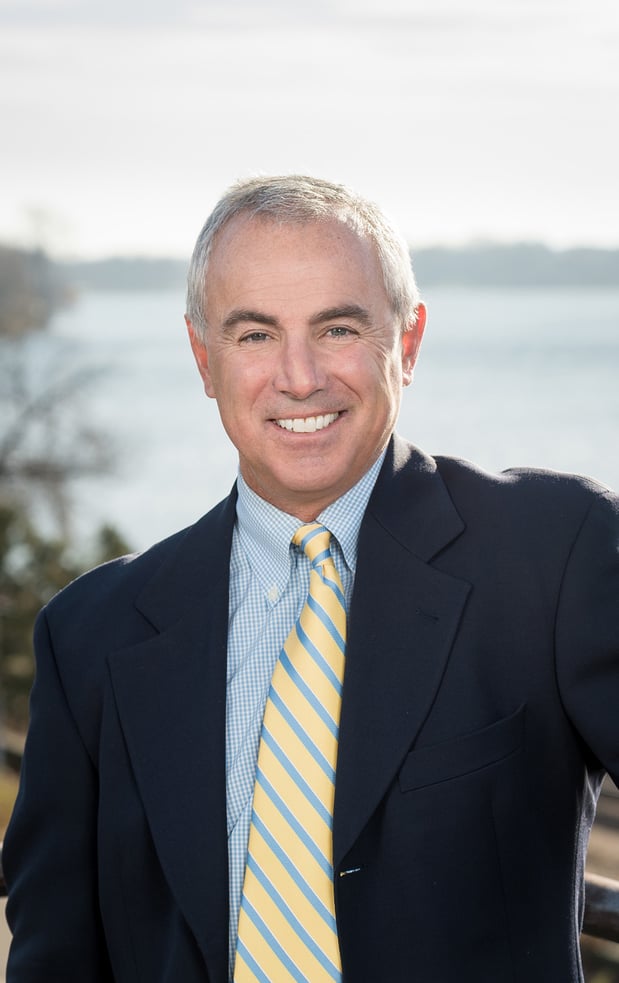

About Brian J Warpinski

With over 22 years of experience in the financial services industry, Brian began his career with Merrill Lynch in 1998 – where he met his business partner Kevin Riskevich. The team moved to Morgan Stanley in 2008, and has been providing highly customized advice and investment solutions since.

Brian has enjoyed puzzles, math, and relationships his entire life – which has brought him to a successful career as a financial advisor. Brian often looks at financial advising in this way, bringing the facets of a client’s life together by putting the picture of their financial life together for them in their own unique way. Brian believes his career as a Financial Advisor has brought his passions and skills together, and that he does not have to work every day because he always thoroughly enjoys it.

When working with clients, Brian likes to work backwards – starting with determining the end goal of what needs to be accomplished. This provides Brian with the direction and path to build the foundational aspect of his client’s lives – Planning, Estate Transfer, Philanthropy, Tax Planning, and Generational Aspects. Brian views his approach as a family office team inside Morgan Stanley, and the team is comprised of diverse and unique skillsets that successfully address the needs of all clients. His favorite aspect of the business is truly understanding what motivates each individual client.

Outside of the office, Brian can be found spending time with his family, and his three children are the stars of his life. He has coached youth sports for many years, finding time to coach baseball, basketball, and has been a coach in the Edina Youth Football Association for the past 12 years. Brian also has many hobbies that he is passionate about, these include road biking, cross country skiing, and golf. Brian is also the former Board Chair of the Greater Minneapolis Crisis Nursery, AIM Higher Supporter, and an active member of the Our Lady of Grace Church.

Securities Agent: AZ, WI, TX, KY, IA, FL, SD, PA, MO, MN, WA, TN, NE, CO, NJ, IN, MA, NY, NV, ND, IL, OR, ME, CA, MI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1285296