The Saratoga Group at Morgan Stanley

Our Mission Statement

Comprehensive wealth planning strategies for your life and legacy

Our Story and Services

As your Financial Advisor, we believe confidence is priceless. That’s why we focus on helping individuals and families feel confident about their financial future, freeing them to focus on their life’s priorities. Whether it’s leaving wealth to future generations of loved ones or taking steps to support the causes that matter most to you, we help coach you through your options and give you confidence that your family’s future is managed.

We provide comprehensive, creative solution for all of your financial needs. We can help you meet your goals by delivering a vast array of resources to you in the way that is most appropriate for how you invest and what you want to achieve. Once we thoroughly understand you and your goals, we will customize a financial plan and investment strategy that captures how you want your future to look and help ensure no detail falls through the cracks.

Long lasting relationships are the cornerstone of our practice. At the heart of our relationship with you is dedication and proactive client service. Count on us to stay closely in touch, keeping you informed of all your financial opportunities while also addressing challenges before they become concerns.

We provide comprehensive, creative solution for all of your financial needs. We can help you meet your goals by delivering a vast array of resources to you in the way that is most appropriate for how you invest and what you want to achieve. Once we thoroughly understand you and your goals, we will customize a financial plan and investment strategy that captures how you want your future to look and help ensure no detail falls through the cracks.

Long lasting relationships are the cornerstone of our practice. At the heart of our relationship with you is dedication and proactive client service. Count on us to stay closely in touch, keeping you informed of all your financial opportunities while also addressing challenges before they become concerns.

Services Include

- Wealth ManagementFootnote1

- Wealth PlanningFootnote2

- Asset Management

- Estate Planning StrategiesFootnote3

- Retirement PlanningFootnote4

- Business Succession PlanningFootnote5

- Endowments and FoundationsFootnote6

- 401(k) Rollovers

- Planning for Individuals with Special Needs and their Families

- Municipal BondsFootnote7

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

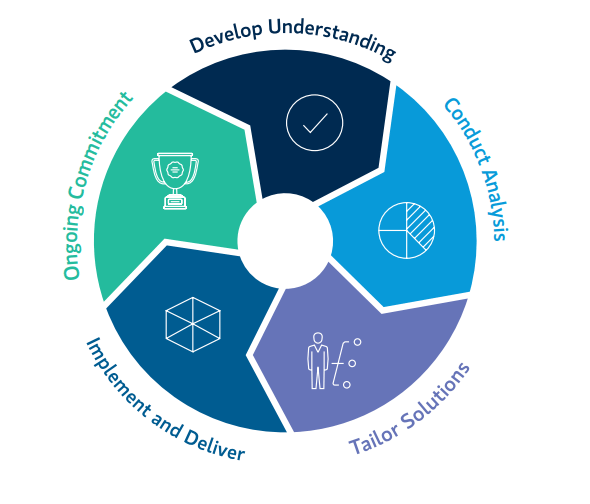

Our Wealth Management Process

As a client of the Saratoga Group, our relationship begins with a thorough understanding of you – your needs, your lifestyle, family, and your goals for the future. Leveraging our vast resources, including intellectual capital, experience, and dedicated service, we can work with you to create a personalized wealth strategy. Over time, we will adapt it to changing circumstances, helping you achieve your goals and protect what is meaningful to you.

Morgan Stanley’s personalized wealth management process is designed to provide a road map to your financial future.

This process can help you visualize the financial future you want for yourself and your family.

Below is the outline of steps to help you achieve your financial goals:

Morgan Stanley’s personalized wealth management process is designed to provide a road map to your financial future.

This process can help you visualize the financial future you want for yourself and your family.

Below is the outline of steps to help you achieve your financial goals:

Develop Understanding

Our process begins with an in-depth conversation with you to help clarify your financial goals, investment preferences and risk tolerance.

Conduct Analysis

Next, your Financial Advisor review your current and future financial situation, identify the likelihood of reaching your goals, and address any potential shortfalls or the impact of unexpected life events.

Identify Risks

We proactively help our clients identify any potential risks that may pose a threat to their financial well-being. Using a dynamic risk assessment overlay, we identify current risks within your investment portfolios and offer suggestions for risk-mitigation strategies that will help decrease future portfolio volatility.

Tailor Solutions

Utilizing all the information obtained through this thorough discovery process, your Financial Advisor will then create a customized strategy to help you achieve your objectives.

Implement and Deliver

As a client of the Saratoga Group along with the trusted guidance from your Financial Advisor, you’ll have access to a comprehensive array of products, services, and accounts that, collectively, can provide you with the foundation for implementing and carrying out your financial strategy.

Ongoing Commitment

Finally, with the dynamic experience of our team and the comprehensive resources of Morgan Stanley, our Wealth Management process will monitor your progress considering changing market conditions — or changes in your circumstances — and can recommend adjustments to help keep you on track.

