Industry Award Winner

Industry Award WinnerOur Mission Statement

We provide tailored, objective advice that is focused on doing what’s right for you. We listen to you as our friend and support you as our family.

You Define Success, We Help You Achieve It

Like many successful individuals, you seek greater balance. You would rather spend less time thinking about your finances and more time living your life. You appreciate sound advice, and value caring professionals who take the time to educate you about your money, while helping you manage the emotions that can often get in the way of making smart investment decisions.

At The Plaza Group, we understand the challenges you face.

As a family team, we created a unique advisory practice that brings together decades of industry knowledge with extensive skills in investment management and risk mitigation to create a personalized experience where you feel listened to, understood, and always the most important part of our relationship. Our team of five professionals includes three family members and multigenerational depth. We are here to take care of you and your extended family. We understand the value of families and the complexities of building and transitioning wealth.

In January 2026, The Plaza Group was recognized as #29 Best-In-State Wealth Management Teams in Kansas by Forbes and Shook Research. This marks the team's fourth consecutive year of recognition. With passion and attention to detail, we guide you in making informed decisions about your wealth through ongoing education and a commitment to outstanding service. We begin with a deep understanding of what’s important to you and your future. This discovery process serves as the foundation of a comprehensive plan that is completely yours and has the built-in flexibility to evolve as your life changes.

Getting started is easy. It begins with a conversation. We look forward to getting to know you and sharing details on how we can enhance the quality of your life. Our ultimate goal is to provide you with a level of confidence and comfort that allows to spend less time worrying about your finances and more time living your best life.

Source: Forbes (Awarded Jan 2026) Data compiled by SHOOK Research LLC based for the period 3/31/24-3/31/25.

https://www.morganstanley.com/disclosures/awards-disclosure.html

At The Plaza Group, we understand the challenges you face.

As a family team, we created a unique advisory practice that brings together decades of industry knowledge with extensive skills in investment management and risk mitigation to create a personalized experience where you feel listened to, understood, and always the most important part of our relationship. Our team of five professionals includes three family members and multigenerational depth. We are here to take care of you and your extended family. We understand the value of families and the complexities of building and transitioning wealth.

In January 2026, The Plaza Group was recognized as #29 Best-In-State Wealth Management Teams in Kansas by Forbes and Shook Research. This marks the team's fourth consecutive year of recognition. With passion and attention to detail, we guide you in making informed decisions about your wealth through ongoing education and a commitment to outstanding service. We begin with a deep understanding of what’s important to you and your future. This discovery process serves as the foundation of a comprehensive plan that is completely yours and has the built-in flexibility to evolve as your life changes.

Getting started is easy. It begins with a conversation. We look forward to getting to know you and sharing details on how we can enhance the quality of your life. Our ultimate goal is to provide you with a level of confidence and comfort that allows to spend less time worrying about your finances and more time living your best life.

Source: Forbes (Awarded Jan 2026) Data compiled by SHOOK Research LLC based for the period 3/31/24-3/31/25.

