About Jack Evans

Jack Evans is a Senior Vice President and Financial Advisor who has been with Morgan Stanley since 2007. He has been a financial advisor since 1981, previously with Smith Barney and its predecessor firm, Robinson Humphrey. He has a wealth of knowledge, experience, and wisdom in helping people make important financial decisions.

A Charleston area native, Jack graduated with a BA and a Master’s from Clemson University. He and his attorney wife, Evie, have lived in Mt. Pleasant since 1983. They have three married children also living in the Charleston area: Drew and Kelly Evans, Emily and Thomas Limehouse, and Forrest and Anna Evans and seven grandchildren: Owen, Rhys, Louis, John Forrest, Eliza and Ellis. Jack is active in church and community, serving as both a Deacon and an Elder at Mt. Pleasant Presbyterian, Past-President of the Rotary Club of Mt. Pleasant, and Past-President of Charleston Men’s Chorus, where he has been a member since 1994.

“Over all these many years I have been blessed to have been able to work with and been exposed to the very best of our industry. What they taught me about helping people make important financial decisions doesn’t have a shelf life. Investors want to work with someone they can trust, and that principal will stand the test of time.”

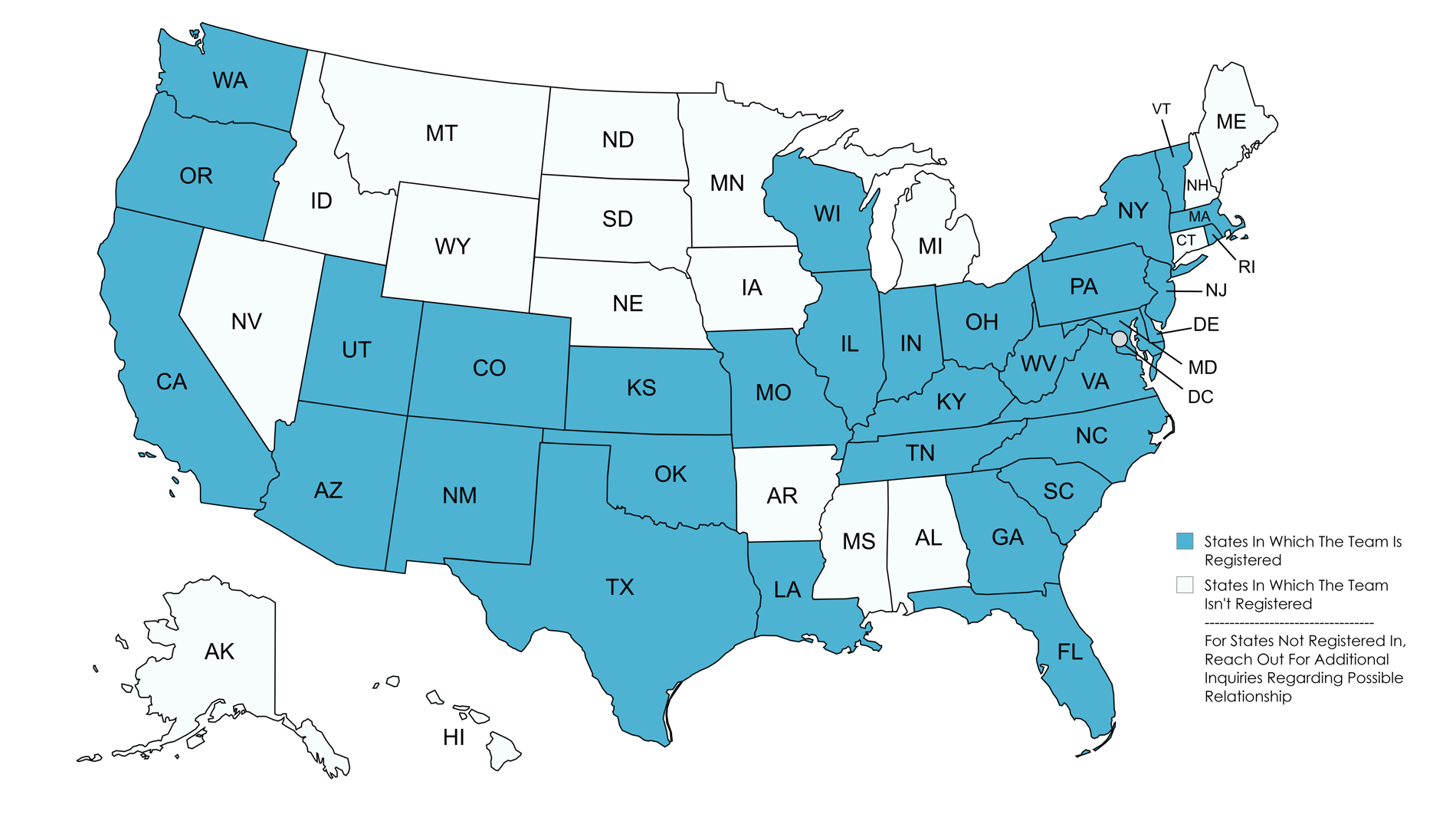

Securities Agent: CO, KY, IL, TN, IN, VT, NJ, MD, FL, AR, AL, UT, OK, NH, KS, TX, OH, NY, AZ, WV, SC, OR, DC, MO, MA, LA, GA, CA, WA, VA, RI, NM, NC, MI, DE, PA; General Securities Representative; Investment Advisor Representative

NMLS#: 1288250