Location

340 Broadway

Saratoga Springs, NY 12866

US

Direct:

(518) 583-5635(518) 583-5635

Meet The Saratoga Group

About Cody Moore

Cody Moore began his investment career in 2010 after earning his Master of Business Administration with a concentration in Economics and Statistics from Sam Houston State University. Joining Morgan Stanley in 2015, Cody is a Senior Vice President focusing on financial planning, estate planning strategies, fixed income analysis, and portfolio management. He has over a decade of experience helping clients meet their investment and retirement goals. Cody strives to provide his clients with thoughtful, strategic guidance by delivering detailed and well-organized road maps for each individual based on their financial needs.

Cody is a Certified Financial Planner, a standard of excellence in financial planning, taxes, insurance, estate planning, and retirement. He also received The Certified Portfolio Manager Designation from Columbia University as well as a Masters of Finance through Penn State University. These designations and degrees give him the knowledge and expertise to develop comprehensive financial plans for his clients.

Prior to joining the firm, Cody held several positions in the financial industry. Cody started out as a Financial Advisor for Merrill Lynch after earning his MBA. He then transitioned to Invesco, becoming a Regional Vice President working with the top financial advisors all over the country and seeing how elite advisors serve their clients and what sets them apart. Cody brings an institutional money management perspective to all of his clients, helping better serve them in achieving their financial goals.

Cody is a family man first and passionate golfer second. His wife Corey, son Johnny, and daughter Georgia reside in Saratoga Springs. They love to travel and experience new places and foods together. Cody has been an avid golfer since he was a young boy and still maintains a scratch handicap, participating in NY State amateur tournaments.

Cody is a Certified Financial Planner, a standard of excellence in financial planning, taxes, insurance, estate planning, and retirement. He also received The Certified Portfolio Manager Designation from Columbia University as well as a Masters of Finance through Penn State University. These designations and degrees give him the knowledge and expertise to develop comprehensive financial plans for his clients.

Prior to joining the firm, Cody held several positions in the financial industry. Cody started out as a Financial Advisor for Merrill Lynch after earning his MBA. He then transitioned to Invesco, becoming a Regional Vice President working with the top financial advisors all over the country and seeing how elite advisors serve their clients and what sets them apart. Cody brings an institutional money management perspective to all of his clients, helping better serve them in achieving their financial goals.

Cody is a family man first and passionate golfer second. His wife Corey, son Johnny, and daughter Georgia reside in Saratoga Springs. They love to travel and experience new places and foods together. Cody has been an avid golfer since he was a young boy and still maintains a scratch handicap, participating in NY State amateur tournaments.

Securities Agent: HI, FL, CT, MT, IL, GA, AZ, VT, TN, NM, CO, AR, NV, MD, DE, NH, WI, PA, NY, IA, CA, OH, NJ, ME, DC, WA, TX, NC, MN, MI, IN, VA, UT, SC, RI, MA; General Securities Representative; Investment Advisor Representative

NMLS#: 1498379

NMLS#: 1498379

About Mark Pierre

Mark joined Morgan Stanley in 2001 as a Financial Advisor and was promoted to First Vice President in 2021 . After spending his first two years working in the Albany, NY office, he relocated to the Saratoga Springs office where he continues to service his clients today. With over 20 years of experience helping to guide both individual and business clients as they utilize Morgan Stanley’s Intellectual Capital to achieve their Financial, Investment and Banking goals.

Mark, his wife Lisa and their three children reside in Halfmoon, NY. He is an avid outdoorsman and enjoys performing locally with his “Country Music Band”.

Mark, his wife Lisa and their three children reside in Halfmoon, NY. He is an avid outdoorsman and enjoys performing locally with his “Country Music Band”.

Securities Agent: DE, AZ, MN, IA, HI, AR, DC, UT, MT, ME, FL, CO, TX, PA, WI, NC, MI, MA, IL, GA, CT, TN, CA, VT, OH, MD, VA, SC, RI, NY, NJ, NH, LA, IN; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1316471

NMLS#: 1316471

About Wayne Stevens

“I appreciate the opportunity to help our clients understand the intricacies of their financial lives through a collaborative and consultive approach and take great pride in helping clients design and implement financial plans using various strategies to meet client needs.”

Wayne has been a Financial Advisor with Morgan Stanley for over a decade and joined the Saratoga Group at Morgan Stanley in 2022. Among the designations Wayne holds is that of being an Insurance Planning Director, critical in offering small business owner’s strategies with complex wealth transfer concepts, including estate planning, charitable giving, and more.

Wayne graduated from Binghamton University with a BS in Mathematics.

