Industry Award Winner

Industry Award WinnerOur Mission Statement

Delivering clients tailored advice to help manage, grow, and preserve wealth while striving to create sustainable income solutions.

The Pelkey Dannies Kelley Group

The Pelkey Dannies Kelley Group is a multigeneration team of seasoned Financial advisors. We work with sophisticated individual and institutional clients, guiding them in the creation, implementation, and monitoring of goals-based investment programs. When you work with us, you should expect proactive, unbiased advice that is coupled with an exceptional client service experience.

Services Include

- Professional Portfolio ManagementFootnote1

- Financial PlanningFootnote2

- Wealth ManagementFootnote3

- Asset Management

- Alternative InvestmentsFootnote4

- Institutional ServicesFootnote5

- Equity Compensation

- Business PlanningFootnote6

- Endowments and FoundationsFootnote7

- Estate Planning StrategiesFootnote8

- Corporate Retirement PlansFootnote9

- Philanthropic ManagementFootnote10

- 401(k) Rollovers

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

105 West View Rd

5th Fl

Colchester, VT 05446

US

Direct:

(802) 652-6025(802) 652-6025

Meet The Pelkey Dannies Kelley Group

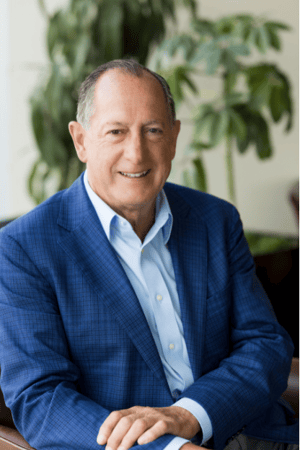

About Brian A Pelkey

Brian Pelkey is a seasoned Financial Advisor with Morgan Stanley, dedicated to helping clients achieve their financial goals and navigate the complexities of wealth management. With over 40 years of experience in the financial industry, Brian brings a wealth of knowledge and experience to his role.

Throughout his career, Brian has developed a deep understanding of investment strategies, retirement planning, and risk management. He is committed to providing personalized solutions tailored to each client's unique needs and aspirations. Whether working with individuals, families, or businesses, Brian takes a holistic approach to financial planning, helping ensure that virtually all aspects of a client's financial life are carefully considered.

Throughout his career, Brian has developed a deep understanding of investment strategies, retirement planning, and risk management. He is committed to providing personalized solutions tailored to each client's unique needs and aspirations. Whether working with individuals, families, or businesses, Brian takes a holistic approach to financial planning, helping ensure that virtually all aspects of a client's financial life are carefully considered.

Securities Agent: MI, AZ, RI, NY, NM, NH, MO, CA, AL, VA, MA, DC, CO, UT, OH, NC, IN, IA, WI, NV, MD, VT, PA, NE, OR, NJ, HI, WA, TX, TN, KS, FL, CT, SC, ME, ID, OK, MT, MN, IL, GA, DE; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 176131

NMLS#: 176131

About Jeff Dannies

For over four decades Jeff has designed and implemented wealth strategies for his clients by listening carefully to their goals, values, and aspirations.

A graduate of the University of Vermont with a Bachelor of Science in Finance, Jeff lives with his wife of 38 years, Kim, in Williston, VT where they raised their three daughters. Active in the community, Jeff is a board member of Hunger Free Vermont. Jeff and Kim’s passion is adventure travel. Along with visiting their far-flung children, they also enjoy cycling, skiing, and crossfit together.

A graduate of the University of Vermont with a Bachelor of Science in Finance, Jeff lives with his wife of 38 years, Kim, in Williston, VT where they raised their three daughters. Active in the community, Jeff is a board member of Hunger Free Vermont. Jeff and Kim’s passion is adventure travel. Along with visiting their far-flung children, they also enjoy cycling, skiing, and crossfit together.

Securities Agent: VA, TN, SC, OR, NJ, MI, WI, TX, RI, NE, IN, VT, UT, NV, NM, NC, OK, OH, MN, DE, DC, AL, HI, CO, CA, AZ, PA, NH, ID, MS, MD, MA, MO, IL, GA, CT, KS, FL, NY, MT, ME, WA; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 176124

NMLS#: 176124

About Joe Kelley

Joe Kelley is a seasoned Financial Advisor with 44 years of experience at Morgan Stanley, providing financial guidance to individuals, corporations, trusts, and retirement plans. His focus is building and managing tailored individual portfolios to help clients define and meet their objectives. Joe collaborates closely with clients to coordinate retirement planning, estate planning and tax strategies alongside their attorneys and accountants. His extensive industry experience includes 15 years of office management and attendance at the Wharton School’s Advanced Advisor training.

Joe resides in Shoreham, Vermont, with his wife Deb. They have two adult children and two grandchildren. In his free time, Joe enjoys music, the violin, boating, pickleball, working on the land and vintage motorcycles.

Joe resides in Shoreham, Vermont, with his wife Deb. They have two adult children and two grandchildren. In his free time, Joe enjoys music, the violin, boating, pickleball, working on the land and vintage motorcycles.

