The Paladin Group at Morgan Stanley

Direct:

(919) 785-7162(919) 785-7162

Toll-Free:

(855) 830-0665(855) 830-0665

Industry Award Winner

Industry Award WinnerOur Mission Statement

We are passionate about helping families make smart decisions so that their money serves the people, causes and goals they cherish.

Our Story

The Paladin Group at Morgan Stanley advocates for the needs of successful families and their business interests. With almost a century of collective experience, we understand that your achievements often come with new concerns about preserving your lifestyle, minimizing your tax burden, and properly preparing your heirs. We believe that the complexity of the problems you face requires time, knowledge, and judgment delivered by a team dedicated to wealth management. Our team is purposefully designed to deliver the strengths of each member to our clients. Because the Paladin Group is part of Morgan Stanley, we can also provide the depth and breadth of one of the world’s most respected wealth management firms. With a deep-seated dedication to long-term client relationships, our group fully engages our clients in the service of the people, causes, and goals that they cherish. We invite you to explore the following pages to understand the unique way that we can serve you.

Services Include

- Executive Financial ServicesFootnote1

- Professional Portfolio ManagementFootnote2

- Wealth ManagementFootnote3

- 401(k) Rollovers

- Alternative InvestmentsFootnote4

- Business Succession PlanningFootnote5

- Estate Planning StrategiesFootnote6

- Financial PlanningFootnote7

- Lending Products

- Life InsuranceFootnote8

- Long Term Care InsuranceFootnote9

- Planning for Education FundingFootnote10

- Retirement PlanningFootnote11

- Trust Services*

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

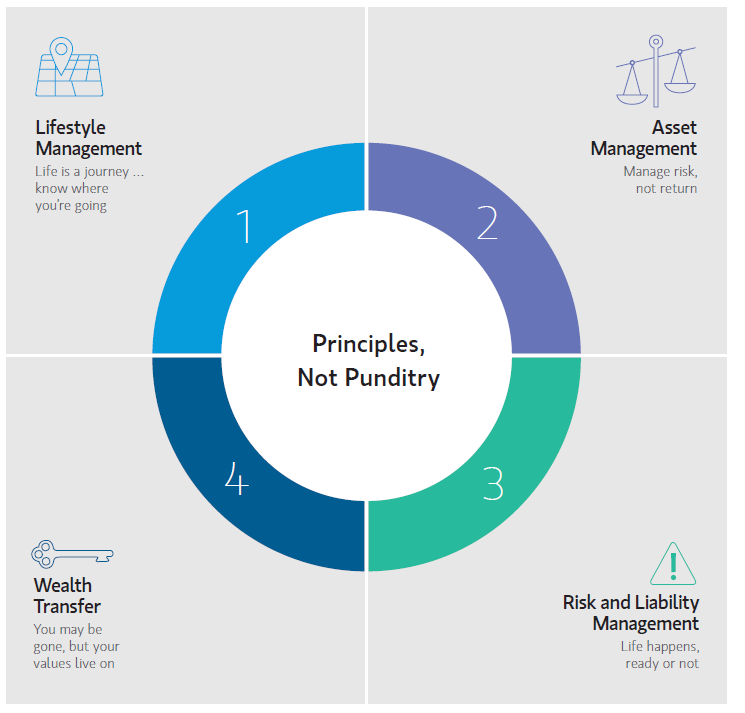

How We are Different

Our Clients

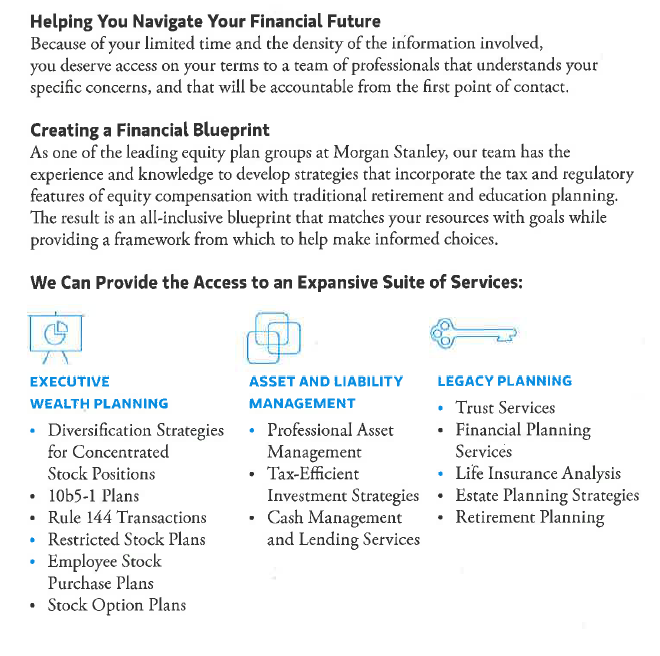

The Paladin Group’s clientele is largely comprised of successful families and their business interests. Many of our clients are in or nearing retirement, a time which presents many questions and challenges, including healthcare, housing, taxes, generating retirement income, and more. We also have a significant portion of our clientele that are successful executives focused on building wealth, protecting their families, and managing the risks associated with their position. To this end, we are affiliated with many of Morgan Stanley’s Stock Plan clients, and have a presence at major publicly traded companies in and around the Triangle.