Wayne is active in his community and a long serving member of the Saratoga Springs Lion’s Club. He also enjoys the great outdoors; an avid hiker having traveled to many of the National Parks in the United States. Wayne also enjoys skiing with friends and family during the winter months.

Wayne has been a Financial Advisor with Morgan Stanley for over a decade and joined the Saratoga Group at Morgan Stanley in 2022. Among the designations Wayne holds is that of being an Insurance Planning Director, critical in offering small business owner’s strategies with complex wealth transfer concepts, including estate planning, charitable giving, and more.

Wayne graduated from Binghamton University with a BS in Mathematics.

Wayne is active in his community and a long serving member of the Saratoga Springs Lion’s Club. He also enjoys the great outdoors; an avid hiker having traveled to many of the National Parks in the United States. Wayne also enjoys skiing with friends and family during the winter months.

Securities Agent: NJ, IN, TN, ME, AL, RI, NY, NC, MD, CA, DE, VT, FL, CO, VA, UT, TX, SC, NH, MT, IA, DC, MN, IL, CT, PA, MI, MA, HI, GA, AZ, AR, WI, OH; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1275653

NMLS#: 1275653

About Matthew Waskiewicz

Matthew Waskiewicz is a Financial Advisor with Morgan Stanley. Born and raised in the Capital Region, Matthew obtained his graduate degree College of Saint Rose and worked in the mental health field for 20 years. Matthew joined Morgan Stanley in order to bring his great attention to detail and his innate ability to connect with people to the clients of The Saratoga Group. Matthew helps bring dynamic support and advice to The Saratoga Group’s clients along with an institutional money management perspective that is among the top of the industry.

Matthew’s emphasis is on providing collaborative financial solutions. He believes that with a good plan, persistence and high-quality oversight, anyone can achieve their financial goals. Matthew strives to provide his clients with thoughtful and strategic guidance. By delivering detailed and well-organized road maps, Matthew can cater to different situations, and help people meet their goals.

Outside of the office, Matthew is a family man first and an active outdoors person second. His wife Bhakta, daughter Avery, and son Evan reside in Glenville, NY. They love to travel to the mountains, the ocean and with extended family to experience new places and food together. Matthew is an avid golfer in the summer and a passionate skier in the winter. Matthew continues to actively volunteer his time to a variety of non-profit groups in the area.

Matthew’s emphasis is on providing collaborative financial solutions. He believes that with a good plan, persistence and high-quality oversight, anyone can achieve their financial goals. Matthew strives to provide his clients with thoughtful and strategic guidance. By delivering detailed and well-organized road maps, Matthew can cater to different situations, and help people meet their goals.

Outside of the office, Matthew is a family man first and an active outdoors person second. His wife Bhakta, daughter Avery, and son Evan reside in Glenville, NY. They love to travel to the mountains, the ocean and with extended family to experience new places and food together. Matthew is an avid golfer in the summer and a passionate skier in the winter. Matthew continues to actively volunteer his time to a variety of non-profit groups in the area.

Securities Agent: HI, CA, IN, NY, NH, DE, AL, RI, MT, MN, IL, IA, AZ, TX, SC, OH, NJ, NC, MA, GA, CO, AR, PA, DC, CT, VA, UT, ME, WI, VT, TN, MI, MD, FL; General Securities Representative; Investment Advisor Representative

NMLS#: 2409492

NMLS#: 2409492

Contact Cody Moore

Contact Mark Pierre

Contact Wayne Stevens

Contact Matthew Waskiewicz

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Michael Ryan

Michael Ryan is a Private Banker serving Morgan Stanley Wealth Management offices in New Jersey and New York.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Michael began his career in financial services in 2010 and joined Morgan Stanley in 2017. Prior to joining the firm, he was a Citigold Relationship Manager for Citibank in Queens, NY. Michael was also a Private Client Banker with JP Morgan Chase Bank in New Jersey.

Michael is a graduate of Ramapo College where he received a Bachelor of Science with a concentration in Law and Society Studies. He lives at the Jersey Shore with his family. Outside of the office, Michael donates his time to the Juvenile Diabetes Research Foundation. He enjoys playing golf, skiing, the beach, and spending time with his family.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Michael began his career in financial services in 2010 and joined Morgan Stanley in 2017. Prior to joining the firm, he was a Citigold Relationship Manager for Citibank in Queens, NY. Michael was also a Private Client Banker with JP Morgan Chase Bank in New Jersey.

Michael is a graduate of Ramapo College where he received a Bachelor of Science with a concentration in Law and Society Studies. He lives at the Jersey Shore with his family. Outside of the office, Michael donates his time to the Juvenile Diabetes Research Foundation. He enjoys playing golf, skiing, the beach, and spending time with his family.

NMLS#: 600637

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Saratoga Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)