The Irvine Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story & Services

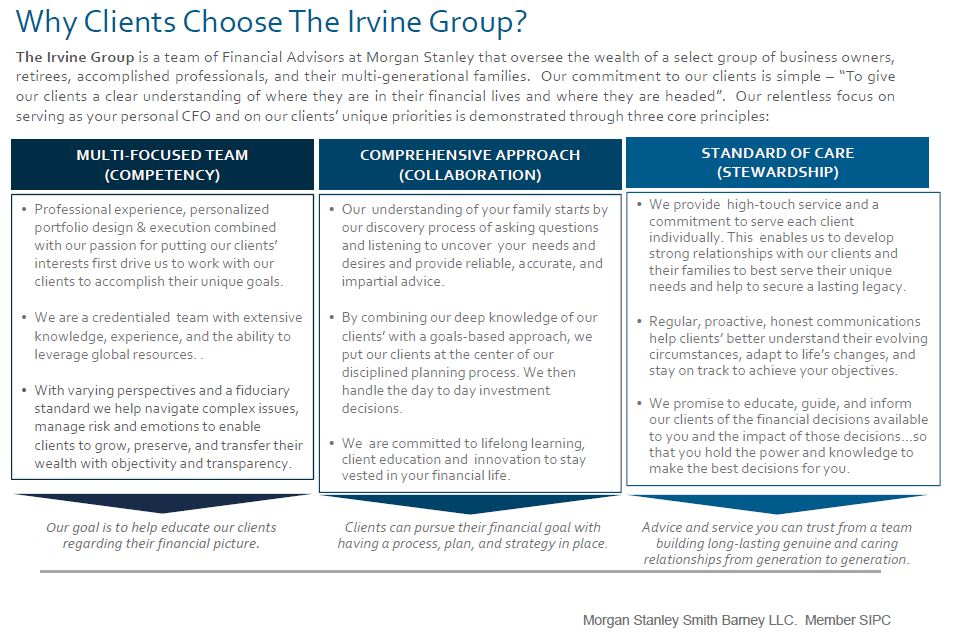

The Irvine Group is a team of 5 accomplished financial experts with over 160 years of collective experience. Our team is comprised of 4 CERTIFIED FINANCIAL PLANNERS™, a Certified Divorce Financial Analyst™, a Certified Portfolio Manager™, as well as one of the world's first Retail Portfolio Managers.

We are your personal Financial Advisors, your business's CFO, and your family friend that gives the unfiltered advice you need. Whether you are a business owners, retirees, accomplished professionals, or just a family; The Irvine Group stand's by our commitment – "To give our clients a clear understanding of where they are in their financial lives and where they are headed". We have the experience designing and implementing intricate financial plans to help meet your specific goals. Like with our own family, we will craft and engage with you on our holistic approach to financial planning in order to help you invest with purpose. Our process helps ensure that you do not have any financial blind spots that could negatively impact you. Every step of the way, we will explain in detail what you need to know. Once we identify all key aspects, we use our experience as discretionary fee based portfolio managers to build your customized investment strategy, and adapt when the need arises.

- Financial PlanningFootnote1

- Professional Portfolio ManagementFootnote2

- Wealth ManagementFootnote3

- Fixed IncomeFootnote4

- Executive Financial ServicesFootnote5

- Trust ServicesFootnote6

- 401(k) Rollovers

- Retirement PlanningFootnote7

- 529 PlansFootnote8

- Estate Planning StrategiesFootnote9

- Endowments and FoundationsFootnote10

- Divorce Financial AnalysisFootnote11

- Life InsuranceFootnote12

- Long Term Care InsuranceFootnote13

- Planning for Individuals with Special Needs

Working With You

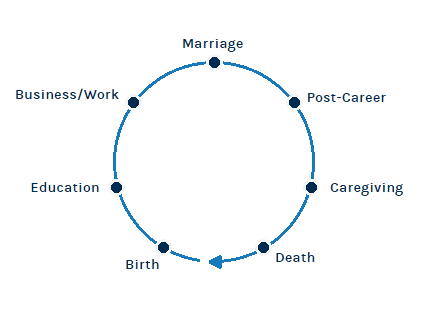

Life Cycle

There are 7 important stages in your life, each with a complexity that requires thorough preparation and customization.