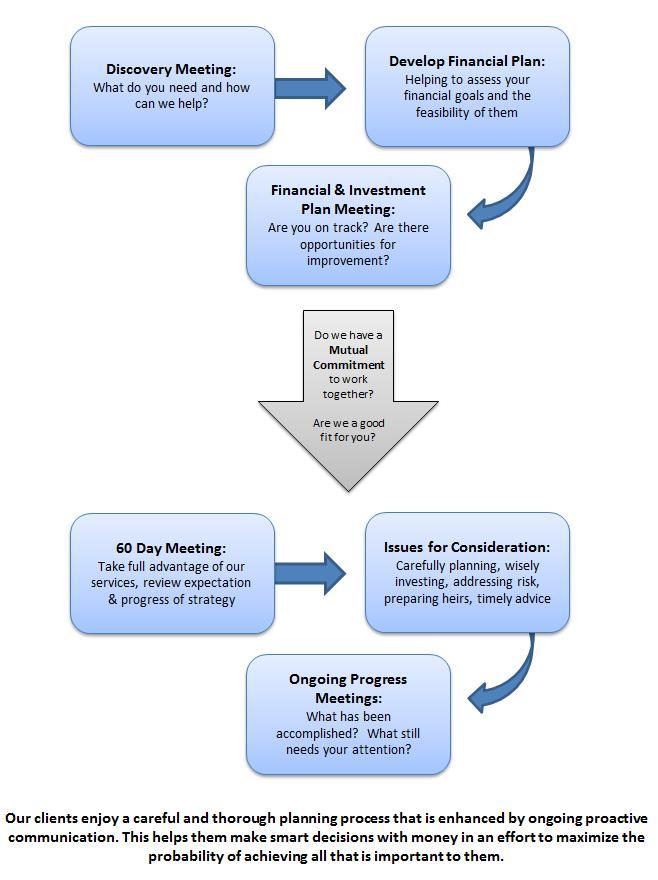

Working With You

The Paladin Group’s clients enjoy a consultative process that begins with deep discovery. We believe the foundation of any productive relationship is a thorough understanding of a family’s values, goals, and concerns. We accomplish this understanding by asking good questions and listening attentively.

We then collaborate with our clients to proactively and regularly engage them on various topics such as markets, estate planning strategies, insurance, and more. We find this disciplined communication improves the experience of our clients.

We then collaborate with our clients to proactively and regularly engage them on various topics such as markets, estate planning strategies, insurance, and more. We find this disciplined communication improves the experience of our clients.

The Paladin Group at Morgan Stanley advocates for the needs of successful executives and their families. We understand that your achievements often come with the need for a comprehensive financial plan that identifies your unique goals, accounts for complex equity compensation issues, and helps assure that you are making smart decisions to achieve all that is important to you.

Location

3800 Glenwood Ave

Ste 500

Raleigh, NC 27612

US

Direct:

(919) 785-7162(919) 785-7162

Toll-Free:

(855) 830-0665(855) 830-0665

Meet The Paladin Group

About Bob Randolph

For 35 years at Morgan Stanley, Bob Randolph has put into practice the belief that the long term financial success of his clients must first begin with a complete review of their financial circumstances and a thorough understanding of their goals. From his pre-advisor years managing logistics for a major chemical company, Bob has always understood the importance of proper planning and execution.

With his B.S. in Business Administration from Penn State and after post-Graduate studies at the University of Pittsburgh, Bob began his current career in 1984 with a predecessor firm of Morgan Stanley in Raleigh.

Bob’s historical experience with two major bull and bear markets over the past three decades has garnered his intense interest in understanding risks while designing appropriate strategies that can keep clients on track to help meet their goals. In addition to servicing the needs of our clients, he leads the team’s investment committee and is our primary resource for client estate planning strategies and trust services

As an active member of the Raleigh community, Bob was the Chair of the Finance Council at St. Francis of Assisi Catholic Church, a long-time member of the Rotary Club of Raleigh, a tutor for Communities in Schools of Wake County and a member of the WakeMed Society of 1961. He and his wife Maryanne raised their three grown children in Raleigh and now reside in the Warehouse District downtown.

