The Shoreview Group at Morgan Stanley

Our Mission Statement

Experience, intellectual capital and dedicated personal service to help you meet your life goals

Our Story and Services

Our goal is to thoroughly understand your financial needs and then align the resources to help you meet or exceed them. We can help you evaluate near-term concerns and plan for long-term goals, be a sounding board for investment ideas, assist you in developing and executing a strategy that is precisely your own and helps you meet your needs.

Services Include

- Alternative InvestmentsFootnote1

- AnnuitiesFootnote2

- Art AdvisoryFootnote3

- Cash Management and Lending ProductsFootnote4

- Certificates of DepositFootnote5

- Asset Management

- Financial PlanningFootnote6

- Corporate BondsFootnote7

- Corporate Retirement PlansFootnote8

- Divorce Financial AnalysisFootnote9

- Endowments and FoundationsFootnote10

- Estate Planning StrategiesFootnote11

- Exchange Traded FundsFootnote12

- Executive Financial ServicesFootnote13

- Life InsuranceFootnote14

- Long Term Care InsuranceFootnote15

- Municipal BondsFootnote16

- Philanthropic ManagementFootnote17

- Professional Portfolio ManagementFootnote18

- Qualified Retirement PlansFootnote19

- Retirement PlanningFootnote20

- Sustainable InvestingFootnote21

- Trust ServicesFootnote22

- 401(k) Rollovers

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

500 Post Road East

3rd Fl

Westport, CT 06880

US

Meet The Shoreview Group

About Daniel J. Wright

As a Financial Advisor and Senior Portfolio Management Director, Dan provides investment management and financial planning services to high net worth investors, their families, and foundations. Dan was one of the founding members of the Shoreview Group based in Morgan Stanley’s Westport, CT office in 2018. He developed and manages the group’s discretionary model portfolios. Prior to joining Morgan Stanley in 2009, he worked as a Financial Advisor for UBS in Washington, DC and later Connecticut.

Dan is a graduate of Georgetown University (magna cum laude) with a degree in finance and accounting. He became licensed as a CPA shortly after graduation (currently inactive) and is a CFA charterholder. In 2016, he attained Morgan Stanley’s Family Wealth Advisor (FWA) designation. Forbes Magazine listed Dan as a Top Next-Gen Wealth Advisor in 2018, a Best-In-State Next-Gen Advisor in 2019 and a Best-In-State Wealth Advisor in 2021-2023.

Dan resides in Newtown, CT with his wife and four children. In his spare time, he enjoys spending time with his family, golfing, and volunteering as a youth basketball coach.

Forbes Top 1,000 Next Gen Wealth Advisors

Source: Forbes.com (Awarded Jul 2018) Data compiled by SHOOK Research LLC based on time period from 3/31/17 - 3/31/18.

Forbes Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded June 2019) Data compiled by SHOOK Research LLC based on time period from 3/31/18 - 3/31/19.

Dan is a graduate of Georgetown University (magna cum laude) with a degree in finance and accounting. He became licensed as a CPA shortly after graduation (currently inactive) and is a CFA charterholder. In 2016, he attained Morgan Stanley’s Family Wealth Advisor (FWA) designation. Forbes Magazine listed Dan as a Top Next-Gen Wealth Advisor in 2018, a Best-In-State Next-Gen Advisor in 2019 and a Best-In-State Wealth Advisor in 2021-2023.

Dan resides in Newtown, CT with his wife and four children. In his spare time, he enjoys spending time with his family, golfing, and volunteering as a youth basketball coach.

Forbes Top 1,000 Next Gen Wealth Advisors

Source: Forbes.com (Awarded Jul 2018) Data compiled by SHOOK Research LLC based on time period from 3/31/17 - 3/31/18.

Forbes Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded June 2019) Data compiled by SHOOK Research LLC based on time period from 3/31/18 - 3/31/19.

Securities Agent: MI, DE, UT, TX, HI, CA, MN, PR, NH, GA, WV, OK, MD, IL, IA, AZ, VA, PA, NV, NC, AR, VT, SC, OR, LA, KY, IN, ID, CO, TN, OH, NJ, ME, FL, CT, WI, WA, MA, DC, RI, NY; General Securities Representative; Investment Advisor Representative

NMLS#: 1270113

CA Insurance License #: 0K24478

NMLS#: 1270113

CA Insurance License #: 0K24478

About Matthew S Bisland

Matthew is a Senior Portfolio Management Director, Insurance Planning Director, and Senior Vice President at Morgan Stanley. His multidisciplinary knowledge enables him to provide guidance on a wide array of complicated financial issues that impact high net worth individuals, non-profits and businesses alike. Matt was one of the founding members of the Shoreview Group at Morgan Stanley based in Westport, CT in 2018. In 2021 he was listed as one of Forbes Magazine’s Top Next-Gen Wealth Advisors.

