The King, Barrios, Bartlett, Duncan Group at Morgan Stanley

Our Mission Statement

Leveraging experience, knowledge, and personal dedication to help guide you toward your life goals.

Our Story and Services

We are a team of dedicated investors and disciplined planners, fully committed to your financial success. With us, you gain the collective experience of a highly-personalized investment team, backed by the vast resources of a global financial institution.

As financial professionals and community leaders, we put your best interests first, holding ourselves accountable to doing what is right for you. Our team brings world-class experience, deep financial knowledge, and comprehensive resources to clients both in our community and across the country.

As financial professionals and community leaders, we put your best interests first, holding ourselves accountable to doing what is right for you. Our team brings world-class experience, deep financial knowledge, and comprehensive resources to clients both in our community and across the country.

Services Include

- Professional Portfolio ManagementFootnote1

- Alternative InvestmentsFootnote2

- Business Succession PlanningFootnote3

- Estate Planning StrategiesFootnote4

- Retirement PlanningFootnote5

- Trust ServicesFootnote6

- Cash Management and Lending ProductsFootnote7

- Executive Financial ServicesFootnote8

- Endowments and FoundationsFootnote9

- Fixed IncomeFootnote10

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

439 E Shore Drive

Suite 100

Eagle, ID 83616

US

Direct:

(208) 338-2714(208) 338-2714

101 S. Capitol Blvd

Suite 401

Boise, ID 83702

US

Meet The King, Barrios, Bartlett, Duncan Group

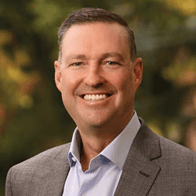

About Me

Brian is a Managing Director and founding member of the King, Barrios, Bartlett & Duncan Group. In this role, he is instrumental in crafting the strategic direction of the team, as well as serving on its investment and planning committees. Brian focuses on developing customized strategies for high-net-worth individuals, families, entrepreneurs, institutional relationships, trusts and charitable organizations.

Brian began his career at Smith Barney Shearson Lehman in 1992, and then spent many years at both Merrill Lynch and the Royal Bank of Canada. He joined Morgan Stanley in 2024. Brian graduated from Boise State University with a B.S. in finance. He is also a graduate of the Estate and Wealth Management Strategies Institute at Michigan State University, the Center for Fiduciary Studies at the University of Pittsburgh Joseph M. Katz School of Business, the U.C.L.A. Behavior Science Program, and has earned the Accredited Wealth Manager designation.

Brian lives in Eagle, Idaho, with his wife, Sonja. He is involved with the College of Business at Boise State University, the Investment committee at the College of Western Idaho, and serves as a board member for the Idaho Youth Sports council. For the past 25 years, he has coached youth basketball and worked as a color commentator for college basketball games. If Brian is not at home, in the office or on the court, he is probably hunting upland birds (especially chukars), golfing, fly-fishing or traveling.

Brian began his career at Smith Barney Shearson Lehman in 1992, and then spent many years at both Merrill Lynch and the Royal Bank of Canada. He joined Morgan Stanley in 2024. Brian graduated from Boise State University with a B.S. in finance. He is also a graduate of the Estate and Wealth Management Strategies Institute at Michigan State University, the Center for Fiduciary Studies at the University of Pittsburgh Joseph M. Katz School of Business, the U.C.L.A. Behavior Science Program, and has earned the Accredited Wealth Manager designation.

Brian lives in Eagle, Idaho, with his wife, Sonja. He is involved with the College of Business at Boise State University, the Investment committee at the College of Western Idaho, and serves as a board member for the Idaho Youth Sports council. For the past 25 years, he has coached youth basketball and worked as a color commentator for college basketball games. If Brian is not at home, in the office or on the court, he is probably hunting upland birds (especially chukars), golfing, fly-fishing or traveling.

Securities Agent: DE, ID, UT, SD, MA, CO, OK, MT, HI, WA, NM, CT, AK, NJ, KY, AZ, MN, MD, IL, GA, FL, CA, OR, NV, NC, ME, AR, TN, WY, VA, NE, TX, PA, NY, WI, KS, IN; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 2053559

NMLS#: 2053559

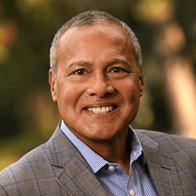

About George Barrios

George’s focus is to help clients understand the importance of establishing a disciplined and well-crafted wealth management strategy. Specifically, he advises clients on the complete life cycle of wealth: seeking to help create and grow wealth, preserve assets, generate sustainable income and prepare for a successful wealth transfer. George also helps clients plan for the four phases of retirement and focuses on longevity planning to help navigate the many events and transitions of later life.