https://www.morganstanley.com/disclosures/awards-disclosure.html

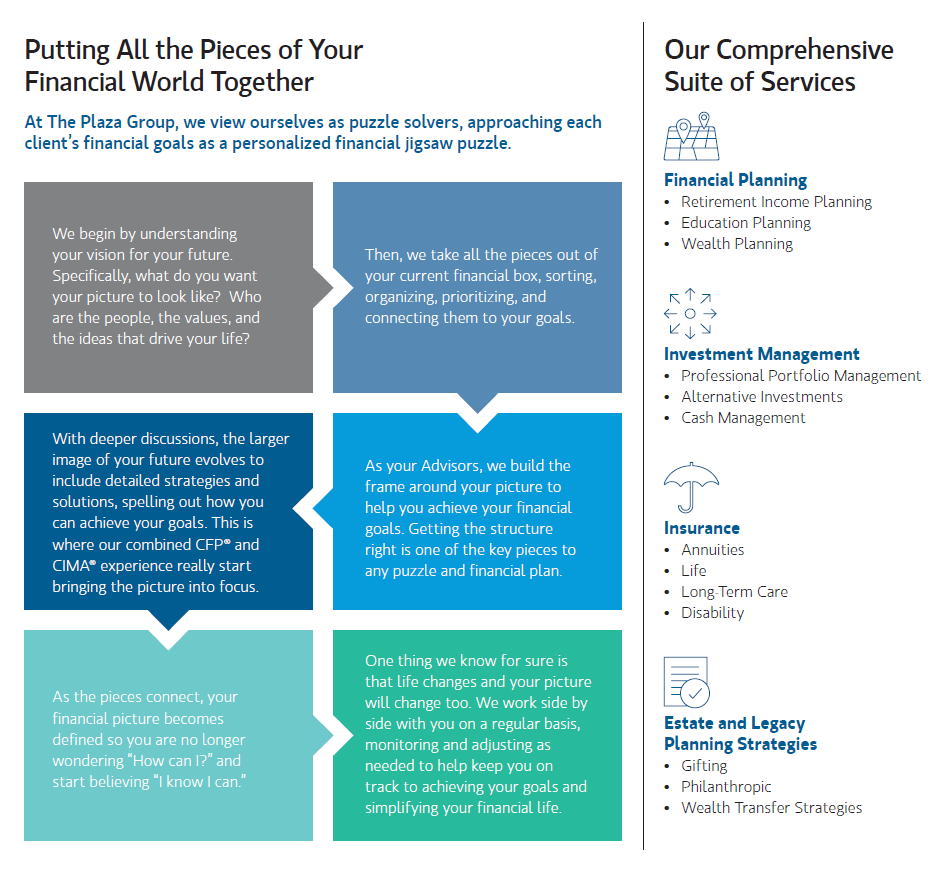

Services Include

- Wealth ManagementFootnote1

- Financial PlanningFootnote2

- Professional Portfolio ManagementFootnote3

- Alternative InvestmentsFootnote4

- Sustainable InvestingFootnote5

- Planning for Education FundingFootnote6

- Retirement PlanningFootnote7

- AnnuitiesFootnote8

- Life InsuranceFootnote9

- Long Term Care InsuranceFootnote10

- Estate Planning StrategiesFootnote11

- Cash Management and Lending ProductsFootnote12

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Our Strengths

We come to work every day focused on making a real difference in the lives of our clients and the people they care about. The following attributes underscore our commitment to an exceptional client experience.

Awards and Recognition

We are grateful to work with an exceptional group of clients. We take pride in guiding them in the management of their finances so they can pursue their life goals. For the work we do, we have been honored to receive both firm and industry recognition. In 2026, Teri was recognized as a Forbes Top Women Wealth Advisors Best-in-State. This marks her seventh consecutive year of recognition by Forbes. Sheila was named to Morgan Stanley’s Pacesetter’s Club in 2013, 2015 and 2016. Jen was named to Morgan Stanley’s Pacesetter’s Club in 2024 and 2025. The Pacesetter’s Club recognizes advisors early in their career for demonstrating exceptional professional standards and first-class client service. For 2026, Sheila was awarded the Five Star Wealth Manager Award, marking the sixth consecutive year she has received this award. Teri has been awarded the Five Star Wealth Manager Award for 2021 – 2025.

The Plaza Group as a whole is pleased to announce that we have been awarded the Forbes Best-in-State Wealth Management Teams for 2026. This marks the team’s fourth consecutive year of recognition.

2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded January 2026). This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period 3/31/24–3/31/25.

2021 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2021). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2021-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2021-2023) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2021 Award - 04/20/20 - 10/23/20

2022 Award - 04/20/21 - 10/15/20

2023 Award - 04/18/22 - 10/21/22

2024 Award - 04/10/24 - 10/31/24

2025 Award - 04/10/25 - 10/01/25

2026 Forbes Best-In-State Wealth Management TeamsThe Plaza Group as a whole is pleased to announce that we have been awarded the Forbes Best-in-State Wealth Management Teams for 2026. This marks the team’s fourth consecutive year of recognition.

2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded January 2026). This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period 3/31/24–3/31/25.

