About Casey Armstrong

After a decade in the financial industry, Casey’s business model is strongly rooted in financial planning to include insurance needs, educational funding, wealth management and estate planning strategies. Casey is a Morgan Stanley Financial Planning Specialist and Financial Advisor; she attained her Series 6, 7, 63, 65 and life and health insurance licenses. She was recognized as a young, evolving leader in the financial industry in 2021-2023; when she was awarded the Five Star Wealth Manager recognition and named to the Firm’s Pace Setters Club. Casey prides herself in client service and relationships.

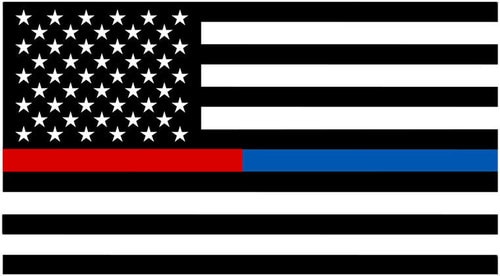

Casey earned her Bachelor’s degree in Criminal Justice from Bowling Green State University in Ohio, which led to her strong community ties with law enforcement officers. She also holds her Master’s Degree in Marketing and Communication from Franklin University in Columbus, Ohio.

Casey is passionate about her work with children and supporting those who protect others at risk. Casey is active with several nonprofit organizations that assist families of first responders and others in crisis. Casey volunteers much of her time with children services as a foster and adoptive parent. In her free time, she enjoys traveling, sampling new restaurant menus and spending time outside with her husband, David, their children and two dogs.

Morgan Stanley Smith Barney LLC and its Financial Advisors do not provide tax or legal advice. Individuals should seek advice based on their particular circumstances from an independent tax advisor.

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

"This award was issued in 2023 based on the evaluation process below. This evaluation was not based on a specific time period, but was conducted by Five Star Professional (FSP) that considered, among other factors, the following:

• Favorable regulatory and complaint history review. As defined by FSP, the wealth manager has not: 1.) Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; 2.) Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed, or denied complaints with any regulatory authority or FSP’s consumer complaint process.

• Personal bankruptcy filing within the past 11 years.

• Termination from a financial services firm within the past 11 years.

• Conviction of a felony.

• One-year client retention rate.

• Five-year client retention rate.

Five Star Professional, as a third party research firm, identified pre-qualified award candidates based on industry data and contacted all identified broker dealers, Registered Investment Advisor firms and FINRA-registered representatives to gather wealth manager nominations. Self-nominations are not accepted. Wealth managers and/or their firms do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers.

For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com.

Securities Agent: VT, PA, GA, NM, MI, DC, TX, OR, MD, AZ, UT, NY, NC, HI, CO, AR, KY, WA, TN, IN, VA, OK, MT, MA, ID, CA, AL, OH, SC, LA, MO, ME, IL, FL, CT, MN, IA; General Securities Representative; Investment Advisor Representative

NMLS#: 1073357

AR Insurance License #: 17121098

Industry Award Winner

Industry Award Winner