George has been working with the King, Barrios, Bartlett & Duncan Investment Group since 1999. In his current role, he draws upon nearly two decades of experience coaching NCAA collegiate basketball. His strategic mindset, disciplined approached and ability to listen help him anticipate and plan for clients’ challenges. George graduated from California State University-Fullerton, and he has earned the Accredited Wealth Manager designation.

George played and coached basketball for Cal State-Fullerton and Cal State-Bakersfield before spending the last 14 years of his coaching career at Boise State University. He was instrumental in guiding his teams to six NCAA tournament appearances, including one Elite Eight and two Final Fours. Outside the office, George enjoys spending time with his wife, Heidi, and son, Jack. He also loves weekend getaways with his daughters, Kaila and Andrea. And, of course, he loves to watch basketball.

George has been working with the King, Barrios, Bartlett & Duncan Investment Group since 1999. In his current role, he draws upon nearly two decades of experience coaching NCAA collegiate basketball. His strategic mindset, disciplined approached and ability to listen help him anticipate and plan for clients’ challenges. George graduated from California State University-Fullerton, and he has earned the Accredited Wealth Manager designation.

George played and coached basketball for Cal State-Fullerton and Cal State-Bakersfield before spending the last 14 years of his coaching career at Boise State University. He was instrumental in guiding his teams to six NCAA tournament appearances, including one Elite Eight and two Final Fours. Outside the office, George enjoys spending time with his wife, Heidi, and son, Jack. He also loves weekend getaways with his daughters, Kaila and Andrea. And, of course, he loves to watch basketball.

NMLS#: 2637900

About Philip Bartlett

Phil assists individuals, executives, high-net-worth families and foundations with addressing their wealth management needs. With his institutional investment knowledge and the support of Morgan Stanley, he offers a lifetime of experience helping families and friends with investments, wealth planning, estate planning strategies and trust services. A seasoned financial professional, Phil brings a strong understanding of global and U.S. macro-economic policy and analysis, as well as strategies to help implement those trends into his clients’ portfolios.

Prior to joining Morgan Stanley in 2024, Phil enjoyed a successful career as an institutional fixed income portfolio manager, trader and credit analyst managing a proprietary emerging-market bond portfolio in London in the 1990s. He was also the lead analyst on a multi-billion-dollar high-grade and high-yield portfolio for GE Financial Assurance in Seattle, and he managed multi-billion-dollar fixed income portfolios for the state of Alaska and the Alaska Retirement Management Board, with oversight of external fixed income managers and strategies. Most recently, Phil managed institutional fixed income portfolios for Fortune 500 companies, large public and private universities, and governmental entities at Clearwater Advisors in Boise. He earned his M.B.A. from the Simon School at the University of Rochester with concentrations in finance and accounting and holds a B.A. in history and political science from the University of Richmond.

Phil and his wife, Beth, have three children. Outside the office, he enjoys traveling with his family, studying American and European history, researching family genealogy, and fly-fishing. Born in Brazil, Phil has visited, lived in or worked in 54 countries in Latin America, North America, Europe and Africa, and he has visited 49 U.S. states. He has coached youth soccer and lacrosse in his community and volunteers on various reunion, booster and fundraising boards and committees. He also has a life-long commitment to higher education and college placement as part of his nearly two decades of alumni recruitment for the University of Rochester and the University of Richmond.

Prior to joining Morgan Stanley in 2024, Phil enjoyed a successful career as an institutional fixed income portfolio manager, trader and credit analyst managing a proprietary emerging-market bond portfolio in London in the 1990s. He was also the lead analyst on a multi-billion-dollar high-grade and high-yield portfolio for GE Financial Assurance in Seattle, and he managed multi-billion-dollar fixed income portfolios for the state of Alaska and the Alaska Retirement Management Board, with oversight of external fixed income managers and strategies. Most recently, Phil managed institutional fixed income portfolios for Fortune 500 companies, large public and private universities, and governmental entities at Clearwater Advisors in Boise. He earned his M.B.A. from the Simon School at the University of Rochester with concentrations in finance and accounting and holds a B.A. in history and political science from the University of Richmond.

Phil and his wife, Beth, have three children. Outside the office, he enjoys traveling with his family, studying American and European history, researching family genealogy, and fly-fishing. Born in Brazil, Phil has visited, lived in or worked in 54 countries in Latin America, North America, Europe and Africa, and he has visited 49 U.S. states. He has coached youth soccer and lacrosse in his community and volunteers on various reunion, booster and fundraising boards and committees. He also has a life-long commitment to higher education and college placement as part of his nearly two decades of alumni recruitment for the University of Rochester and the University of Richmond.

NMLS#: 2637902

About Nick Duncan

Nick concentrates on managing and maintaining client portfolios, managing the team’s due diligence process on outside strategies, providing financial market research, and handling asset allocation and tactical rebalancing. He also works with next-generation clients through a disciplined wealth accumulation approach in the early stages of their careers. Nick is also the Portfolio Manager for the Equity Income strategy for the King, Barrios, Bartlett and Duncan group.

