Samuel C. Kenary, CPWA®

Industry Award Winner

Industry Award WinnerThank you for visiting The Kenary Wealth Management Group's website. We appreciate the opportunity to engage with you and share the resources we have assembled for you; we hope you find them valuable and informative.

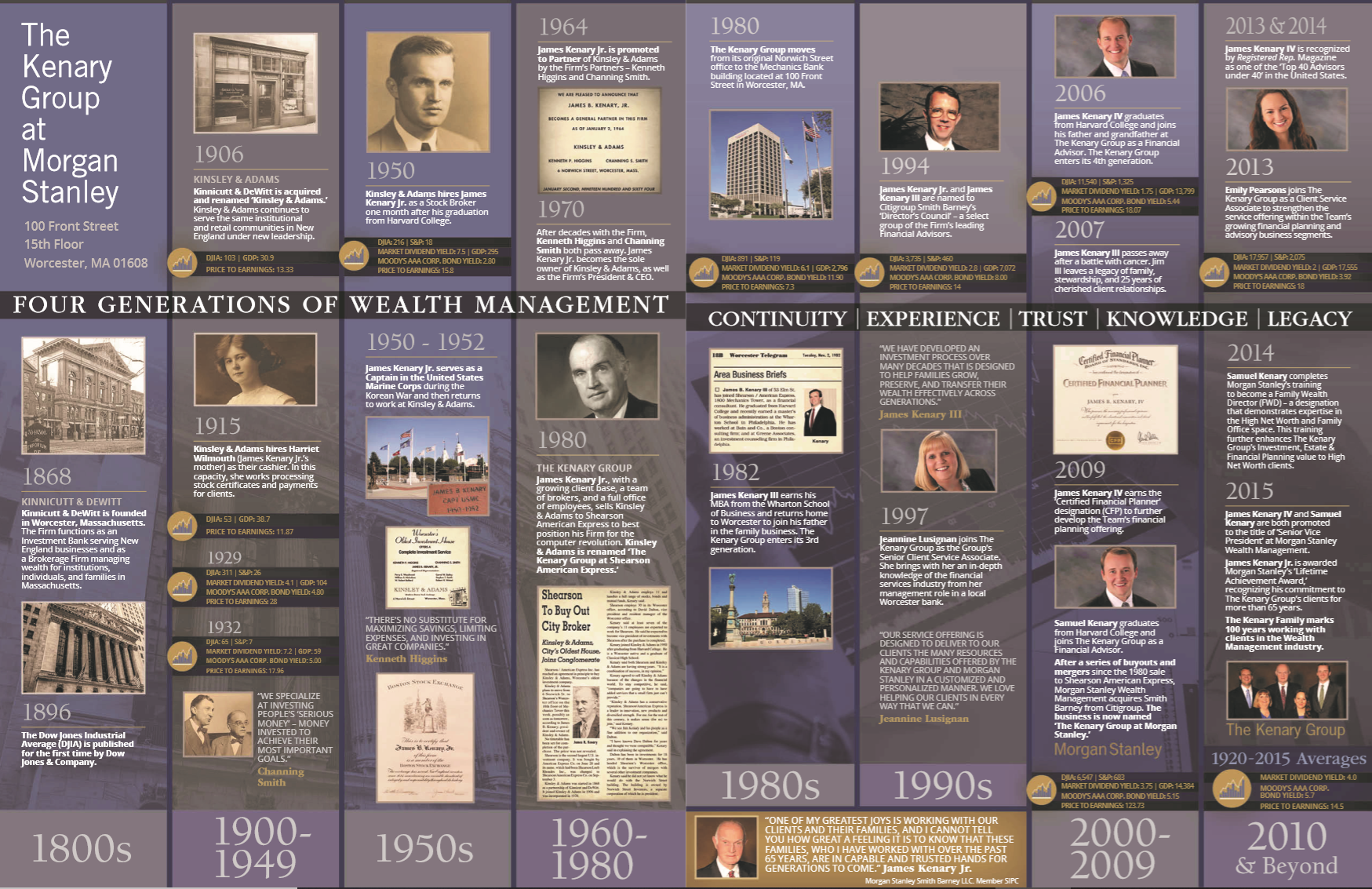

The Kenary family has been in the wealth management business for four generations. Over the past 100+ years, we have been fortunate to work closely with multiple generations of our clients' families.

Our mission is to support and strengthen the financial lives of our clients and their families with the four pillars of Wealth Management: Service, Financial Planning, Investment Management, and Financial Education. Our process is designed to proactively provide you with the guidance and resources you need to achieve your financial goals.

We invite current clients to visit the "For Clients" tab where we highlight some of the key resources available to you. If you are new to our website and would like to learn more about the services we provide, please visit the "For Prospective Clients" tab.

We look forward to the important work that we will do together to achieve your financial goals. As always, we are just a phone call away: 508-751-5658.

People often ask us how we support our clients. The spectrum of our services is wide; however, we're confident that, whatever your needs or questions are, our team is equipped to help. Below is just a sample of questions that we work to address with our clients. We encourage you to click on the "Questions We Help You Answer" link so you can see a more expansive list of what we often encounter when engaging with a new client.