Industry Award Winner

Industry Award WinnerOur Mission Statement

We strive to enhance the financial well-being of those who depend on us by providing them with tailored, solutions-oriented investing strategies paired with an unabated commitment to exceptional client service.

Welcome

In an ever-changing financial landscape, we believe having a seasoned professional at your side has become crucial to achieving financial success. We can help you with virtually all aspects of your financial journey including planning, creation, and implementation of your strategy.

The Mercury Group at Morgan Stanley was founded around a mutual passion for understanding clients’ goals and developing solutions that strive to achieve them. Our group is made up of financial professionals who understand the importance of being creative, diligent, and effective in navigating today’s fast paced global economy. Today’s challenges call for more than a “one-size fits all” investment approach, we must be proactive and adapt accordingly.

We begin by developing a comprehensive understanding of your current financial situation. We then leverage the extensive, robust tools available to us through our industry-leading firm. Our firm has some of the industry’s smartest individuals along with superior tools and analytics. Combining our experience with our tool’s analytics we are able to identify what rate or return is necessary to help achieve your goals at a given level of risk. Once we know what you need, we create a truly customized strategy for you that seeks to achieve the necessary return.

Our goal is to provide our clients with the opportunity to enjoy their wealth today, tomorrow, and for years to come. We encourage you to reach out to our team to find out how we can help you and your family.

The Mercury Group at Morgan Stanley was founded around a mutual passion for understanding clients’ goals and developing solutions that strive to achieve them. Our group is made up of financial professionals who understand the importance of being creative, diligent, and effective in navigating today’s fast paced global economy. Today’s challenges call for more than a “one-size fits all” investment approach, we must be proactive and adapt accordingly.

We begin by developing a comprehensive understanding of your current financial situation. We then leverage the extensive, robust tools available to us through our industry-leading firm. Our firm has some of the industry’s smartest individuals along with superior tools and analytics. Combining our experience with our tool’s analytics we are able to identify what rate or return is necessary to help achieve your goals at a given level of risk. Once we know what you need, we create a truly customized strategy for you that seeks to achieve the necessary return.

Our goal is to provide our clients with the opportunity to enjoy their wealth today, tomorrow, and for years to come. We encourage you to reach out to our team to find out how we can help you and your family.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

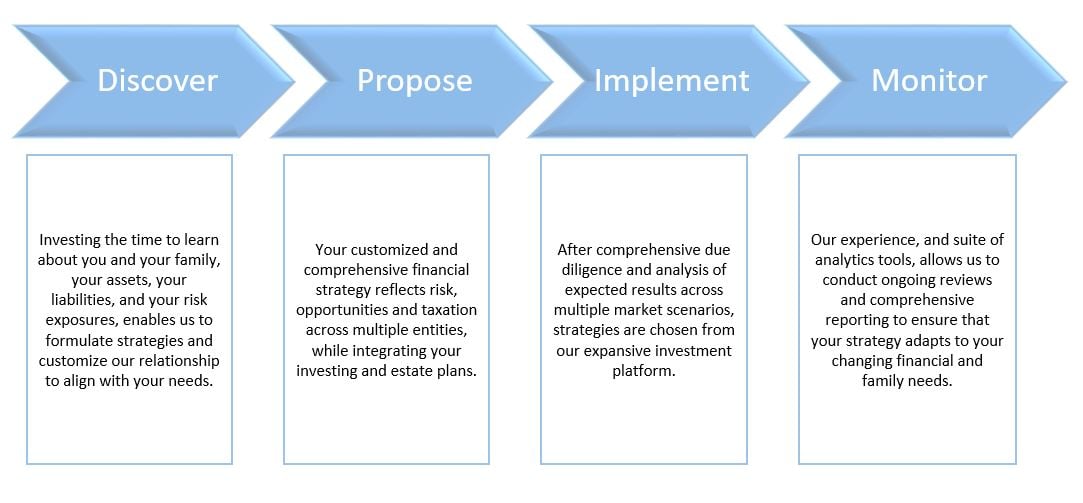

Our Process Built Around You

The Mercury Group considers proper planning to be paramount in helping achieve your financial goals. Therefore, charting a clear, realistic course to financial independence begins with understanding your values, priorities and goals for the future. Working together, we define what is most important to you and your family and then develop the appropriate strategies to help you achieve your goals. Through each step, we provide objective advice and investment insights to construct a plan that is uniquely yours.

