About Darren Pfefferman

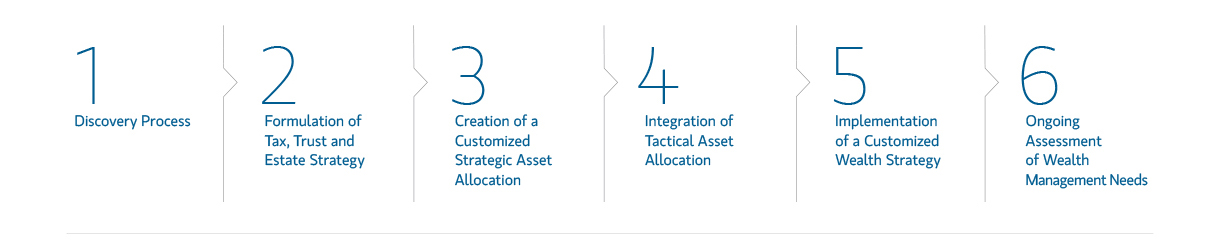

A 30-year Morgan Stanley veteran, Darren Pfefferman provides comprehensive wealth planning and investment strategies for corporate executives, high net worth individuals, family offices, institutional endowments and foundations. He is a designated Family Wealth Director, a title held by fewer than 4% of Morgan Stanley Advisors. As such, Darren is qualified to help provide his clients with the highest level of consulting services and resources. These consulting areas include business succession planning, monetizing business ownership, alternative investments, control and restricted securities, equity and interest rate risk management, family dynamics, philanthropy and wealth transfer strategies.

Darren is also a Portfolio Management Director and Alternative Investments Director within Morgan Stanley. He consults with clients on developing asset and liability management strategies tailored to meet their specific goals and objectives. Darren has extensive knowledge and experience in risk management and the applications of multiple investment advisory methods and disciplines.

Darren holds a Bachelor of Science degree in finance from San Diego State University and is a graduate of the Wharton School of Business Investment Management Analyst Program at the University of Pennsylvania, where he earned the designation of Certified Investment Management Analyst®. He is an active member of the Investment Management Consultants Association (IMCA), and the CFA® Institute.

Darren has been recognized by the Financial Times as one of the Top 400 Financial Advisors in the United States for 2016-2019. He has also been recognized by Barron’s as one of the Top 1,200 Advisors in America for 2017-2025. In 2018-2025, he was named to Forbes Magazine's List of America's Best-in-State Wealth Advisors.

He and his wife have three children and reside in San Diego, California

Disclosure(s):

2018, 2019, 2020, 2021, 2022, 2023, 2024 and 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018, 2019, 2020, 2021, 2022, 2023, 2024, 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2017, 2018, 2019, 2020, 2021, 2022, 2023, 2024 and 2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2017, 2018, 2019, 2020, 2021, 2022, 2023, 2024 and 2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2016, 2017, 2018, and 2019 Financial Times 400 Top Financial Advisors

Source: ft.com. Data compiled by the Financial Times based the following time periods:

Awarded 2020; data 6/30/16 - 6/30/19

Securities Agent: OR, CA, VA, SD, NE, MO, MD, IA, HI, OH, NM, NH, MI, NY, NV, CT, WA, MN, KY, WY, UT, NJ, CO, AZ, TX, PA, FL, NC, IL, ID, DE; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1270212

Industry Award Winner

Industry Award Winner