2021 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2021). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2021-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2021-2023) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2021 Award - 04/20/20 - 10/23/20

2022 Award - 04/20/21 - 10/15/20

2023 Award - 04/18/22 - 10/21/22

2024 Award - 04/10/24 - 10/31/24

2025 Award - 04/10/25 - 10/01/25

We Treat You Like Family

We commit to building deep and caring relationships. We do this by working with a select group of clients who value our depth of knowledge in providing comprehensive strategies that go well beyond investments. The bonds we form are fundamental to our mission and it is our goal that they span generations.

Personalized Service

We take the time to get to know you personally, so we may truly understand the challenges and circumstances surrounding you and your family. This enables us to create a plan that is customized to your situation and can easily adapt to changes in your life and new priorities as they change over time.

Extensive Experience

With significant experience working in different roles and industries before turning our talents to financial services, we believe the diversity of our backgrounds enables us to deliver fresh ideas for today’s complex world. We leverage our business acumen and analytical skills to identify appropriate strategies for your specific circumstances. Our priority is to be your first call for any financial matter – no matter how simple or complex the situation.

Knowledge and Understanding

We have a concentration of education and experience that is rare in one group of advisors. Our industry credentials include Certified Investment Management Analyst® and Certified Wealth Strategist® (Teri) and Certified Financial PlannerTM (Sheila). And with nearly 50 years of collective financial services experience, we believe we have gained the wisdom and skills needed to tackle the challenges of managing everything that life throws at you.

Location

11161 Overbrook Rd.

Ste 225

Leawood, KS 66211

US

Direct:

(913) 402-5264(913) 402-5264

Meet The Plaza Group

About Teri Salach

Teri Salach is a Senior Vice President, Senior Portfolio Manager Director, and Financial Advisor. She has been with Morgan Stanley since 1998, providing wealth management for her clients. She holds the Certified Investment Management Analyst® (CIMA®) and Certified Wealth Strategist® (CWS®) designations. Teri has also been named a Top Women Wealth Advisor by Forbes in 2024.

Teri grew up an Iowa farm girl and has a strong work ethic. She followed in her father’s footsteps and became a Financial Advisor. She is proud of her family’s legacy.

Her broad based knowledge coupled with Morgan Stanley’s vast resources help her to produce comprehensive solutions including retirement, estate, investment, and insurance planning strategies.

Teri is very analytical. In addition to her professional designations, she holds degrees in Mathematics and Computer Science. Her analytical skills help her to successfully manage portfolios and create customized plans, as well as fostering a thorough appreciation of her clients’ unique objectives.

By putting clients first and sincerely caring about their well-being, Teri has built a successful practice. She takes pride in having developed relationships that have lasted for decades, including families whom her practice has served for multiple generations. She enjoys working with individuals, helping them feel confident with their wealth and investments.

She earned a BS in Mathematics and Computer Science from Central Michigan University and holds Certified Investment Management Analyst® (CIMA®) from the Wharton School of Business, Certified Wealth Strategist® (CWS®) from the Cannon Financial Institute, and Senior Portfolio Management Director designations.

Teri serves on the Executive Board of The Rehabilitation Institute Foundation, teaches classes at Church of the Resurrection, volunteers for Harvesters, and has worked as a Girls Scout Troop leader. She is married with two grown children, all living in Kansas City. Teri enjoys outdoor activities: golf, hiking, skiing, running and likes to play the piano and harp.

Most recently, Teri's consistent creativity and excellence in providing a wide range of investment products and wealth management services to her clients earned her Morgan Stanley’s prestigious Century Club recognition for 2024.

Forbes America's Top Women Wealth Advisors (2024)

Source: Forbes.com (Awarded Apr 2024) Data compiled by SHOOK Research LLC based on time period from 9/30/23 - 9/30/24.

https://www.morganstanley.com/disclosures/awards-disclosure.html

Teri grew up an Iowa farm girl and has a strong work ethic. She followed in her father’s footsteps and became a Financial Advisor. She is proud of her family’s legacy.

Her broad based knowledge coupled with Morgan Stanley’s vast resources help her to produce comprehensive solutions including retirement, estate, investment, and insurance planning strategies.

Teri is very analytical. In addition to her professional designations, she holds degrees in Mathematics and Computer Science. Her analytical skills help her to successfully manage portfolios and create customized plans, as well as fostering a thorough appreciation of her clients’ unique objectives.