One of the greatest joys a family can experience is to welcoming a child into the family. As much as the happiness the child will bring into your life, becoming a parent is daunting. The preparation for the arrival of the child is crucial, but what comes after? What sources of income do you have to provide for your child's needs? Have you set aside enough money for your child's future? How will you cover any unexpected expenses, such as unforeseen medical needs?

According to Forbes, the national average charge for childbirth is $18,865 ($26,280 for a C-section). Costs can change depending on the type of delivery, location, insurance type and prenatal care. In addition, the U.S. Department of Agriculture estimated that the cost for the average middle-income parent to support a child through their 18th birthday is almost $233,610 (more than $280,000 when adjusted for projected inflation), EXCLUDING the cost of college tuition. Of course, the cost of raising a family can vary significantly, depending on location and lifestyle considerations. What's important is making sure you have a plan in place for managing these costs over time.

In today's hyper-specialized globalist economy, education is crucial to develop high-level skills for future career development & advancement. Education is a major investment not to just yourself but your family as well. It is an investment that often requires years of careful, advanced planning. As educational costs continue to rise—from primary education through undergraduate, graduate and professional schools—it is important to take into account the different types of educational expenses, such as tuition, extension programs and advanced professional training, with appropriate funding strategies for their particular situations.

What plans do you have to finance their or a loved one's education? Are they familiar with the education savings plans available to them?

Your work is complicated, it could be a standard employment, executive compensations, and situations to various levels of investment in a multitude of business ventures—from startups to established enterprises. You need expert advice in navigating the complexities retirement investment, business ownership, and associated activities such as selling, divesting or planning for succession.

How does your work/employment fit in your overall investment/retirement process? Are you looking to start a business? Have you considered any market influences on the type of business you're seeking to invest in? Are you looking to divest from or exit a business? Why?

There are few events in life as important as Love & Marriage. The fabric of society rests upon this union of 2 parties. There are conversations you should have with your partner before tying the knot. One of the most important is about money—how they'll make it, save it, spend it and invest it. In addition, helping fund an adult child's wedding is a goal for many parents (and grandparents). The Irvine Group plays an important role in helping clients plan for these milestones and guiding their conversations for over 20 years.

What are your financial goals as a couple? Have they discussed budgets or created a family budget? Have they spoken with their partner about any existing loans and other financial

obligations?

Saving for retirement is a lifelong process that relies on defined financial planning strategies. It is equally crucial to look at personal considerations and help ease the fear of the unknown. Finally you are ready to settle down and enjoy your nest egg. Having enough income is the hallmark of a successful retirement but it is not everything. Have you planned enough for retirement healthcare? Are you optimized in your retirement tax mitigation?

You have spent years working and planning so that you have enough income for a comfortable retirement—but have you considered what might happen if you or your spouse require long-term care? Are you prepared in case of illness? Planning for long-term care can help manage this risk and provide more choices and more control over the care receive.

Death is hard to take in. Aside from coping with the loss of a loved one, legal matters also require immediate attention, including administration of the estate. Though it may be hard to discuss estate planning because of the heartache, addressing it promptly is crucial to saving both time and money, and to minimizing family conflict or confusion. Passing away without a will, known as intestacy, means the state determines how the deceased's assets will be distributed, and this may not be consistent with the family's wishes. Proceedings can also be painful and costly for the family.

Have you reviewed beneficiary arrangements of their existing retirement and insurance plans? Have you established a Will or Trust?

Popular Service Combinations

The Irvine Group offers many different services to fully encompass any client needs our clients may face. Take a look at how our other clients match our services to fit their needs. There is no restriction to what services combination you may request.

