John J Lerose III, CFP®, CIMA®

Senior Vice President, Wealth Management,

Financial Advisor,

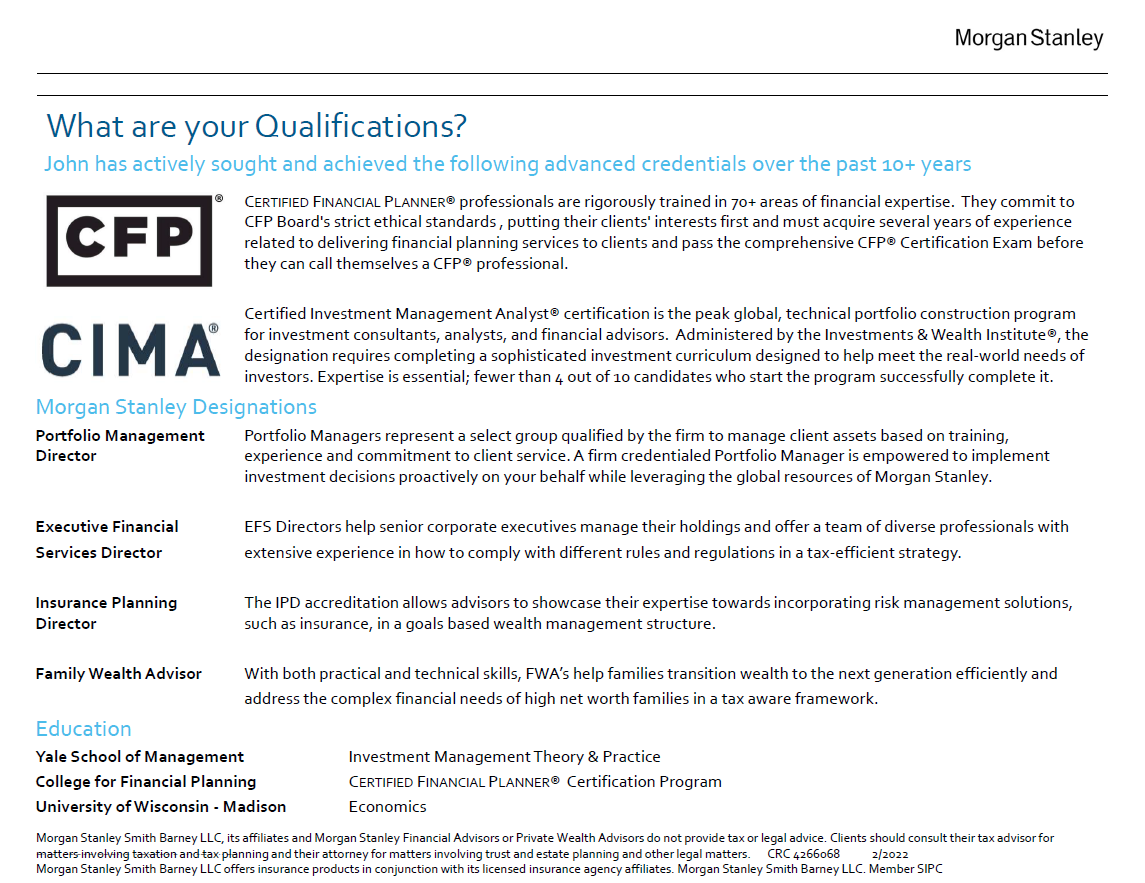

CERTIFIED FINANCIAL PLANNER®,

Certified Investment Management Analyst,

Portfolio Management Director,

Executive Financial Services Director,

Financial Planning Specialist,

Lending Specialist,

Family Wealth Director,

Workplace Advisor - Equity Compensation

Direct:

(414) 226-3118(414) 226-3118

Toll-Free:

(800) 965-4967(800) 965-4967

My Mission Statement

Providing full service financial guidance built on custom planning, precision investment management and proactive communication.

My Story and Services

To me, wealth is about more than money, true wealth is about your life and the things you value most. As a wealth manager, I make this belief a reality by structuring my approach with four key elements: putting clients first, doing the right thing, leading with exceptional ideas, and giving back. Our relationship begins with listening to understand what you care about most. We then form strategies to align your investments with your priorities, goals, and beliefs while balancing risk and return to ensure your financial security. You will stay well informed through a customized communications program that provides regular perspectives on the market and economy and reinforces the expectations set forth in your financial plan.

Preparation is critical to success which has led me to undergo rigorous training to provide the best outcomes for my clients. As a Certified Investment Management Analyst (CIMA®) and Senior Portfolio Manager, I apply in-depth knowledge of capital markets and portfolio construction and leverage the vast resources of Morgan Stanley to personally managing my clients’ investment assets. As a CERTIFIED FINANCIAL PLANNER (CFP®), I take a holistic view of my clients’ finances that goes beyond investments to form a comprehensive plan for all their wealth. And as a Morgan Stanley Family Wealth Advisor, I am positioned to handle complex situations unique to high-net-worth families and develop estate planning strategies to effectively transition their wealth to future generations.