With his B.S. in Business Administration from Penn State and after post-Graduate studies at the University of Pittsburgh, Bob began his current career in 1984 with a predecessor firm of Morgan Stanley in Raleigh.

Bob’s historical experience with two major bull and bear markets over the past three decades has garnered his intense interest in understanding risks while designing appropriate strategies that can keep clients on track to help meet their goals. In addition to servicing the needs of our clients, he leads the team’s investment committee and is our primary resource for client estate planning strategies and trust services

As an active member of the Raleigh community, Bob was the Chair of the Finance Council at St. Francis of Assisi Catholic Church, a long-time member of the Rotary Club of Raleigh, a tutor for Communities in Schools of Wake County and a member of the WakeMed Society of 1961. He and his wife Maryanne raised their three grown children in Raleigh and now reside in the Warehouse District downtown.

Securities Agent: OR, NY, ND, IL, WA, TX, PA, MS, KY, AZ, TN, NC, SC, IA, VA, MN, MI, ME, MD, KS, CA, WY, NJ, MA, LA, HI, AL, UT, NH, GA, FL, CT, CO; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1430995

NMLS#: 1430995

About Harold Russell

As a 25 year industry veteran, Vann Russell began his financial service career in 1994 and has worked at Morgan Stanley or its predecessor firms since 2001. Vann has extensive North Carolina roots and an extended family with long professional, political and business history in North Carolina. Vann is a native of Raleigh with strong ties to the local community. He and his wife Caroline have been influential in organizing Artsplosure, the city’s annual Arts Festival. Vann has also served in an advisory capacity with the Carolina Country Club. At Morgan Stanley, Vann holds the title of Senior Vice President and the designation as a Family Wealth Advisor. Throughout his career, Vann has taken a strong interest in helping corporate executives execute diversification strategies and he takes the lead for our team in consulting clients on concentrated stock positions and hedging strategies. As part of the team’s commitment to comprehensive financial planning, Vann also works closely with tax advisors and planning attorneys as part of our commitment to help successful clients and their families meet their most important goals.

Vann received a BA degree from Hampden-Sydney College and remains active in the Alumni Association.

Vann resides in Raleigh, North Carolina with his wife and two children. He attends Edenton Street United Methodist Church and has worked with numerous other charities through the years. He also enjoys spending time with his family, running, fishing, and playing golf.

Diversification does not guarantee a profit or protect against loss in a declining financial market.

Vann received a BA degree from Hampden-Sydney College and remains active in the Alumni Association.

Vann resides in Raleigh, North Carolina with his wife and two children. He attends Edenton Street United Methodist Church and has worked with numerous other charities through the years. He also enjoys spending time with his family, running, fishing, and playing golf.

Diversification does not guarantee a profit or protect against loss in a declining financial market.

Securities Agent: ME, LA, KS, CO, NH, MS, MA, PA, NY, HI, FL, GA, CA, IA, CT, AZ, WY, ND, MN, TN, OR, OH, VA, TX, NJ, NC, IL, AL, WA, MI, MD, KY, UT, SC; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1426086

NMLS#: 1426086

About William Nave

Bill Nave began his career in the shadows of the financial crisis in 2010 and saw this time as an opportunity to help families navigate uncertainty and decided to begin his path towards becoming a dedicated financial advisor. Educating clients sparked a deep interest in Bill. Bill takes the lead in business development and serves as the go-to person for equity compensation related issues. In addition, he is the author of our team’s quarterly newsletter.

Bill believes in leaving things better than he found them; his current charitable work includes the Society of Saint Vincent de Paul - Our Lady of Lourdes, Centro Para Familias Hispanas - Catholic Charities of the Diocese of Raleigh, Junior Achievement of Eastern North Carolina, the St. Anthony Foundation, Samaritan's Purse, and the ALS Association. Within Morgan Stanley, he is a former board member of the Association of Professional Investment Consultants (APIC), which is focused on the betterment of the practices of Morgan Stanley Financial Advisors.

A native of Virginia Beach and a graduate of UNC-Wilmington, it’s no surprise that Bill’s favorite hobby is surfing, which he practices on North Carolina's many beaches as well as abroad. In addition to his native English, Bill is fluent in Spanish & Italian, conversational in French, and is currently learning Portuguese & Latin. Bill also enjoys reading, Brazilian jiu-jitsu, swimming, travelling, and spending time with his wife Maddie and boxer Frankie.