Every person should be prepared for their future, and it is important to develop the roadmap to financial success and stability through either goals or life cycles. Speaking with a Financial Advisor with experience and the proper designations is the first step to mapping out the financial journey of you and your family. There are times where you may encounter a situation which brings unease and require specific and special financial preparation. Speak with us to get the full customized planning and guidance you need!

As your wealth grows through proper financial planning, you will find yourself faced with more to manage. Managing your work & business, spending time with family, and planning vacations & trips, takes up a significant portions, if not, ALL of your time. It is incredibly difficult for you to manage your wealth directly in a rapidly changing economic environment which demands immediately adaptability and response. Talk with our Certified Portfolio Managers about how to manage your investment portfolio and match your goals with your time.

For the first time in two decades, interest rates record have soared to its 20 years peak. Traditionally viewed as a safe but low-yield asset class, Fixed Income have fallen out of favor during the extended low interest financial environment for the past couple of decades. However, with the rapid rise of Federal Fund Rates, the previously long neglected asset has been catapulted into stardom once again. Speak with us to see how you take advantage of Fixed Income investments today.

As an executive, you have plenty of business problems on your mind. The least of your worries should be your compensation and your financial needs, yet it always will bother you. Financial Advisors of The Irvine Group are expert for Executive Financials Service. We will help you navigate dangerous water created by SEC regulations regarding insider trading, control/restricted stocks, and create investment strategies based on your equity compensation. All of your complicated financial needs are resolved with us. Schedule a call now.

Due to shifting demographics, a proper retirement planning is more important now than ever. It is projected that social security is depleting at an alarming rate. Current projections from the Social Security Administration forecast will become insolvent after 2035. As a result, retirees could face a 25% benefit cut, and future retiree would likely have to work until the age of 70 for full benefits. 401(k)s is more crucial now as an additional retirement income source. We heavily recommend a conversation with our Advisors to help you plan for the future.

As your progress through your life, thoughts of legacy may occupy your mind. Preparing for your children and grandchildren's education, planning for estate succession and inheritance, or even establishing a foundation for charitable purposes. These are complex entities and require long-term planning to secure you and your families wealth through inheritance.

Divorce is a difficult topic and process for anyone. It is not just tough for you emotionally, but it can do large financial damage as well. When you finally decide to pull that trigger, you shouldn't see just a lawyer but also a Certified Divorce Financial Analyst (CDFA). It is important to take control of your finances and to understand the impact of property distributions, credits & basic finances, health & retirement, and your estate.

It is sad that as time passes, our health gradually deteriorates with it. While you have spent your time building wealth and enjoying the wonderous lifestyles you deserve, have you considered what needs to be done if you or your spouse require long-term care? Everyone should plan for the inevitable future scenario were we require quality care. It is may be hard to imagine now, but it is easy to set up with a Financial Advisor.

Location

Meet The Irvine Group

About Dick S Joe

As a pioneer in the industry, Dick was one of the first active money managers. During these experiences he developed an approach to managing money that is predicated on preservation. He views himself as a guardian of assets and seeks to maintain a defensive posture. This is designed to preserve the assets of his clients and identify opportunities in undervalued stocks when market and economic conditions present potential favorable returns. Dick was named to the President’s council at Morgan Stanley, which represents top performers, for multiple years. He holds a Bachelor Degree in Engineering from Purdue University and a Masters Degree in Electrical Engineering from the University of Southern California.

Outside of the workplace Dick enjoys spending family time on the weekend with his three sons and 4 grandchildren. He lives in Fullerton with wife Marian.

NMLS#: 1373258

CA Insurance License #: #0A18785

About Andrew D Joe

Throughout his career, Andy has used his mottos of “Winning by not losing” as a guideline for investing on behalf of his clients. He focuses on value investing which helps preserve wealth over time and helps clients to achieve responsible growth. This approach has led him to the Morgan Stanley President’s Council on multiple occasions. Andy graduated from the University of California, Irvine with his degree in Economics, and is a CERTIFIED FINANCIAL PLANNER since 2007.

