Industry Award Winner

Industry Award WinnerOur Mission Statement

Welcome

The great thing about significant wealth is that when managed properly, it creates unique opportunities for you and your family. However, it can also unleash complex challenges that could stand in the way of you achieving many of your life's goals. That's where we can make a difference.

We're an ally for every step of your financial journey.

The SkyPointe Wealth Management Group is an award-winning team that's made up of highly-experienced and deeply-trustworthy financial professionals. We embrace change and innovation to drive net after-tax results. By concentrating on your unique needs, we customize and implement an approach that helps to maximize growth potential and minimize risk. Above all, we deliver a level of service that's personal and proactive.

There's a reason we're consistently recognized as "Best-In-State".

We're fortunate that Forbes keeps naming us to their various "Best-In-State" lists, but the way we measure success is by how well we deliver against our three pillars to success:

- Deep Discovery – To build your wealth, we start by building a relationship.

- Life-long Learning –We're always searching for new ideas to propel you forward.

- Grace & Hustle – While our solutions are sophisticated, we're not afraid to roll up our sleeves and go to work for your success. So, let's get started!

Forbes Best-In-State Wealth Management Teams 2025

Forbes Best-In-State Wealth Advisors 2024

2025 Forbes Best-In-State Wealth Management Teams ranking awarded in 2025. This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period from 3/31/23–3/31/24.

2023-2024 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2023-2024). Data compiled by SHOOK Research LLC based 12-month period concluding in June of year prior to the issuance of the award. Source: Forbes (Jan 2025)

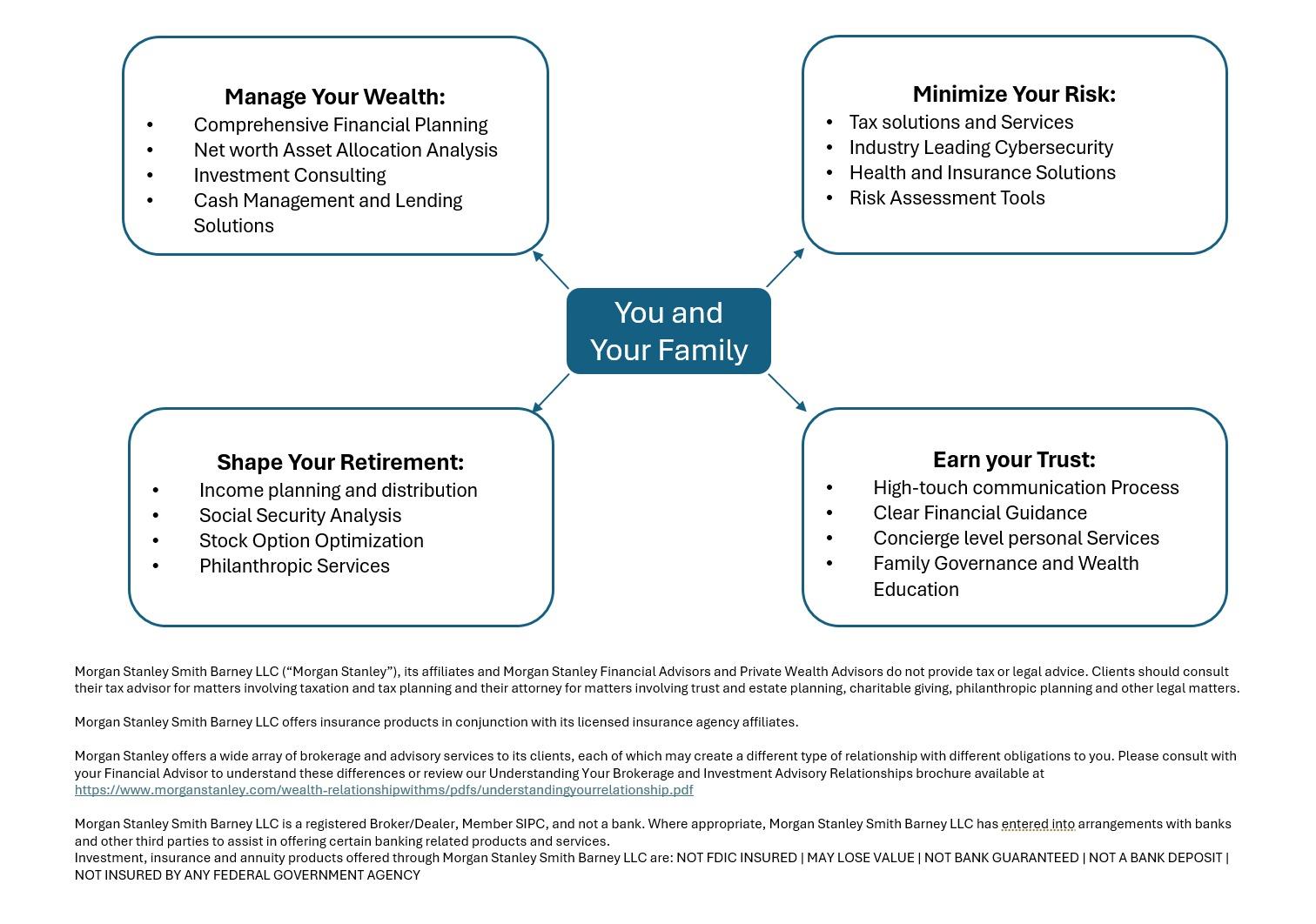

We’re here to build your wealth…and make your life easier.

Your true wealth potential becomes more realistic when you have a team that brings a broad range of skill sets to your life. We're your trusted partner for your finances, the quarterback for your day-to-day activities, and the architect of your legacy.

It all starts with our Deep Discovery process. We'll take the time to understand your challenges, values, and financial aspirations. Then we'll handcraft a financial plan designed exclusively for you. Whether you're looking to retire at 62 or you're constantly striving to reach new heights, we have the experience, global resources and connections to take you to where you want to go.

Location

Meet SkyPointe Wealth Management Group

About Paul B. Majauskas

I’ve always had a fascination about how money works. As a son of emigrants, my family didn’t have much of it growing up, so I became a lifelong student of the markets. I believe that’s why I’m able to explain to my clients their options and opportunities in plain speak. You can leave the financial jargon and overcomplicated explanations to some other firm. We believe in clarity and transparency.

My career as a Financial Advisor began at Morgan Stanley in 1986. As the Managing Partner of the SkyPointe Wealth Management Group, I’m responsible for our overall practice, including supporting my great team in areas such as Client Services, New Business Development, and Capital Markets. Once you meet us, it’s easy to see why Forbes named us to their annual “Best-In-State Wealth Management Teams” list for 2025.

I earned both a Bachelor of Science and a Master of Management in Finance from Northwestern University. And to help manage my clients risk/return goals, I went on to earn my Certified Investment Management Analyst® (CIMA®) designation from the Wharton School at the University of Pennsylvania.

On a personal note, I’ve been married to my wonderful wife since 1990. We moved to Downers Grove, IL in 1996, where we raised 3 children who are now grown adults. We are a bilingual family, speaking both English and Lithuanian. I am also a lifelong volunteer within the Lithuanian-American community. My wife and I are also international travelers and have visited more than 100 countries. My hobbies include tennis, cooking, astronomy, and chess.

Paul.B.Majauskas@morganstanley.com

Forbes Best-In-State Wealth Advisors 2023 (Ranked #14)

Forbes Best-In-State Wealth Advisors 2024 (Ranked #16)

Forbes Best-In-State Wealth Advisors 2025 (Ranked #11)

Forbes Best-In-State Wealth Management Teams 2025 (Ranked #24)

2023 - 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2023 - 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award. Awards Disclosures | Morgan Stanley

Forbes Best-In-State Wealth Management Teams

Source: Forbes (Awarded Jan 2025) Data compiled by SHOOK Research LLC based for the period 3/31/23-3/31/24. . Awards Disclosures | Morgan Stanley

NMLS#: 1285376

CA Insurance License #: 0B75085

About William B. Jene

I really do have my client’s best interest at heart. I often say I treat them with the same level of respect and appreciation that I have for my own family. As a realist, I’ll always be upfront with you about your risks and expectations. My job is to help you have an increased comfort level that I’ve carefully structured your investments to best meet your needs and goals.

The first step I always take is to create a comprehensive analysis of your situation and then craft a plan that helps get you to where you want to go. I’ll help make sure that your estate strategy, insurance and financial plan are in place, so you’ll feel more comfortable with whatever comes your way. And as a Alternative Investments Director, I have the knowledge and experience to open the door to new opportunities for you and your family.

My financial services career began at Paine Weber back in 1983. Now I’m fortunate to call Morgan Stanley my home for more than 35 years. The SkyPointe Wealth Management Group is a truly special group of financial professionals, who happen to be some of the smartest and most thoughtful people I’ve ever had the pleasure to know. It’s little wonder that Forbes has named us as one of their “Best-In-State Wealth Management Teams” for the past two years.

I earned my BA degree from Indiana University of Pennsylvania and my MBA in finance from The Keller Graduate School of Business. I then went on to obtain my Certified Investment Management Analyst® (CIMA®) from The Wharton School, The University of Pennsylvania.

