About Dominick R. Scavelli

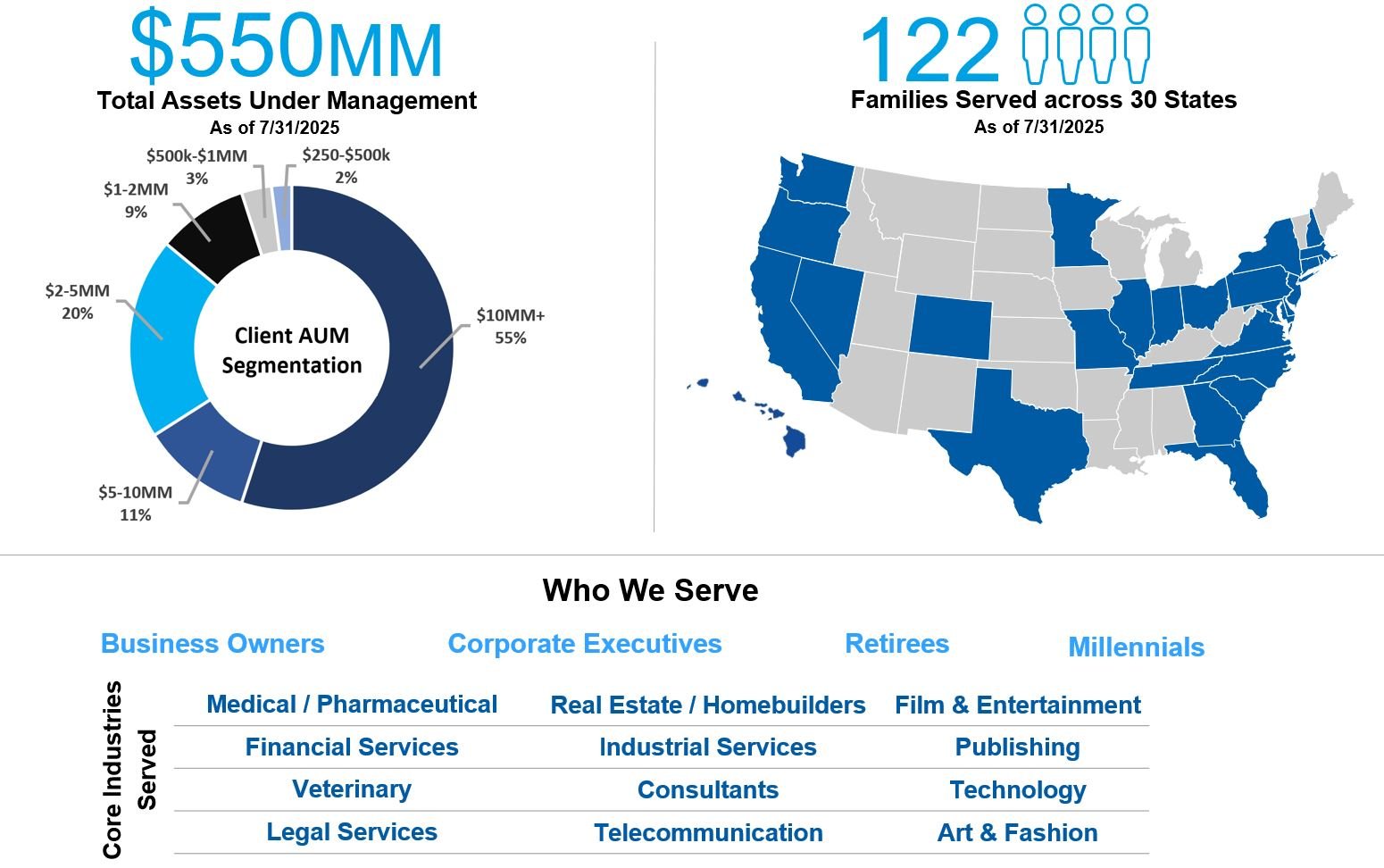

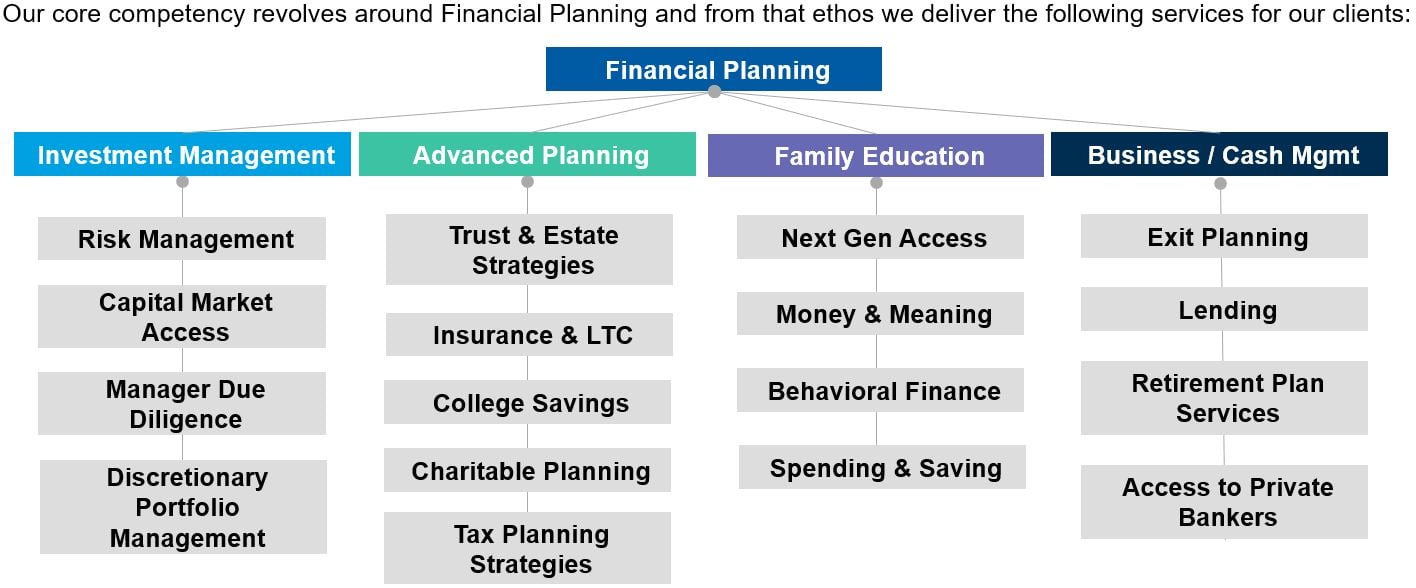

Dominick helps a select group of individuals and families manage wealth through comprehensive financial planning, strategic portfolio management, tailored lending, and advanced trust, tax and wealth transfer strategies. Dominick holds a particular focus working with entrepreneurs, millennials and corporate executives who rely heavily on his expertise in major liquidity events.

Before joining Morgan Stanley in 2021, Dominick spent over a decade at Merrill Lynch and has been recognized by Forbes as a “Best-In-State” Wealth Advisor (2024 & 2025) and a "Top Next-Gen" Wealth Advisor (2019, 2023, 2024 & 2025) – with his team similarly recognized by Forbes as a "Best in State Wealth Management Team" (2023-2026). Professionally he holds the Certified Financial Planner (CFP) certification awarded by the Certified Financial Planner Board of Standards, Inc., earned his Certified Private Wealth Advisor (CPWA) certification from the Investments and Wealth Institute at the University of Chicago’s Booth School of Business, and also holds the Certified Exit Planning Advisor (CEPA) designation as a member of the Exit Planning Institute.

He is a graduate of the Stillman School of Business at Seton Hall University, where he was a distinguished scholar of the University Honors Program and earned a dual bachelor’s degree in Finance and Information Technology Management.

Dominick enjoys spending time with his growing family and playing golf, competitive baseball and basketball on the weekends. He lives in Chatham, NJ with his wife Erica and their three sons.

2024 Forbes America’s Top Wealth Advisors & Best-In-State Wealth Advisors

Source: Forbes (Awarded April 2024) Data compiled by SHOOK Research LLC based on time period from

6/30/22 - 6/30/24.

Forbes Top Next-Gen Wealth Advisors

Source: Forbes.com (Awarded June 2019, August 2023 & August 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/18 - 3/31/19, 3/31/2022-3/31/2023 & 3/31/2023-3/31/2024

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (award Jan 2023-2026) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/25.

Securities Agent: NJ, VT, PA, NC, FL, CT, VA, NY, KY, IN, MO, HI, GA, RI, CA, TX, NH, MD, IL, DC, TN, OR, DE, ME, NV, MA, WA, SC, OH, MN, CO; General Securities Representative; Investment Advisor Representative

NMLS#: 1042089

Industry Award Winner

Industry Award Winner