Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Services

At The Olexa Lougheed Group, we are dedicated to helping you organize and understand your wealth. Our team is committed to providing personalized financial strategies that cater to a diverse clientele, including everyday families, business executives, globally recognized athletes, and entertainers. We understand that each client has unique needs and aspirations, and we strive to deliver the highest standards of financial stewardship to all.

Our Exclusive Approach

We believe that every client deserves a tailored approach to wealth management. Our customized strategies are carefully crafted, leveraging innovative research and insights to help you address your current needs and prepare for the future.

Our Commitment

We are committed to delivering a level of service that is as exceptional as our clients. Our team is dedicated to building long-lasting relationships founded on confidence, care, and transparency. Whether you are navigating complex financial landscapes or planning for generational wealth, we aim to provide the guidance and experience you need to help achieve your aspirations with confidence.

- Wealth ManagementFootnote1

- Financial PlanningFootnote2

- Cash Management and Lending ProductsFootnote3

- Trust ServicesFootnote4

- Estate Planning StrategiesFootnote5

- Donor Advised Funds

- 529 PlansFootnote6

- Business PlanningFootnote7

- Retirement PlanningFootnote8

- 401(k) Rollovers

- Defined Contribution PlansFootnote9

- Qualified Retirement PlansFootnote10

- Equity Compensation

- Alternative InvestmentsFootnote11

- AnnuitiesFootnote12

- Life InsuranceFootnote13

- Long-term Care InsuranceFootnote14

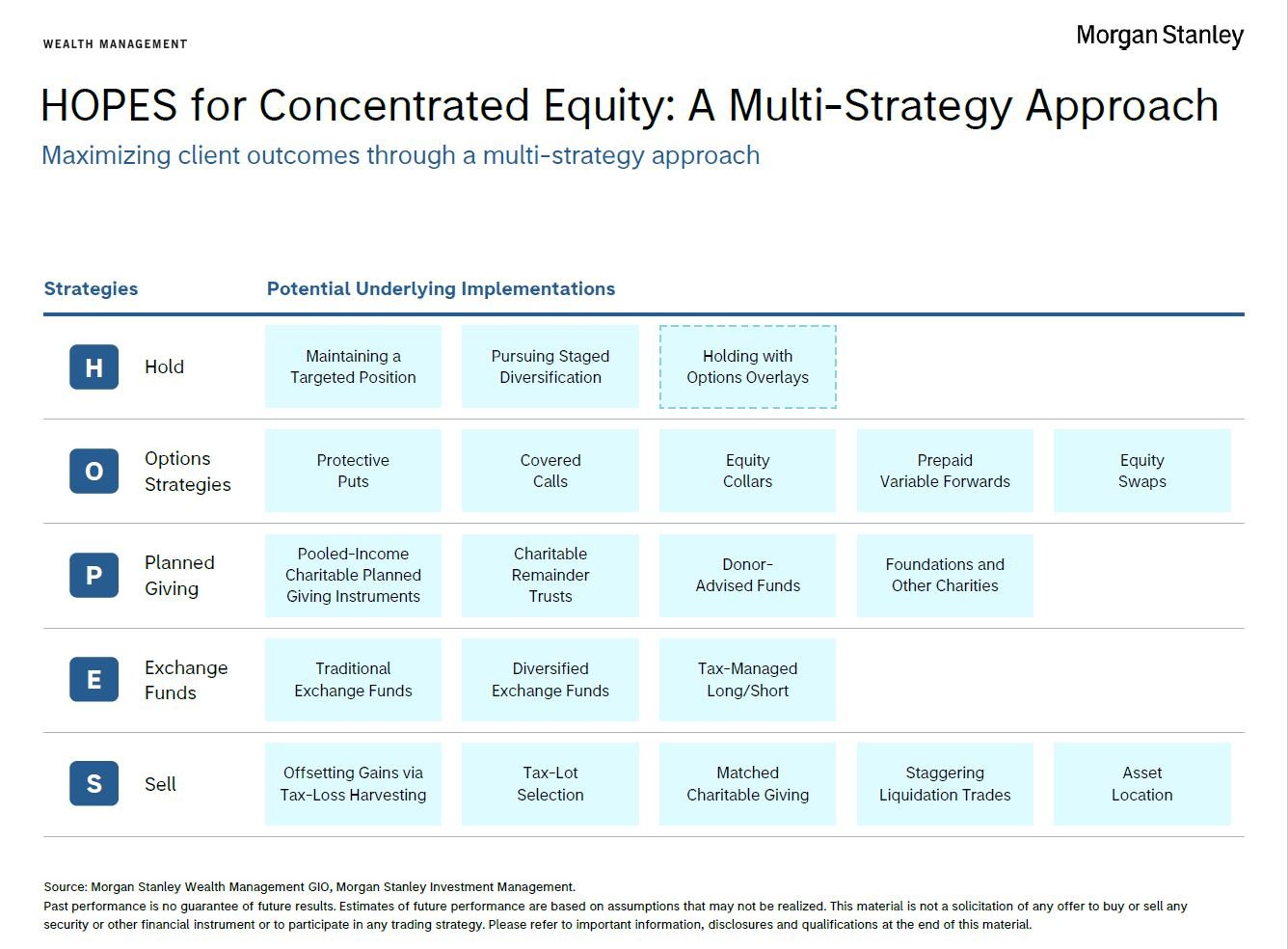

Our Specialty in Concentrated Stock: The HOPES Framework

Concentrated stock positions present investors with both a blessing and a curse: a blessing in that the significant concentration likely resulted from past price appreciation, boosting the investors' wealth, but a curse in that their outsized contribution to total portfolio risk dominates the future.

Our team specializes in planning for these large concentrated stock positions. There are unique challenges and opportunities that come with holding significant equity stakes—from both a tax and risk standpoint. Our expertise lies in guiding you through these complexities using the HOPES Framework; a comprehensive, research-backed approach we have mastered to optimize your financial outcomes while considering tax implications and personal goals.

HOPES Framework:

H – Hold the Concentrated Equity

O – Enter into Options-based strategy

P – Pursue a Planned Giving strategy

E – Transfer the concentrated equity into an Exchange Fund