Our goals-based approach allows our clients to remain confident with their financial future, so they can continue to enjoy their wealth today, tomorrow, and for years to come. If your circumstances change – whether by chance or choice – The Mercury Group will be with you every step of the way. We welcome you to take a look at our comprehensive approach outlined below.

Our goals-based approach allows our clients to remain confident with their financial future, so they can continue to enjoy their wealth today, tomorrow, and for years to come. If your circumstances change – whether by chance or choice – The Mercury Group will be with you every step of the way. We welcome you to take a look at our comprehensive approach outlined below.

Location

5565 Glenridge Conn

Suite 1900

Atlanta, GA 30342

US

Direct:

(404) 459-3891(404) 459-3891

Meet The Mercury Group

About Jonathan Dickson

Jon Dickson is a Managing Director, Senior Portfolio Management Director, and Alternative Investments Director at Morgan Stanley. As the senior team leader of The Mercury Group, his primary responsibilities include the formulation, implementation, and management of truly custom / bespoke investment strategies for a limited number of high net worth and institutional clients. He began his investment career in 2000 after earning his Bachelor’s degree in Business and Behavioral Science from Oglethorpe University. Jon began his career at Merrill Lynch directly upon graduation from Oglethorpe, then transitioned to UBS where he spent 10 years building a significant wealth management practice before moving to Morgan Stanley in 2010.

Jon is a regular member of the prestigious “President’s Club” at Morgan Stanley, in addition to consistently being named as a “Best-in-State Wealth Advisor” for high net worth clients by Forbes from 2022-2024

Jon is passionate about developing a firm understanding of each client’s unique goals and objectives and, accordingly, utilizing the vast resources of Morgan Stanley to craft a truly customized solution to achieve the objectives. In fact, Jon’s very reason for getting into the industry was to change lives through helping grow and preserve significant wealth. Jon started in the business at the young age of twenty one which offers him distinctive insight when helping clients in any stage of life. His long industry tenure has also exposed him to a vast array of market conditions, making Jon a seasoned advisor and giving him an abundance of market knowledge.

Jon’s passion for helping people and changing lives extends beyond his work. He is also an active member of his community and supporter of a variety of philanthropic organizations including the Cobb County Community Foundation, and the Juvenile Diabetes Research Foundation. He also supports the SOS Children’s Villages of Bosnia (a charity that both he and his wife, Lejla, take great pride in due to Lejla’s Bosnian heritage). Jon has been happily married for fifteen years and is the proud father of two wonderful children, Grace and Grant. Outside of the office, Jon enjoys coaching youth sports, reading, and traveling. Jon also enjoys playing tennis, pickleball, and golf.

Jon’s industry tenure, customized approach, and experience make him an ideal strategic choice for clients seeking a knowledgeable, trustworthy Financial Advisor. He invites, and encourages, anyone looking for advice to reach out and schedule a time to talk about their financial situation and goals.

2022 - 2024 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2022 - 2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Jon is a regular member of the prestigious “President’s Club” at Morgan Stanley, in addition to consistently being named as a “Best-in-State Wealth Advisor” for high net worth clients by Forbes from 2022-2024

Jon is passionate about developing a firm understanding of each client’s unique goals and objectives and, accordingly, utilizing the vast resources of Morgan Stanley to craft a truly customized solution to achieve the objectives. In fact, Jon’s very reason for getting into the industry was to change lives through helping grow and preserve significant wealth. Jon started in the business at the young age of twenty one which offers him distinctive insight when helping clients in any stage of life. His long industry tenure has also exposed him to a vast array of market conditions, making Jon a seasoned advisor and giving him an abundance of market knowledge.

