Paul Groves

Our Story

We are a multidisciplinary team of 14 experienced professionals who combine our talents to help highly affluent families address the complex challenges of managing generational wealth. By focusing all of our attention on the needs of a select few clients, we are able to serve as close family advisors to each. We understand their needs and aspirations and deliver comprehensive solutions to help them pursue their most important life goals.

Having worked with ultra high net worth families and their foundations for many years, we have learned that there is no substitute for thoughtful, proactive and strategic advice. We have also learned that no individual Advisor, no matter how qualified, can meet the full spectrum of their needs. That is why we place great emphasis on collaboration. That starts within our team and extends to our colleagues across Morgan Stanley, the investment banking community and our clients' attorneys, CPAs and other trusted advisors.

We look forward to learning more about you and your family, and to discussing our approach to helping you achieve your multigenerational goals.

Awards & Recognitions

Over the years our team members have been recognized for their hard work and dedicated service to our clients. Our founding partner, Paul Groves, has been recognized by Barron's Magazine as a "Top 1,200 Financial Advisor" from 2016 through 2025. Managing Director, Eric Olson, was recognized by Forbes as one of America's "Top Next Generation Wealth Advisors" from 2017 through 2024. Both Paul and Eric were named to Forbes 2024 & 2025 Best-In-State Wealth Advisors.

Our team was ranked #1 on the Forbes Best-In-State Wealth Management Teams list in Arizona for 2026, and have been ranked since 2024. Our team was ranked on Forbes Top 100 US Wealth Management Teams in 2023.

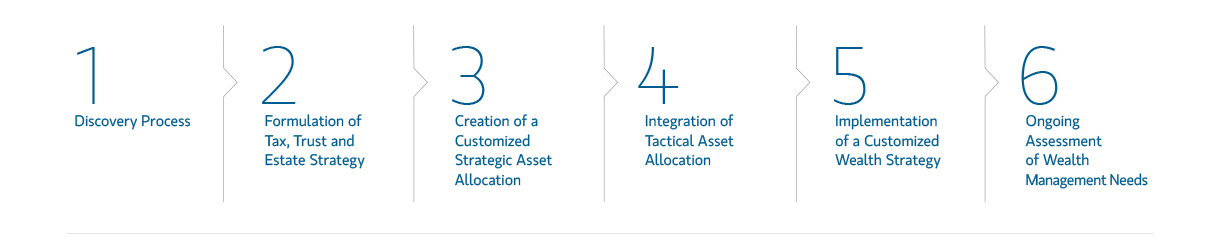

Our Services

Awards Disclosures

2016-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2016-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2017-2024 Forbes America's Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors)

Source: Forbes.com (Awarded 2017-2024). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

2024-2025 Forbes Best-In-State Wealth Advisors Source: Forbes.com (Awarded 2024-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2023 Forbes America's Top Wealth Management Teams: High Net Worth Source: Forbes.com (Awarded November 2023) Data compiled by SHOOK Research based on time period from Mar 2022-Mar 2023.

2024-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2024-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

The term "Family Office Resources" is being used as a term of art and not to imply that Morgan Stanley and/or its employees are acting as a family office pursuant to Investment Advisers Act of 1940.