Prior to joining the team in 2014, Nick completed his Bachelor of Business Administration in finance with a minor in accounting at Boise State University, where he played on the men’s basketball team for four years with academic distinction in his conference and the NCAA. Nick also holds the Certified Financial Planner (CFP) designation.

A native of Australia, Nick has lived in Idaho since 2014. Nick and his wife Lauren, have one child: Abel. In his free time, he spends as much time as possible with his wife and son, catching up with friends, playing golf and skiing.

Prior to joining the team in 2014, Nick completed his Bachelor of Business Administration in finance with a minor in accounting at Boise State University, where he played on the men’s basketball team for four years with academic distinction in his conference and the NCAA. Nick also holds the Certified Financial Planner (CFP) designation.

A native of Australia, Nick has lived in Idaho since 2014. Nick and his wife Lauren, have one child: Abel. In his free time, he spends as much time as possible with his wife and son, catching up with friends, playing golf and skiing.

About Brooks King

Brooks focuses on alternative investments and fixed income, helping design and manage current and future asset allocation strategies. He provides market insights and sector-specific ideas to help support the team’s investment decisions. In addition to his work in alternatives and fixed income, Brooks works closely with next-generation clients, emphasizing the importance of strategic planning during the capital appreciation phase of wealth building.

Brooks joined Morgan Stanley in 2024 after spending three years at Goldman Sachs in the Global Markets Division. During his time at GS, he focused on risk management for the Global Credit desk. Brooks holds a B.S. in Finance from the David Eccles School of Business at the University of Utah. While at Utah, Brooks competed for 4 years on the men’s basketball team earning academic distinction’s every year.

Brooks is a born-and-raised Idahoan, living in Boise with his wife Emma. He enjoys spending his free time outdoors with friends and family – whether it’s racing cross-country mountain bikes, fly fishing local rivers, skiing in the mountains, or traveling to new places.

Disclosures:

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Asset allocation and diversification do not guarantee a profit or protect against a loss in a declining financial market.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Brooks joined Morgan Stanley in 2024 after spending three years at Goldman Sachs in the Global Markets Division. During his time at GS, he focused on risk management for the Global Credit desk. Brooks holds a B.S. in Finance from the David Eccles School of Business at the University of Utah. While at Utah, Brooks competed for 4 years on the men’s basketball team earning academic distinction’s every year.

Brooks is a born-and-raised Idahoan, living in Boise with his wife Emma. He enjoys spending his free time outdoors with friends and family – whether it’s racing cross-country mountain bikes, fly fishing local rivers, skiing in the mountains, or traveling to new places.

Disclosures:

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Asset allocation and diversification do not guarantee a profit or protect against a loss in a declining financial market.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Securities Agent: TX, AK, WI, NJ, CA, MT, FL, VA, TN, SD, OR, NE, NC, WA, NM, ME, KY, KS, DE, CO, PA, MN, HI, NV, WY, MA, ID, UT, NY, MD, IL, CT, OK, IN, GA, AZ, AR; General Securities Representative; Investment Advisor Representative

NMLS#: 2718541

NMLS#: 2718541

About Ryan Stratton

Ryan assists individuals, executives, high-net worth families, trusts and charitable organizations address their wealth management and financial planning needs. He focuses on helping clients navigate the complexities of wealth through wealth preservation strategies, tax management strategies, and estate and trust planning strategies.

Ryan began his career with PricewaterhouseCoopers, the largest personal services firm in the world, and then spent 20 years managing his own accounting practice, Stratton & Associates. He is a Certified Public Accountant and holds certifications in Business Valuation and Financial Forensics. While in private practice, he specialized in personal and business income tax compliance, consulting, and planning; estate and financial planning; tax-exempt entity formation, taxation, and governance; business valuation; and financial forensics. Ryan graduated from the University of Washington with a B.A. in Business Administration and a Masters in Public Accounting/Taxation.

Ryan lives in Hidden Springs, Idaho, with his wife, Kelsey and two children: Shae and Sedona. As swimmers at the University of Washington, Ryan & Kelsey were Pacific-10 Conference All-Americans, Academic All-Americans, and four-year varsity letter winners. For the past 20 years, they have passed their love of the sport to their children, both of whom continue to swim competitively. Ryan is the founder and developer of the Idaho Central Aquatic Center, an elite natatorium in Southeast Boise. If you can’t find him at the pool, you’ll find him in McCall enjoying the lake.