After beginning my career as a financial advisor in 2010, I joined Morgan Stanley and formed The LeRose Group in 2013. I worked in partnership with Joan LeRose for seven years prior to her retirement in 2020. Together we built a thriving wealth management practice dedicated to the best interests of our clients. I am excited to be able to continue this important work with our clients moving forward.

I grew up in Racine, Wisconsin and attained a bachelor’s degree in Economics from the University of Wisconsin-Madison. I have also completed the Investment Management, Theory & Practice program at the Yale School of Management.

When not working, I enjoy reading, traveling, and volunteering to improve the lives of others. As a big believer in always challenging myself, I became a member of MENSA in 2012 and previously served as the Membership Officer for the state of Wisconsin. I am also a member of Roma Lodge and St. Stephen’s Church. I live in Oak Creek, Wisconsin with my wife Evelyn, and our children, Leonardo and Alma.

Preparation is critical to success which has led me to undergo rigorous training to provide the best outcomes for my clients. As a Certified Investment Management Analyst (CIMA®) and Senior Portfolio Manager, I apply in-depth knowledge of capital markets and portfolio construction and leverage the vast resources of Morgan Stanley to personally managing my clients’ investment assets. As a CERTIFIED FINANCIAL PLANNER (CFP®), I take a holistic view of my clients’ finances that goes beyond investments to form a comprehensive plan for all their wealth. And as a Morgan Stanley Family Wealth Advisor, I am positioned to handle complex situations unique to high-net-worth families and develop estate planning strategies to effectively transition their wealth to future generations.

After beginning my career as a financial advisor in 2010, I joined Morgan Stanley and formed The LeRose Group in 2013. I worked in partnership with Joan LeRose for seven years prior to her retirement in 2020. Together we built a thriving wealth management practice dedicated to the best interests of our clients. I am excited to be able to continue this important work with our clients moving forward.

I grew up in Racine, Wisconsin and attained a bachelor’s degree in Economics from the University of Wisconsin-Madison. I have also completed the Investment Management, Theory & Practice program at the Yale School of Management.

When not working, I enjoy reading, traveling, and volunteering to improve the lives of others. As a big believer in always challenging myself, I became a member of MENSA in 2012 and previously served as the Membership Officer for the state of Wisconsin. I am also a member of Roma Lodge and St. Stephen’s Church. I live in Oak Creek, Wisconsin with my wife Evelyn, and our children, Leonardo and Alma.

Services Include

- Professional Portfolio ManagementFootnote1

- Wealth ManagementFootnote2

- Retirement PlanningFootnote3

- Estate Planning StrategiesFootnote4

- Business Succession PlanningFootnote5

- Divorce Financial AnalysisFootnote6

- Sustainable InvestingFootnote7

- 401(k) Rollovers

- Trust AccountsFootnote8

- Executive Financial ServicesFootnote9

- Stock Option PlansFootnote10

- Precious MetalsFootnote11

Securities Agent: OH, MN, RI, NV, MO, CA, AZ, AL, UT, OR, MD, KS, IN, HI, GA, WI, TN, NM, IL, MS, FL, WY, VA, ME, IA, CT, AR, SD, DC, WA, PA, MT, MA, WV, VT, MI, LA, ID, DE, CO, NC, KY, TX, SC, NY, NJ; General Securities Representative; Investment Advisor Representative

NMLS#: 1282665

CA Insurance License #: 0M24097

NMLS#: 1282665

CA Insurance License #: 0M24097

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Focused on Your Success

Think of me as your personal Chief Financial Officer, supporting your business and family. Our financial planning process is geared toward what is most important to you and is centered around three main priorities:

1. Seek to preserve your assets

2. Align investments with your goals

3. Organize and simplify your finances

I am passionate about keeping you well informed and poised for success by providing exceptional ideas, personal service, and in-depth analysis of markets on a timely basis. I host a monthly conference call for all clients that addresses such topics as Social Security, market history and sustainable investing. Those calls are one component of the customized service plan we maintain for client relationships to stay connected. I will also hold proactive investment and planning discussions with you at the frequency that best suits your needs.

You will benefit from a disciplined investment process and custom-tailored financial strategies that leverage my training as a Senior Portfolio Manager. I generally manage assets on a discretionary basis, primarily through managed accounts and individual securities, communicating changes to your portfolio and how those support your long-term investment goals.

I am fortunate to work with an outstanding number of individuals, families, and businesses in the local community, with a broad focus on helping them plan for retirement. I serve quite a few health care professionals, including doctors, pharmacists and nurses. I have also developed an affinity for assisting individuals going through major life changes such as selling a closely held business, retiring from a successful career, marriage, death of a loved one or a divorce.