S – Sell the concentrated equity; diversify

Our team has the experience and understanding to provide time-tested, tailored solutions that align with your financial objectives. By leveraging our specialized knowledge of the HOPES Framework, we aim to help you achieve a balanced and diversified portfolio, mitigate risks, and enhance your overall financial well-being. Contact us to discover how our expertise in managing concentrated equity positions can benefit you.

Location

Meet The Olexa Lougheed Group

About Joe Olexa

Throughout his career, Joe has been dedicated to professional development, a cornerstone of his dynamic wealth management practice. This helps him to remain on the forefront of the most effective strategies, while ensuring a powerful client experience. Joe was named to 2024 Forbes Best in State Wealth Advisors and the Olexa Lougheed Group was named to the 2024 Forbes Best in State Wealth Management Teams.

Originally from Youngstown, Ohio, Joe has been calling Fishers, Indiana his home for the past 35 years. He lives there with his wife of 30 years and their three children. An avid reader of financial publications, Joe’s favorite leisure activities include exercise, golf and cheering on the Colts and Browns.

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based for the period from 3/31/22-3/31/23.

Forbes America's Top Wealth Advisors & Best-In-State Wealth Advisors

Source: Forbes.com (Awarded April 2024) Data compiled by SHOOK Research LLC for the period 6/30/22 - 6/30/23.

NMLS#: 1293960

About Pete Lougheed

As a Financial Advisor Pete helps clients define and strive to meet their goals by delivering a vast array of resources to them. He is firmly committed to long term relationships and works to deliver exceptional client service. Pete listens carefully to client’s goals, values, aspirations and concerns and is committed to helping them achieve their financial objectives.

Originally from Fort Wayne, Indiana, Pete has lived in Fishers Indiana for over 15 years with his wife Leslie, 2 children, and their dog Mackey. In addition to spending time with his family Pete enjoys coaching his kids in youth sports.

NMLS#: 1290549

CA Insurance License #: OG42845

About Jocko Olexa

I am a CERTIFIED FINANCIAL PLANNER™ practitioner and take my responsibility with the utmost seriousness. I believe in process, research, consistency, and doing the right thing. I fight for my clients to achieve their goals and act in their best interest as their trusted advisor.

I take a holistic approach in my client relationships that includes financial planning, investment management, workplace solutions, tax-efficient investing, cash management and lending solutions.