Ryan began his career with PricewaterhouseCoopers, the largest personal services firm in the world, and then spent 20 years managing his own accounting practice, Stratton & Associates. He is a Certified Public Accountant and holds certifications in Business Valuation and Financial Forensics. While in private practice, he specialized in personal and business income tax compliance, consulting, and planning; estate and financial planning; tax-exempt entity formation, taxation, and governance; business valuation; and financial forensics. Ryan graduated from the University of Washington with a B.A. in Business Administration and a Masters in Public Accounting/Taxation.

Ryan lives in Hidden Springs, Idaho, with his wife, Kelsey and two children: Shae and Sedona. As swimmers at the University of Washington, Ryan & Kelsey were Pacific-10 Conference All-Americans, Academic All-Americans, and four-year varsity letter winners. For the past 20 years, they have passed their love of the sport to their children, both of whom continue to swim competitively. Ryan is the founder and developer of the Idaho Central Aquatic Center, an elite natatorium in Southeast Boise. If you can’t find him at the pool, you’ll find him in McCall enjoying the lake.

Securities Agent: AR, OR, NM, KY, ID, FL, WI, MD, IN, NC, KS, CT, WY, NV, GA, TX, CA, AZ, MN, DE, VA, UT, TN, NY, MA, CO, AK, WA, PA, NJ, ME, SD, SC, NE, IL, HI, OK, MT; General Securities Representative; Investment Advisor Representative

NMLS#: 2722982

NMLS#: 2722982

About Tamra Skerjanec

Tamra is the team lead on portfolio lending solutions and charitable donor-advised funds, in addition to her other client facing responsibilities. She has a thorough understanding of processes and procedures that allows her to find comprehensive strategies to unique problems. She enjoys contributing to the client experience by providing assistance with Morgan Stanley’s broad menu of services. Tamra began her career in 2014 and has been with The King, Barrios, Bartlett, Duncan Group since 2019. She graduated from Oregon State University with a B.F.A. in Applied Visual Arts.

Tamra and her husband stay busy chasing after their twin toddlers, but she enjoys gardening, baking and the occasional home improvement project in her free time.

Disclosures:

"Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY"

The Morgan Stanley Global Impact Funding Trust, Inc. (MS GIFT) is an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended. MS Global Impact Funding Trust (MS GIFT) is a donor advised fund. Morgan Stanley Smith Barney LLC provides investment management and administrative services to MS GIFT. Back office administration provided by RenPSG, an unaffiliated charitable gift administrator.

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Tamra and her husband stay busy chasing after their twin toddlers, but she enjoys gardening, baking and the occasional home improvement project in her free time.

Disclosures:

"Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY"

The Morgan Stanley Global Impact Funding Trust, Inc. (MS GIFT) is an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended. MS Global Impact Funding Trust (MS GIFT) is a donor advised fund. Morgan Stanley Smith Barney LLC provides investment management and administrative services to MS GIFT. Back office administration provided by RenPSG, an unaffiliated charitable gift administrator.

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a Financial Advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

About Allison Moss

Allison supports the operational and investment needs of the team’s clients as a Wealth Management Associate. She handles all client-related issues and often serves as a critical part of our clients’ lives. Since starting her career at Merrill Lynch in 1985, she has gained extensive financial knowledge that she applies to her role today. Allison began working with Brian King as a senior registered client associate in 1995 and has been a member of the KBBD team since it was founded in 1999.

Outside the office, Allison enjoys boating, riding ATVs and watching NASCAR races with her husband, Doug. She has two sons, Ian and Matthew, and loves spending time with her grandchildren.

Outside the office, Allison enjoys boating, riding ATVs and watching NASCAR races with her husband, Doug. She has two sons, Ian and Matthew, and loves spending time with her grandchildren.

Contact Brian King

Contact George Barrios

Contact Philip Bartlett

Contact Nick Duncan

Contact Brooks King

Contact Ryan Stratton

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Ian McCormick

Ian McCormick is a Private Banker serving Morgan Stanley Wealth Management offices in Oregon.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Ian began his career in financial services in 2011, and joined Morgan Stanley in 2015 as a Private Banker. Prior to joining the firm, he was a Director of Business Development at Fort West. He also served as a Production Manager-Loan Officer at Churchill Mortgage.

Ian is a graduate of Oregon State University, where he received a Bachelor of Science in Finance. He lives in Portland, Oregon with his family. Outside of the office, Ian enjoys hunting, fishing, skiing and rafting.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Ian began his career in financial services in 2011, and joined Morgan Stanley in 2015 as a Private Banker. Prior to joining the firm, he was a Director of Business Development at Fort West. He also served as a Production Manager-Loan Officer at Churchill Mortgage.

Ian is a graduate of Oregon State University, where he received a Bachelor of Science in Finance. He lives in Portland, Oregon with his family. Outside of the office, Ian enjoys hunting, fishing, skiing and rafting.

NMLS#: 845310

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The King, Barrios, Bartlett, Duncan Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)