Securities Agent: TN, NJ, UT, MT, MN, IN, SC, NM, NE, NC, IL, CA, VA, OR, OH, ME, ID, DE, CT, NV, GA, PA, MS, KS, HI, DC, AZ, VT, MO, MD, MA, WI, NY, NH, FL, WA, RI, CO, MI, AL, OK, TX; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1409330

NMLS#: 1409330

About Nicholas Fukuda, CFP®

Nick is the Financial Planning Specialist for The Pelkey Dannies Group. He holds the CERTIFIED FINANCIAL PLANNER™ designation awarded by the CFP Board of Standards and focuses on delivering family office services to all client accounts.

Prior to joining Morgan Stanley in 2019, Nick spent three years working in politics representing various trade associations in a lobbying capacity. He also served as a congressional campaign manager for several State level candidates in Pennsylvania.

As an active community member, Nick currently serves on Chittenden County’s Special Olympics Management Committee. He also volunteer coaches Ice Hockey for the Essex Sting.

Nick has a Master’s in Finance and Management from the University of St Andrews and a Bachelor of Arts in Political Science and Japanese from Dickinson College.

He lives with his wife, Catherine, and daughter, Ginny, in Essex Junction.

Prior to joining Morgan Stanley in 2019, Nick spent three years working in politics representing various trade associations in a lobbying capacity. He also served as a congressional campaign manager for several State level candidates in Pennsylvania.

As an active community member, Nick currently serves on Chittenden County’s Special Olympics Management Committee. He also volunteer coaches Ice Hockey for the Essex Sting.

Nick has a Master’s in Finance and Management from the University of St Andrews and a Bachelor of Arts in Political Science and Japanese from Dickinson College.

He lives with his wife, Catherine, and daughter, Ginny, in Essex Junction.

Securities Agent: WI, VT, HI, OK, UT, CO, OH, NM, MT, CA, AZ, NY, NH, MI, MA, GA, DE, DC, TN, MN, NC, MO, IN, ID, TX, NV, MD, IL, FL, AL, WA, VA, NJ, ME, SC, RI, PA, KS, CT, OR, NE, WY; General Securities Representative; Investment Advisor Representative

NMLS#: 1913297

NMLS#: 1913297

About Meg Pelkey

I have been in the financial industry for the past 5 years working with a team with over 40 years of experience. We focus on helping individual investors and small business owners with various aspects of their finances.

We use a disciplined client process that focuses on you, your family and your financial future. We work closely with you to create a customized financial plan that covers virtually all of your financial needs and concerns. This starts with a comprehensive overview of your financial goals. We then implement our strategy and continuously monitor and adjust as needed.

Morgan Stanley offers a wide variety of modern wealth management products and services we incorporate into our everyday client experience.

We enjoy helping our clients like you achieve financial success.

We use a disciplined client process that focuses on you, your family and your financial future. We work closely with you to create a customized financial plan that covers virtually all of your financial needs and concerns. This starts with a comprehensive overview of your financial goals. We then implement our strategy and continuously monitor and adjust as needed.

Morgan Stanley offers a wide variety of modern wealth management products and services we incorporate into our everyday client experience.

We enjoy helping our clients like you achieve financial success.

Securities Agent: OR, GA, MO, IA, KS, FL, CT, VT, CA, TN, IL, DC, AZ, NM, NJ, MD, DE, VA, RI, NY, MT, MA, AL, NV, NH, ME, IN, ID, HI, WI, TX, OH, MN, CO, PA, NE, NC, MI, OK, WA, UT, SC; General Securities Representative; Investment Advisor Representative

NMLS#: 2109159

NMLS#: 2109159

About Julie DeSpirito

Julie DeSpirito is a Senior Registered Client Service Associate. She began her career in 1996 and has remained a dedicated employee of our branch for over 25 years. With over two decades of experience in the financial services industry, Julie is an integral part of our client service experience.

Julie works closely with clients on administrative and operational needs. She helps ensure client requests are met with efficiency, knowledge, and extreme attention to detail. Her level of care and professionalism can deliver a top-notch client service experience.

Julie works closely with clients on administrative and operational needs. She helps ensure client requests are met with efficiency, knowledge, and extreme attention to detail. Her level of care and professionalism can deliver a top-notch client service experience.

About Carrie Raftery

With over 20 years in the financial services industry, Carrie has a vast knowledge of the operational and procedural rules and regulations to assist clients in achieving superior client care. Carrie takes great pride and care to make sure every client receives the highest level of client service possible on a day to day basis. Carrie holds the Series 7 and Series 66 licenses and has an Associate's Degree in Accounting.

About Grady Wimble

With nearly a decade of experience in the financial services industry, Grady brings a strong service-oriented approach to our wealth management team. Grady works closely with advisors and clients to support portfolio management and planning efforts, helping ensure a smooth and efficient experience. His focus is centered around building and maintaining client relationships with trust, coordination, and clear communication to support advisors in delivering thoughtful financial guidance. Originally from Vermont, Grady holds his series 7 and series 66 licenses and has a Bachelor of Science in management. Grady brings a steady, relationship driven approach to each workday.

Contact Brian A Pelkey

Contact Jeff Dannies

Contact Joe Kelley

Contact Nicholas Fukuda, CFP®

Contact Meg Pelkey

Awards and Recognition

Forbes Best-In-State Wealth Advisors

2018-2023 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2018-2023). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Barron's Top 1,200 Financial Advisors: State-by-State

2009-2023 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2009-2023). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Forbes America's Top Wealth Management Teams

2024-2026 Forbes America's Top Wealth Management Teams Source: Forbes.com (Awarded 2024-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year the award was issued.

3

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Pelkey Dannies Kelley Group today.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)