Jon’s passion for helping people and changing lives extends beyond his work. He is also an active member of his community and supporter of a variety of philanthropic organizations including the Cobb County Community Foundation, and the Juvenile Diabetes Research Foundation. He also supports the SOS Children’s Villages of Bosnia (a charity that both he and his wife, Lejla, take great pride in due to Lejla’s Bosnian heritage). Jon has been happily married for fifteen years and is the proud father of two wonderful children, Grace and Grant. Outside of the office, Jon enjoys coaching youth sports, reading, and traveling. Jon also enjoys playing tennis, pickleball, and golf.

Jon’s industry tenure, customized approach, and experience make him an ideal strategic choice for clients seeking a knowledgeable, trustworthy Financial Advisor. He invites, and encourages, anyone looking for advice to reach out and schedule a time to talk about their financial situation and goals.

2022 - 2024 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2022 - 2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Securities Agent: NV, MA, TN, HI, DE, AR, UT, MT, KS, IN, WV, WI, TX, NY, NJ, NC, VT, OK, DC, MI, CT, CA, OH, NM, NE, LA, KY, IL, GA, FL, AL, WY, OR, MS, VA, SC, RI, MO, MD, CO, AZ, SD, PA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279063

NMLS#: 1279063

About Ethan Staats

Ethan Staats began his investment career in 1995 after earning his Bachelor’s degree in Finance from the University of Georgia. Prior to joining Morgan Stanley in 2012, Ethan spent time working at both Wells Fargo and Northwestern Mutual. Ethan currently serves as a Family Wealth Advisor and holds the Certified Financial Planner (CFP) designation. As a member of The Mercury Group, Ethan focuses on working with clients to create long-term, personalized financial plans in addition to coordinating the financial care of clients with their other advisors.

Ethan cares deeply about his clients on both a financial and personal level. His passion for financial advisory formed because the role allows him to listen to, and learn from, others. Everyday Ethan learns more about his clients, which allows him to constantly refine his approach to crafting their tailored financial plans. His perspective encourages the identification of specific goals and the determination of the necessary rate of return to help achieve them. This needs-based investing style distinguishes him from many in the industry.

A native Atlantan with four generations of history, Ethan’s commitment to improving the lives of people around him is further carried out through his community involvement. He provides pro-bono work as a treasurer for a local child daycare center. Ethan’s family hosts foreign exchange students which he finds to be a rewarding opportunity to help students achieve their educational goals. Ethan also teaches sailing for three of Atlanta’s high schools. He is a devoted husband to his lovely wife and deeply committed father to his four wonderful children. A man of many interests, he also enjoys fly-fishing, bird hunting, fly-tying, sailing, tennis, golf, pickleball and squash, among other activities. His thirst for learning even challenged him to become an instrument rated, commercial pilot for single engine and multi-engine piston aircraft.

Ethan’s innate ability to connect with and understand his clients, along with his dedication to his family and to learning new things makes him a wise choice for those looking for an experienced, well-rounded financial advisor.

Ethan cares deeply about his clients on both a financial and personal level. His passion for financial advisory formed because the role allows him to listen to, and learn from, others. Everyday Ethan learns more about his clients, which allows him to constantly refine his approach to crafting their tailored financial plans. His perspective encourages the identification of specific goals and the determination of the necessary rate of return to help achieve them. This needs-based investing style distinguishes him from many in the industry.

A native Atlantan with four generations of history, Ethan’s commitment to improving the lives of people around him is further carried out through his community involvement. He provides pro-bono work as a treasurer for a local child daycare center. Ethan’s family hosts foreign exchange students which he finds to be a rewarding opportunity to help students achieve their educational goals. Ethan also teaches sailing for three of Atlanta’s high schools. He is a devoted husband to his lovely wife and deeply committed father to his four wonderful children. A man of many interests, he also enjoys fly-fishing, bird hunting, fly-tying, sailing, tennis, golf, pickleball and squash, among other activities. His thirst for learning even challenged him to become an instrument rated, commercial pilot for single engine and multi-engine piston aircraft.

Ethan’s innate ability to connect with and understand his clients, along with his dedication to his family and to learning new things makes him a wise choice for those looking for an experienced, well-rounded financial advisor.