Bill believes in leaving things better than he found them; his current charitable work includes the Society of Saint Vincent de Paul - Our Lady of Lourdes, Centro Para Familias Hispanas - Catholic Charities of the Diocese of Raleigh, Junior Achievement of Eastern North Carolina, the St. Anthony Foundation, Samaritan's Purse, and the ALS Association. Within Morgan Stanley, he is a former board member of the Association of Professional Investment Consultants (APIC), which is focused on the betterment of the practices of Morgan Stanley Financial Advisors.

A native of Virginia Beach and a graduate of UNC-Wilmington, it’s no surprise that Bill’s favorite hobby is surfing, which he practices on North Carolina's many beaches as well as abroad. In addition to his native English, Bill is fluent in Spanish & Italian, conversational in French, and is currently learning Portuguese & Latin. Bill also enjoys reading, Brazilian jiu-jitsu, swimming, travelling, and spending time with his wife Maddie and boxer Frankie.

Securities Agent: MN, MD, MA, AL, KY, IL, CA, SC, MS, KS, GA, UT, TN, NY, NJ, ND, LA, HI, WA, FL, AZ, IA, ME, CO, PA, MI, OR, NH, NC, CT, WY, VA, TX; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1428680

NMLS#: 1428680

About Ginny Whitley

Drawing on 19 years of diverse financial industry experience as a Consulting Group Analyst, Portfolio Associate, and a Wealth Management Associate, Ginny brings an experienced perspective to the service of our clients. She helps ensure that client’s needs are met with efficiency, professionalism, and extreme attention to detail. Ginny’s knowledge of Morgan Stanley’s financial planning tools and dedication to constructing individualized solutions allows her to take an active role in our clients by creating comprehensive plans tailored to their specific needs, challenges, and goals. By incorporating their current assets, investment outlook and specific risk tolerance, she seeks to recommend efficient and realistic ways to help clients meet their financial objectives. Ginny also manages the team by administering their client service model and organizational structure.

Prior to joining The Paladin Group in 2006, Ginny began her career with Morgan Stanley in 2000 as a part-time employee while attending college and joined the firm full-time in 2005. Ginny graduated from Meredith College and received a Bachelor of Science degree in Business Administration with an emphasis in Computer Science and Finance.

Growing up in Newport, North Carolina, Ginny’s favorite place to be outside of work is the beach. She enjoys traveling, being outdoors, volunteering in her son’s various interests and spending time with her family. Ginny and her husband, Ben, make their home in Clayton, North Carolina, with their son, Rylan.

Prior to joining The Paladin Group in 2006, Ginny began her career with Morgan Stanley in 2000 as a part-time employee while attending college and joined the firm full-time in 2005. Ginny graduated from Meredith College and received a Bachelor of Science degree in Business Administration with an emphasis in Computer Science and Finance.

Growing up in Newport, North Carolina, Ginny’s favorite place to be outside of work is the beach. She enjoys traveling, being outdoors, volunteering in her son’s various interests and spending time with her family. Ginny and her husband, Ben, make their home in Clayton, North Carolina, with their son, Rylan.

Securities Agent: TX, NJ, HI, MS, LA, KY, CA, UT, SC, IA, AL, TN, ND, AZ, WY, WA, NH, CT, MN, KS, CO, VA, NC, MA, GA, IL, PA, OR, NY, FL, MI, ME, MD; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1767241

NMLS#: 1767241

About Buzzy Russell

Harold “Buzzy” Russell began his career with Morgan Stanley in 2024. As a Financial Advisor, Buzzy strives to advocate for the best financial outcomes for the team’s clients. He strives to guide successful families on how best to meet their goals. Growing up in the shadows of the 2008 financial crisis, Buzzy has always had a keen interest in the markets’ performance and in helping others so that they can better handle life’s financial hurdles.

Buzzy is a Raleigh native who attended North Carolina State University to study Finance and History. While at NC State Buzzy, was able to study history at the University of Oxford through the University Honors Program, as well as studying business at University College London.

In his free time, Buzzy enjoys watching NC State athletics, fishing, golfing, traveling, and exercising. He attends Edenton Street United Methodist Church.

Buzzy is a Raleigh native who attended North Carolina State University to study Finance and History. While at NC State Buzzy, was able to study history at the University of Oxford through the University Honors Program, as well as studying business at University College London.

In his free time, Buzzy enjoys watching NC State athletics, fishing, golfing, traveling, and exercising. He attends Edenton Street United Methodist Church.