Andy, wife, and two daughters reside in his hometown of Fullerton. Away from the office, Andy enjoys spending time with his family, and watching his daughters play soccer and golf.

NMLS#: 1377014

About Dan A Young

Dan studied Political Science & Finance at Fresno State and utilizes his education with career experience to offer a multi-faceted analytical approach to wealth management. In the current world, market risk is deeply intertwined with political risk, and this has trickled down to corporate levels as well. As your financial advisor, Dan pays attention to what struggles each corporation would experience, and how damaging new changes & actions would impact the brand value & asset value of the company. This would not only hurt customer base but injure the portfolio health of clients too. Dan is a Board Member of the Academy of Certified Portfolio Managers. Dan joined the City of Orange Chamber of Commerce and became the Chairman of the Board after serving 6 years on the Board. Dan utilized his position to build opportunities for development and drive growth in the local communities factoring both political & market risk.

In times of great stress and uncertainty, emotions, and irrationality drive societies decisions. By taking emotion out of the game, our conviction is placed in ongoing evaluation of where the markets are offering opportunity. We believe that buying value is the best way to get ahead and avoid the damage of major market swings. With our discretionary trading platform, we can be nimble and move in and out of markets as we see fit.

NMLS#: 1285141

CA Insurance License #: 0G30103

About Mark E Chew

Following the credit crisis of 2007 and the Global Recession of 2008, Mark had made it his mission to help people with proper wealth management. He understands the struggles families face and the pain suffered by everyone, so he made it his purpose to tailor every aspect of service to his client. Joining "The Irvine Group", he brought the idea of "Investing with Purpose" to clients, navigating them through treacherous waters in pursuit of financial confidence. Communication is key to Mark's style and he continuously build upon his knowledge and experience through deep-dives into the latest trends and developments in the world.

In his own words: "Our clients appreciate our proactive approach, attention to detail, and commitment to delivering exceptional service. We believe that if someone were to refer us, they would describe our practice as trustworthy, knowledgeable, and dedicated to helping clients achieve their financial objectives. We take a comprehensive approach by through a deep understanding of our clients' unique financial situations, risk tolerances, and long-term goals."

NMLS#: 1312573

CA Insurance License #: 0G00206

About Walter E Kaminski

The impact of my loss greatly influenced my purpose. Thus, I focus on organizing the affairs of successful entrepreneurs, executives and affluent families to plan for the unexpected, and to reduce taxes.

Many of my clients are interested in preservation of the wealth they have diligently acquired. I have developed a perspective that goes beyond investments to include my clients’ comprehensive financial life.

I strive to be my clients’ knowledgeable and trusted confidant. My clients can benefit from an approach that begins by listening to and understanding their unique needs and desires. I leverage over thirty-five years of experience in Banking and Trust, Real Estate and Portfolio Management; experience that affords me the opportunity to implement wealth management and planning solutions including philanthropic planning delivered with concierge-level service.

My clients feel secure in the knowledge that I capitalize on the foremost tax-efficient, risk-mitigation strategies in order to achieve their goals. I collaborate with my clients’ tax professionals, estate planning attorneys, and other trusted advisers on a regular basis. As a result, I can effectively coordinate the important aspects of my clients’ financial lives – allowing them to focus on their passions and interests.

One of my passions is cooking and was trained as a professional chef. I have many clients from the food and hospitality industry. I am actively involved with charities for the homeless as a guest chef.

NMLS#: 1255785

CA Insurance License #: 0E99769

Contact Dick S Joe

Contact Andrew D Joe

Contact Dan A Young

Contact Mark E Chew

Contact Walter E Kaminski

Hear From Our Clients

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24

Awards and Recognition

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

13Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Verified Client

Verified Client