By putting clients first and sincerely caring about their well-being, Teri has built a successful practice. She takes pride in having developed relationships that have lasted for decades, including families whom her practice has served for multiple generations. She enjoys working with individuals, helping them feel confident with their wealth and investments.

She earned a BS in Mathematics and Computer Science from Central Michigan University and holds Certified Investment Management Analyst® (CIMA®) from the Wharton School of Business, Certified Wealth Strategist® (CWS®) from the Cannon Financial Institute, and Senior Portfolio Management Director designations.

Teri serves on the Executive Board of The Rehabilitation Institute Foundation, teaches classes at Church of the Resurrection, volunteers for Harvesters, and has worked as a Girls Scout Troop leader. She is married with two grown children, all living in Kansas City. Teri enjoys outdoor activities: golf, hiking, skiing, running and likes to play the piano and harp.

Most recently, Teri's consistent creativity and excellence in providing a wide range of investment products and wealth management services to her clients earned her Morgan Stanley’s prestigious Century Club recognition for 2024.

Forbes America's Top Women Wealth Advisors (2024)

Source: Forbes.com (Awarded Apr 2024) Data compiled by SHOOK Research LLC based on time period from 9/30/23 - 9/30/24.

https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: IA, NH, WA, NY, MT, IN, WV, VA, GA, CT, NM, NC, MN, TX, PA, NE, CO, TN, OK, OH, MS, MO, AZ, NV, MI, IL, CA, SC, KS, FL, DC, AL, ID, AR, UT; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1430987

NMLS#: 1430987

About Sheila K Davis

Sheila K. Davis, CFP®

Senior Vice President

Financial Advisor

Financial Planning Specialist

Family Wealth Advisor

Portfolio Management Director

Sheila brings a wealth of experience to her role as a Certified Financial Planner®, Family Wealth Advisor and founding partner of The Plaza Group. With more than 25 years of industry experience, she empowers clients to live a better life and aims to be their first call for anything financial. Her extensive background allows her to provide a broad array of services – from diversifying an investment portfolio to generating an income stream in retirement to optimizing the benefits of social security. She loves working with people and sharing information to help them reach a goal or solve a puzzle. For Sheila, being a Financial Advisor is not just her profession, it’s her life.

Growing up in the small town of DeSoto, KS, Sheila has always been a knowledge-based person. As a woman, she was told that people would take advantage of her if she didn’t know what she was doing. This advice has become an underlying principle of her life and her practice. From filing taxes to buying a home, Sheila invests the time to educate herself on the finer details of the discipline, so she can make informed decisions with confidence. She brings this diligence to her advisory practice, helping clients understand the intimate nuances of their finances so they can make better and smarter decisions.

A magna cum laude graduate of Emporia State University, Sheila earned her M.B.A. from the University of Kansas. These are just two of the many credentials Sheila has achieved throughout her life. As a Financial Advisor at Morgan Stanley, Sheila has completed various advanced programs, earning such designations as Financial Planning Specialist, Family Wealth Advisor, and Portfolio Management Director. She is also a Certified Financial Planner® (CFP®), the recognized standard of excellence for personal financial planning. These distinctions demonstrate Sheila’s unrelenting commitment to a world-class client experience. She draws upon her deep knowledge and insights to provide clients with tailored advice and customized strategies to help them achieve their goals.

Sheila believes balance is vital to a happy life. She and her husband, Randy, have been married 30 years and have two grown sons. With a passion for helping women, Sheila is the Chair of the Women’s Advisory Committee for the Kansas/Missouri complex at Morgan Stanley, where she first met her current business partner, Teri Salach. Outside of the office, Sheila enjoys a wide array of activities from scuba diving to wildlife photography to boating. She loves to travel to great places for great adventures and is working on taking 10 amazing trips over 10 years. Trips so far have been Australia, Belize, Africa, Alaska Chile, Thailand, and Spain. Next up is The Galapagos Islands in 2025.