Prior to joining Morgan Stanley, Matthew worked as a Financial Analyst for Intersil, a semiconductor producer in California. Matthew is also a graduate of Cornell University.

Forbes America’s Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded Sept 2021) Data compiled by SHOOK Research LLC based on time period from 3/31/20 - 3/31/21.

Prior to joining Morgan Stanley, Matthew worked as a Financial Analyst for Intersil, a semiconductor producer in California. Matthew is also a graduate of Cornell University.

Forbes America’s Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded Sept 2021) Data compiled by SHOOK Research LLC based on time period from 3/31/20 - 3/31/21.

Securities Agent: OK, LA, DE, UT, NC, ME, CO, VT, OH, GA, PR, MA, KY, HI, FL, WI, TN, SC, MD, IA, DC, CT, AZ, WV, NJ, AR, TX, NV, IN, ID, VA, NY, IL, CA, WA, NH, MN, MI, RI, PA, OR; General Securities Representative; Investment Advisor Representative

NMLS#: 1282881

CA Insurance License #: 0K94041

NMLS#: 1282881

CA Insurance License #: 0K94041

About Donna Jordan

Securities Agent: GA, TX, KS, WA, SC, RI, NH, KY, AZ, WV, NJ, NC, MT, PA, FL, DC, CA, WI, UT, OH, NY, IA, CT, HI, TN, ME, MD, IL, DE, AR, VT, PR, OR, MN, IN, VA, OK, NM, LA, CO, SD, NV, MI, MA, ID; General Securities Representative; Investment Advisor Representative

NMLS#: 1255694

NMLS#: 1255694

About William Levy

William started his career at Salomon Brothers working as an investment banker in the Financial Institutions Group as well as Mortgage Backed Trading. He has held various senior roles in Fixed Income and Equities. Most recently before joining Wealth at Barclays, William was a Managing Director of the Special Situations Desk covering some of the firms largest and most sophisticated accounts. He also acted as the relationship banker for the largest global Gaming and Lodging company as well as working with the related families. He had joined Lehman Brothers as the Global Head of Equity Derivatives and Program Trading. Prior to Lehman, William held senior management roles in Equity Derivatives at Morgan Stanley.

Securities Agent: KY, OR, NV, KS, IN, TN, NC, MI, LA, IA, CA, AR, MD, PA, NJ, WV, WI, OK, CO, VA, PR, IL, ID, GA, FL, CT, UT, SD, AZ, ME, HI, MT, RI, OH, NM, DE, VT, SC, NH, DC, WA, TX, NY, MN, MA; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1418883

NMLS#: 1418883

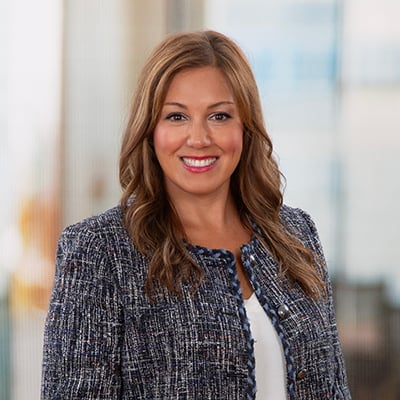

About Jennifer Hradek

Jen has been strategically managing client’s assets and wholistic financial picture for over 18 years. As a Certified Financial Planner™, Jen works closely with high-net worth clients and families to develop and implement comprehensive and often complex financial plans, encompassing goals based portfolio management as well as planning for retirement, tax and estate planning, liability analysis, educational funding. Jen collaborates with clients' attorneys and accountants to ensure that financial recommendations are working in tandem with their tax and estate planning.

Jen is an impassioned advocate for helping women understand their entire financial picture and guides them to financial confidence and independence in all stages of their lives. Through her detail-oriented approach, process to simplify and streamline, and as a constant support and champion for, she has helped many female clients navigate transitions in their lives such as divorce, unexpected loss of a spouse, and caregiving for loved ones.

