About Samuel C Buxton

Samuel "Sam" Buxton is a Senior Vice President, International Client Advisor, and Alternative Investments Director who has worked for Morgan Stanley (legacy Smith Barney) since 2005. Prior to joining the firm, he graduated from the University of Michigan - Ann Arbor in 2003 and went onto work at Credit Suisse Private Wealth Management with Michael Darling. Sam’s areas of focus include asset allocation, manager due diligence, and insurance/annuity reviews.

Sam completed Morgan Stanley’s rigorous Family Wealth Director Certification program, which enables him to assist clients with wealth transfer, family governance, and philanthropic services. He is a member of Morgan Stanley's prestigious Century Club, an group composed of the firm's most successful financial advisors (https://mgstn.ly/3J3ywqw). Sam was also named to the Forbes Best-In-State Wealth Advisor ranking in 2023.

Sam was born and raised just outside of Philadelphia in Villanova, Pennsylvania, and he currently resides in New York City with his wife, Pam, their daughter, Abigail, and their Cavapoo, Parker. Sam is a proud Philadelphia Eagles fan and enjoys playing sports in his free time. He plays both tennis and squash and is an aspiring golfer.

[Source: Forbes.com (Awarded April 2023) Data compiled by SHOOK Research LLC based on time period from 6/30/21 - 6/30/22. https://mgstn.ly/43OzL4E]

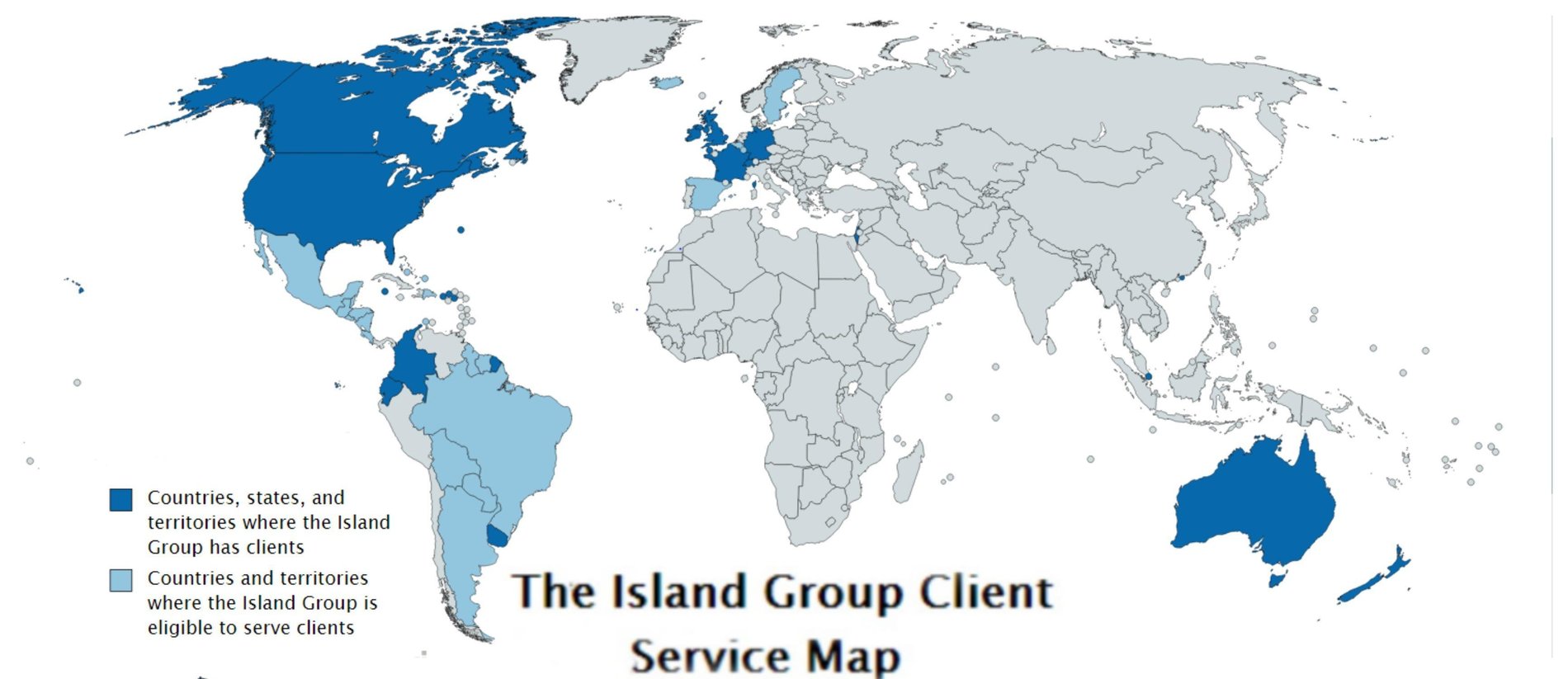

Securities Agent: NH, MO, IL, CT, DC, PR, NY, LA, CA, TX, ID, WY, SC, OH, NC, MA, CO, AZ, IN, FL, WI, MI, ME, VT, VI, VA, UT, SD, NM, MN, NV, DE, WA, RI, NJ, MT, MD, KS, HI, GA, PA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1264960

CA Insurance License #: 0H29363

Industry Award Winner

Industry Award Winner