About Kurt E Meyer

Kurt Evan Meyer

Global Sports & Entertainment Director

Family Wealth Director

Senior Portfolio Management Director

Financial Planning Specialist

Financial Advisor

Kurt E. Meyer is a Family Wealth Director, Global Sports and Entertainment Director, and founding partner of The MPT Wealth Management Group. For more than 35 years, he has enjoyed serving the needs of individuals and families with significant wealth, helping to empower them to achieve new levels of success through a disciplined wealth management approach and a commitment to outstanding service.

Raised in Scottsdale, Arizona, Kurt always had an interest in the financial markets. At the age of 13, he purchased his first shares of stock with his paper-route savings. He found it fascinating to learn about companies and what they did. Instead of becoming the president of one company, he realized he could own a part of many great companies. This experience inspired Kurt to pursue a career in wealth management. After earning his B.A. in finance from Arizona State, Kurt joined Merrill Lynch in 1986. Two years later, he moved to Morgan Stanley and has been an integral member of the firm ever since, being named to the firm's President's Club every year from 2000-2025.

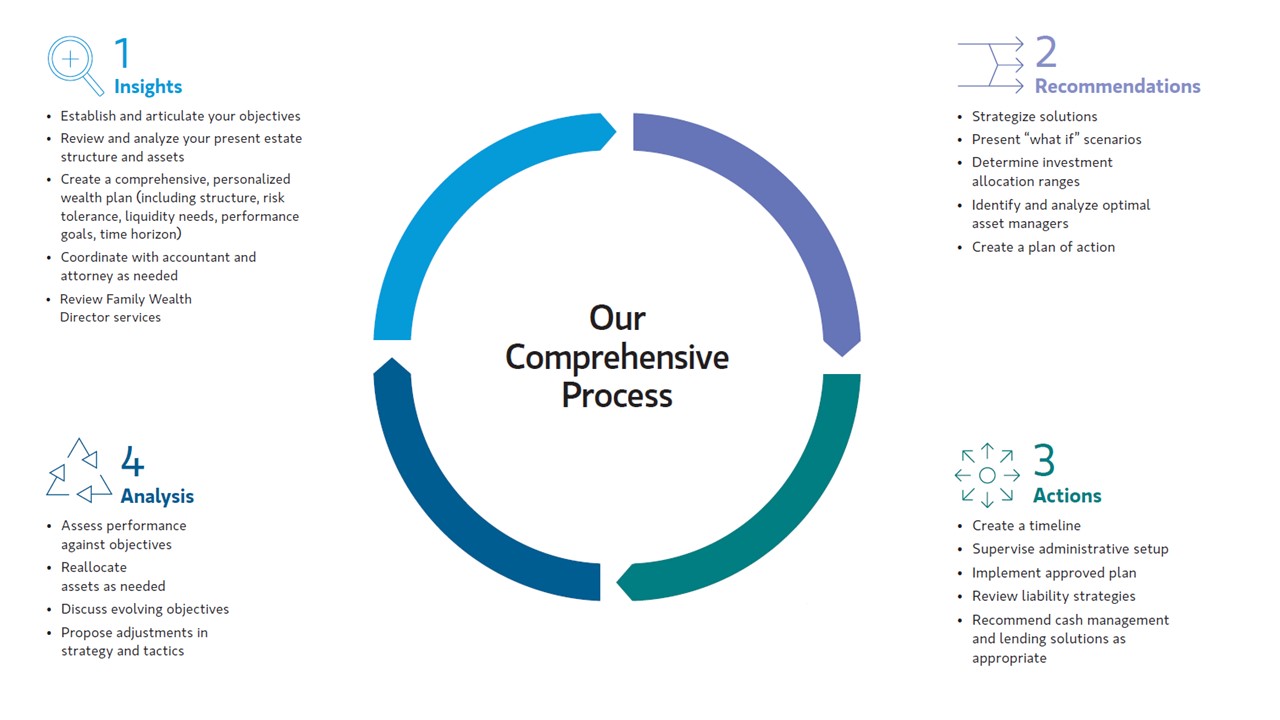

Kurt has built his career educating and advising clients on how to better understand and manage their total financial picture. He holds several professional designations at Morgan Stanley, including Family Wealth Director, Global Sports and Entertainment Director, Senior Portfolio Management Director and Alternative Investment Director. He is among a select group of Advisors qualified to serve the specialized needs of ultra-high new worth families and those working in the sports and entertainment industries. These credentials provide Kurt and his colleagues an extensive range of resources designed specifically to help these families and professionals manage the unique challenges of significant wealth.

Kurt enjoys working with like-minded clients who value and appreciate the level of skill and service he and his team deliver. He guides them in simplifying their finances and developing a tailored plan to meet their life goals while helping them navigate the challenges of today's complex markets. Kurt receives great satisfaction knowing he is making a significant impact on the quality of his client's lives and appreciates the close personal relationship with the families he represents.

Believing balance is vital to a happy life, Kurt enjoys running marathons, travelling, playing basketball, reading classics, playing the guitar, listening to music and watching movies. He and his wife, Mary, have a beautiful home in Scottsdale and love spending time with their six grown children.

Morgan Stanley Wealth Management President's Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance.

Securities Agent: WI, AR, AK, AL, AZ, CA, CO, CT, DC, FL, GA, HI, IA, ID, IL, IN, KS, MA, MD, MI, MN, MO, MT, NC, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, VT, WA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1275719

CA Insurance License #: 0B66921

Industry Award Winner

Industry Award Winner