About Me

Randy J. Peterson is a Managing Director and Private Wealth Advisor with Morgan Stanley based in San Francisco, CA.

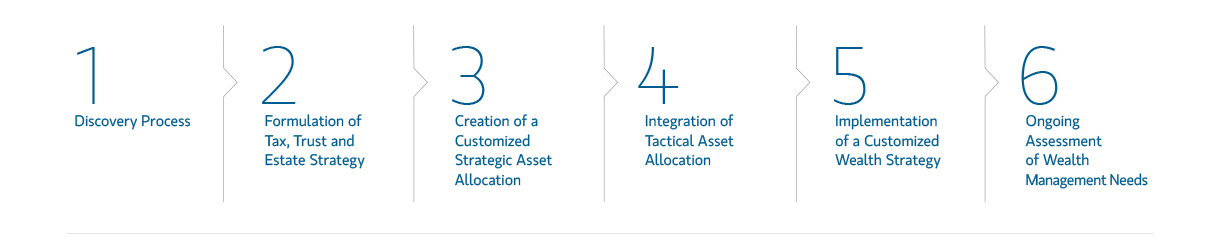

Randy has 32 years of investment management experience. Prior to joining Morgan Stanley, Mr. Peterson was a Senior Managing Director and Wealth Manager for First Republic Investment Management since 2006. He manages relationships for ultra-high net worth families. Mr. Peterson focuses on a broad array of customized family office services, including asset management and financial planning. He specializes in tactical asset allocation, equity and fixed income security selection, and due diligence on external managers, and invests broadly in stocks, bonds, real estate, and alternative investments. His continued work has led him to recognition on Barron’s Top Advisor Rankings*. His team currently manages approximately $3 billion in multi-asset class portfolios for wealthy families. Prior to First Republic, he was with U.S. Trust Company from 1998 to 2006, where he served as a Senior Portfolio Manager. Mr. Peterson began his career as an investment officer in the Investment Management Group at Wells Fargo.

Randy received his B.S. from the University of Colorado, Boulder, and MBA from the University of Oregon. He serves on the board of the San Francisco Maritime National Park Association. In his free time, Randy enjoys skiing, mountain biking, and boating and spends time in Telluride, CO and Tahoe City, CA. Randy lives in San Francisco with his wife, Jennifer, two daughters, and two golden retrievers.

*Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com. Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Securities Agent: MT, MN, NJ, WA, PA, PR, SC, UT, IN, NV, GA, WI, AR, ND, OK, AZ, VT, DC, CT, RI, DE, NM, HI, KY, VA, ME, OR, IL, FL, TX, CA, MD, MA, WY, NH, TN, NC, MI, IA, AL, KS, VI, LA, OH, WV, MS, NY, SD, MO, ID, AK, NE, CO; General Securities Representative; Investment Advisor Representative

NMLS#: 2511635

Industry Award Winner

Industry Award Winner