Securities Agent: AZ, ND, MD, AL, WA, MN, LA, DE, VA, OR, GA, FL, UT, PA, HI, TN, OH, NH, KS, SC, MI, CO, WY, NJ, NC, MS, KY, ME, IA, TX, MA, IL, CA, WI, NY, CT; General Securities Representative; Investment Advisor Representative

NMLS#: 2748215

CA Insurance License #: 4452969

NMLS#: 2748215

CA Insurance License #: 4452969

About Erin Beavers

As a Portfolio Associate, Erin brings to her role on the team a broad range of experience. Prior to joining Morgan Stanley in 2013, Erin worked for six years as a paralegal in a local law firm then honed her customer service skills through four subsequent years traveling as a national trainer for Chick-fil-A. During her time as a paralegal, Erin worked closely with estate planning and real estate attorneys and is able to bring important knowledge of wills and trusts to support the legacy planning portions of our team’s mission. Her customer service training background, love of people, personal warmth, and sincere desire to serve our clients is front and center in her daily work. Her duties encompass appointment scheduling and preparation, client digital support services, account trading and other administrative duties inherent with the daily operation of our practice.

Erin received her BS in Business Administration from East Carolina University in Greenville, NC. She also holds the necessary securities license to process client investment orders.

Erin resides in Clayton, North Carolina with her husband and children. She serves with her husband on the Youth Staff of the Temple of Pentecost in Raleigh, NC, where she and her husband are active members. She enjoys spending time with her family, running, exploring new places and creating memorable adventures for her children.

Erin received her BS in Business Administration from East Carolina University in Greenville, NC. She also holds the necessary securities license to process client investment orders.

Erin resides in Clayton, North Carolina with her husband and children. She serves with her husband on the Youth Staff of the Temple of Pentecost in Raleigh, NC, where she and her husband are active members. She enjoys spending time with her family, running, exploring new places and creating memorable adventures for her children.

About Mita Kapila

Mita began her career at Morgan Stanley in 2014 and was quickly intrigued by the high standard of service that advisors provide for their clients in helping them achieve their financial goals. She focuses on providing an outstanding client experience by maintaining attention to detail, a swift response standard and a thorough knowledge of Morgan Stanley’s capabilities. Often one of the first members of the team to assist clients with their needs, Mita’s friendly and professional manner sets the tone for our commitment to provide a congenial and supportive culture in the service of our clients. In addition, with her excellent organization skills, fresh thinking, and desire to streamline processes, she has become an essential part of The Paladin Group at Morgan Stanley.

Mita obtained her Bachelor of Science degree in business administration with a concentration in Finance in 2012 from East Carolina University and obtained her Master in Business Administration from North Carolina Central University in 2014. Finance has always been a strong interest for Mita and she thoroughly enjoys being a part of helping clients with their full financial picture.

Mita lives in Morrisville with her husband, Atul. During her free-time, she enjoys cooking, traveling the world, and spending time her family and friends.

Mita obtained her Bachelor of Science degree in business administration with a concentration in Finance in 2012 from East Carolina University and obtained her Master in Business Administration from North Carolina Central University in 2014. Finance has always been a strong interest for Mita and she thoroughly enjoys being a part of helping clients with their full financial picture.

Mita lives in Morrisville with her husband, Atul. During her free-time, she enjoys cooking, traveling the world, and spending time her family and friends.

About Justin Johnson

Justin began his career with Morgan Stanley in 2022. As a Registered Associate, Justin strives to provide an exceptional client experience while helping clients meet their financial goals. His duties consist of processing funds transfers and account forms, scheduling appointments, responding to client requests and other administrative duties required for the efficient daily operation of our practice.

Justin earned his Bachelor’s degree in Business Administration from Campbell University, with a major in Trust and Wealth Management and a minor in Financial Planning.

Justin lives in Benson, North Carolina with his wife Blair. During his free time, he enjoys hunting, fishing, grilling, and spending time outdoors. Justin is an avid conservationist, volunteering with various organizations to preserve wildlife habitat and introduce youth to the outdoors.

Justin earned his Bachelor’s degree in Business Administration from Campbell University, with a major in Trust and Wealth Management and a minor in Financial Planning.

Justin lives in Benson, North Carolina with his wife Blair. During his free time, he enjoys hunting, fishing, grilling, and spending time outdoors. Justin is an avid conservationist, volunteering with various organizations to preserve wildlife habitat and introduce youth to the outdoors.

Contact Bob Randolph

Contact Harold Russell

Contact William Nave

Contact Ginny Whitley

Contact Buzzy Russell

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2024-2025 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2024-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Wealth Management

From Our Team

THE PRUDENT PALADIN 4TH QUARTER 2025 NEWSLETTER - ON THE OTHER HAND

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Paladin Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)