NMLS#: 2348326

About Amanda Bishop

Amanda currently holds the Series 7 and 66 FINRA registrations, enabling her to process unsolicited trades in addition to handling all client inquiries and account administration for the team. Her attention to detail comes from her years of experience working in a variety of important roles at Morgan Stanley.

A native of Chicago, Amanda moved to Indianapolis in 1999, where she lives with her husband and two children. In her free time, she enjoys boating, biking on the Monon Trail and spending time with family and friends.

About Jeff Holzbach

After graduating from Duquesne University (Pittsburgh) in 1996 with a Bachelor of Science degree in Finance , I moved to Indianapolis IN to work for Charles Schwab. At Schwab, I grew in my role to eventually lead our Financial Planning division and earned the CERTIFIED FINANCIAL PLANNER™ designation in 2003. In addition, I have worked the past 10 years to develop knowledge and skills to help families and companies with equity award analysis and planning. This includes earning the Certified Equity Professional (CEP) designation in 2019. In 2021, I joined Morgan Stanley to support initiatives to enhance the depth and breadth of education and planning capabilities related to equity awards.

Outside of work, I have been married for 25 years and have two children. My time is spent finding ever smaller windows of time with my kids. My son is a senior in college studying finance/economics, and my daughter is a sophomore in college studying Mathematics. I enjoy outdoor activities including hiking, camping, and fishing.

About Joey Conte

Joey is an alumnus of the University of Tampa, where he earned a bachelor's degree in marketing. He is licensed with the Series 7, Series 63, and Series 65, positioning him as part of the next generation of advisors who prioritize thoughtful strategy and a client-first approach to wealth management.

Contact Joe Olexa

Contact Pete Lougheed

Contact Jocko Olexa

Awards and Recognition

The Power of Partnerships

About Kimberly Guidone

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Kimberly began her career in financial services in 1996 and joined Morgan Stanley in 2016. Prior to joining the firm, she was a Wealth Management Banker at Merrill Lynch. She also served as an Investment Relationship Manager with Key Investment Services and a Financial Advisor at Thrivent Financial.

Kimberly is a graduate of Wright State University where she received a Bachelor of Arts degree in Psychology. Outside of the office, Kimberly spends time with her family enjoying hiking, camping, and other outdoor activities.

About Mamta Shah

Before joining Trust Services in 2010, she was the Wealth Analyst with the Chicago based Wealth Planning Center at Morgan Stanley. Mamta was responsible for providing information and education on a full range of income and estate tax topics and concerns.

Prior to joining the Planning Center team in 2006, Mamta was Vice President of an Independent Investment Advisory Firm. She worked closely with the clients of the firm on a variety of financial planning and investment advisory services.

Mamta obtained her bachelor’s degree from Babson College with a major in Finance/Entrepreneurship. Mamta is a licensed CPA and holds a CFP® designation, She has been in the financial services industry since 1999. She is Series 7, 63, 65 and life/health insurance licensed. She is a member of the AICPA and the Illinois CPA Society. She lives in Chicago with her family.

About Jackson F. Rone

He earned his undergraduate degree from Fordham University and received the Financial Planning Specialist® designation from the College for Financial Planning. Jackson is originally from Kansas City, Kansas and currently resides in New York, New York.

About Ryan Tobin

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking-related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley does not accept appointments, nor will it act as a trustee, but it will provide access to trust services through an appropriate third-party corporate trustee.

Trusts are not necessarily appropriate for all clients. There are risks and considerations which may outweigh any potential benefits. Establishing a trust will incur fees and expenses which may be substantial. Trusts often incur ongoing administrative fees and expenses such as the services of a corporate trustee, attorney, or tax professional.

Trust services are provided by third parties who are not affiliated with Morgan Stanley. Neither Morgan Stanley nor its affiliates are the provider of such trust services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with these trust services. Neither Morgan Stanley nor its affiliates shall be responsible for any advice or services provided by the unaffiliated third parties. Morgan Stanley or its affiliates may participate in transactions on a basis separate from the referral of clients to these third parties and may receive compensation in connection with referrals made to them.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

What's it like to work with a Morgan Stanley Financial Advisor

Portfolio Insights

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

4Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

12Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

13Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

14Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley