About Rhonda G. Loy

A Baton Rouge native, Rhonda joined Morgan Stanley in the summer of 2017, bringing with her over 20 years of experience in wealth management. She began her financial services career in 1995 as a financial advisor with Merrill Lynch, where she spent nearly two decades prior to making the move to Morgan Stanley.

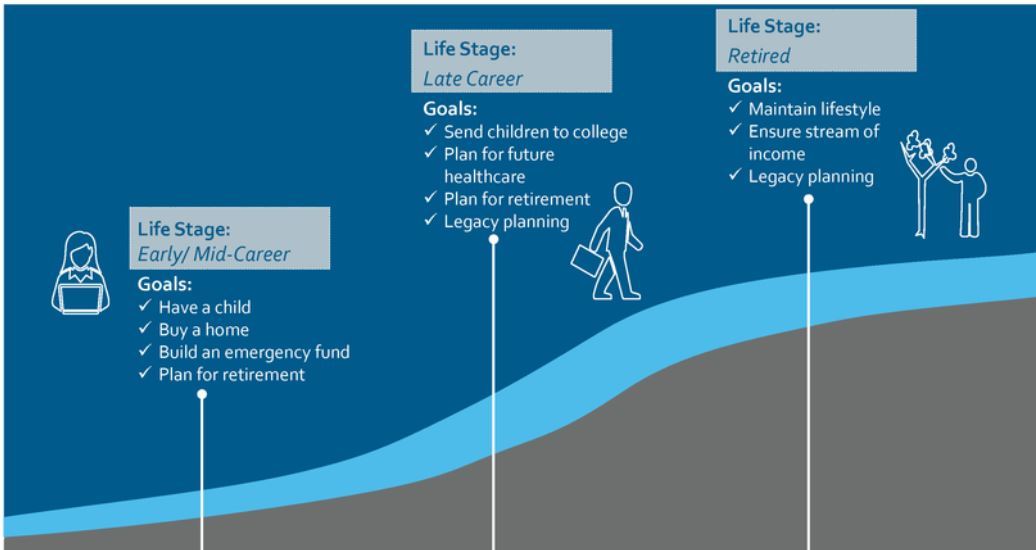

Rhonda holds a Bachelor of Science degree in Finance from LSU and is also a CERTIFIED FINANCIAL PLANNER™ professional who focuses on working with retirees, small business owners and corporate executives. She strives to deliver exceptional client service and is fully committed to long-term relationships with both clients and their families. She carefully listens to their goals, aspirations and concerns in an effort to develop a wealth management strategy suited to their unique situation.

Rhonda and Shawn are the proud parents of two children, Hannah and Nicholas. When she’s not at work or involved with family activities, Rhonda likes to read, travel, and play tennis.

Securities Agent: IA, NC, GA, KS, NY, DC, OK, VA, AL, SC, CA, CO, TX, TN, OH, MS, FL, LA, NM; General Securities Representative; Investment Advisor Representative

Industry Award Winner

Industry Award Winner