In addition to the emotional toll, a divorce can pose significant financial challenges. In most couples, one spouse manages the household finances while the other may not even know what or where they are. One of the most useful roles I can play in such situations is to help clients get organized, create an inventory of their assets, and explain the role of each retirement account or insurance policy. I can also work with their divorce attorney to help ensure proper treatment and titling of assets, management of trusts as well as tax planning strategies.

Feel free to listen in to one of my monthly conference calls, they are held on the third Thursday of the month at 10:00am CST. Phone Number (877) 777-0154; Participant Code 7277395#

1. Seek to preserve your assets

2. Align investments with your goals

3. Organize and simplify your finances

I am passionate about keeping you well informed and poised for success by providing exceptional ideas, personal service, and in-depth analysis of markets on a timely basis. I host a monthly conference call for all clients that addresses such topics as Social Security, market history and sustainable investing. Those calls are one component of the customized service plan we maintain for client relationships to stay connected. I will also hold proactive investment and planning discussions with you at the frequency that best suits your needs.

You will benefit from a disciplined investment process and custom-tailored financial strategies that leverage my training as a Senior Portfolio Manager. I generally manage assets on a discretionary basis, primarily through managed accounts and individual securities, communicating changes to your portfolio and how those support your long-term investment goals.

I am fortunate to work with an outstanding number of individuals, families, and businesses in the local community, with a broad focus on helping them plan for retirement. I serve quite a few health care professionals, including doctors, pharmacists and nurses. I have also developed an affinity for assisting individuals going through major life changes such as selling a closely held business, retiring from a successful career, marriage, death of a loved one or a divorce.

In addition to the emotional toll, a divorce can pose significant financial challenges. In most couples, one spouse manages the household finances while the other may not even know what or where they are. One of the most useful roles I can play in such situations is to help clients get organized, create an inventory of their assets, and explain the role of each retirement account or insurance policy. I can also work with their divorce attorney to help ensure proper treatment and titling of assets, management of trusts as well as tax planning strategies.

Feel free to listen in to one of my monthly conference calls, they are held on the third Thursday of the month at 10:00am CST. Phone Number (877) 777-0154; Participant Code 7277395#

Upcoming Firm Events

The Lessons in Leadership Virtual Event Series will continue throughout 2025.

Check back soon for details on upcoming events.

What Impact are your Investments Making?

Volunteering, making charitable donations or setting up trusts for philanthropic giving are great ways for clients to make a difference in society.

Many people do not realize, however, what a powerful influence they can make through their investment selection. Morgan Stanley’s Investing with Impact platform is unique in the wealth management industry for the depth and breadth of choices it offers to support causes you are passionate about.

I can help guide you through the many options to align your investments with your environmental, social, and similar aspirations. Whether it is gender equality, environmental concerns, diversity and inclusion, a faith based mission, or something else you can message me for more information on a specific area you are passionate about: john.lerose@morganstanley.com

Many people do not realize, however, what a powerful influence they can make through their investment selection. Morgan Stanley’s Investing with Impact platform is unique in the wealth management industry for the depth and breadth of choices it offers to support causes you are passionate about.

I can help guide you through the many options to align your investments with your environmental, social, and similar aspirations. Whether it is gender equality, environmental concerns, diversity and inclusion, a faith based mission, or something else you can message me for more information on a specific area you are passionate about: john.lerose@morganstanley.com

Location

411 E Wisconsin Ave

Suite 2200

Milwaukee, WI 53202

US

Direct:

(414) 226-3118(414) 226-3118

Toll-Free:

(800) 965-4967(800) 965-4967

Fax:

(414) 226-3081(414) 226-3081

Wealth Management

From My Desk

You're Ready for Retirement. Is Your Portfolio?

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact John J Lerose III today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

11Physical precious metals are non-regulated products. Precious metals are speculative investments, which may experience short-term and long-term price volatility. The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price you receive may be less than your original investment. Unlike bonds and stocks, precious metals do not make interest or dividend payments. Therefore, precious metals may not be appropriate for investors who require current income. Precious metals are commodities that should be safely stored, which may impose additional costs on the investor. The Securities Investor Protection Corporation (“SIPC”) provides certain protection for customers’ cash and securities in the event of a brokerage firm’s bankruptcy, other financial difficulties, or if customers’ assets are missing. SIPC protection does not apply to precious metals or other commodities.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

11Physical precious metals are non-regulated products. Precious metals are speculative investments, which may experience short-term and long-term price volatility. The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price you receive may be less than your original investment. Unlike bonds and stocks, precious metals do not make interest or dividend payments. Therefore, precious metals may not be appropriate for investors who require current income. Precious metals are commodities that should be safely stored, which may impose additional costs on the investor. The Securities Investor Protection Corporation (“SIPC”) provides certain protection for customers’ cash and securities in the event of a brokerage firm’s bankruptcy, other financial difficulties, or if customers’ assets are missing. SIPC protection does not apply to precious metals or other commodities.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)