Senior Vice President

Financial Advisor

Financial Planning Specialist

Family Wealth Advisor

Portfolio Management Director

Sheila brings a wealth of experience to her role as a Certified Financial Planner®, Family Wealth Advisor and founding partner of The Plaza Group. With more than 25 years of industry experience, she empowers clients to live a better life and aims to be their first call for anything financial. Her extensive background allows her to provide a broad array of services – from diversifying an investment portfolio to generating an income stream in retirement to optimizing the benefits of social security. She loves working with people and sharing information to help them reach a goal or solve a puzzle. For Sheila, being a Financial Advisor is not just her profession, it’s her life.

Growing up in the small town of DeSoto, KS, Sheila has always been a knowledge-based person. As a woman, she was told that people would take advantage of her if she didn’t know what she was doing. This advice has become an underlying principle of her life and her practice. From filing taxes to buying a home, Sheila invests the time to educate herself on the finer details of the discipline, so she can make informed decisions with confidence. She brings this diligence to her advisory practice, helping clients understand the intimate nuances of their finances so they can make better and smarter decisions.

A magna cum laude graduate of Emporia State University, Sheila earned her M.B.A. from the University of Kansas. These are just two of the many credentials Sheila has achieved throughout her life. As a Financial Advisor at Morgan Stanley, Sheila has completed various advanced programs, earning such designations as Financial Planning Specialist, Family Wealth Advisor, and Portfolio Management Director. She is also a Certified Financial Planner® (CFP®), the recognized standard of excellence for personal financial planning. These distinctions demonstrate Sheila’s unrelenting commitment to a world-class client experience. She draws upon her deep knowledge and insights to provide clients with tailored advice and customized strategies to help them achieve their goals.

Sheila believes balance is vital to a happy life. She and her husband, Randy, have been married 30 years and have two grown sons. With a passion for helping women, Sheila is the Chair of the Women’s Advisory Committee for the Kansas/Missouri complex at Morgan Stanley, where she first met her current business partner, Teri Salach. Outside of the office, Sheila enjoys a wide array of activities from scuba diving to wildlife photography to boating. She loves to travel to great places for great adventures and is working on taking 10 amazing trips over 10 years. Trips so far have been Australia, Belize, Africa, Alaska Chile, Thailand, and Spain. Next up is The Galapagos Islands in 2025.

Securities Agent: TX, NH, WV, UT, MT, IA, CO, TN, NY, KS, CT, NV, MN, WA, VA, OH, NC, NM, IN, GA, CA, NE, MS, AL, ID, PA, OK, MO, IL, MI, DC, AZ, AR, SC, FL; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1290488

NMLS#: 1290488

About Jennifer Denning

Jen brings a fresh face and perspective to The Plaza Group at Morgan Stanley. Her role as a Certified Financial Planner® (CFP®), gives her the experience and knowledge to support clients in achieving their financial goals. Prior to working for Morgan Stanley, Jen worked for several years at Deloitte, a major public accounting firm, as a Senior Auditor. She earned her Certified Public Accounting (CPA) license after graduating with her master’s degree in Accounting from the University of Kansas (she is non-practicing at Morgan Stanley). These distinctions demonstrate Jen's unrelenting commitment to a world-class client experience. She draws upon her deep knowledge and insights to provide clients with tailored advice and customized strategies to help them achieve their goals.

Growing up in Overland Park, KS, Jen has always been an analytical person, having a strong attention to detail, and priding herself on her business acumen. She even uses these skills in her free time as you can often find her painting, doing all types of puzzles, and playing around in her excel workbooks.

While Jen’s accounting experience found her success and allowed her to use all her strengths, there was one core piece missing in her professional life: the rewarding aspect of helping others. Becoming a financial advisor filled that missing piece and provided her the holistic career path she was looking for.

Jen currently lives in Overland Park with her husband, Matt, and son, Brooks, who was born in September 2024. Outside of the office, Jen enjoys music; she plays the piano, sings, and has intentions to learn the guitar. She also loves spending time outdoors, and you will often hear her talk about spending weekends at the lake, golfing, or in the mountains hiking and skiing. She is also an avid Kansas City Chiefs fan, for which she has season tickets.

Most recently, Jen was named to Morgan Stanley's 2024 Pacesetters Club. A program that recognizes successful financial advisors who demonstrate the highest professional standards and first-class client service.

