Sandy Sulik

As your Financial Advisor, I work alongside you to help preserve and grow your wealth. I can assist you in clearly defining your goals and can assess which resources are appropriate to achieve them, both from the vast array available at Morgan Stanley and from our partners. I can offer you access to award-winning platforms, a full suite of financial products and services, and some of the world's most seasoned and respected investment partners.

With over 39 years of experience as a financial advisor, Fred carries licenses as a General Securities Representative (Series 7), Manager (Series 9 and 10), Managed Futures (Series 31) and insurance and annuities representative. Fred offers experience in creating custom portfolios tailored to each phase of a client's financial life. He successfully implements strategies incorporating equities, bonds, preferred and hybrid instruments, ETFs, mutual funds, options and annuity products. His practice provides a proactive approach to investing and exceptional client service.

In The Villages, Fred holds a leadership position with The Villages Camaro Club and enjoys playing Men's Divisional Softball and golf. He was active in his South Florida community as a past president of the Fort Lauderdale Beach Kiwanis Club and the Westminster Academy Booster Club, parish member and lector, as well as a volunteer high school basketball coach. Spending time with family and friends is a leisure activity he enjoys.

Fred is a Massachusetts native and the oldest of three siblings. His family moved to Fort Lauderdale in 1970 where

Fred grew up working in the family's automobile business. He is the father of four adult children and six grandchildren.

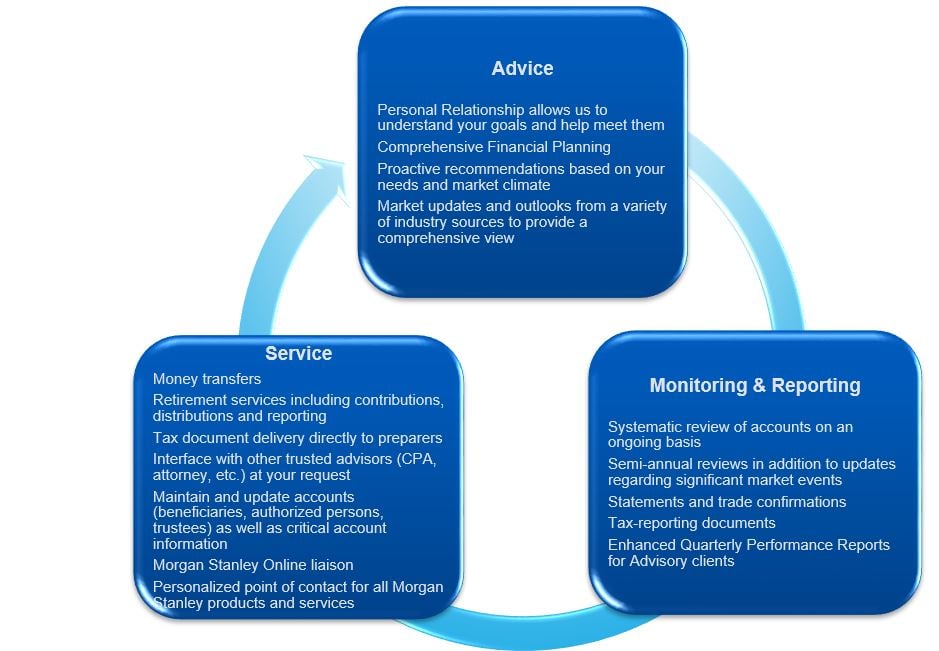

Our client experience model is based on these core values:

Price is what you pay. Value is what you get. – Warren Buffett

Retirees

Developing a plan for retirement is essential. Working with an experienced advisor can help you define and meet your personal retirement goals. Retirement planning on your own can be stressful...we strive to make the process as easy as possible.

Multi-Generational Families

Our financial planning process for multi-generational families takes into account your lifestyle, portfolio objectives and legacy goals. We strive to educate the next generation on handling the responsibilities of inheriting wealth.

Financial Planning Goals are personal…your financial plan should be, too. We will work with you to identify your goals, manage risk and build a customized plan to navigate your course.

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24