Before joining Morgan Stanley in 2011, she was an Associate at JPMorgan Chase, providing asset management and dedicated, concierge-level communication and service. She earned her B.S. with honors, double majoring in Finance and Business Management from Sacred Heart University in 2004.

Jen lives in Stratford, CT with her rescue dog Pepper. She is an advocate for dog rescue and is a foster mom for dogs while helping to find their forever homes. She is an avid concert-goer, and enjoys gardening, cooking and spending time on the beach in Montauk, her home away from home.

Jen is an impassioned advocate for helping women understand their entire financial picture and guides them to financial confidence and independence in all stages of their lives. Through her detail-oriented approach, process to simplify and streamline, and as a constant support and champion for, she has helped many female clients navigate transitions in their lives such as divorce, unexpected loss of a spouse, and caregiving for loved ones.

Before joining Morgan Stanley in 2011, she was an Associate at JPMorgan Chase, providing asset management and dedicated, concierge-level communication and service. She earned her B.S. with honors, double majoring in Finance and Business Management from Sacred Heart University in 2004.

Jen lives in Stratford, CT with her rescue dog Pepper. She is an advocate for dog rescue and is a foster mom for dogs while helping to find their forever homes. She is an avid concert-goer, and enjoys gardening, cooking and spending time on the beach in Montauk, her home away from home.

Securities Agent: WI, MT, UT, SC, DC, CT, WV, WA, OK, NH, KS, DE, CO, SD, OR, LA, MD, TN, PR, NC, MA, ID, AR, MI, ME, IN, IA, AZ, HI, VT, RI, PA, NY, NV, KY, GA, FL, TX, OH, NM, NJ, IL, VA, MN, CA; General Securities Representative; Investment Advisor Representative

NMLS#: 1663884

CA Insurance License #: 0H14944

NMLS#: 1663884

CA Insurance License #: 0H14944

About Elizabeth Selimovic

As a Wealth Management Associate, Liz is dedicated to providing clients with highly personalized client service and exceeding clients’ expectations at every interaction. She conducts outreach to maintain strong relationships for the team’s client base and helps identify Firm services and solutions that help support and identify clients’ needs. She assists in safeguarding client assets and is committed to providing excellent client service while providing administrative and operational support to the team. She is an integral member of the team and her many responsibilities include the coordination of the team's day-to-day operations, as well as all aspects of the client experience. Prior to joining Morgan Stanley in 2007, Liz has gained experience in the financial services industry working for prior firms and attended Sacred Heart University. Liz enjoys reading, traveling and volunteering in her community.

About Dennis Berardi

As a Registered Client Service Associate, Dennis assists with onboarding new clients, resolving client inquiries, preparing materials for client meetings and helping clients execute trades. Dennis enjoys working closely with clients and is dedicated to providing world class customer service. Prior to joining our team in June of 2019, Dennis received his Bachelor of Science degree in Business Administration with a Minor in Finance, receiving Magna Cum Laude honors, followed by his Master of Business Administration degree with a Focus in Analytics, both from the University of Bridgeport. While completing his undergraduate degree, Dennis was a member of the University’s Baseball program where he was selected as a team captain during his senior year. Dennis now loves to spend his spare time playing golf or on a beach with friends and family.

About Dylan Roy

As a Client Service Associate, Dylan supports advisors with client onboarding, account servicing, and daily operational needs while helping deliver a high-quality client experience. Dylan works closely with advisors and team members to prepare for client meetings and client inquires. Prior to joining the team in January of 2026, Dylan earned his Bachelor of Science in Business Administration from the Darla Moore School of Business at the University of South Carolina, majoring in Business Economics and Finance. While completing his bachelor’s degree, Dylan gained experience in the financial services industry through internships at prior firms. Outside of work, Dylan enjoys playing golf, staying active, and spending time with family and friends.

Contact Daniel J. Wright

Contact Matthew S Bisland

Contact Donna Jordan

Contact William Levy

Contact Jennifer Hradek

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Shoreview Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

3Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley does not assist with buying or selling art in any way and merely provides information to clients interested learning more about the different types of art markets at a high level. Any client interested in buying or selling art should consult with their own independent art advisor.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

12An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

14Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

15Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

16Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

17Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

18Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

19When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

20When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

21Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

22Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

3Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley does not assist with buying or selling art in any way and merely provides information to clients interested learning more about the different types of art markets at a high level. Any client interested in buying or selling art should consult with their own independent art advisor.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

12An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

14Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

15Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

16Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

17Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

18Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

19When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

20When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

21Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

22Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)