Growing up in Overland Park, KS, Jen has always been an analytical person, having a strong attention to detail, and priding herself on her business acumen. She even uses these skills in her free time as you can often find her painting, doing all types of puzzles, and playing around in her excel workbooks.

While Jen’s accounting experience found her success and allowed her to use all her strengths, there was one core piece missing in her professional life: the rewarding aspect of helping others. Becoming a financial advisor filled that missing piece and provided her the holistic career path she was looking for.

Jen currently lives in Overland Park with her husband, Matt, and son, Brooks, who was born in September 2024. Outside of the office, Jen enjoys music; she plays the piano, sings, and has intentions to learn the guitar. She also loves spending time outdoors, and you will often hear her talk about spending weekends at the lake, golfing, or in the mountains hiking and skiing. She is also an avid Kansas City Chiefs fan, for which she has season tickets.

Most recently, Jen was named to Morgan Stanley's 2024 Pacesetters Club. A program that recognizes successful financial advisors who demonstrate the highest professional standards and first-class client service.

Securities Agent: KS, DC, WA, UT, NE, MO, ID, IA, TN, PA, IN, CO, NC, FL, MT, MS, MN, GA, CA, AZ, AR, VA, NY, NM, CT, AL, TX, MI, IL, NH, WV, NV, SC, OK, OH; General Securities Representative; Investment Advisor Representative

NMLS#: 2309306

NMLS#: 2309306

About David Salach

David joined The Plaza Group in 2022 and is fully registered having passed the Series 7 and 66 as well as being licensed in insurance. Before working at Morgan Stanley, he worked in both corporate logistics and banking. While at Famers Bank of Kansas City he focused on lending and mortgages. David earned his B.S. in Finance and Management at Washburn University where he also competed on the Men’s Basketball team.

David brings his experience in the banking and lending industry to the team as both Morgan Stanley and The Plaza Group grow and continue to broaden the services offered to manage your wealth. He has worked with managing client's complex situations and creating solutions. This experience is valuable as each of our clients have unique lives and situations in which we strive to develop plans and recommendations.

David is a third generation Financial Advisor at Morgan Stanley, joining his mother, Teri Salach, on the team and retired grandfather, Gary Christensen. His sister, Jen Denning, is also on the team. David is proud to carry on the family legacy. Working as a family team gives us insight and empathy to working with the complexities of your family wealth.

Growing up in Overland Park, Kansas, David developed his competitive spirit and work ethic by participating in various activities and sports. He currently lives in De Soto, Kansas with his wife Shayla. David enjoys sports, playing the guitar and spending time with his friends. He loves to golf and competing in local basketball pro-am leagues. He is a fan of the Kansas City Chiefs, Royals and Michigan State Spartans

David brings his experience in the banking and lending industry to the team as both Morgan Stanley and The Plaza Group grow and continue to broaden the services offered to manage your wealth. He has worked with managing client's complex situations and creating solutions. This experience is valuable as each of our clients have unique lives and situations in which we strive to develop plans and recommendations.

David is a third generation Financial Advisor at Morgan Stanley, joining his mother, Teri Salach, on the team and retired grandfather, Gary Christensen. His sister, Jen Denning, is also on the team. David is proud to carry on the family legacy. Working as a family team gives us insight and empathy to working with the complexities of your family wealth.

Growing up in Overland Park, Kansas, David developed his competitive spirit and work ethic by participating in various activities and sports. He currently lives in De Soto, Kansas with his wife Shayla. David enjoys sports, playing the guitar and spending time with his friends. He loves to golf and competing in local basketball pro-am leagues. He is a fan of the Kansas City Chiefs, Royals and Michigan State Spartans

Securities Agent: VT, MN, TX, OH, NC, KS, ID, MS, IA, WV, MT, MD, DE, AR, UT, OR, NV, MA, CO, AZ, GA, DC, CT, TN, AL, OK, FL, NH, VA, MI, IN, IL, WI, SC, PA, NE, CA, WA, SD, NY, NM, MO; General Securities Representative; Investment Advisor Representative

NMLS#: 2038960

NMLS#: 2038960

About TM Murphy

TM has been with Morgan Stanley for 11 years and brings extensive knowledge of the financial industry and experience servicing clients. As she says, “Service is my motto!” Prior to Morgan Stanley, she worked in the commercial banking and mortgage lending field for 30 years.

