal and attentive; she thrives on the fast-paced nature of the industry and the genuine satisfaction that comes from assisting clients.

Amy's journey, which joined paths with Morgan Stanley in 2015, is fueled by a profound care for client well-being and a strategic focus on their entire financial picture for long-term investing. Described by peers as kind, helpful, and remarkably efficient, she stands out in her ability to get the job done with a personal touch.

She holds the Series 7, 63, and 65 licenses, enhancing her role on a team she considers her family, which she's been a vital part of alongside Dwight and Angie since 2003. Beyond the office, Amy is deeply invested in her community as an active member of Englewood Baptist Church, a dedicated volunteer at RIFA, and a supporter of local organizations like Women of Hope and WRAP.

At home, Amy enjoys life with her husband Brandon and their blended family which includes four children, and the joy of four grandsons. Whether it's sharing the thrill of the hunt or exploring new destinations, family and faith are her anchors. Amy's clients are an extension of her family, and she values transparency and confidence above all, seeking to be a guide on each client's financial journey with open arms.

Amy's journey, which joined paths with Morgan Stanley in 2015, is fueled by a profound care for client well-being and a strategic focus on their entire financial picture for long-term investing. Described by peers as kind, helpful, and remarkably efficient, she stands out in her ability to get the job done with a personal touch.

She holds the Series 7, 63, and 65 licenses, enhancing her role on a team she considers her family, which she's been a vital part of alongside Dwight and Angie since 2003. Beyond the office, Amy is deeply invested in her community as an active member of Englewood Baptist Church, a dedicated volunteer at RIFA, and a supporter of local organizations like Women of Hope and WRAP.

At home, Amy enjoys life with her husband Brandon and their blended family which includes four children, and the joy of four grandsons. Whether it's sharing the thrill of the hunt or exploring new destinations, family and faith are her anchors. Amy's clients are an extension of her family, and she values transparency and confidence above all, seeking to be a guide on each client's financial journey with open arms.

Contact Angie Lowery

Contact Dwight Tomlin

Contact Mike Tankersley

Contact Colton Lowery

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The Tankersley Tomlin Lowery Group today.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

9Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

7Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

9Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)