Mercedes Paratje

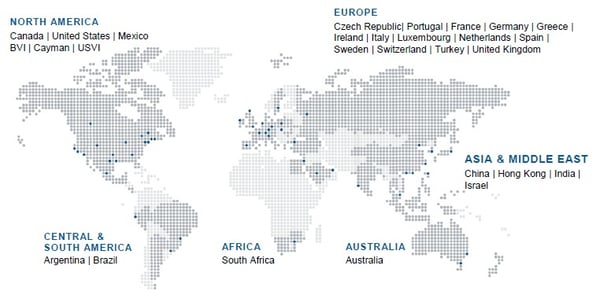

Our story begins with a unique global perspective. Our three partners come from three different countries and have all spent their professional lives focused on the needs of international investors. They have developed a deep understanding of the regions in which they work, and have built extensive professional networks. Having worked closely together for over 25 years, they combine their talents to provide comprehensive wealth management services to an elite multinational clientele.

Our clients are financially sophisticated people with complicated financial needs. Adding our own insights and perspectives to Morgan Stanley's vast global resources, our goal is to help our clients address the complex, multidimensional challenges of managing significant wealth. We understand the unique needs of highly affluent international clients, and are well-prepared to help them craft highly customized strategies to protect the wealth they have created and support the lifestyles they enjoy.

We look forward to learning more about you and your family, and to discussing how we can help you address your challenges and reach your goals.

Awards & Recognition

The MDM Group is honored to have received recognition from both Forbes and Barron's for demonstrating our strong commitment to helping our clients achieve their financial goals. Recognition from these esteemed publications would not have been, nor would continue to be possible without the hard work of our team and the relationships we built with our wonderful clientele, who have entrusted us over the years and will continue to inspire us for many more to come.

2022, 2023 | Barron's Top 100 Private Wealth Management Teams

(Formerly referred to as Barron's Top 50 Private Wealth Management Teams, Barron's Top 50 Private Wealth Advisory Teams) Source: Barrons.com (Awarded 2022, 2023). Data compiled by Barron's based on 12-month period concluding in Dec of the year prior to the issuance of the award.

2023, 2024, 2025 | Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2023, 2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in March of year prior to the issuance of the award.

Mercedes Paratje | 2025 | Barron's Top 100 Women Financial Advisors

Source: Barrons.com (Awarded July 2025) Data compiled by Barron's based on 12-month time

period Apr 2024-Mar 2025.

Mercedes Paratje | 2022, 2023 2024, 2025 | Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2023, 2024, 2025) Data compiled by Shook Research LLC based on based on 12-month time period concluding in Sep. of the year prior to the issuance of the award.

Mercedes Paratje | 2021, 2024, 2025 | Forbes America's Top Women Wealth Advisors

Source: Forbes.com (Awarded 2021, 2024, 2025) Data compiled by Shook Research LLC based on based on 12-month time period concluding in Sep. of the year prior to the issuance of the award.

Mercedes Paratje | 2023, 2024, 2025 | Forbes Best-In-State Women Wealth Advisors

Source: Forbes.com (Awarded 2023, 2024, 2025) Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sep. of the year prior to the issuance of the award.

David Lew | 2022, 2023, 2024, 2025 | Forbes Best-In-State Wealth Advisor

Source: Forbes.com (Awarded 2022, 2023, 2024, 2025) Data compiled by Shook Research LLC based on based on 12-month time period concluding in Apr. of the year prior to the issuance of the award.

Miguel Bacal | 2023, 2024, 2025 | Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2023, 2024, 2025) Data compiled by Shook Research LLC based on based on 12-month time period concluding in Apr. of the year prior to the issuance of the award.

Everardo Vidaurri | 2023, 2024 | Forbes Top Next-Gen Wealth Advisor

Source: Forbes.com (Awarded 2023, 2024) Data compiled by Shook Research LLC based on 12-month time period concluding in Aug. of the year prior to the issuance of the award. SHOOK considered advisors born in 1985 or later with a minimum 4 years as an advisor.

Everardo Vidaurri | 2023, 2024, 2025 | Forbes Top Nex-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded 2023, 2024, 2025) Data compiled by Shook Research LLC based on 12-month time period concluding in Aug. of the year prior to the issuance of the award. SHOOK considered advisors born in 1986 or later with a minimum 4 years as an advisor.

Our approach to wealth management is driven by your needs. We take the time to understand what you are trying to accomplish, what you have to work with and what obstacles stand in your way. Then we create customized solutions designed to help achieve your objectives. In order to deliver on a solutions-oriented approach to wealth management, we believe you need to have more than a single solution at your disposal.

Drawing on our diverse backgrounds as institutional investors, we can explore derivatives solutions or FX strategies, create proprietary portfolios or provide access to carefully vetted long-only and alternative managers on Morgan Stanley's vast open architecture platform. Supplementing our own experience and regional knowledge, we can call upon the extraordinary intellectual capital of our firm and our professional networks. We can call in experts on tax, trust and estate planning, philanthropy management, family dynamics, wealth education and a broad variety of other wealth management services.

Discovery Process

• Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

• Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

• Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

• Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

• After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

• In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.