TM is a native of Ohio, although she calls Kansas her home for the last 26 years. She holds a Degree from the University of Mississippi and spends her spare time pursuing her passions of antiquing, politics, and teaching children’s church. She has been married to her husband, Mike, for 41 years, and together they share two adored children and their spouses, two grandchildren, and a sweet fur baby named Winniepoo.

TM is a native of Ohio, although she calls Kansas her home for the last 26 years. She holds a Degree from the University of Mississippi and spends her spare time pursuing her passions of antiquing, politics, and teaching children’s church. She has been married to her husband, Mike, for 41 years, and together they share two adored children and their spouses, two grandchildren, and a sweet fur baby named Winniepoo.

About Aaliyah Buckner

Aaliyah has worked with Morgan Stanley for just under a year, after graduating from John Brown University with her Bachelors in Accounting and Management and her Masters in International Business. Aaliyah is a Certified Associate in Project Management (CAPM). Aaliyah is the Treasurer of a non-profit organization, The Women of Purpose, as well as Parade Coordinator for their annual Juneteenth event hosted at Prairiefire in Overland Park, KS.

Aaliyah is a Kansas City native, born and raised. Although she calls KC her home, she loves to travel and is always the first person to plan the entire trip. Her passion lies in experiencing new things and embracing other cultures; something about experiencing other cultures and recognizing the similarities and differences truly brings her joy. As a former athlete, Aaliyah loves to stay active whether that be - running, going to the gym, playing volleyball, or dancing – she is always on the move. Outside of that, Aaliyah spends a lot of time hanging out with her friends and family.

Aaliyah is a Kansas City native, born and raised. Although she calls KC her home, she loves to travel and is always the first person to plan the entire trip. Her passion lies in experiencing new things and embracing other cultures; something about experiencing other cultures and recognizing the similarities and differences truly brings her joy. As a former athlete, Aaliyah loves to stay active whether that be - running, going to the gym, playing volleyball, or dancing – she is always on the move. Outside of that, Aaliyah spends a lot of time hanging out with her friends and family.

Contact Teri Salach

Contact Sheila K Davis

Contact Jennifer Denning

Contact David Salach

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

Forbes Best-In-State Wealth Management Teams Source: Forbes (Awarded Jan 2026) Data compiled by SHOOK Research LLC based for the period 3/31/24-3/31/25.

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Jerry Luckett Jr.

Jerry Luckett Jr. is a Private Banker serving Morgan Stanley Wealth Management offices in Oklahoma, Missouri, and Kansas.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jerry began his career in financial services in 2020 and joined Morgan Stanley in 2022. Prior to joining the firm, he was a Senior District Consumer Banker at Webster Bank.

Jerry is a graduate of the Southern Connecticut State University, where he received a Bachelor of Arts in Interdisciplinary Studies and a Master of Science in Sports and Entertainment Management. He currently lives in Tulsa, Oklahoma with his wife Gabriela and their dog Zoe.

Jerry was a former professional basketball player in Europe, and an All-Conference basketball player for Southern Connecticut State University. Outside of the office, he enjoys playing basketball, lifting weights, and making music.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jerry began his career in financial services in 2020 and joined Morgan Stanley in 2022. Prior to joining the firm, he was a Senior District Consumer Banker at Webster Bank.

Jerry is a graduate of the Southern Connecticut State University, where he received a Bachelor of Arts in Interdisciplinary Studies and a Master of Science in Sports and Entertainment Management. He currently lives in Tulsa, Oklahoma with his wife Gabriela and their dog Zoe.

Jerry was a former professional basketball player in Europe, and an All-Conference basketball player for Southern Connecticut State University. Outside of the office, he enjoys playing basketball, lifting weights, and making music.

NMLS#: 2109945

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

From Our Team

Want to Keep More of Your Investment Returns? Consider These Tax Moves

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Overcoming Your 5 Biggest Retirement Challenges

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Plaza Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

12Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

12Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)