Securities Agent: SD, PA, FL, CO, CA, AR, NV, NM, NC, MT, LA, DC, SC, OR, OH, MS, MD, MA, CT, VT, TN, IN, GA, WA, RI, OK, MO, TX, NY, NJ, DE, VA, KS, IL, AL, UT, MI, NE, KY, HI, AZ, WY; General Securities Representative; Investment Advisor Representative

NMLS#: 1274545

NMLS#: 1274545

About Michelle Veach

Michelle joined Morgan Stanley in 2019 after working in banking, finance, and insurance. Her extensive knowledge, and experience, that she brings makes her an invaluable resource to both the team and our valued clients. She is the newest addition to our team and assists our clients with all administrative tasks and questions.

Michelle currently resides in Brookhaven with her daughter. In her spare time, she enjoys spending time with family, friends and her dog Leia.

Michelle currently resides in Brookhaven with her daughter. In her spare time, she enjoys spending time with family, friends and her dog Leia.

About Debbie Restauri

Debbie takes great pride and plays a significant role in providing our clients with exceptional service in her administrative position. Debbie will generally be your first point of contact with your on-boarding process, and any administrative task or question you may have.

With over 30 years of experience in the financial services industry, Debbie brings a wealth of knowledge to our team to best serve you. She holds the FINRA Series 7,63, 65, and 31.

Debbie currently resides in Marietta. She enjoys spending time with friends, and visiting her son, Brandon, in Park City, Utah.

With over 30 years of experience in the financial services industry, Debbie brings a wealth of knowledge to our team to best serve you. She holds the FINRA Series 7,63, 65, and 31.

Debbie currently resides in Marietta. She enjoys spending time with friends, and visiting her son, Brandon, in Park City, Utah.

About Lissa Dewindt

Raised in Weston, Florida, Lissa developed an early passion for investing that led her to study Finance at American University, where she helped manage a million-dollar Student Managed Investment Fund. A former soccer player and dedicated lifter, she brings the same discipline and drive to her professional life.

Her experience spans wealth management, early-stage private equity, startup strategy, and exposure to alternative assets and risk-focused investment approaches. As a student representative for the Dominican Republic and an active leader in women-focused business organizations, she is committed to expanding access to financial education.

Her experience spans wealth management, early-stage private equity, startup strategy, and exposure to alternative assets and risk-focused investment approaches. As a student representative for the Dominican Republic and an active leader in women-focused business organizations, she is committed to expanding access to financial education.

Contact Jonathan Dickson

Contact Ethan Staats

Awards and Recognition

Forbes Best-In-State Wealth Advisors

2019-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2019-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Maranda Barbour

Maranda Barbour is a Private Banker serving Morgan Stanley Wealth Management offices in Georgia.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Maranda began her career in financial services in 1999, and joined Morgan Stanley in 2010 as an Associate Private Banker. Prior to joining the firm, she was a Premier Client Manager at Bank of America.Maranda is a graduate of Winthrop University, where she received a Bachelor of Science in Marketing. She lives in Alpharetta, Georgia with her family.

Outside of the office, Maranda dedicates her time to youth mentoring programs and numerous community organizations, including Girl Scouts of America and the Greater North Atlanta Chapter of Jack and Jill of America, Inc. She also enjoys walking, traveling, and hiking.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Maranda began her career in financial services in 1999, and joined Morgan Stanley in 2010 as an Associate Private Banker. Prior to joining the firm, she was a Premier Client Manager at Bank of America.Maranda is a graduate of Winthrop University, where she received a Bachelor of Science in Marketing. She lives in Alpharetta, Georgia with her family.

Outside of the office, Maranda dedicates her time to youth mentoring programs and numerous community organizations, including Girl Scouts of America and the Greater North Atlanta Chapter of Jack and Jill of America, Inc. She also enjoys walking, traveling, and hiking.

NMLS#: 1182370

About Mark Jansen

Mark Jansen is a Family Office Resources Generalist for Morgan Stanley’s Family Office Resources, covering the Southeast Region. In this capacity, Mark provides specialized expertise to Financial Advisors and their UHNW clients across a broad range of family wealth management issues including; family governance and wealth education, strategic estate and financial planning, philanthropy management and lifestyle advisory. Mark has over 30 years of experience advising wealthy families, business owners, and their children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Mercury Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)