My lovely wife and I have five grown children—and are proud grandparents of eight wonderful grandkids. We live in Downers Grove, IL and enjoy spending summers with the family on the lake in Wisconsin. I also enjoy sailing, boating, and downhill skiing. Giving back to the community is very important to me and I especially enjoy efforts to support non-profit organizations as a team outing.

My lovely wife and I have five grown children and are proud grandparents of eight wonderful grandkids. We live in Downers Grove, IL and enjoy spending summers with the family on Green lake in Wisconsin. I enjoy sailing, boating, and downhill skiing, as well as giving back to the community and am currently serving on the Finance committee for the Green Lake Association.

William.B.Jene@morganstanley.com

Forbes Best-In-State Wealth Management Teams 2024, 2025

Source: Forbes.com (Awarded 2024,2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award. Awards Disclosures | Morgan Stanley

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

NMLS#: 1282767

About Cheryl A. Snook

I’m approachable and personable. And it's my diligence and drive that helps to ensure that no stone gets left unturned when it comes to your family’s success. Whether it’s crafting an all-encompassing financial plan, or executing it thoroughly, I’m committed to helping you reach new heights, feel better prepared for the future, and create wealth that can support your lifestyle and span generations. I’ll also deliver the full breath of the firm’s global resources to you, including coordinating your needs and opportunities with a team of Morgan Stanley experts.

What attracted me to financial industry was growing up around family members who owned businesses. That and my abilities in mathematics led me to earn a BBA in Finance from the University of Wisconsin at Eau Claire and my Certified Investment Management Analyst® (CIMA®) at the University of Chicago, Booth School of Business. My career began more than 30 years ago, building on my broad financial expertise with several major financial institutions and a range of clients from business owners to individuals. I joined Morgan Stanley in 2002 and am now proud to be part of a group that was named as one of Forbes “Best-in-State Wealth Management Teams.”

My husband, of 34 years, and I live in St. Charles, IL, where we raised two children who are now fully grown. Our son is an army veteran and a doctor in Louisville, KY. Our daughter also majored in finance and is now a CPA working nearby in Chicago. Outside of the office, I have a passion for supporting education. I am a long-standing board member for the St. Charles Education Foundation and active with other charitable organizations. It's the foundation of family, education, and financial expertise that continue to inspire my work with clients every day.

Cheryl.Snook@morganstanley.com

Forbes Best-In-State Wealth Management Teams 2025

Forbes Best-In-State Wealth Management Teams

Source: Forbes (Awarded Jan 2025) Data compiled by SHOOK Research LLC based for the period 3/31/23-3/31/24. Awards Disclosures | Morgan Stanley

NMLS#: 1265066

About Debra Greening

About Ty Coates

Ty.Coates@morganstanley.com

About Michele Meyer

Michele.Meyer@morganstanley.com

About Samantha Janisse

Samantha. Janisse@morganstanley.com

About Mark Ramseth

mark.ramseth@morganstanley.com

About Lukas Rekasius

Lukas.Rekasius@morganstanley.com

About Helen Dendura-Janyk

Helen.Dendura-Janyk@morganstanley.com

Contact Paul B. Majauskas

Contact William B. Jene

Contact Cheryl A. Snook

Awards and Recognition

The Power of Partnerships

About Jordan Hoerter

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jordan began his career in financial services in 2010 and joined Morgan Stanley in 2019. Prior to joining the firm, he was Vice President, Private Banker at Associated Bank.

Jordan is a graduate of the University of Wisconsin Stevens Point where he received a Bachelor of Science in Business Administration and Marketing. He lives in Chicago, Illinois. Jordan donates his time with United Way, Emerging Leaders, Blessings in a Backpack and Junior Achievement. When not in the office, Jordan enjoys running, snowboarding, traveling, and spending time with his family.

About Amy Gross

Amy began her career in financial services in 2009 and joined Morgan Stanley in 2021. Prior to her current position, she worked at Merrill Lynch and Credit Suisse as a Senior Registered Associate working with high-net-worth clients on an individual basis and making sure all their financial and operational needs were met.

Amy graduated from Illinois State University and holds her Certified Financial Planner® designation. Amy lives in Brookfield, IL with her husband Garrett, daughter Felicity and son Emmett. Outside of work, Amy enjoys both going to and volunteering at Brookfield Zoo and is a Chicago Zoological Association Associate Board Member. Outside of work she enjoys reading, traveling and exploring new places whenever she can.

About Ana Majauskas

She earned her undergraduate degree from Tulane University and received the Financial Planning Specialist® designation from the College for Financial Planning. Anastasija Majauskas is originally from Downers Grove, IL and currently resides in New York City, NY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Portfolio Insights

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley