About Laura H Longhi

Laura is a Certified Financial Planner™ and founding partner at The Rolling Wave Group, a highly skilled advisory team located in Sea Girt, NJ. With energy and enthusiasm, Laura empowers clients to achieve new levels of success through a disciplined and personalized approach to financial planning. She enjoys helping individuals, families, and business owners understand their full financial picture, so they can identify and overcome any obstacles, while achieving their specific financial goals.

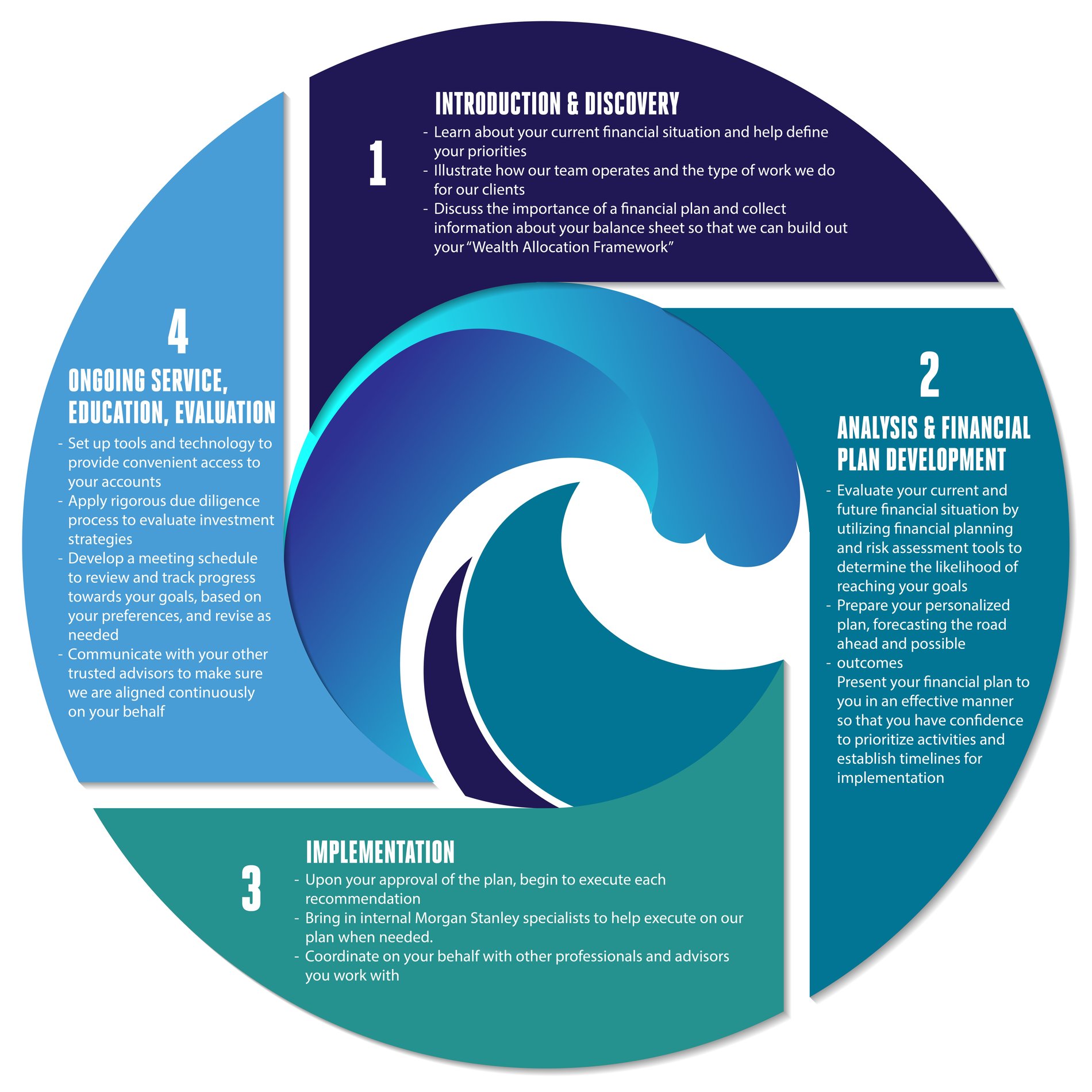

Laura’s comprehensive financial planning process focuses on building personal relationships with her clients to understand their values, needs, and the why behind them. Her approachable style helps educate clients so that they can make well-informed decisions, while maintaining the discipline necessary to navigate today’s changing markets. Sharing insights from others who have experienced similar situations in life and business allows Laura to think outside of the box when making recommendations. Laura takes great pride in providing her clients with the highest level of service on both sides of their balance sheet.

Growing up in Brielle, Laura attended Rutgers University where she earned her Bachelor’s degree in Economics in 2012. Upon graduation, she joined Merrill Lynch as a Financial Advisor. Throughout her career, she has remained committed to advanced education for herself and her clients. She earned her Certified Financial Planner™ designation in 2017.

Laura believes balance is vital to a happy life. She lives in Point Pleasant with her husband, Ludovico, and son, Levi. Outside of the office she enjoys giving back to the community in which she grew up. Laura also loves to do Pilates, host dinner parties, and spends most of her time with her large and extended family.

Securities Agent: CT, CA, PA, DE, WA, OH, NC, MA, ID, AL, SC, FL, IL, CO, KS, AK, VA, NV, NJ, WV, TX, HI, GA, AZ, VT, NY, MI, MD, IN; General Securities Representative; Investment Advisor Representative

NMLS#: 1116100